Mastering Family Budgeting: Expert Tips And Strategies For Financial Success

Family Budgeting Tips Strategies

Greetings, Readers! Today, we will discuss some valuable tips and strategies for family budgeting. Managing finances can be challenging, but with the right approach, it becomes much easier. In this article, we will explore various methods to help you create an effective family budget and achieve your financial goals. Let’s dive in!

Introduction

1. What is Family Budgeting?

2 Picture Gallery: Mastering Family Budgeting: Expert Tips And Strategies For Financial Success

Family budgeting refers to the process of planning and allocating income and expenses within a household. It involves tracking and managing the flow of money to ensure financial stability and meet both short-term and long-term goals.

2. Who Should Practice Family Budgeting?

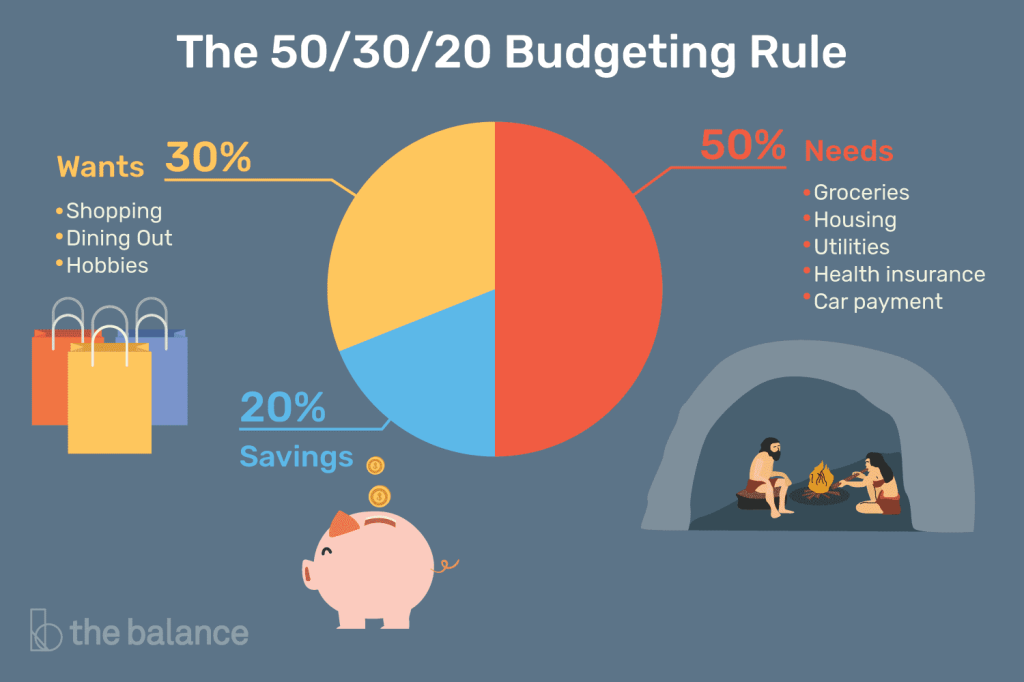

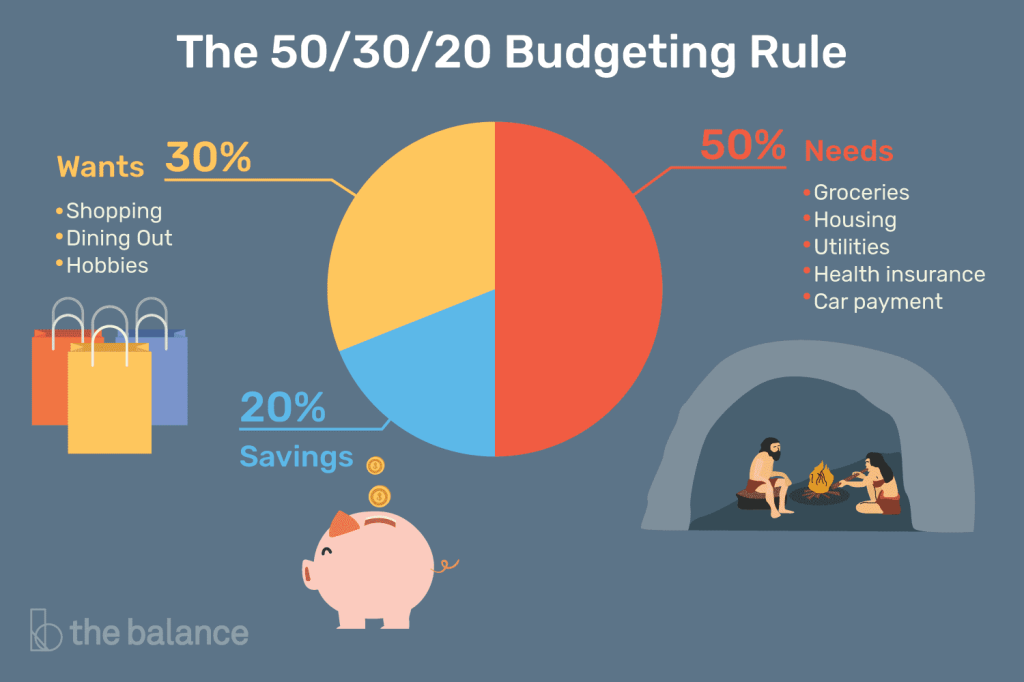

Image Source: thebalancemoney.com

Family budgeting is essential for everyone, regardless of their income level or family size. Whether you are a single parent, a couple, or have a large family, budgeting can help you make informed financial decisions and avoid unnecessary debt.

3. When Should You Start Family Budgeting?

