Secure Your Future: Maximize Retirement Fund 2035 Now!

Retirement Fund 2035: Preparing for a Secure Future

Greetings, Readers! In this article, we will delve into the world of retirement fund 2035 and discuss how it can help you secure a comfortable future. Planning for retirement is crucial, and the retirement fund 2035 is one investment option that can ensure financial stability during your golden years. Let’s explore the details of this fund and understand its benefits and advantages.

Introduction

Retirement fund 2035 is a long-term investment plan designed to provide financial support after retirement, specifically targeting individuals who plan to retire in the year 2035. This fund offers a diversified portfolio that includes stocks, bonds, and other investment instruments, aiming to generate substantial returns over time.

2 Picture Gallery: Secure Your Future: Maximize Retirement Fund 2035 Now!

The table below provides a comprehensive overview of retirement fund 2035:

Overview

Retirement Fund 2035

Target Retirement Year

2035

Image Source: fintel.io

Investment Mix

60% Stocks, 30% Bonds, 10% Cash

Risk Level

Moderate to High

Expected Return

8-10% per annum

Management Fees

0.5% per annum

1. What is Retirement Fund 2035?

Retirement fund 2035 is a specialized investment vehicle that caters to individuals planning to retire in the year 2035. It offers a combination of stocks, bonds, and cash, providing a diversified portfolio that aims to maximize returns while managing risk. This fund is professionally managed by experienced investment managers who make strategic decisions to optimize growth.

2. Who is Eligible for Retirement Fund 2035?

Image Source: voya.com

Retirement fund 2035 is open to individuals of all ages who are planning to retire in the year 2035. It is suitable for both employees who have access to employer-sponsored retirement plans and self-employed individuals who want to secure their financial future. The fund allows for regular contributions, making it accessible to individuals with varying income levels.

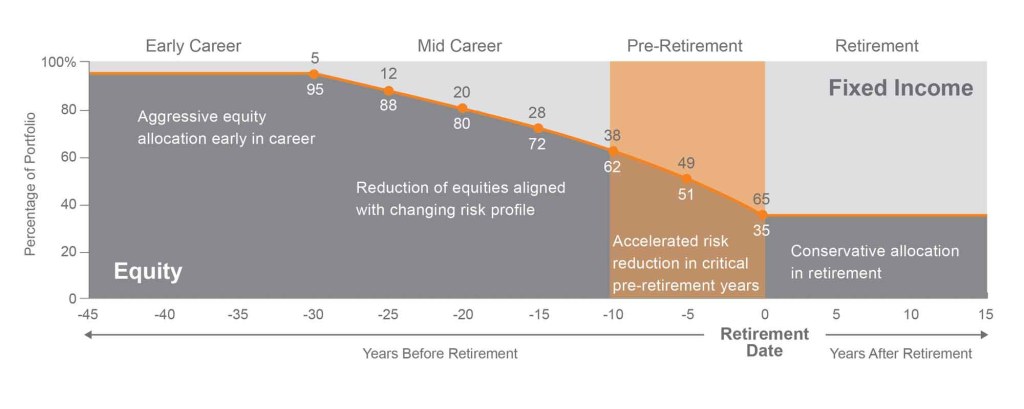

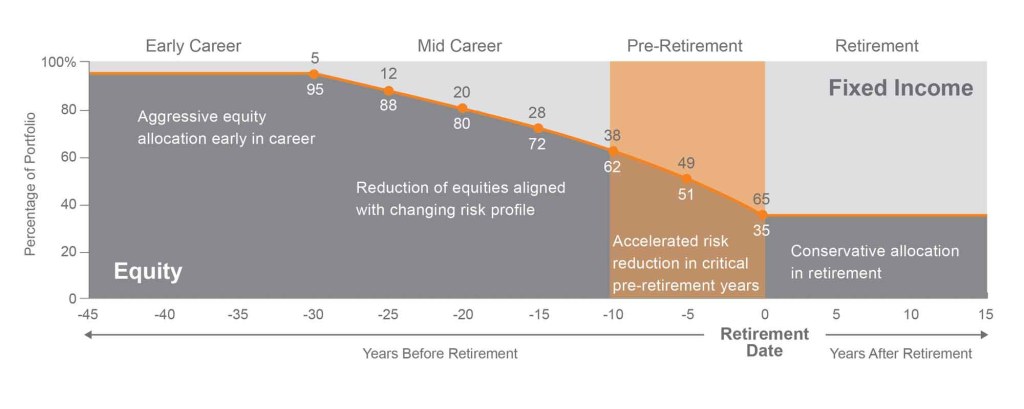

3. When Should You Start Investing in Retirement Fund 2035?

It is recommended to start investing in retirement fund 2035 as early as possible. The power of compounding allows your investments to grow exponentially over time, so the earlier you start, the more substantial your retirement savings will be. However, it is never too late to begin investing in this fund, as it offers attractive returns and flexibility even for those nearing their retirement age.

