Secure Your Future With A 100 Percent Retirement Plan: Click To Take Action Now!

Retirement Plan 100 Percent: Ensuring a Secure Future

Introduction

Hello Readers,

3 Picture Gallery: Secure Your Future With A 100 Percent Retirement Plan: Click To Take Action Now!

Welcome to our comprehensive guide on retirement plan 100 percent. In today’s fast-paced world, planning for retirement has become more important than ever. With the uncertainty surrounding social security and the rising cost of living, it is crucial to have a solid retirement plan in place. In this article, we will explore the concept of retirement plan 100 percent, its benefits, and how you can make the most of it to ensure a secure future for yourself and your loved ones.

Retirement plan 100 percent is an investment strategy that aims to provide individuals with a guaranteed income stream during their retirement years. It is designed to ensure that you have enough funds to cover your expenses and maintain your lifestyle without relying on any other source of income.

Image Source: visualcapitalist.com

Having a retirement plan 100 percent in place is essential for a stress-free retirement. It allows you to enjoy your golden years without worrying about financial constraints. By understanding the ins and outs of this retirement strategy, you can make informed decisions and secure your financial future.

What is Retirement Plan 100 Percent?

Retirement plan 100 percent refers to a comprehensive savings and investment strategy that aims to replace 100 percent of an individual’s pre-retirement income. It is a long-term approach that involves setting aside a portion of your income, maximizing tax-deferred investment accounts, and diversifying your investments to ensure steady growth over time.

🔑 Key Point: Retirement plan 100 percent focuses on building a retirement fund that can provide you with a stable income stream in your post-work years.

Who Should Consider Retirement Plan 100 Percent?

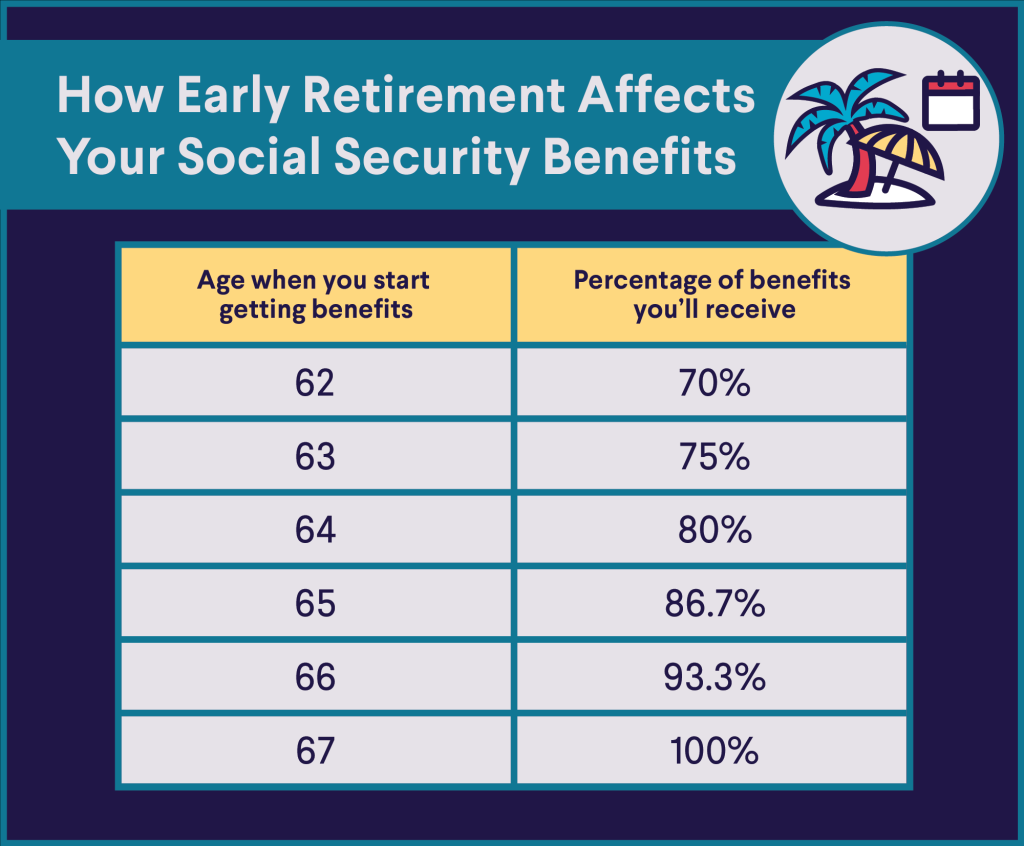

Image Source: 360financial.net

Retirement plan 100 percent is suitable for anyone who wants to achieve financial independence during their retirement years. Whether you are just starting your career or approaching retirement, it is never too early or too late to start planning for your future.