The sooner, the better! It is never too early or too late to start budgeting. Ideally, it is recommended to begin budgeting as soon as you have a stable income and financial responsibilities. The earlier you start, the more control you will have over your finances.

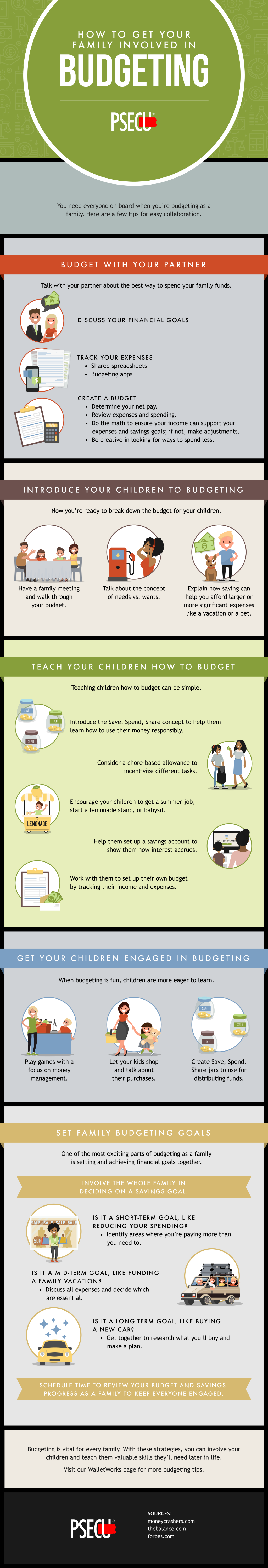

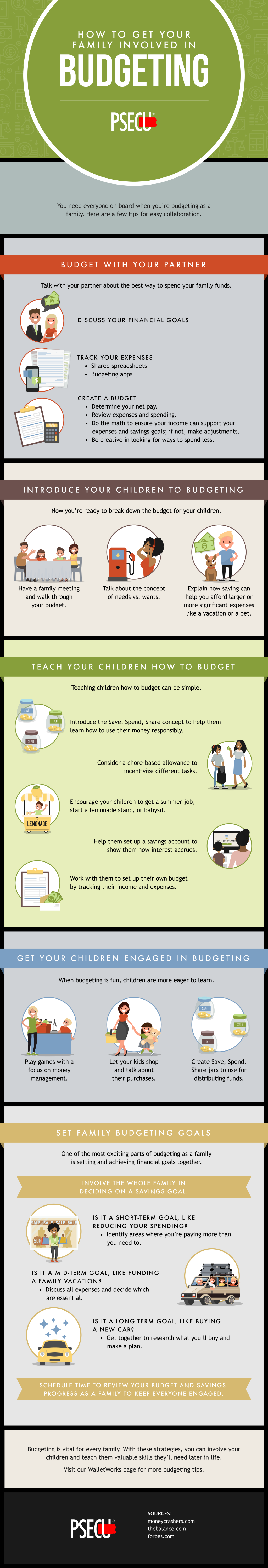

Image Source: psecu.com

4. Where Can You Implement Family Budgeting?

Family budgeting can be implemented anywhere – whether you live in a rented apartment, own a house, or are nomadic. It is a universal practice that can be adapted to any living situation and lifestyle.

5. Why is Family Budgeting Important?

Budgeting allows you to have a clear picture of your income and expenses, enabling you to make informed financial decisions. It helps you achieve financial goals, save for emergencies, and reduce stress related to money matters. Moreover, budgeting promotes transparency and open communication within the family.

6. How to Start Family Budgeting?

Starting a family budget involves several steps, including assessing your current financial situation, setting financial goals, tracking expenses, and adjusting your spending habits. We will discuss these steps in detail in the upcoming sections.

