Mastering Budgeting Strategy Income: Unlocking Financial Success With Effective Techniques

Budgeting Strategy Income: A Comprehensive Guide to Manage Your Finances

Introduction

Greetings, Readers! Today, we will delve into the world of budgeting strategy income – a crucial aspect of financial management that can help you achieve your financial goals and secure a stable future. In this article, we will explore the ins and outs of budgeting strategy income, providing you with valuable insights and tips to effectively manage your finances. So, let’s dive in!

But first, let’s understand what budgeting strategy income entails and why it is essential. Budgeting strategy income refers to a systematic approach to managing your income. It involves creating a plan to allocate your earnings to various expenses, savings, investments, and debt repayments. By implementing an effective budgeting strategy income, you can attain financial stability, reduce debt, build savings, and work towards achieving your long-term financial goals.

2 Picture Gallery: Mastering Budgeting Strategy Income: Unlocking Financial Success With Effective Techniques

Now, let’s delve into the various aspects of budgeting strategy income and how it can benefit you.

What is Budgeting Strategy Income? 🤔

Budgeting strategy income is a financial management technique that involves allocating your income effectively to meet your financial goals. It enables you to track your expenses, save money, and invest wisely. By formulating a budgeting strategy income, you gain better control over your finances, avoid overspending, and make informed financial decisions.

A successful budgeting strategy income requires careful planning, thorough analysis of your income and expenses, and regular monitoring. It involves categorizing your income, prioritizing expenses, setting specific financial goals, and adjusting your spending habits accordingly.

How Can Budgeting Strategy Income Help You? 🌟

Image Source: mymoneycoach.ca

1️⃣ Financial Discipline: A budgeting strategy income instills financial discipline by helping you manage your money effectively. It encourages you to spend within your means, avoid unnecessary expenses, and prioritize your financial goals.

2️⃣ Debt Reduction: Implementing a budgeting strategy income allows you to allocate funds towards debt repayment, helping you reduce your outstanding debts and ultimately become debt-free.

3️⃣ Savings and Investments: By adhering to a budgeting strategy income, you can set aside a portion of your income for savings and investments. This enables you to build an emergency fund, achieve short-term financial goals, and secure your future through long-term investments.

4️⃣ Financial Goal Achievement: Whether it’s purchasing a house, planning a vacation, or saving for retirement, a budgeting strategy income helps you stay focused and reach your financial goals. It provides a roadmap for allocating resources effectively and ensures that you make progress towards your aspirations.

5️⃣ Improved Financial Decision-Making: With a budgeting strategy income in place, you can make informed financial decisions. You can evaluate the feasibility of large expenses, weigh the pros and cons, and assess their impact on your overall financial well-being.

