Maximize Your Retirement Savings Amount Now: Unlock Your Financial Freedom!

Retirement Savings Amount

Introduction

Welcome, Readers! Today, let’s delve into the important topic of retirement savings amount. Planning for retirement is crucial, and understanding how much to save can make a significant difference in your financial future. In this article, we will explore the various aspects of retirement savings amount, including what it entails, who should consider it, when to start saving, where to invest, why it is essential, and how to calculate the ideal amount. So, let’s begin!

2 Picture Gallery: Maximize Your Retirement Savings Amount Now: Unlock Your Financial Freedom!

What is Retirement Savings Amount? 🤔

Retirement savings amount refers to the sum of money an individual should set aside to cover their expenses during retirement. It is crucial to determine this amount to ensure a comfortable and financially secure retirement. Various factors such as living expenses, healthcare costs, inflation, and desired lifestyle should be considered when calculating the retirement savings amount.

Who Should Consider Retirement Savings Amount? 🤷♂️

Image Source: edwardjones.com

Everyone, regardless of age or income level, should consider retirement savings amount. It is never too early or too late to start saving for retirement. Whether you are in your 20s or nearing retirement, having a solid savings plan will greatly benefit your financial future. Retirement savings amount is especially essential for individuals without pension plans or those who wish to maintain their desired lifestyle post-retirement.

When Should You Start Saving? ⌛

The earlier you start saving for retirement, the better. Ideally, individuals should begin setting aside funds as soon as they start earning income. The power of compounding interest allows for significant growth over time. However, if you have not started yet, it is never too late. It is essential to start saving as soon as possible to maximize your savings and ensure a comfortable retirement.

Where Should You Invest? 🌍

When it comes to retirement savings, there are various investment options available. These include individual retirement accounts (IRAs), employer-sponsored plans such as 401(k)s, stocks, bonds, and real estate. It is crucial to diversify your investments to minimize risk and maximize returns. Consulting with a financial advisor can provide valuable insights into the best investment strategies for your retirement savings.

Why is Retirement Savings Amount Essential? ❓

Image Source: ctfassets.net

Retirement savings amount is essential to maintain financial independence and security during retirement. With increasing life expectancy and rising healthcare costs, relying solely on government benefits or pension plans may not be sufficient. By calculating and saving an adequate retirement savings amount, individuals can enjoy their golden years without financial stress and have the freedom to pursue their passions.