Assessing Your Current Financial Situation

Assessing your current financial situation is the first step towards effective family budgeting. Take a comprehensive look at your income, expenses, and debts to understand your financial standing.

1. Calculate Your Monthly Income

List all sources of income, including salaries, freelance work, investments, and any other sources. Calculate the total monthly income to determine the amount available for budgeting.

2. Track Your Expenses

Keep a record of all your expenses for at least a month. Categorize them into fixed expenses (such as rent, bills, and loan payments) and variable expenses (such as groceries, dining out, and entertainment). This will help you identify areas where you can cut back to save money.

3. Identify Areas for Improvement

Review your expenses and identify areas where you can make adjustments. Look for unnecessary expenses that can be eliminated or reduced. This step is crucial for creating a budget that aligns with your financial goals.

4. Analyze Your Debt Situation

If you have any outstanding debts, such as credit card balances or loans, analyze their interest rates and payment terms. Prioritize paying off high-interest debts first to reduce financial burden in the long run.

5. Set Financial Goals

Setting financial goals will help you stay motivated and focused on your budgeting journey. Whether it’s saving for a down payment on a house, funding your child’s education, or planning for retirement, define your goals clearly to establish a roadmap for your finances.

6. Create a Realistic Budget

Based on your income, expenses, and financial goals, create a realistic budget that allows you to allocate funds towards essential expenses, savings, and debt repayment. Ensure that your budget is flexible and adaptable to changing circumstances.

7. Monitor and Adjust Regularly

Once you have established a budget, it is crucial to monitor your progress regularly. Review your expenses, track your savings, and make adjustments as needed. Regular monitoring will help you stay on track and make necessary modifications to achieve your financial goals.

Advantages and Disadvantages of Family Budgeting

Advantages of Family Budgeting

1. Financial Stability: Budgeting allows you to have better control over your finances, leading to increased stability and reduced financial stress.

2. Debt Reduction: By monitoring your expenses and prioritizing debt repayment, budgeting helps you reduce your overall debt burden.

3. Goal Achievement: Setting financial goals and tracking your progress through budgeting increases the likelihood of achieving your desired milestones.

4. Savings Growth: Budgeting helps you allocate a portion of your income towards savings, enabling you to build an emergency fund and plan for future expenses.

5. Improved Communication: Budgeting encourages open discussions about money matters within the family, promoting transparency and teamwork.

Disadvantages of Family Budgeting

1. Time and Effort: Creating and maintaining a family budget requires time and effort. It may involve tracking expenses, reviewing financial statements, and making adjustments regularly.

2. Restrictive Nature: Following a budget may require certain lifestyle changes and sacrifices. It may limit spontaneous spending and require careful planning for discretionary expenses.

3. Unexpected Expenses: Despite careful budgeting, unexpected expenses may still arise. It is important to have contingency plans and emergency funds to handle such situations.

4. Discipline and Consistency: Budgeting requires discipline and consistency. It may be challenging to adhere to the budget consistently, especially during times of temptation or financial hardship.

5. Potential Conflict: Differences in financial priorities and spending habits within the family can lead to conflicts. Effective communication and compromise are essential to overcome such challenges.

Frequently Asked Questions (FAQs)

1. Is budgeting necessary for families with a stable income?

Yes, budgeting is essential for families with a stable income as it helps in managing expenses, saving for future goals, and ensuring financial stability.

2. How often should I review and adjust my budget?

It is recommended to review your budget monthly or quarterly. Adjustments can be made based on changes in income, expenses, or financial goals.

3. Should I involve my children in the budgeting process?

Yes, involving children in the budgeting process can teach them valuable financial skills and promote responsible money management from an early age.

4. Can budgeting help me reduce debt?

Absolutely! Budgeting allows you to allocate funds towards debt repayment, helping you reduce your overall debt burden over time.

5. What if my financial situation changes significantly?

If your financial situation changes significantly, such as a job loss or a major unexpected expense, you may need to revisit and adjust your budget accordingly to adapt to the new circumstances.

Conclusion

In conclusion, family budgeting is a crucial practice that helps in managing finances, achieving financial goals, and ensuring stability. By assessing your current financial situation, setting realistic goals, and creating a budget, you can take control of your finances and work towards a better future. Remember, consistent monitoring and adjustments are key to successful budgeting. Start today and reap the rewards of financial empowerment!

Final Remarks

Family budgeting requires dedication and effort, but the benefits are worth it. It allows you to make informed decisions, reduce financial stress, and achieve your goals. However, it’s important to remember that every family’s financial situation is unique, and budgeting strategies may vary. Consult a financial advisor or expert for personalized advice. Happy budgeting!

This post topic: Budgeting Strategies