Master The Art Of Budgeting: Unlocking The Secrets With The 6.2 Budgeting Strategies Answer Key – Grab It Now!

6.2 Budgeting Strategies Answer Key

Introduction

Hello readers,

3 Picture Gallery: Master The Art Of Budgeting: Unlocking The Secrets With The 6.2 Budgeting Strategies Answer Key – Grab It Now!

Welcome to this informative article on 6.2 budgeting strategies answer key. In this article, we will explore the various strategies and techniques used in budgeting, specifically focusing on the answer key for 6.2 budgeting strategies. Budgeting is an essential aspect of financial management, and having a solid understanding of effective budgeting strategies can significantly impact one’s financial well-being. So, let’s dive into the details and explore the key aspects of 6.2 budgeting strategies.

Table of Contents

Image Source: openpublishing.com

What is 6.2 budgeting strategies answer key?

Who can benefit from 6.2 budgeting strategies?

When should 6.2 budgeting strategies be implemented?

Where can 6.2 budgeting strategies be applied?

Why are 6.2 budgeting strategies important?

How can one effectively use 6.2 budgeting strategies?

Advantages and disadvantages of 6.2 budgeting strategies

Frequently Asked Questions (FAQ)

Conclusion

Final Remarks

What is 6.2 Budgeting Strategies Answer Key?

6.2 budgeting strategies answer key refers to the comprehensive set of answers and solutions for the specific budgeting strategies outlined in section 6.2 of the budgeting guide. This answer key provides individuals with a clear understanding of how to implement and execute effective budgeting techniques to achieve their financial goals.

Who can benefit from 6.2 Budgeting Strategies?

Individuals from all walks of life can benefit from implementing 6.2 budgeting strategies. Whether you are a student, a working professional, a business owner, or a homemaker, understanding and utilizing these strategies can help you gain control over your finances, reduce debt, and save for future expenses.

When Should 6.2 Budgeting Strategies be Implemented?

Image Source: lardbucket.org

The ideal time to implement 6.2 budgeting strategies is as early as possible. It is never too late to start budgeting and taking control of your financial situation. Whether you are just starting your career, getting married, or nearing retirement, these strategies can be applied at any stage of life.

Where Can 6.2 Budgeting Strategies be Applied?

6.2 budgeting strategies can be applied to various aspects of personal and professional finances. They can be used to manage monthly expenses, plan for major purchases, allocate savings, track investments, and even handle business finances effectively.

Why are 6.2 Budgeting Strategies Important?

