The Ultimate Retirement Plan: Master The 10-Year Rule And Secure Your Future!

Retirement Plan 10 Year Rule: What You Need to Know

Introduction

Hello, Readers! Today, we will discuss an important aspect of retirement planning – the retirement plan 10 year rule. Planning for retirement is crucial to ensure financial security in your golden years. Among the many rules and regulations that govern retirement plans, the 10 year rule plays a significant role. In this article, we will delve into the details of this rule, its implications, and how it may affect your retirement strategy. So, let’s dive in!

3 Picture Gallery: The Ultimate Retirement Plan: Master The 10-Year Rule And Secure Your Future!

Overview

Before we explore the retirement plan 10 year rule, let’s understand the basics of retirement planning. Retirement planning involves setting aside funds and investments during your working years to provide income and financial stability when you retire. Retirement plans come in various forms, including 401(k)s, individual retirement accounts (IRAs), and pension plans.

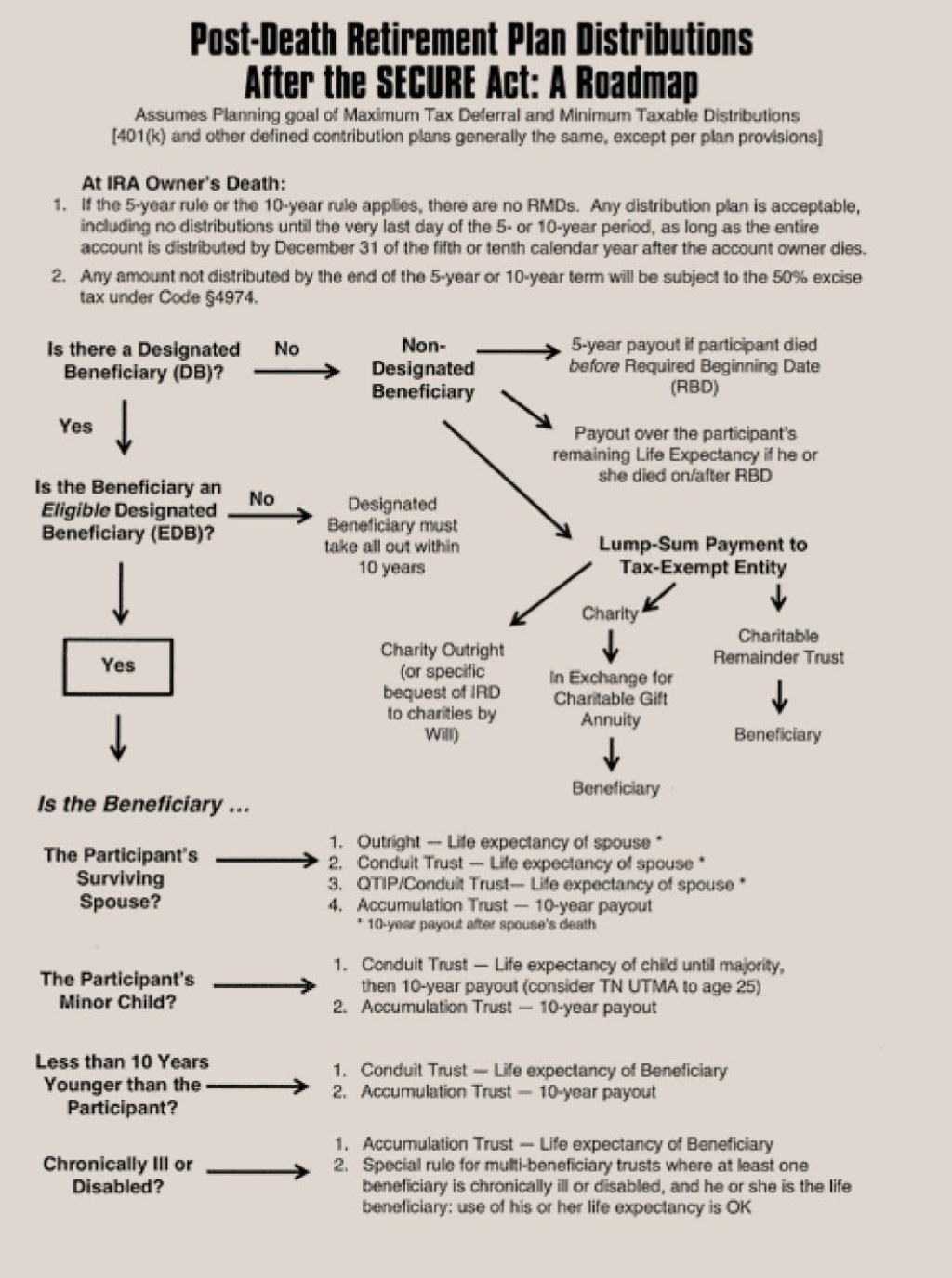

Now, let’s turn our attention to the retirement plan 10 year rule. This rule applies to certain beneficiaries of retirement plans, such as non-spouse beneficiaries or designated beneficiaries. It determines the timeline within which these beneficiaries must withdraw the funds from the inherited retirement account. Failure to comply with this rule may result in hefty penalties and tax implications.

