Secure Your Future: Invest In Retirement Fund 2022 Today For A Blissful Retirement!

Retirement Fund 2022: Preparing for a Secure Financial Future

Greetings, Readers!

Welcome to our comprehensive guide on retirement funds for the year 2022. In this article, we will explore everything you need to know about retirement planning, investment options, and strategies to ensure a secure financial future. As retirement is a significant milestone in one’s life, it is crucial to make informed decisions and take the necessary steps towards financial stability.

3 Picture Gallery: Secure Your Future: Invest In Retirement Fund 2022 Today For A Blissful Retirement!

Table of Contents

1. Introduction

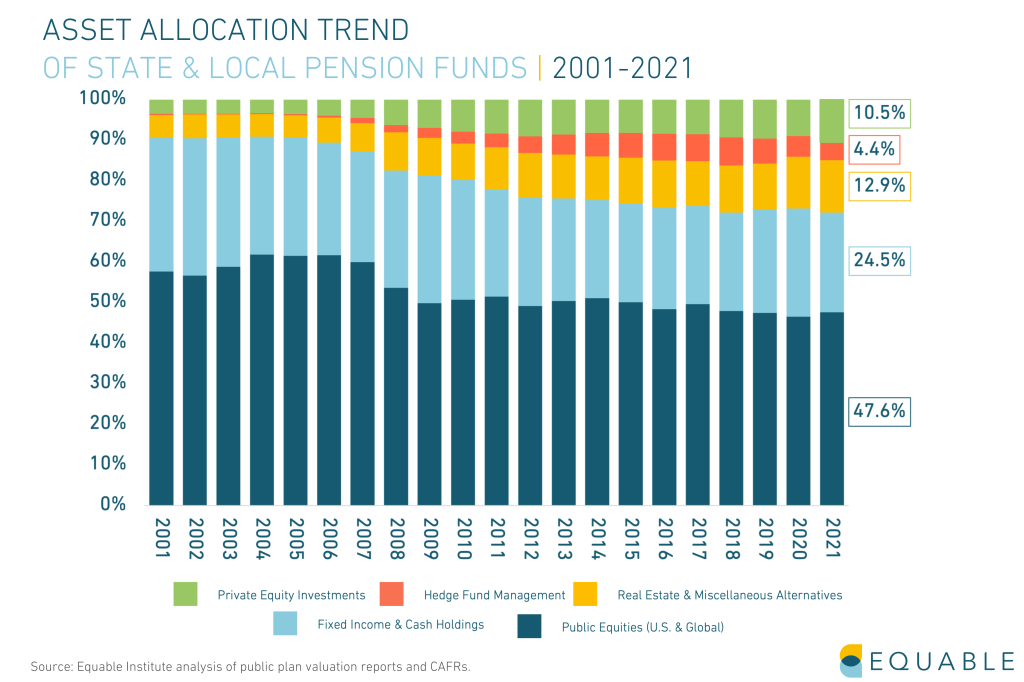

Image Source: equable.org

2. What is a Retirement Fund?

3. Who Should Consider a Retirement Fund?

4. When to Start Planning for Retirement?

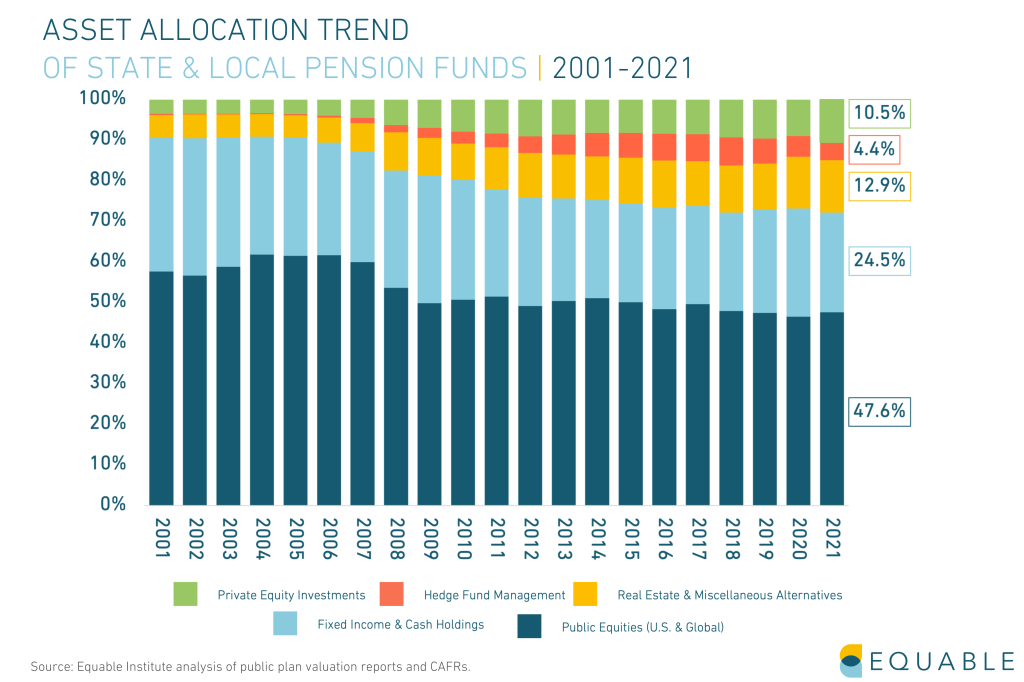

Image Source: equable.org

