Master The Budgeting Strategy Of Success: Unlock Your Financial Potential Now!

Budgeting Strategy of Panjang: A Comprehensive Guide

Introduction

Dear Readers,

1 Picture Gallery: Master The Budgeting Strategy Of Success: Unlock Your Financial Potential Now!

Welcome to our comprehensive guide on the budgeting strategy of Panjang. In this article, we will explore the various aspects of budgeting strategy and how it can benefit individuals and businesses alike. Budgeting strategy is a crucial component of financial planning, and by implementing effective strategies, one can achieve financial stability and success. Join us as we delve into the world of Panjang’s budgeting strategy and uncover the secrets to effective budgeting.

Image Source: yimg.com

Before we dive into the details, let us first understand what budgeting strategy of Panjang entails.

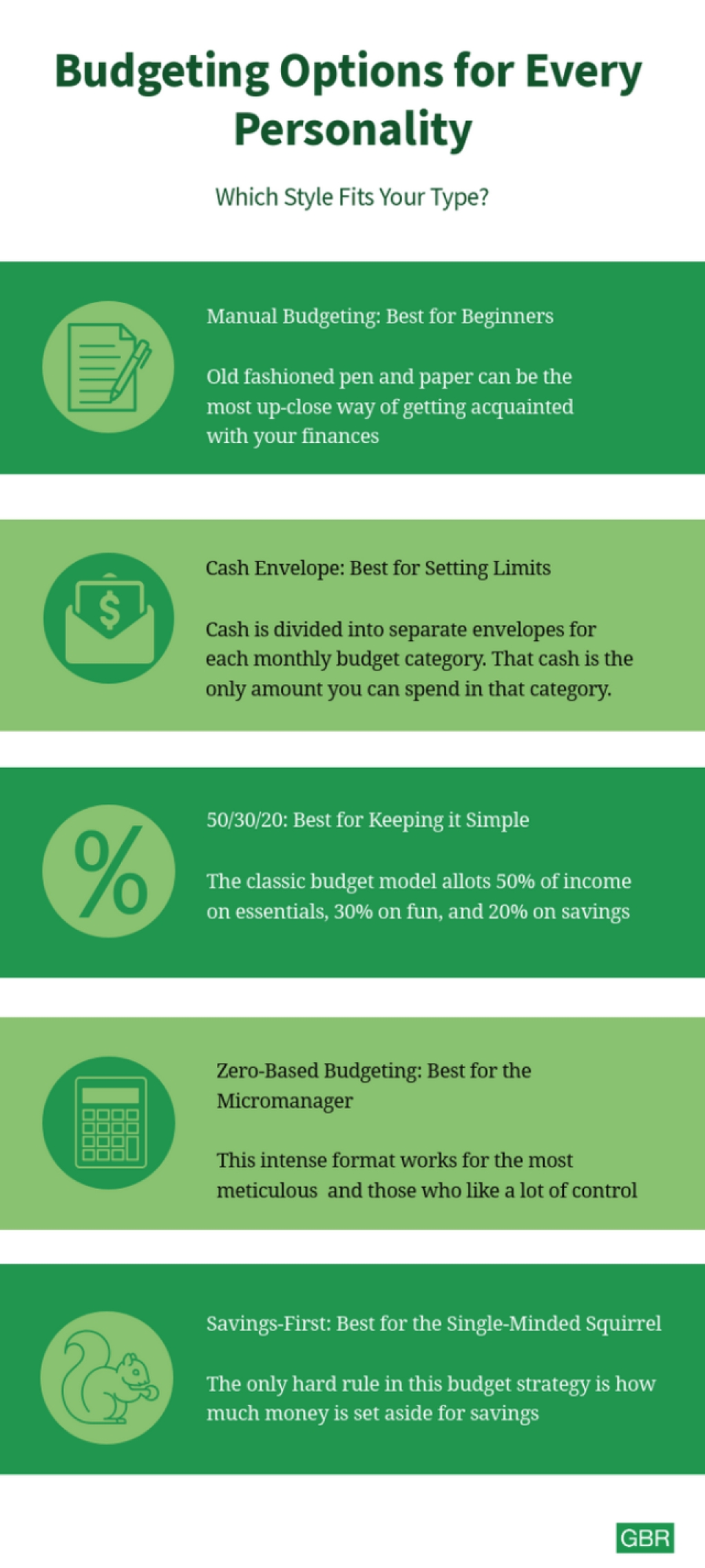

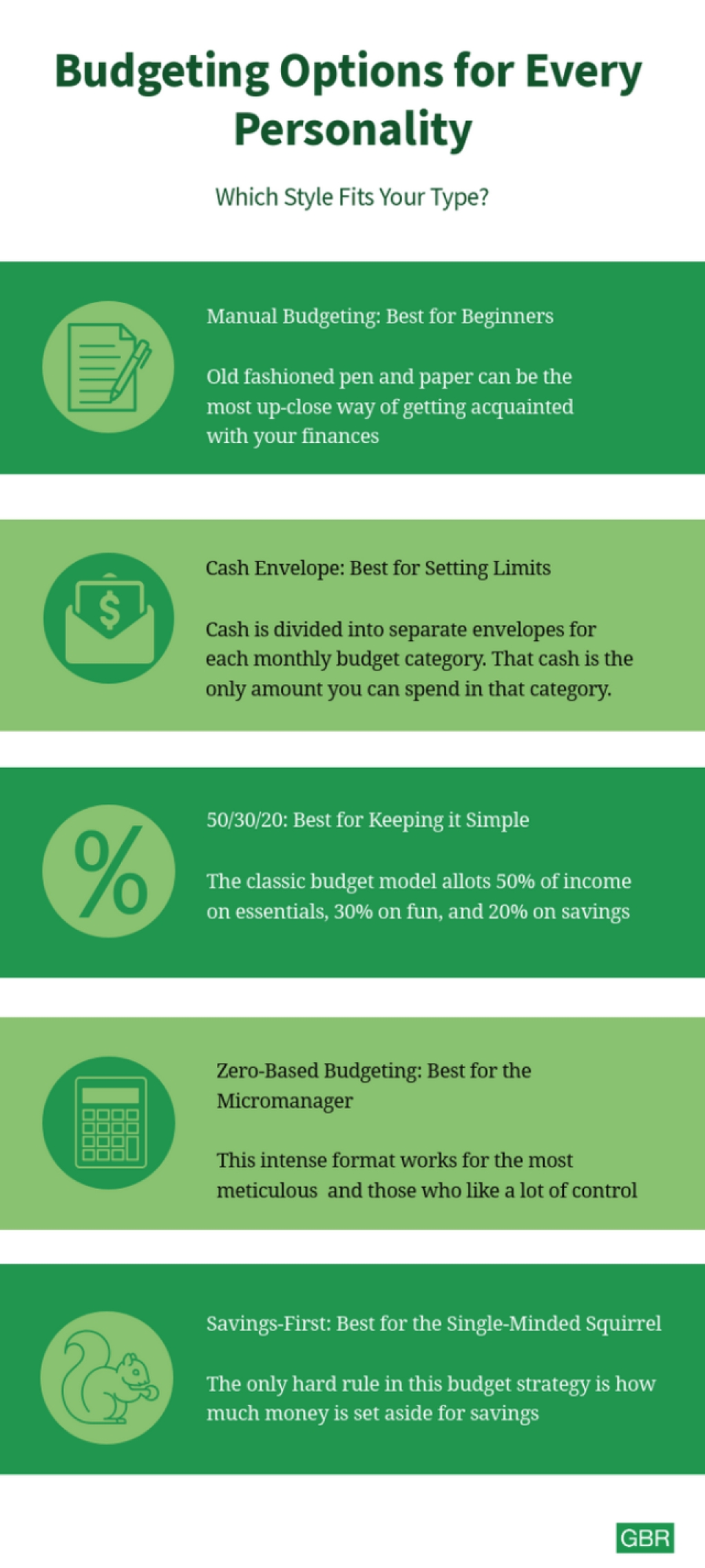

The What of Budgeting Strategy of Panjang 📝

The budgeting strategy of Panjang refers to the systematic and strategic allocation of funds and resources to achieve financial goals. It involves managing income, expenses, investments, and savings in a way that optimizes financial outcomes. By implementing a well-defined budgeting strategy, individuals and businesses can effectively plan for their financial future and make informed decisions regarding spending and saving.

With the budgeting strategy of Panjang, you can gain better control over your finances and ensure that your money is utilized efficiently.

The Who of Budgeting Strategy of Panjang 👨

Image Source: licdn.com

The budgeting strategy of Panjang is applicable to individuals, households, and businesses of all sizes. It is a versatile approach that can be tailored to suit the specific needs and goals of each entity. Whether you are a young professional looking to save for the future or a business owner aiming to maximize profits, the budgeting strategy of Panjang can provide valuable insights and guidance.

