Secure Your Future: Build A Strong Retirement Fund In The UK Now!

Retirement Fund UK: Everything You Need to Know

Introduction

Dear Readers,

1 Picture Gallery: Secure Your Future: Build A Strong Retirement Fund In The UK Now!

Welcome to our comprehensive guide on retirement funds in the UK. In this article, we will delve into the details of retirement funds, their purpose, benefits, and how they can help secure a comfortable retirement for individuals in the United Kingdom. Whether you’re planning for your own retirement or seeking information on behalf of a loved one, we aim to provide you with valuable insights and guidance. So, let’s begin!

What is a Retirement Fund?

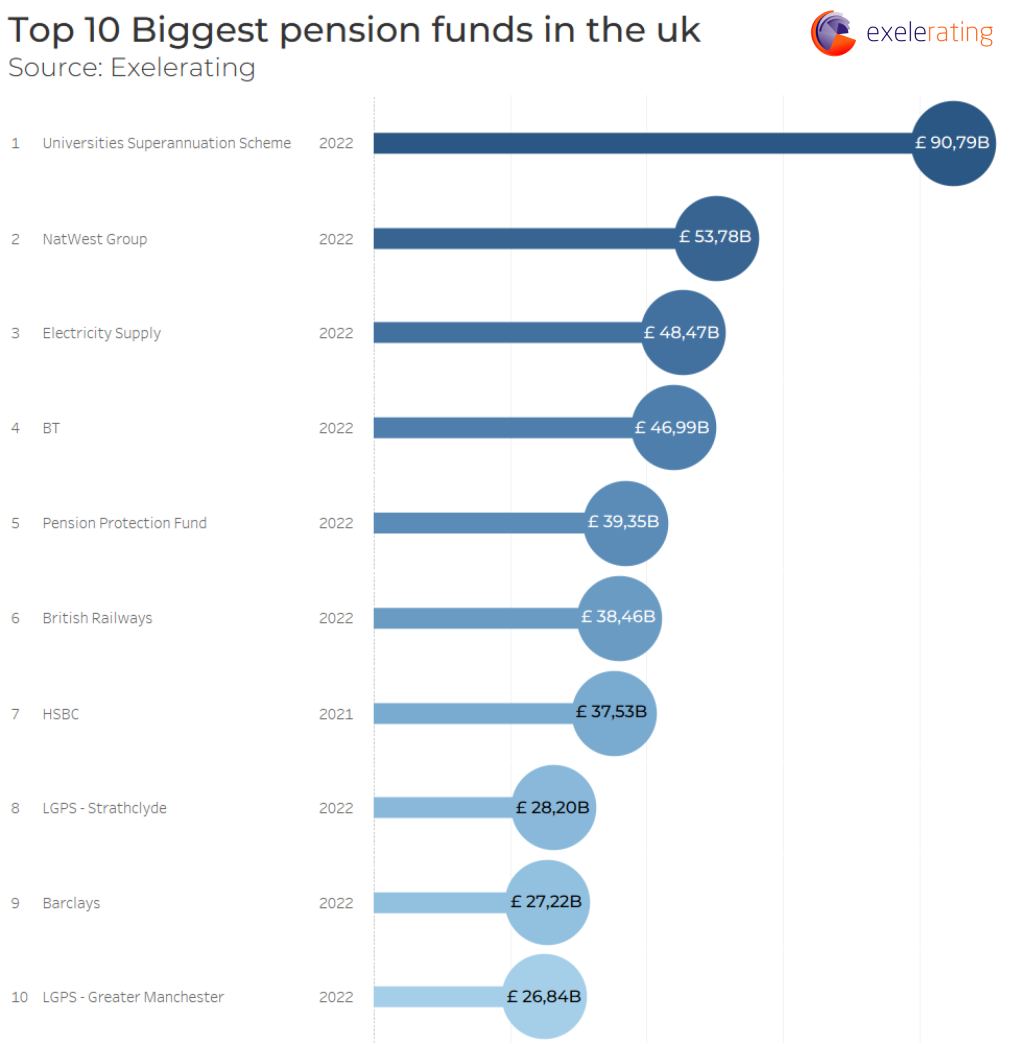

Image Source: exelerating.com

🔍 A retirement fund refers to a financial account or investment portfolio specifically designed to accumulate savings and provide income during retirement. It serves as a safety net for individuals to ensure financial stability in their later years, allowing them to maintain a comfortable lifestyle even after they stop working.

A retirement fund typically consists of contributions made by the individual, their employer, and possibly the government in the form of tax incentives or state pension schemes. These funds are then invested in various assets such as stocks, bonds, and mutual funds to generate returns over time.

By setting aside money regularly and letting it grow through investment, individuals can build a substantial retirement fund that will support their needs when they no longer have a regular income.

Who Can Benefit from a Retirement Fund?

🔍 Retirement funds are beneficial for individuals from all walks of life who wish to secure their financial future post-retirement. Whether you’re self-employed, a salaried employee, or a business owner, having a retirement fund is crucial for long-term financial stability.