5. Where to Invest for Retirement?

6. Why is a Retirement Fund Important?

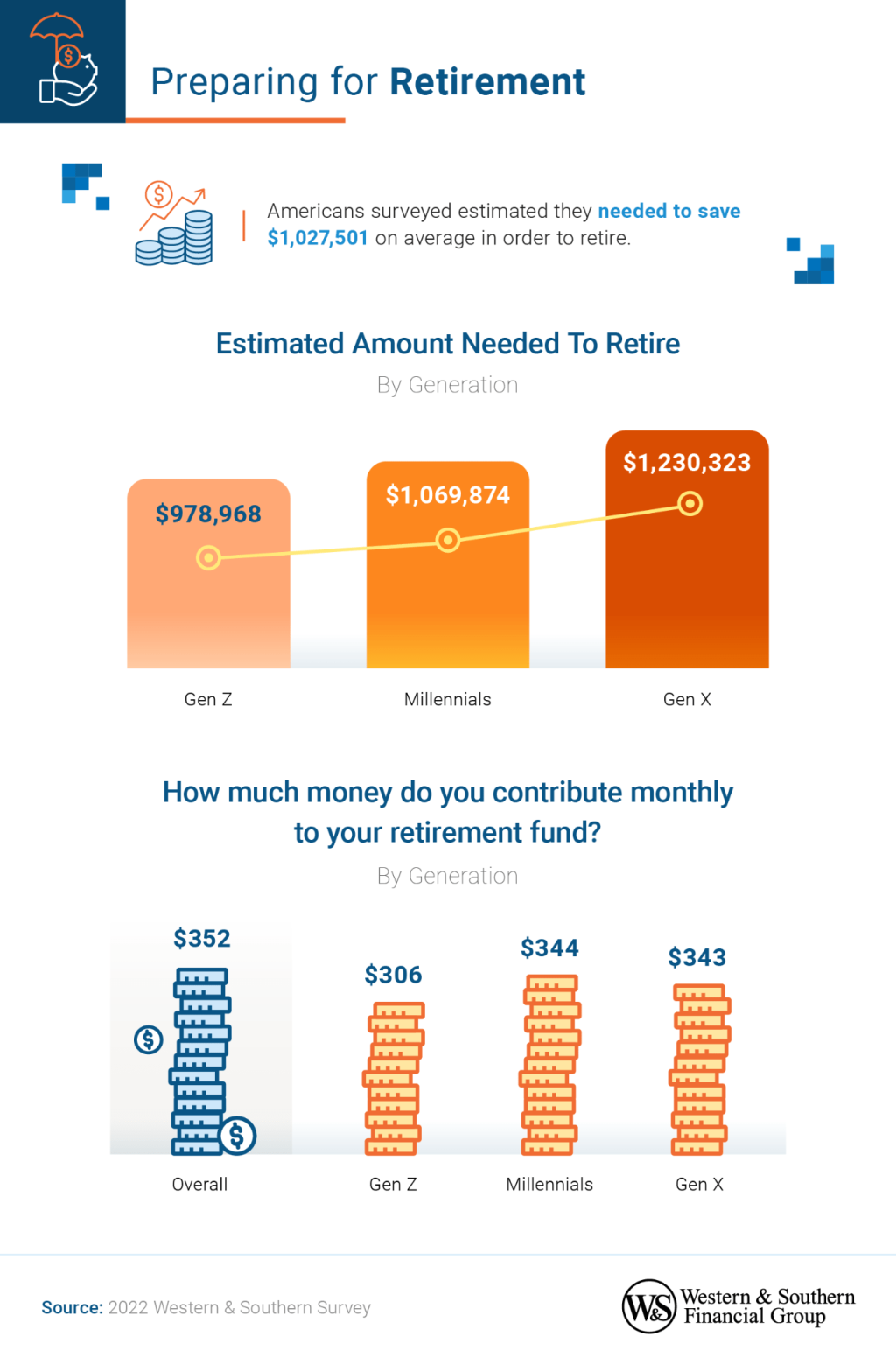

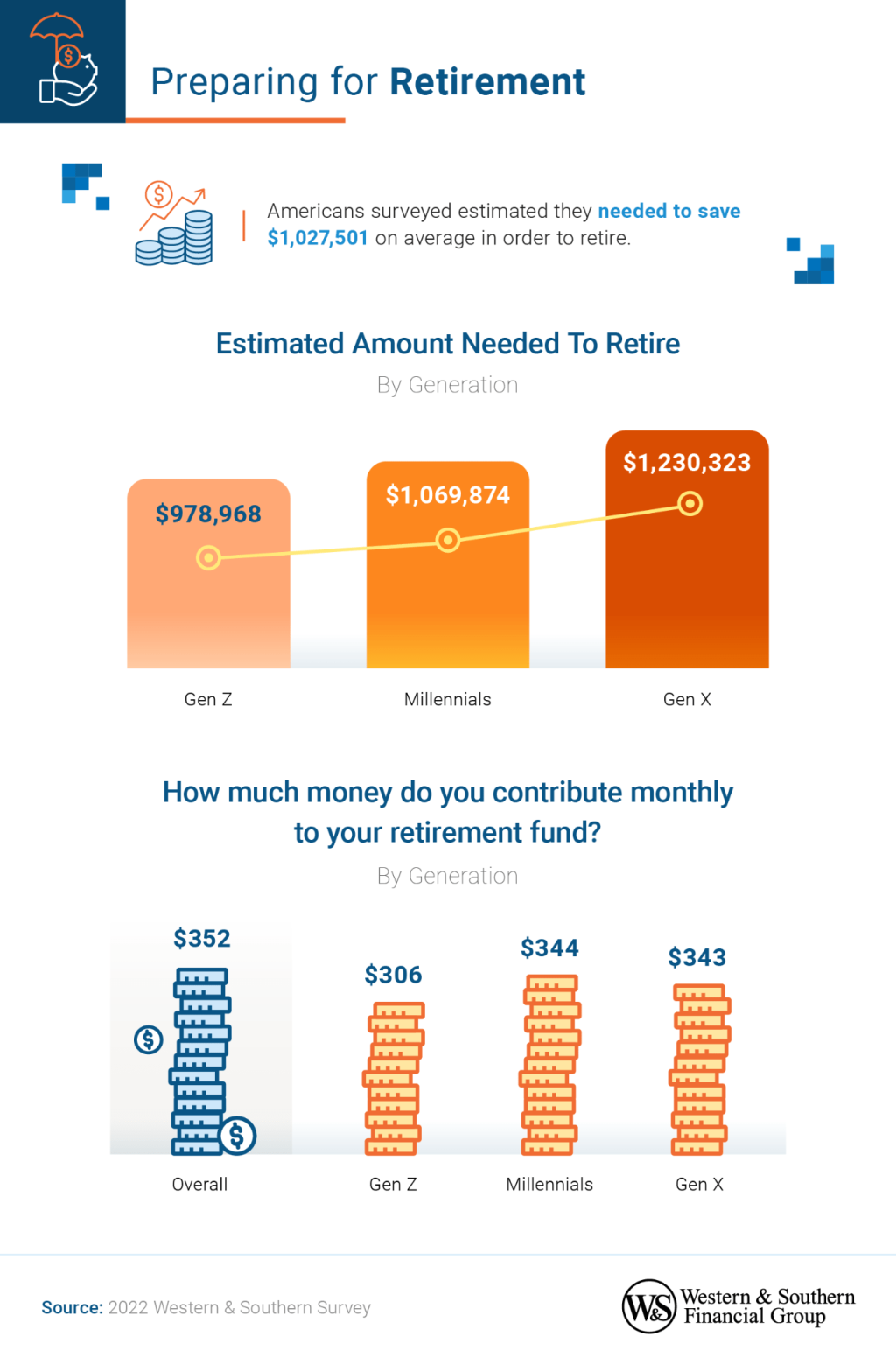

Image Source: westernsouthern.com

7. How to Create a Retirement Fund?

8. Advantages and Disadvantages of Retirement Funds

9. Frequently Asked Questions

10. Conclusion

11. Final Remarks

1. Introduction

In this section, we will provide a brief overview of retirement funds and their significance in securing a comfortable retirement. We will discuss the various aspects of retirement planning and highlight the importance of starting early and making regular contributions to your retirement fund. Additionally, we will explore the potential challenges faced by retirees and how a retirement fund can mitigate these risks.

1.1 Retirement Fund Definition

A retirement fund refers to a financial account specifically designed to accumulate funds for retirement. It serves as a long-term investment