The Ultimate Budget Strategy Guide: Your Key To Financial Success!

Budget Strategy Guide: A Comprehensive Approach to Managing Finances

Welcome, Readers! Today, we are going to delve into the world of budget strategy. In this guide, we will explore the importance of having a well-defined budget, its benefits, and how it can help you achieve your financial goals. Managing your finances effectively is crucial for a stable and secure future, and we are here to assist you every step of the way. So, let’s dive in and discover the secrets to successful budgeting!

Introduction

1. What is a Budget Strategy?

2 Picture Gallery: The Ultimate Budget Strategy Guide: Your Key To Financial Success!

A budget strategy refers to a systematic approach to managing your income and expenses. It involves creating a plan to allocate your financial resources effectively and make informed decisions about spending and saving.

2. Who Needs a Budget Strategy?

Image Source: slideteam.net

A budget strategy is essential for everyone, regardless of their income level or financial status. Whether you are a student, a young professional, or preparing for retirement, having a well-defined budget strategy can help you achieve financial stability and meet your financial goals.

3. When Should You Start Budgeting?

The ideal time to start budgeting is now! It is never too early or too late to take control of your finances. The sooner you start, the better equipped you will be to handle unexpected expenses and save for the future.

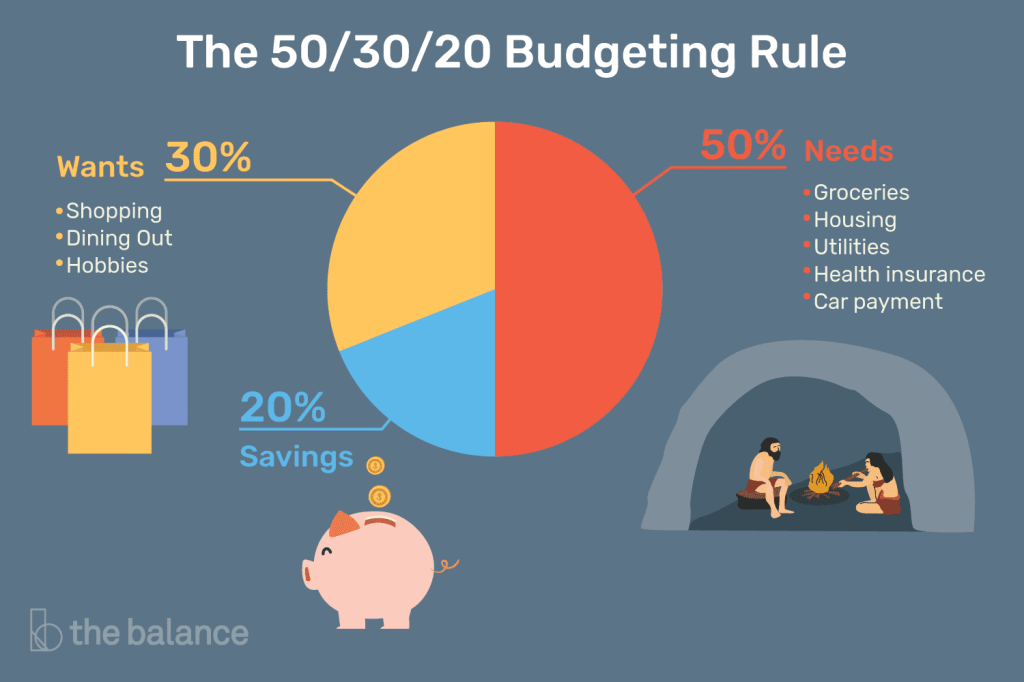

Image Source: thebalancemoney.com

4. Where Can You Implement a Budget Strategy?

A budget strategy can be implemented in various aspects of your life, including personal finances, business finances, and even event planning. It provides a roadmap for managing your income and expenses, regardless of the context.

5. Why is Budget Strategy Important?

Having a budget strategy is crucial for several reasons. It helps you track your spending, prioritize your financial goals, and make informed decisions about saving and investing. A budget strategy also provides a sense of control over your finances and helps you avoid unnecessary debt.

6. How to Create an Effective Budget Strategy?

Creating an effective budget strategy involves several steps. Start by analyzing your income and expenses, setting financial goals, and determining your spending limits. Track your expenses regularly and make adjustments as needed to ensure you stay on track.

Advantages and Disadvantages of Budget Strategy

1. Advantages of Budget Strategy

✅ Enhanced Financial Discipline: A budget strategy helps you develop better financial discipline by encouraging you to make thoughtful spending decisions and prioritize your financial goals.

✅ Improved Saving Habits: By tracking your expenses and setting aside a portion of your income for savings, a budget strategy helps you build a healthy saving habit for future financial security.

✅ Debt Management: Budgeting allows you to identify and manage your debt effectively, enabling you to pay off outstanding balances and avoid unnecessary interest charges.

2. Disadvantages of Budget Strategy

❌ Initial Effort Required: Implementing a budget strategy requires time and effort to analyze your finances, set goals, and monitor your expenses consistently. It may take some adjustment and discipline to get into the habit.

❌ Strict Limitations: Following a budget strategy may mean setting strict spending limits and sacrificing certain luxuries or non-essential expenses in the short term.

❌ Unexpected Expenses: While a budget strategy helps you plan for regular expenses, unexpected financial emergencies can still arise, requiring flexibility and adjustments in your budget.

Frequently Asked Questions (FAQs)

1. Is it necessary to track every penny spent?

Yes, tracking every penny spent is essential to get a clear picture of your spending habits and identify areas where you can make adjustments to save more.

2. How often should I review my budget strategy?

It is recommended to review your budget strategy at least once a month to ensure it aligns with your financial goals and make any necessary adjustments.

3. Can a budget strategy help me pay off my debts?

Absolutely! A budget strategy allows you to allocate a portion of your income towards debt repayment systematically, helping you pay off your debts faster and save on interest charges.

4. What if my income fluctuates each month?

If your income fluctuates, it is important to create a budget strategy that accommodates these changes. Consider setting aside a portion of your income during months with higher earnings to cover expenses during low-income months.

5. Can a budget strategy help me achieve long-term financial goals?

Yes, a budget strategy is vital in achieving long-term financial goals. It helps you save and invest strategically, ensuring you are on track to meet your objectives, such as buying a home, starting a business, or retiring comfortably.

Conclusion

In conclusion, implementing a budget strategy is a crucial step towards achieving financial stability and reaching your financial goals. It provides you with a roadmap for managing your income and expenses, helping you make informed decisions and prioritize your spending. While budgeting requires discipline and effort, the benefits far outweigh the challenges. So, take control of your financial future today and start building a solid foundation for a prosperous life!

Final Remarks

It is important to note that while a budget strategy can greatly improve your financial well-being, it is not a one-size-fits-all solution. Each individual’s financial situation is unique, and it is essential to tailor your budget strategy to your specific needs and goals. Consult with a financial advisor or expert to gain personalized insights and guidance. Remember, patience and perseverance are key when it comes to budgeting. Good luck on your financial journey, and may you achieve all your financial aspirations!

This post topic: Budgeting Strategies