4. Where Can You Invest in Retirement Fund 2035?

Retirement fund 2035 is offered by various financial institutions, including banks, mutual fund companies, and investment firms. You can either invest directly with these institutions or seek the assistance of a financial advisor who can guide you through the investment process. Additionally, many online platforms provide easy access to retirement funds, allowing you to manage your investments conveniently.

5. Why Choose Retirement Fund 2035?

Retirement fund 2035 offers several advantages. Firstly, its diversified portfolio helps mitigate risk and provides potential for higher returns compared to traditional savings accounts. Secondly, the fund is managed by professionals who have expertise in navigating the financial markets, ensuring that your investments are in capable hands. Lastly, the retirement fund 2035 allows for flexibility, enabling you to adjust your contribution amounts based on your financial situation.

6. How to Invest in Retirement Fund 2035?

Investing in retirement fund 2035 is a straightforward process. Firstly, research and select a reputable financial institution or platform that offers this fund. Next, open an investment account and complete the necessary paperwork. You will then be able to make regular contributions to the fund either through automatic deposits or manual transfers. It is advisable to review your investment strategy periodically and make adjustments as needed.

Advantages and Disadvantages of Retirement Fund 2035

Retirement fund 2035 comes with its own set of advantages and disadvantages. Let’s explore them further:

Advantages:

1. Potential for Higher Returns: The diversified portfolio of retirement fund 2035 offers the potential for higher returns compared to traditional savings accounts.

2. Professional Management: The fund is managed by experienced professionals who make informed investment decisions on your behalf.

3. Flexibility: You have the flexibility to adjust your contribution amounts based on your financial situation.

Disadvantages:

1. Market Risk: As retirement fund 2035 invests in stocks and bonds, there is a certain level of market risk involved, and the value of your investments can fluctuate.

2. Management Fees: The fund charges management fees, which can impact your overall returns. It is essential to consider these fees when evaluating the fund’s performance.

Frequently Asked Questions (FAQs)

1. Can I withdraw my money from retirement fund 2035 before reaching retirement age?

No, retirement fund 2035 is designed for long-term investment and is intended to support your retirement. Early withdrawals may attract penalties and can significantly impact your future savings.

2. Is retirement fund 2035 suitable for conservative investors?

Retirement fund 2035 has a moderate to high risk level due to its allocation in stocks. It may not be suitable for conservative investors seeking low-risk options. It is advisable to consult with a financial advisor to determine the appropriate investment strategy based on your risk tolerance.

3. Can I contribute to retirement fund 2035 even if I have an employer-sponsored retirement plan?

Yes, you can contribute to retirement fund 2035 in addition to your employer-sponsored retirement plan. It allows you to diversify your investments and increase your retirement savings.

4. What happens to my retirement fund 2035 investments after the target retirement year?

After the target retirement year, the fund gradually shifts its allocation towards more conservative investments to reduce risk. It aims to preserve capital and provide stable income during retirement.

5. Can I change my retirement fund 2035 investment strategy?

Yes, most retirement funds, including retirement fund 2035, allow investors to change their investment strategy. It is advisable to review your investment goals periodically and make adjustments accordingly.

Conclusion

In conclusion, retirement fund 2035 offers a promising investment opportunity for individuals planning to retire in the year 2035. It provides a diversified portfolio, potential for higher returns, and professional management. However, it is essential to consider the associated risks, such as market fluctuations and management fees. By starting early and making regular contributions, you can secure a comfortable future and enjoy your retirement years to the fullest.

Final Remarks

Friends, planning for retirement is a critical step towards securing financial stability in the future. Retirement fund 2035 can be a valuable tool in achieving your retirement goals. However, it is important to conduct thorough research, assess your risk tolerance, and consult with a financial advisor before making any investment decisions. Remember, a well-prepared retirement can provide you with peace of mind and the freedom to pursue your passions. Start investing in your future today!

This post topic: Budgeting Strategies