Mastering Your Finances: 5 Budgeting Strategies For Financial Success

5 Budgeting Strategies

Introduction

Dear Readers,

3 Picture Gallery: Mastering Your Finances: 5 Budgeting Strategies For Financial Success

Welcome to our article on 5 budgeting strategies. In this article, we will explore effective methods to manage your finances and achieve your financial goals. Budgeting is crucial for individuals and businesses alike, as it helps in tracking expenses, maximizing savings, and ensuring financial stability. By implementing these strategies, you can gain better control over your money and make informed financial decisions. So, let’s dive in and discover the top five budgeting strategies that will lead you to financial success.

What is Budgeting?

Image Source: charcap.com

Before we dive into the different strategies, let’s first understand what budgeting is. Budgeting is the process of creating a plan for your money, where you allocate funds to various expenses and financial goals. It involves tracking your income, expenses, and savings to ensure you are spending within your means and making progress towards your financial objectives.

Who Can Benefit from Budgeting?

Everyone can benefit from budgeting, regardless of their financial situation. Whether you are a college student, a working professional, a small business owner, or planning for your retirement, budgeting can help you achieve your financial goals. It provides a roadmap for managing your money effectively, reducing debt, saving for emergencies, and planning for the future.

When Should You Start Budgeting?

The sooner you start budgeting, the better. It is never too early or too late to take control of your finances. Whether you are just starting your career or nearing retirement, implementing a budgeting strategy can have a significant impact on your financial well-being. The key is to start now and make it a habit to regularly review and adjust your budget as your financial situation changes.

Where Can You Implement Budgeting Strategies?

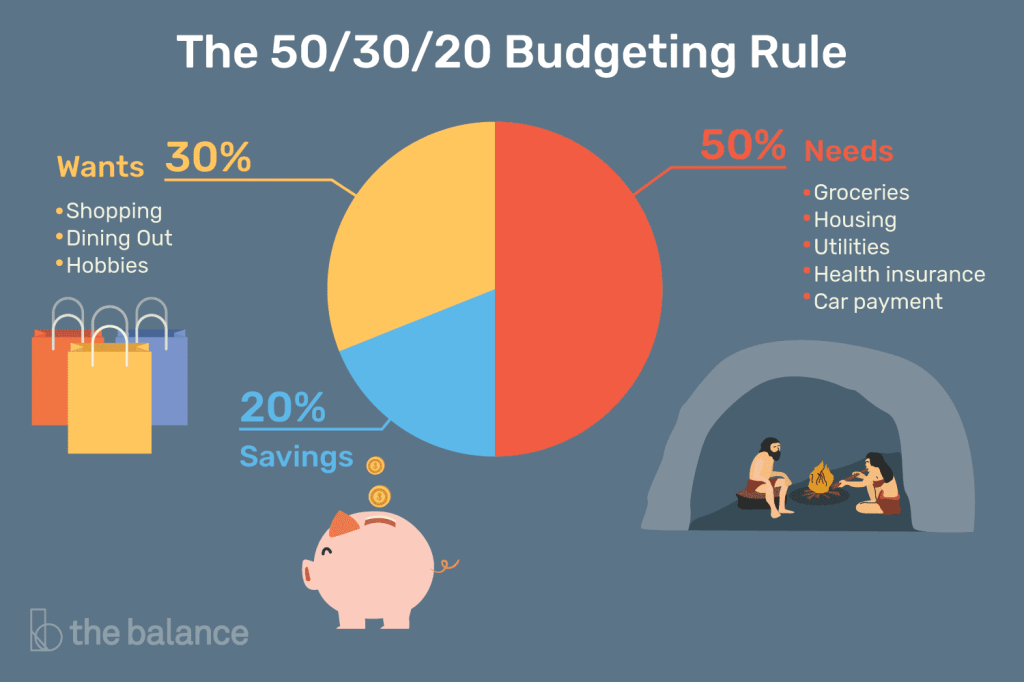

Image Source: thebalancemoney.com

Budgeting strategies can be implemented in any area of your life where money is involved. You can create budgets for personal expenses, such as housing, transportation, groceries, and entertainment. Businesses can also benefit from budgeting by allocating funds for marketing, operations, and investments. The key is to identify the areas where you want to improve your financial management and create a budget accordingly.

Why Are Budgeting Strategies Important?

Budgeting strategies are essential for several reasons. Firstly, they provide a clear overview of your financial situation, allowing you to make informed decisions based on accurate information. Secondly, budgeting helps in identifying areas of overspending and opportunities for savings. It also enables you to prioritize your financial goals and allocate resources accordingly. Lastly, budgeting helps in reducing financial stress and building a solid foundation for your future financial well-being.

How to Implement Budgeting Strategies?