Regardless of your financial situation, implementing an effective budgeting strategy is essential for long-term financial stability and success.

The When of Budgeting Strategy of Panjang 📅

The budgeting strategy of Panjang can be implemented at any stage of life or business. Whether you are just starting your career or are well-established in your field, it is never too early or too late to adopt a budgeting strategy. By starting early, you can develop good financial habits and set a solid foundation for your future. However, even if you have not implemented a budgeting strategy before, it is never too late to start. The key is to take action and make a commitment to improving your financial well-being.

Start today and reap the benefits of effective budgeting strategy in the future.

The Where of Budgeting Strategy of Panjang 🌏

The budgeting strategy of Panjang can be implemented anywhere in the world. Whether you reside in Panjang or in any other corner of the globe, the principles and concepts of budgeting strategy remain the same. However, it is important to consider the local economic conditions and financial regulations when formulating your budgeting strategy. Factors such as currency exchange rates, inflation rates, and tax laws can influence the effectiveness of your strategy. Therefore, it is advisable to seek local financial advice and tailor your budgeting strategy to your specific geographical location.

Remember, no matter where you are, budgeting strategy is a universal tool for financial success.

The Why of Budgeting Strategy of Panjang 👉

The budgeting strategy of Panjang is essential for several reasons. Firstly, it provides you with a clear overview of your financial situation, allowing you to assess your income, expenses, and overall financial health. This awareness enables you to make informed decisions and identify areas of improvement.

Secondly, budgeting strategy helps you set realistic financial goals and track your progress towards achieving them. By breaking down your goals into smaller, manageable tasks, you can stay motivated and focused on your financial objectives.

Furthermore, budgeting strategy allows you to allocate funds towards savings and investments, ensuring that you have a secure financial future. By being proactive and planning for the long term, you can enjoy financial freedom and peace of mind.

In summary, the budgeting strategy of Panjang is vital for financial awareness, goal setting, and long-term financial security.

The How of Budgeting Strategy of Panjang 🔎

Implementing the budgeting strategy of Panjang requires a systematic approach. Here are the steps to get started:

Assess your current financial situation: Determine your income, expenses, debts, and assets. This will give you a clear understanding of where you stand financially.

Set financial goals: Identify your short-term and long-term goals. Whether it’s saving for a down payment on a house or starting a retirement fund, having clear goals will help guide your budgeting strategy.

Create a budget: Based on your financial assessment and goals, create a realistic budget. Allocate funds for essential expenses, savings, investments, and discretionary spending.

Track your expenses: Keep a record of your expenses and regularly review them. This will help you identify areas where you can cut back and save.

Adjust and optimize: Periodically review and adjust your budget as needed. Life circumstances and financial priorities change, so it’s important to be flexible and adapt your budget accordingly.