Who Can Benefit from Budgeting Strategy Income? 🤷♂️

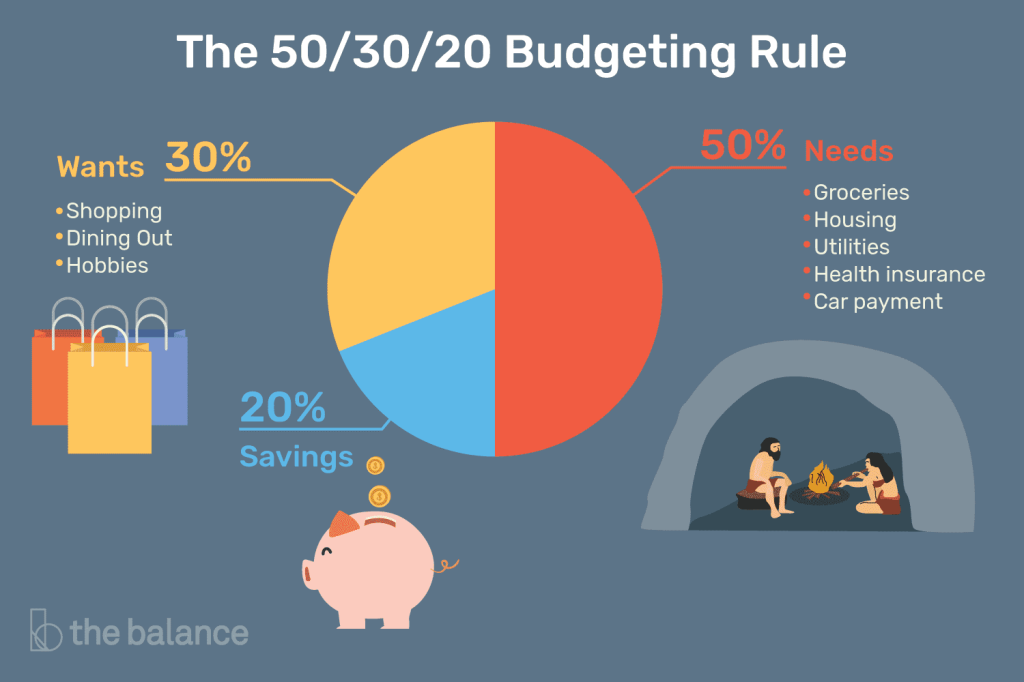

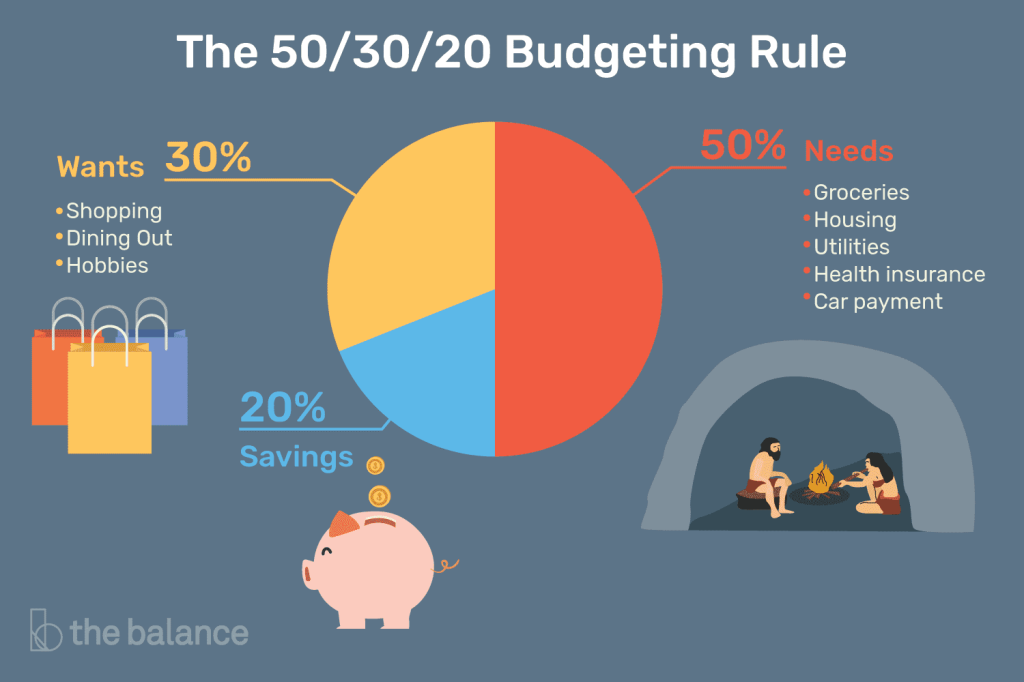

Image Source: thebalancemoney.com

Everyone can benefit from implementing a budgeting strategy income, regardless of their financial standing. Whether you are just starting your career, facing financial challenges, or seeking to grow your wealth, a budgeting strategy income empowers you to take control of your finances and make meaningful progress towards your financial goals.