🔑 Key Point: Retirement plan 100 percent is for individuals who are committed to securing their financial future and want to enjoy a comfortable retirement.

When Should You Start Planning?

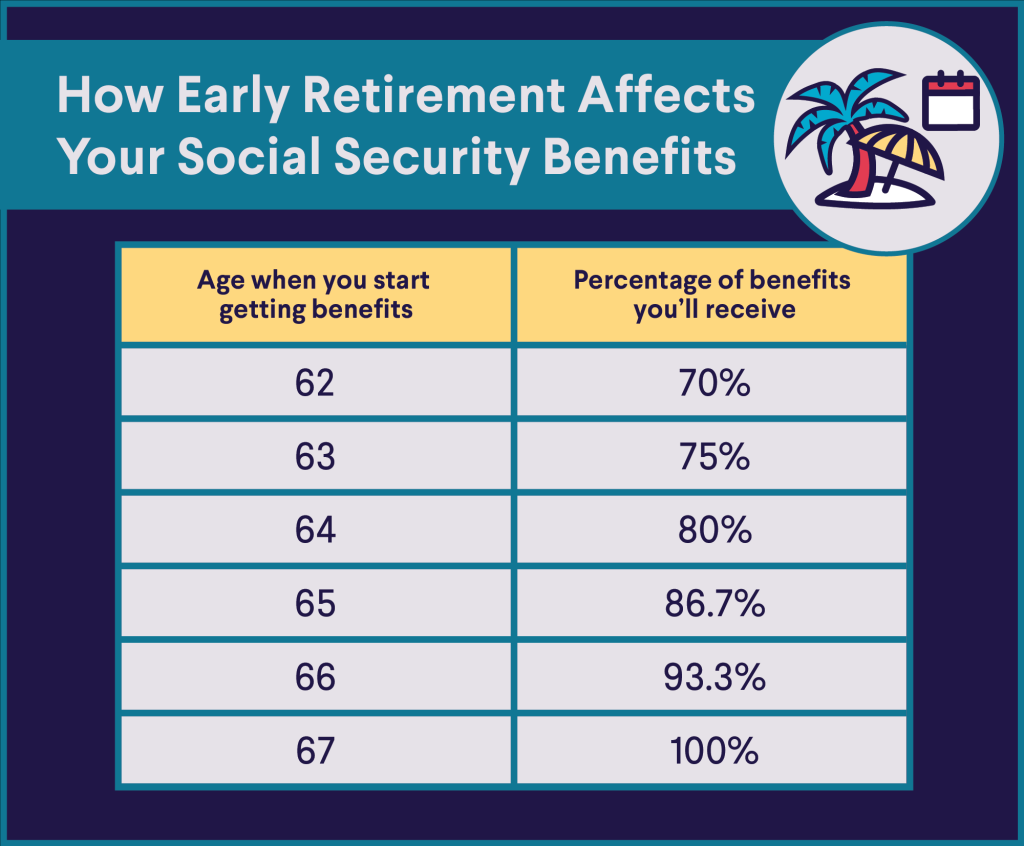

Image Source: cloudfront.net

The earlier you start planning for your retirement, the better. Time is your most valuable asset when it comes to building a retirement fund. By starting early, you can take advantage of compounding returns and give your investments more time to grow.

🔑 Key Point: It is never too early to start planning for retirement. The sooner you start, the more you can benefit from the power of compounding.

Where Can You Invest for Retirement?

When it comes to retirement planning, there are various investment options available. Some of the most common retirement accounts include 401(k) plans, individual retirement accounts (IRAs), and annuities. Each option has its own benefits and considerations, so it is important to choose the one that aligns with your goals and risk tolerance.

🔑 Key Point: There are multiple investment options available for retirement planning, including 401(k) plans, IRAs, and annuities. Choose the option that best suits your needs.

Why is Retirement Plan 100 Percent Important?

Retirement plan 100 percent is important because it provides you with financial security during your golden years. It ensures that you have enough money to cover your living expenses, healthcare costs, and other needs without relying on anyone else.