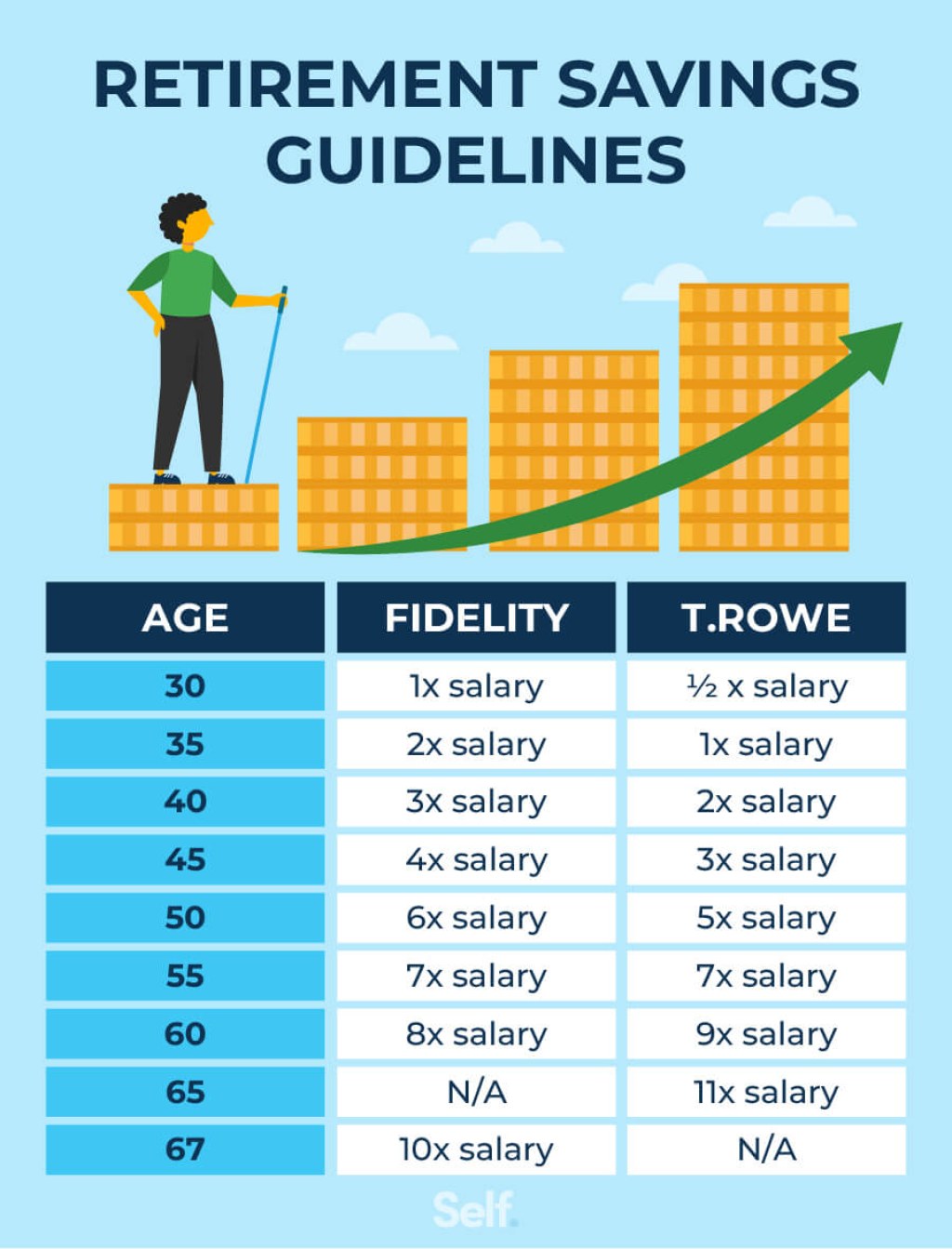

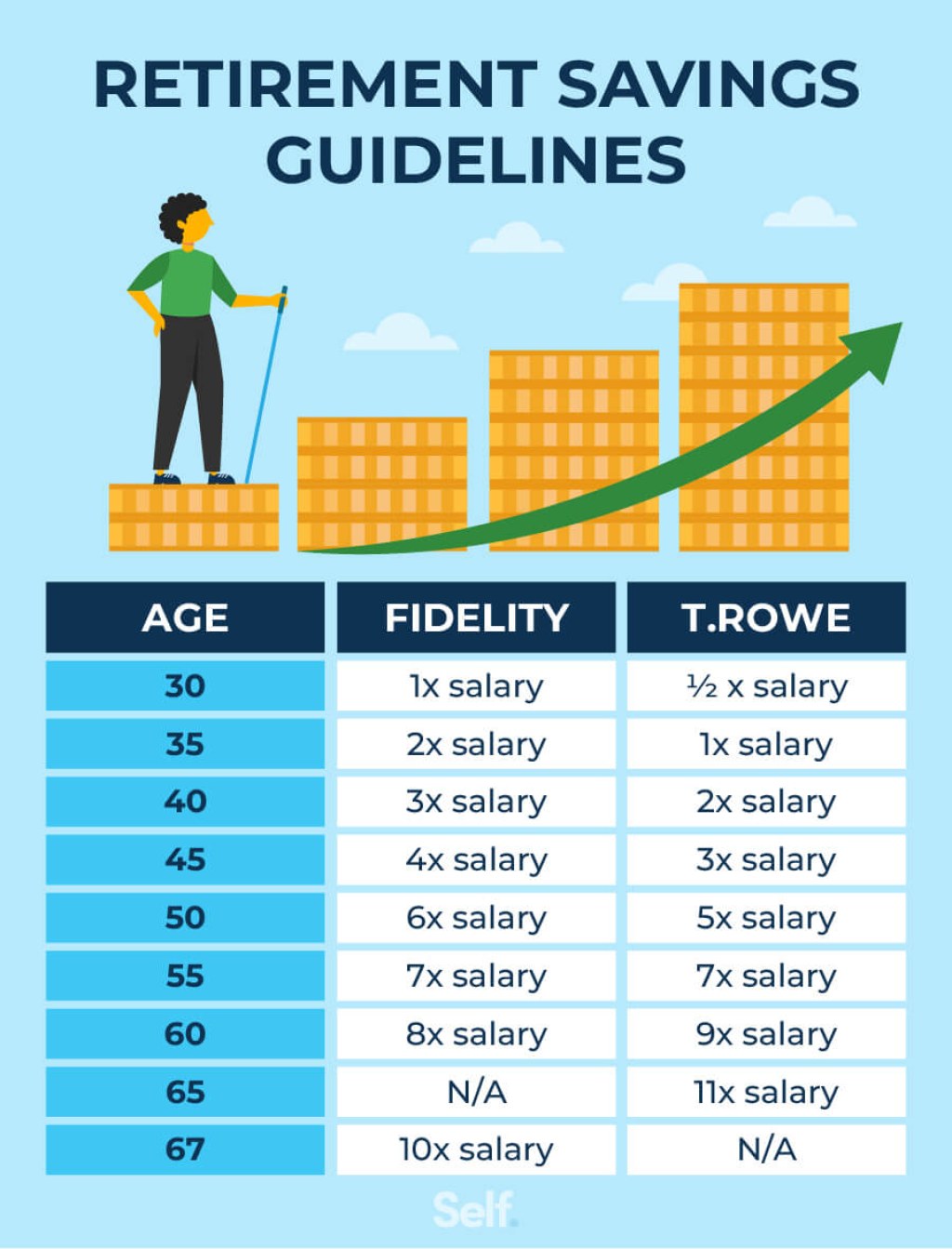

How to Calculate the Ideal Retirement Savings Amount? 🧮

Calculating the ideal retirement savings amount can seem daunting, but it is crucial for proper planning. Several factors need to be considered, such as current age, desired retirement age, life expectancy, expected rate of return on investments, and anticipated living expenses. Utilizing retirement calculators or seeking guidance from financial professionals can help determine the ideal retirement savings amount tailored to your specific needs and goals.

Advantages and Disadvantages of Retirement Savings Amount

Advantages

1. Financial Security: Having a sufficient retirement savings amount provides financial security during your golden years, ensuring you can cover living expenses and unforeseen costs.

2. Flexibility: With a substantial retirement savings amount, you have the flexibility to pursue hobbies, travel, and enjoy a comfortable lifestyle without worrying about money.

3. Legacy Planning: Adequate retirement savings can enable you to leave a financial legacy for your loved ones.

Disadvantages

1. Limited Cash Flow: Allocating a significant portion of your income towards retirement savings may limit your current cash flow and discretionary spending.

2. Market Volatility: Investing in retirement savings comes with market risks, and economic downturns can impact the value of your investments.

3. Inflation: Inflation erodes the purchasing power of your retirement savings over time, making it essential to account for inflation when calculating the ideal amount.

Frequently Asked Questions (FAQs)

1. How much should I save for retirement?

The ideal retirement savings amount varies for each individual based on factors such as desired lifestyle, living expenses, and anticipated healthcare costs. Consulting with a financial advisor can help determine the right amount for you.