Students, working professionals, entrepreneurs, and retirees – anyone can reap the rewards of budgeting strategy income. It provides a solid foundation for financial success and allows individuals to live within their means while working towards a financially secure future.

When Should You Start Implementing a Budgeting Strategy Income? ⏰

The sooner, the better! It is never too early or too late to start implementing a budgeting strategy income. Whether you are just entering the workforce or well into your retirement, now is the perfect time to take control of your finances and set yourself up for financial success.

By starting early, you can develop good financial habits, build a strong financial foundation, and make the most of your earning potential. However, even if you have neglected budgeting strategy income in the past, it is never too late to start. You can still make significant progress towards your financial goals by implementing an effective budgeting strategy income today.

Where Can You Implement Budgeting Strategy Income? 🌍

Budgeting strategy income can be implemented in various aspects of your financial life. Whether it is managing your personal expenses, running a business, or planning for retirement, a budgeting strategy income provides a framework for effective financial management.

From tracking your monthly expenses and creating a savings plan to optimizing your investment portfolio, you can apply budgeting strategy income principles in all areas of your financial life. By doing so, you can gain better control over your finances and make significant progress towards your financial goals, regardless of your location or financial situation.

Why is Budgeting Strategy Income Important? 🧐

Budgeting strategy income plays a crucial role in your financial well-being. Here’s why it is essential:

1️⃣ Financial Stability: A budgeting strategy income provides stability by ensuring that you allocate your income effectively. It helps you avoid living paycheck to paycheck and provides a safety net during financial emergencies.

2️⃣ Debt Management: By implementing a budgeting strategy income, you can effectively manage your debts. It allows you to prioritize debt repayment, avoid accumulating more debt, and improve your overall financial health.

3️⃣ Goal Achievement: A budgeting strategy income enables you to set and achieve your financial goals. Whether it’s saving for a down payment, funding your child’s education, or planning for retirement, a budgeting strategy income lays the groundwork for success.

4️⃣ Financial Awareness: Implementing a budgeting strategy income increases your financial awareness. It provides insights into your spending habits, helps you identify areas for improvement, and empowers you with the knowledge to make informed financial decisions.

5️⃣ Peace of Mind: Knowing that you have a budgeting strategy income in place brings peace of mind. It reduces financial stress, promotes a healthy relationship with money, and allows you to focus on other aspects of your life with confidence.

How to Implement an Effective Budgeting Strategy Income? 📝

Implementing an effective budgeting strategy income involves several key steps:

1️⃣ Assess Your Finances: Start by analyzing your income, expenses, and debts. Understand your current financial situation and identify areas for improvement.

2️⃣ Set Financial Goals: Determine your short-term and long-term financial goals. Whether it’s building an emergency fund, paying off debts, or saving for retirement, clearly define your objectives.

3️⃣ Create a Budget: Develop a comprehensive budget by allocating your income to various expense categories, savings, investments, and debt repayments. Ensure that your budget aligns with your financial goals.

4️⃣ Track Your Expenses: Monitor your expenses regularly and categorize them according to your budget. Use budgeting tools or apps to simplify the process and gain better insights into your spending habits.

5️⃣ Adjust and Prioritize: Regularly review your budget and make adjustments as necessary. Prioritize essential expenses, reduce discretionary spending, and allocate more funds towards debt repayment and savings.

6️⃣ Stay Disciplined: Stick to your budgeting strategy income and practice financial discipline. Avoid impulsive purchases, track your progress, and stay committed to your financial goals.

Advantages and Disadvantages of Budgeting Strategy Income

Advantages:

1. Financial Stability and Security

By implementing a budgeting strategy income, you can achieve financial stability and security. It allows you to plan your expenditures, build an emergency fund, and prepare for unforeseen circumstances.

2. Debt Reduction and Management

With a budgeting strategy income, you can effectively manage your debts and work towards becoming debt-free. It enables you to allocate funds towards debt repayment, minimize interest charges, and improve your credit score.