vehicle that individuals contribute to during their working years, with the aim of building a substantial nest egg to support their post-retirement lifestyle.

1.2 Benefits of a Retirement Fund

Retirement funds offer several advantages. They provide a disciplined savings approach, allow for tax advantages, and offer the potential for compounding growth over time. Moreover, retirement funds often come with employer contributions and matching programs, further boosting the growth of the fund.

1.3 The Importance of Retirement Planning

Planning for retirement is crucial to ensure financial security during the post-working years. With the rising cost of living and increased life expectancy, it is imperative to have a well-structured retirement plan in place. By starting early and making regular contributions to a retirement fund, individuals can build a substantial corpus that will provide them with a comfortable retirement lifestyle.

1.4 Challenges Faced by Retirees

Retirement can pose various challenges, including inadequate savings, inflation, healthcare expenses, and market volatility. Without a well-funded retirement plan, individuals may face financial difficulties and struggle to maintain their standard of living. Therefore, it is essential to carefully plan and invest in a retirement fund to mitigate these challenges.

1.5 Our Approach in this Guide

In this guide, we will provide you with a step-by-step approach to creating a retirement fund. We will explore different investment options, their pros and cons, and guide you through the process of selecting the most suitable retirement fund for your needs. Our aim is to equip you with the knowledge and tools necessary to make informed decisions and secure a financially stable future.

Continue reading to learn more about retirement funds and how they can help you achieve a worry-free retirement.

This post topic: Budgeting Strategies