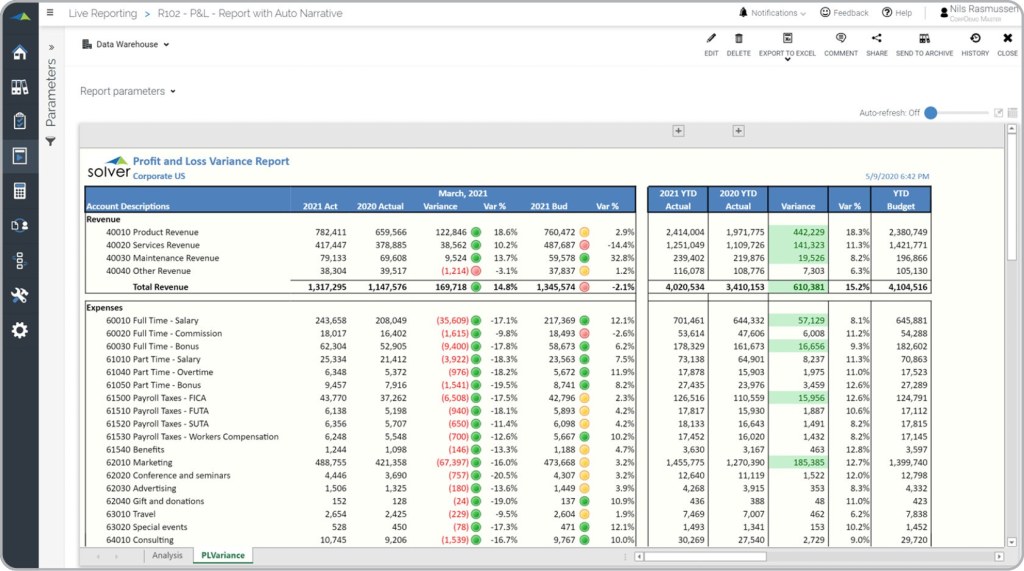

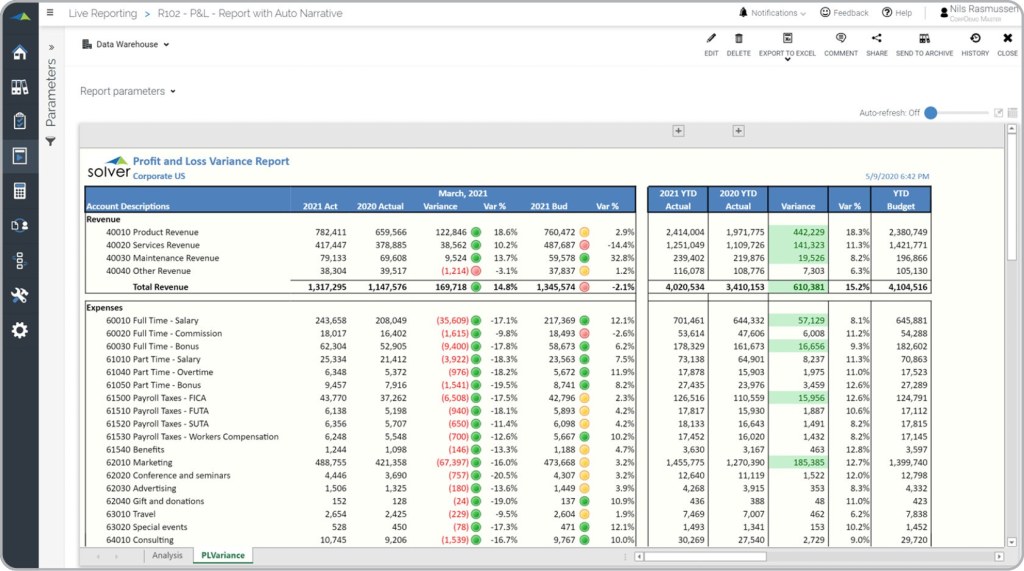

Image Source: solverglobal.com

Effective budgeting strategies are crucial for maintaining financial stability and achieving financial goals. By implementing these strategies, individuals can gain better control over their spending, reduce unnecessary expenses, identify areas of improvement, and save for emergencies or long-term goals.

How Can One Effectively Use 6.2 Budgeting Strategies?

Utilizing 6.2 budgeting strategies involves a step-by-step approach that includes assessing income and expenses, setting financial goals, creating a budget plan, tracking expenses, adjusting spending habits, and regularly reviewing and updating the budget. It requires discipline, commitment, and a willingness to make necessary adjustments.

Advantages and Disadvantages of 6.2 Budgeting Strategies

Like any other financial strategy, 6.2 budgeting strategies have their fair share of advantages and disadvantages. Let’s explore them in detail:

Advantages:

Helps in maintaining financial discipline and control.

Enhances savings and allows for future financial security.

Helps in identifying unnecessary expenses and reducing wasteful spending.

Provides a clear picture of one’s financial health and encourages goal setting.

Allows for better decision-making regarding income allocation.

Disadvantages:

Requires time and effort to maintain and update the budget regularly.

May involve restrictions on certain expenses, impacting lifestyle choices.

Can be challenging for individuals with irregular or unpredictable income.

Requires discipline to stick to the budget and resist impulsive spending.

May require adjustments and fine-tuning over time to suit changing financial circumstances.

Frequently Asked Questions (FAQ)

Q1: Are 6.2 budgeting strategies applicable for businesses as well?

A1: Yes, 6.2 budgeting strategies can be applied to personal finances as well as business finances. The principles remain the same, but the details may vary based on the nature and size of the business.

Q2: Can I modify the 6.2 budgeting strategies to suit my personal preferences?

A2: Absolutely! Budgeting strategies are not one-size-fits-all. You can modify and customize them based on your unique financial goals, income, and lifestyle.

Q3: Will budgeting restrict my ability to enjoy life and have fun?

A3: Budgeting is not about restricting yourself from enjoying life. It’s about making conscious choices and prioritizing your expenses to align with your financial goals. With proper planning, you can still have fun while being financially responsible.

Q4: Can budgeting help me get out of debt?

A4: Yes, budgeting is an effective tool for managing debt. By allocating funds towards debt repayment and reducing unnecessary expenses, you can gradually eliminate your debts and achieve financial freedom.

Q5: What are some common budgeting mistakes to avoid?

A5: Some common budgeting mistakes to avoid include not tracking expenses, underestimating or overestimating income, failing to set realistic goals, and not adjusting the budget as circumstances change.

Conclusion

In conclusion, implementing effective budgeting strategies is crucial for achieving financial stability and reaching your financial goals. The 6.2 budgeting strategies answer key provides valuable insights and solutions for individuals looking to take control of their finances. By understanding the what, who, when, where, why, and how of these strategies, you can make informed decisions, reduce financial stress, and pave the way for a brighter financial future.

Final Remarks

Before concluding, it is important to remember that budgeting is a continuous process that requires dedication and adaptability. The information presented here serves as a guide, but it’s essential to personalize and tailor these strategies to your unique financial situation. Always consult with a financial advisor or expert for specific advice related to your circumstances. By taking control of your finances through effective budgeting, you can create a solid foundation for a stable and prosperous future.

This post topic: Budgeting Strategies