3. Goal Achievement

A budgeting strategy income provides a roadmap for achieving your financial goals. Whether it’s saving for a down payment, starting a business, or planning for retirement, it helps you prioritize and allocate resources accordingly.

4. Financial Awareness and Control

Implementing a budgeting strategy income increases your financial awareness and empowers you with control over your finances. It allows you to track your income and expenses, identify areas for improvement, and make informed financial decisions.

5. Improved Decision-Making

A budgeting strategy income enables you to make better financial decisions. By having a clear overview of your finances, you can evaluate the feasibility of large expenses, weigh the pros and cons, and ensure they align with your overall financial well-being.

Disadvantages:

1. Initial Effort and Discipline

Implementing a budgeting strategy income requires effort and discipline. It may take time to create an effective budget, track expenses, and adjust spending habits. Staying committed to your budgeting strategy income can also be challenging.

2. Unexpected Expenses

While a budgeting strategy income helps you plan for expected expenses, unexpected expenses can still arise. Medical emergencies, car repairs, or home maintenance can disrupt your budget, requiring adjustments and flexibility.

3. Lifestyle Adjustments

A budgeting strategy income may require lifestyle adjustments, particularly if you need to cut back on discretionary spending. This can be challenging for individuals accustomed to a certain lifestyle.

4. Income Fluctuations

If your income is variable or fluctuates, it can be challenging to create a consistent budget. Adapting to income fluctuations and managing your expenses accordingly may require additional planning and flexibility.

5. Emotional Impact

For some individuals, adhering to a budgeting strategy income can lead to emotional stress. Feelings of deprivation or restrictions may arise, requiring careful management of emotional well-being alongside financial stability.

FAQs (Frequently Asked Questions)

1. How often should I review my budget?

It is recommended to review your budget regularly, at least once a month. This allows you to track your progress, make adjustments, and ensure that your budget aligns with your current financial situation and goals.

2. Can I still enjoy my favorite activities while budgeting?

Absolutely! Budgeting does not mean eliminating all enjoyable activities. It involves prioritizing and allocating funds towards your financial goals while still enjoying the activities that bring you happiness. Find a balance that works for you.

3. What if I have an irregular income?

If your income fluctuates, it is crucial to plan and budget accordingly. Consider creating an average income based on past earnings or allocate funds during peak earning periods to cover expenses during lean periods.

4. Should I include unexpected expenses in my budget?

Yes, it is wise to allocate funds for unexpected expenses in your budget. Creating an emergency fund can provide a safety net for unforeseen circumstances and prevent you from dipping into your regular budget.

5. Can I make changes to my budget during the month?

While it is best to stick to your budget as much as possible, it is acceptable to make changes if necessary. Life is unpredictable, and adjustments may be required. Just ensure that any changes align with your financial goals and do not compromise your overall financial health.

Conclusion: Take Control of Your Financial Future

Friends, the importance of budgeting strategy income cannot be overstated. Implementing an effective budgeting strategy income provides you with financial stability, helps you achieve your goals, and empowers you to make informed financial decisions. Remember, it is never too late to start managing your finances better. Take the first step today and embark on a journey towards a secure and prosperous financial future!

Final Remarks

In conclusion, budgeting strategy income is a powerful tool that can transform your financial life. By allocating your income effectively, prioritizing your goals, and practicing financial discipline, you can pave the way for financial stability, debt reduction, and goal achievement. However, it is important to note that every individual’s financial situation is unique, and what works for one person may not work for another. It is advisable to seek professional financial advice and customize a budgeting strategy income that aligns with your specific needs and goals.

Remember, financial success is a journey, and it requires commitment, perseverance, and continuous learning. With the right mindset and a well-designed budgeting strategy income, you can take control of your financial future and create the life you desire. Good luck on your financial journey!

This post topic: Budgeting Strategies