What is the Retirement Plan 10 Year Rule?

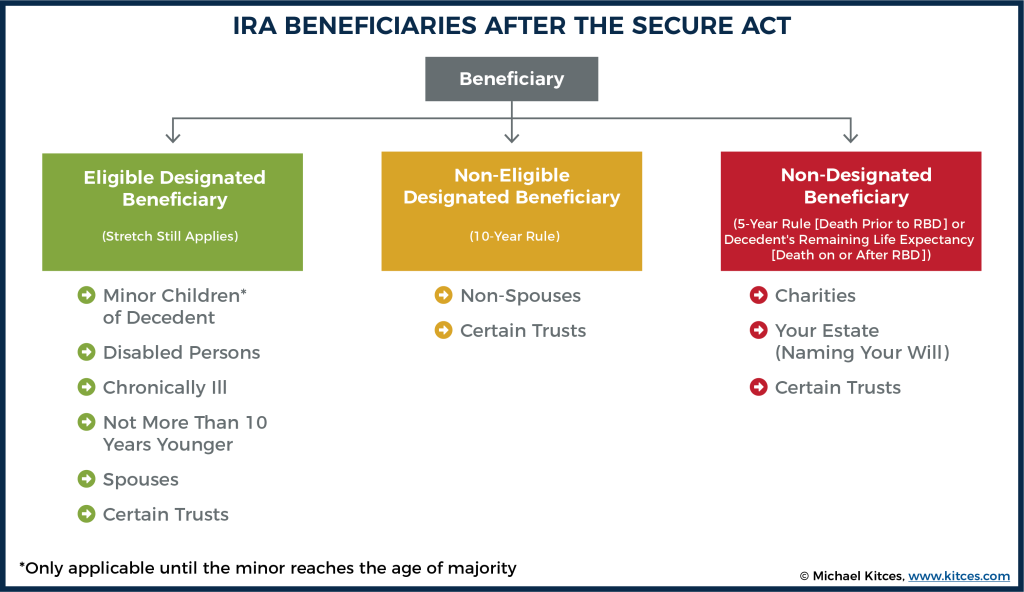

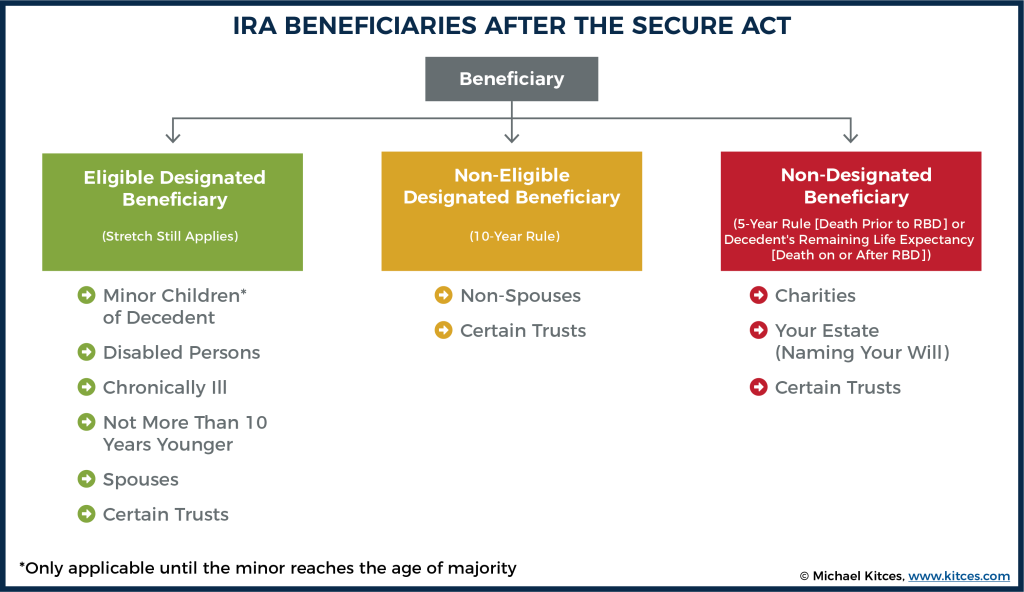

Image Source: kitces.com

The retirement plan 10 year rule, introduced under the Setting Every Community Up for Retirement Enhancement (SECURE) Act, states that non-spouse beneficiaries or designated beneficiaries of retirement plans must withdraw the entire balance within 10 years of the original account holder’s death. Previously, beneficiaries had the option to stretch the distributions over their lifetime, allowing for potentially longer tax-deferred growth. However, this rule change aims to accelerate the distribution of funds and increase tax revenue.

Who Does the Rule Apply to?

The retirement plan 10 year rule primarily applies to non-spouse beneficiaries or designated beneficiaries who inherit retirement accounts. Spouses, however, are exempt from this rule. They can still choose to roll over the inherited retirement account into their own, prolonging the distribution timeline. Additionally, certain eligible designated beneficiaries, such as minor children, disabled individuals, and chronically ill individuals, may qualify for exceptions to the 10 year rule.

When Does the 10 Year Clock Start Ticking?