Seek professional advice: If needed, consult with a financial advisor or planner who can provide personalized guidance and help you optimize your budgeting strategy.

Stay disciplined: Stick to your budget and maintain financial discipline. Avoid unnecessary expenses and prioritize your financial goals.

By following these steps, you can implement a robust budgeting strategy of Panjang and set yourself on the path to financial success.

Advantages and Disadvantages of Budgeting Strategy of Panjang

Like any financial strategy, the budgeting strategy of Panjang has its pros and cons. Let’s explore them in detail:

Advantages:

Financial discipline: Budgeting strategy promotes financial discipline, helping you prioritize your expenses and avoid unnecessary spending.

Goal setting: A budgeting strategy allows you to set clear financial goals and work towards achieving them.

Savings and investments: By allocating funds towards savings and investments, you can build wealth and secure your financial future.

Financial awareness: Budgeting strategy provides a comprehensive overview of your finances, allowing you to track your income, expenses, and net worth.

Emergency preparedness: With a budgeting strategy in place, you can allocate funds for emergencies and unexpected expenses.

Disadvantages:

Restrictive: Budgeting strategy can feel restrictive, as it requires you to limit your spending in certain areas.

Time-consuming: Maintaining a budget and tracking expenses can be time-consuming, especially initially.

Unexpected expenses: Despite careful planning, unexpected expenses may arise that can disrupt your budgeting strategy.

Requires discipline: Budgeting strategy requires discipline and commitment to stick to your financial plan.

Not one-size-fits-all: Each individual or business has unique financial circumstances, and a budgeting strategy may need to be customized accordingly.

While the advantages of budgeting strategy outweigh the disadvantages, it is important to weigh both sides and make an informed decision based on your specific financial situation and goals.

Frequently Asked Questions (FAQs)

Q1: Is budgeting strategy only for people with limited income?

A1: No, budgeting strategy is beneficial for individuals and businesses of all income levels. It helps in managing finances effectively and achieving financial goals, regardless of income.

Q2: How often should I review my budget?

A2: It is recommended to review your budget on a monthly basis. This allows you to track your progress, make adjustments, and ensure that you are on track to achieve your financial goals.

Q3: Can budgeting strategy help me pay off debt?

A3: Yes, budgeting strategy is an effective tool for debt management. By allocating funds towards debt repayment and prioritizing high-interest debts, you can accelerate your journey towards becoming debt-free.

Q4: Are there any budgeting apps or tools that can assist me in implementing the budgeting strategy of Panjang?

A4: Yes, there are many budgeting apps and tools available that can simplify the budgeting process. These apps help you track expenses, set financial goals, and monitor your progress, making it easier to implement and stick to your budgeting strategy.

Q5: Can I modify my budgeting strategy as my financial situation changes?

A5: Absolutely! Your budgeting strategy should be flexible and adaptable to your changing financial circumstances. As your income, expenses, and goals evolve, make the necessary adjustments to ensure your budget remains effective and aligned with your current situation.

Conclusion

In conclusion, the budgeting strategy of Panjang is a powerful tool for financial success. By implementing a well-defined budgeting strategy, individuals and businesses can effectively manage their finances, achieve their goals, and secure their financial future. It is important to assess your current financial situation, set realistic goals, create a budget, track your expenses, and make necessary adjustments along the way. While budgeting strategy requires discipline and commitment, the benefits far outweigh the challenges. Start your journey towards financial stability and success with the budgeting strategy of Panjang today!

Final Remarks

Dear Readers,

Before we conclude, we would like to emphasize that the budgeting strategy of Panjang is a valuable tool, but it is important to remember that every financial situation is unique. The information provided in this article is intended to serve as a general guide, and it is advisable to seek professional advice for personalized financial guidance. Additionally, it is crucial to stay informed about the latest financial trends and regulations that may impact your budgeting strategy. Stay proactive, stay informed, and make wise financial decisions to secure your financial future. Best of luck on your journey towards financial success!

This post topic: Budgeting Strategies