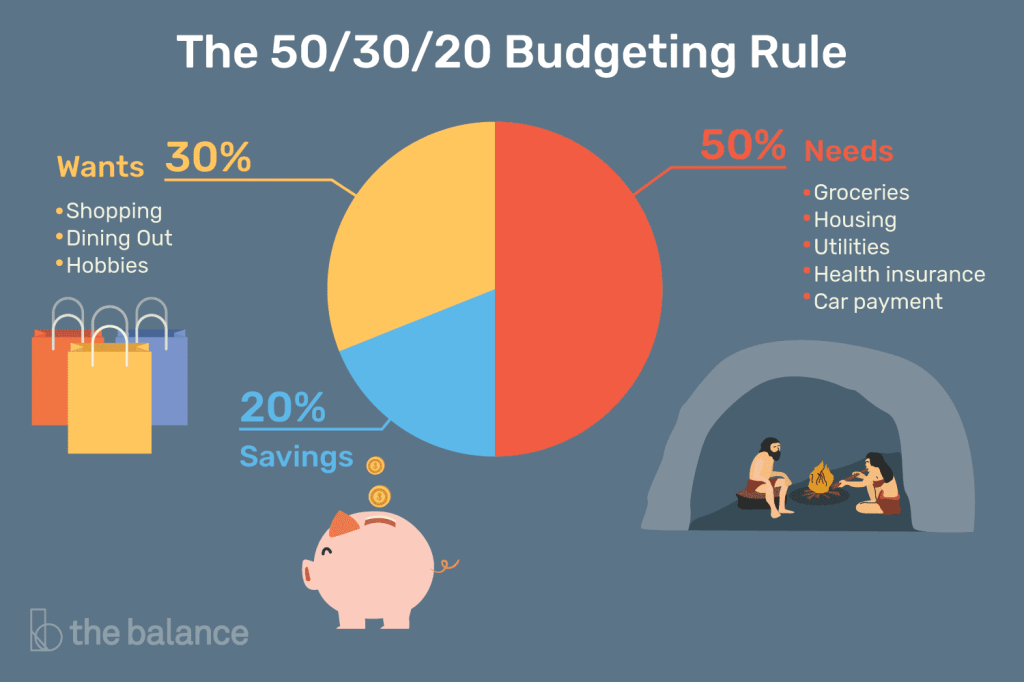

Image Source: thebalancemoney.com

Implementing budgeting strategies involves several steps. Firstly, track your income and expenses to understand your spending patterns. Then, set financial goals that are specific, measurable, achievable, relevant, and time-bound (SMART goals). Next, create a budget by allocating funds to different expense categories while ensuring you have enough for savings and emergencies. Regularly monitor and review your budget to make adjustments as necessary. Finally, stick to your budget and develop good financial habits to achieve long-term financial success.

Advantages and Disadvantages of Budgeting Strategies

Like any financial tool, budgeting strategies have their advantages and disadvantages. Let’s explore both sides to give you a comprehensive understanding.

Advantages of Budgeting Strategies

1. Financial Control: Budgeting strategies provide you with a sense of control over your finances. You know where your money is going and can make informed decisions about your spending.

2. Goal Achievement: By allocating funds to specific financial goals, budgeting strategies help you track your progress and achieve your objectives.

3. Debt Reduction: Budgeting allows you to allocate funds towards debt repayment, helping you reduce your debt and improve your financial standing.

4. Savings Growth: Budgeting strategies prioritize savings, allowing you to build an emergency fund and work towards long-term financial security.

5. Financial Awareness: Regularly reviewing your budget increases your financial awareness and helps you identify areas for improvement.

Disadvantages of Budgeting Strategies

1. Restrictive: Budgeting strategies can feel restrictive as they require you to allocate funds to specific categories, limiting your spending flexibility.

2. Time-consuming: Creating and maintaining a budget can be time-consuming, especially when you have to track every expense and update your budget regularly.

3. Unexpected Expenses: Budgeting strategies may not account for unexpected expenses, leading to adjustments or using emergency funds.

4. Discipline Required: Budgeting requires discipline and commitment to stick to your budget, which may be challenging for some individuals.

5. Limited Flexibility: Budgeting strategies may not allow for spontaneity or impulsive purchases, as they focus on planned spending.

Frequently Asked Questions (FAQs)

1. Can budgeting help me save money?

Yes, budgeting can help you save money by providing a clear overview of your expenses and prioritizing savings in your financial plan.

2. How often should I review my budget?

It is recommended to review your budget at least once a month to ensure it aligns with your financial goals and make any necessary adjustments.

3. Should I include occasional expenses in my budget?

Yes, occasional expenses such as vacations or holiday gifts should be included in your budget. Allocate a certain amount each month towards these expenses to avoid financial strain when they arise.

4. What if my income varies each month?

If your income varies each month, it is essential to create a budget based on your average income. Allocate funds to different expense categories based on this average and adjust as necessary when your income fluctuates.

5. Can budgeting help in reducing debt?

Yes, budgeting strategies can help in reducing debt by allocating funds towards debt repayment and prioritizing debt elimination in your financial plan.

Conclusion

In conclusion, implementing effective budgeting strategies is crucial for achieving financial stability and reaching your financial goals. By understanding what budgeting is, who can benefit from it, when and where to implement it, why it is important, and how to implement it, you can take control of your finances and make informed financial decisions. However, it is important to consider the advantages and disadvantages of budgeting strategies and find a balance that works for you. So, start budgeting today and pave the way for a financially secure future.

Final Remarks

Dear Readers,

We hope this article has provided you with valuable insights into the world of budgeting strategies. Remember that everyone’s financial situation is unique, so it’s essential to customize these strategies to fit your needs. Budgeting requires dedication and discipline, but the long-term benefits are worth it. Take control of your finances, prioritize your goals, and watch your financial success unfold. Good luck on your budgeting journey!

This post topic: Budgeting Strategies