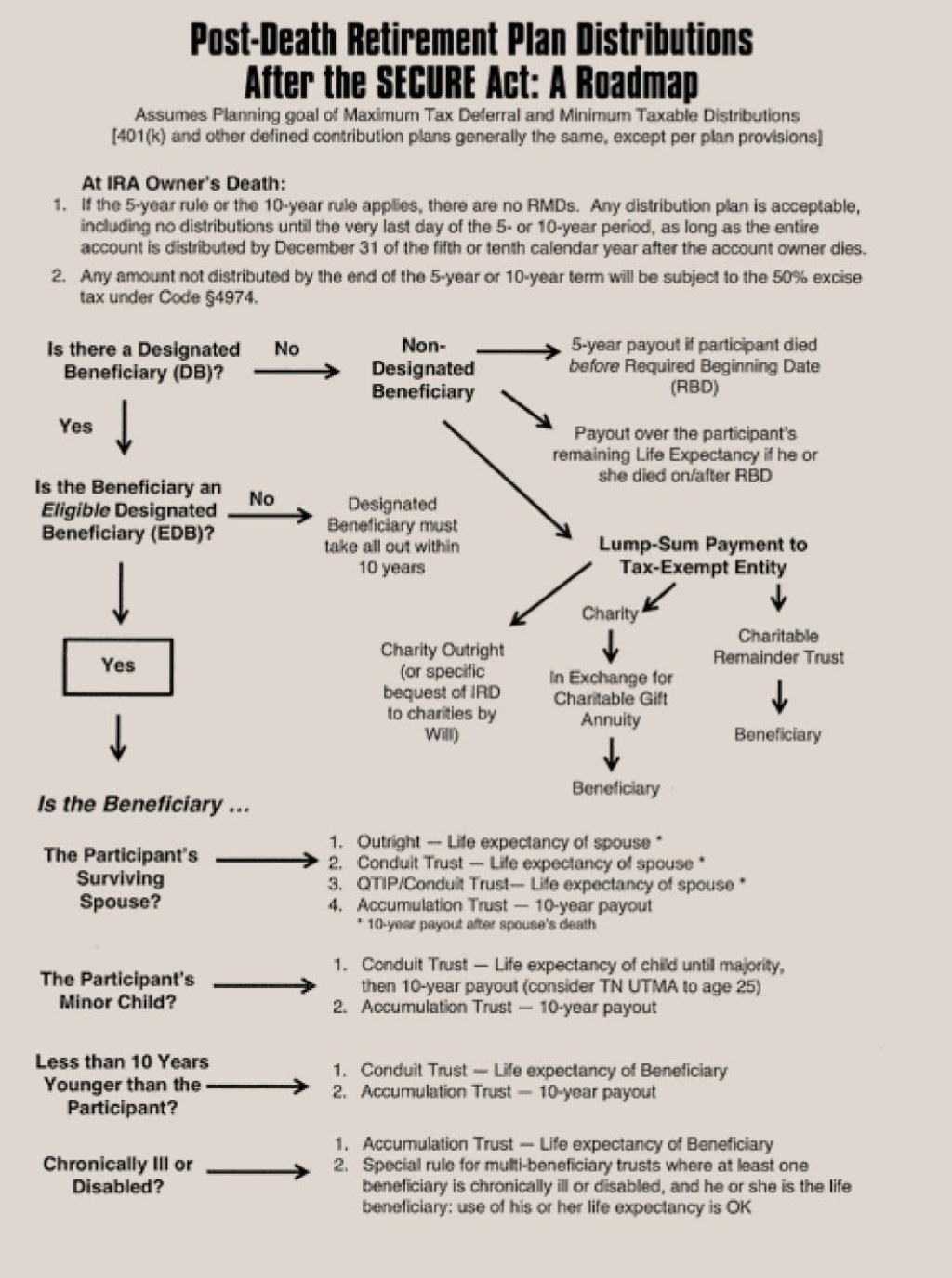

Image Source: tba.org

The 10 year clock starts ticking upon the death of the original account holder. The beneficiary must calculate the distribution period from the year following the account holder’s death. For example, if the account holder passed away in 2022, the beneficiary has until the end of 2032 to withdraw the entire balance.

Where Can You Find More Information?

For more detailed information on the retirement plan 10 year rule, it is advisable to consult a financial advisor or tax professional. They can guide you through the specific implications and strategies relevant to your unique situation.

Why Was the 10 Year Rule Implemented?

The SECURE Act introduced the retirement plan 10 year rule to address concerns over potential abuse of the previous stretch distribution option. By mandating a shorter distribution timeline, the government aims to collect tax revenue sooner and ensure that retirement funds are not excessively accumulated by beneficiaries over an extended period.

How Does the Rule Impact Retirement Planning?

Image Source: investopedia.com

The retirement plan 10 year rule has significant implications for retirement planning. Beneficiaries must carefully consider the tax implications and plan their withdrawals accordingly. With a shorter distribution timeline, it becomes crucial to evaluate the most tax-efficient strategies, such as spreading out withdrawals over the 10-year period or timing withdrawals to minimize tax burdens.

Advantages and Disadvantages of the 10 Year Rule

Advantages:

1. Simplified Distribution: The 10 year rule simplifies the distribution process, eliminating the need for complex calculations and reporting.

2. Accelerated Tax Revenue: By requiring beneficiaries to withdraw funds within a shorter timeframe, the government can collect tax revenue sooner.

3. Increased Transparency: The rule ensures transparency and accountability in the distribution of retirement funds.

Disadvantages:

1. Potentially Higher Tax Burden: The compressed distribution timeline may result in higher taxable income for beneficiaries, potentially pushing them into higher tax brackets.

2. Limited Tax-Deferred Growth: With the shorter timeline, beneficiaries may have less time to benefit from tax-deferred growth on the inherited retirement funds.