🔑 Key Point: Retirement plan 100 percent is crucial to maintain your financial independence and live a comfortable life after retirement.

How to Create a Retirement Plan 100 Percent?

Creating a retirement plan 100 percent requires careful analysis and consideration. Here are the key steps to get started:

Step 1: Determine Your Retirement Goals

Start by setting clear goals for your retirement. Consider your desired lifestyle, anticipated expenses, and any specific milestones you want to achieve during your retirement years.

Step 2: Assess Your Current Financial Situation

Take stock of your current financial situation, including your income, assets, and liabilities. This will help you understand how much you need to save and invest to achieve your retirement goals.

Step 3: Calculate Your Retirement Needs

Estimate your future expenses and calculate how much you will need to cover your living costs, healthcare expenses, and any other financial obligations during your retirement years.

Step 4: Start Saving and Investing

Once you have a clear understanding of your retirement needs, start saving and investing accordingly. Set aside a portion of your income and explore different investment options to grow your retirement fund over time.

Step 5: Review and Adjust Regularly

Regularly review your retirement plan and make adjustments as needed. Life circumstances and financial goals may change over time, so it is important to stay flexible and adapt your plan accordingly.

Advantages and Disadvantages of Retirement Plan 100 Percent

Retirement plan 100 percent comes with its own set of advantages and disadvantages. Let’s explore them in detail:

Advantages:

1. Guaranteed Income: Retirement plan 100 percent provides you with a guaranteed income stream during your retirement years, ensuring financial security.

2. Tax Benefits: Certain retirement accounts offer tax advantages, allowing you to minimize your tax liability and potentially grow your savings faster.

3. Peace of Mind: With a solid retirement plan in place, you can enjoy peace of mind knowing that your financial future is secure.

Disadvantages:

1. Limited Access to Funds: Some retirement accounts have restrictions on when and how you can access your funds, limiting your flexibility.

2. Market Volatility: Investing in the stock market carries the risk of market downturns, which can impact the value of your retirement portfolio.

3. Inflation Risk: Over time, the cost of living may increase, potentially impacting the purchasing power of your retirement funds.

Frequently Asked Questions (FAQs)

1. Is retirement plan 100 percent suitable for everyone?

Retirement plan 100 percent is suitable for individuals who are committed to securing their financial future and want to enjoy a comfortable retirement. However, it is important to assess your own financial situation and consult with a financial advisor to determine the best retirement strategy for you.

2. Can I make changes to my retirement plan?

Yes, you can make changes to your retirement plan as needed. It is important to regularly review and adjust your plan based on your changing financial situation and retirement goals.

3. How much should I save for retirement?

The amount you should save for retirement depends on various factors, such as your desired lifestyle, anticipated expenses, and retirement goals. It is recommended to save at least 10-15% of your income for retirement, but consulting with a financial advisor can help you determine the appropriate savings rate for your specific situation.

4. What happens if I don’t have a retirement plan?

Without a retirement plan, you may face financial challenges during your retirement years. It is important to start planning as early as possible to ensure you have enough funds to cover your living expenses and maintain your desired lifestyle.

5. Can I retire early with a retirement plan 100 percent?

Retiring early with a retirement plan 100 percent is possible, provided you have saved and invested enough to cover your expenses until your desired retirement age. It is important to carefully calculate your retirement needs and consult with a financial advisor to determine if early retirement is feasible for you.

Conclusion

In conclusion, retirement plan 100 percent is a crucial strategy to secure your financial future and enjoy a comfortable retirement. By starting early, setting clear goals, and consistently saving and investing, you can build a retirement fund that provides you with a guaranteed income stream. However, it is important to regularly review and adjust your retirement plan to ensure it aligns with your changing circumstances and goals. Remember, the key to a successful retirement is careful planning and taking action today.

Thank you for reading and best of luck in your retirement planning journey!

Final Remarks

The information provided in this article is for informational purposes only and should not be considered as financial advice. Retirement planning involves a variety of factors, and it is important to consult with a qualified financial advisor to determine the best strategy for your individual needs. Every individual’s financial situation is unique, and there is no one-size-fits-all approach to retirement planning. Take into consideration your risk tolerance, investment preferences, and long-term goals when creating a retirement plan. Remember to regularly review and adjust your plan as necessary to stay on track towards a secure and fulfilling retirement.

This post topic: Budgeting Strategies