2. Can I start saving for retirement in my 40s?

While it is advisable to start saving for retirement as early as possible, starting in your 40s still allows time for significant savings growth. You may need to contribute a higher percentage of your income to catch up.

3. Should I rely on social security for my retirement?

Social security benefits alone may not be sufficient to cover all your retirement expenses. It is essential to have additional savings to ensure a comfortable lifestyle.

4. Is it possible to save too much for retirement?

While saving for retirement is important, it is essential to strike a balance. Saving excessively for retirement may limit your current lifestyle and opportunities.

5. Can I adjust my retirement savings amount over time?

Absolutely! It is recommended to review and adjust your retirement savings amount periodically as your circumstances and goals change.

Conclusion

In conclusion, understanding and planning for your retirement savings amount is vital for a financially secure future. By considering factors such as expenses, investments, and personal goals, you can determine the ideal amount to save. Remember, it’s never too early or too late to start saving for retirement. Take control of your financial future today and enjoy a comfortable retirement tomorrow!

Final Remarks

Friends, planning for retirement is an essential aspect of financial well-being. While this article provides valuable insights into retirement savings amount, it is crucial to seek professional advice and tailor your savings plan to your specific needs and goals. Remember, small steps today can lead to a secure and fulfilling retirement in the future. Start saving now and pave the way for a worry-free retirement. Best of luck on your financial journey!

This post topic: Budgeting Strategies