3. Reduced Flexibility: Beneficiaries may have limited flexibility in managing their withdrawals, potentially impacting their overall financial planning.

Frequently Asked Questions (FAQ)

Q: Does the 10 year rule apply to all types of retirement plans?

A: Yes, the 10 year rule applies to most types of retirement plans, including 401(k)s, traditional IRAs, Roth IRAs, and inherited IRAs.

Q: What happens if a beneficiary fails to comply with the 10 year rule?

A: Failure to comply with the 10 year rule may result in penalties and tax consequences. The funds may be subject to a 50% excise tax on the remaining balance.

Q: Can a beneficiary withdraw funds at any time within the 10 year period?

A: Yes, beneficiaries have the flexibility to withdraw funds at any time within the 10 year period. They are not required to follow a specific distribution schedule.

Q: Are there any exceptions to the 10 year rule?

A: Yes, certain eligible designated beneficiaries, such as minor children, disabled individuals, and chronically ill individuals, may qualify for exceptions to the 10 year rule.

Q: Can beneficiaries still choose the stretch distribution option?

A: No, the stretch distribution option is no longer available for non-spouse beneficiaries. The 10 year rule is now the default distribution requirement.

Conclusion

In conclusion, the retirement plan 10 year rule is a crucial aspect of retirement planning that non-spouse beneficiaries or designated beneficiaries must be aware of. It determines the timeline within which these beneficiaries must withdraw the funds from an inherited retirement account. While the rule has its advantages and disadvantages, it is essential to understand its implications and plan your withdrawals accordingly. Consulting a financial advisor or tax professional can provide personalized guidance to navigate the complexities of the 10 year rule and optimize your retirement strategy.

Final Remarks

Friends, planning for retirement is a long-term journey that requires careful consideration and informed decision-making. The retirement plan 10 year rule is just one piece of the puzzle. It is crucial to stay updated on the latest regulations and seek professional assistance when needed. Remember, your retirement years should be filled with financial security and peace of mind. Start planning today to ensure a bright future tomorrow!

This post topic: Budgeting Strategies