Regardless of your current income level, starting early and contributing consistently to a retirement fund can make a significant difference in the amount you accumulate by the time you retire. It is never too early or too late to start thinking about your retirement and taking steps to ensure a financially secure future.

When Should You Start Contributing to a Retirement Fund?

🔍 The earlier you start contributing to a retirement fund, the better. Time plays a crucial role in building a substantial retirement fund due to the power of compounding. Compounding allows your investments to generate returns, and these returns can then generate even more returns over time.

Starting early gives you more time for your investments to grow and potentially recover from any temporary market downturns. It also allows you to contribute smaller amounts over a more extended period, making it easier to manage your finances.

However, even if you’re starting later in life, it is still important to begin contributing to a retirement fund as soon as possible. Every contribution counts and can make a positive impact on your future financial well-being.

Where Can You Invest Your Retirement Fund?

🔍 Retirement funds in the UK can be invested in various financial instruments and assets. Some common investment options include:

Stocks and Shares: Investing in individual company shares or funds that hold a diversified portfolio of stocks.

Bonds: Purchasing government or corporate bonds, which provide fixed income over a specified period.

Property: Investing in real estate properties to generate rental income or capital appreciation.

Mutual Funds: Investing in funds managed by professionals who pool money from multiple investors to invest in a diversified portfolio.

Personal Pension Plans: Contributing to personal pension plans offered by insurance companies or investment firms.

Each investment option carries its own set of risks and potential rewards. It is essential to carefully consider your risk tolerance, investment goals, and seek professional advice before allocating your retirement fund to specific investments.

Why Should You Invest in a Retirement Fund?

🔍 Investing in a retirement fund offers several advantages:

Financial Security: A retirement fund provides a safety net, ensuring that you have a regular income stream to cover living expenses during retirement.

Tax Benefits: Contributions to retirement funds often come with tax advantages, such as tax relief on contributions and tax-free growth within the fund.

Compound Growth: By investing your retirement fund, you can benefit from compound growth, allowing your investments to grow exponentially over time.

Control over Investments: Depending on the type of retirement fund, you may have the flexibility to choose how your money is invested, aligning with your risk tolerance and investment preferences.

Supplementing State Pension: The retirement fund can supplement the state pension, ensuring a more comfortable lifestyle during retirement.

However, it is crucial to consider the potential disadvantages as well. These may include market risks, volatility, and the need to actively manage your investments. It is advisable to weigh the pros and cons before making any decisions regarding your retirement fund.

How Can You Set Up a Retirement Fund?

🔍 Setting up a retirement fund involves several steps:

Evaluate Your Financial Situation: Assess your current financial standing, retirement goals, and the amount you can comfortably contribute to your retirement fund.

Research and Choose a Suitable Retirement Plan: Consider different retirement plan options, such as personal pensions or workplace pension schemes, and select the one that aligns with your needs.

Open an Account: Complete the necessary paperwork and open a retirement fund account with a trusted provider or pension scheme.

Contribute Regularly: Commit to making regular contributions to your retirement fund, ensuring that you stay on track to reach your retirement goals.

Review and Adjust: Periodically review your retirement fund’s performance and make adjustments if necessary, considering market conditions and your changing needs.

Remember, setting up a retirement fund is a long-term commitment, and it is essential to stay informed and make informed decisions along the way.

Frequently Asked Questions (FAQs)

1. Can I withdraw money from my retirement fund before retirement?

🔍 No, withdrawing money from your retirement fund before retirement is usually not allowed unless you meet specific exceptional circumstances outlined by the pension scheme or plan.

2. How much should I contribute to my retirement fund?

🔍 The amount you should contribute to your retirement fund depends on various factors, such as your income, retirement goals, and lifestyle expectations. It is advisable to contribute as much as you can comfortably afford while considering other financial obligations.

3. What happens to my retirement fund if I change jobs?

🔍 If you change jobs, you typically have several options for your retirement fund. These options include leaving the fund with your previous employer’s pension scheme, transferring it to your new employer’s scheme, or transferring it to a personal pension plan.

4. What if my retirement fund underperforms?

🔍 If your retirement fund underperforms, it is important to review your investment strategy and consider seeking professional advice. You may need to adjust your investment allocations or explore alternative investment options to improve your fund’s performance.

5. Can I have multiple retirement funds?

🔍 Yes, it is possible to have multiple retirement funds. This can be beneficial for diversification and providing more flexibility in managing your retirement savings. However, it is crucial to keep track of all your funds and ensure they align with your overall retirement goals.

Conclusion

In conclusion, a retirement fund is an essential tool for securing your financial future in the UK. By starting early, contributing consistently, and making informed investment decisions, you can build a substantial retirement fund that will support you during your golden years. Remember, it’s never too late to start planning and taking action. Begin today, and enjoy a worry-free retirement tomorrow!

Final Remarks

Dear Readers,

Thank you for taking the time to read our comprehensive guide on retirement funds in the UK. We hope that the information provided has been helpful in understanding the importance of retirement planning and the various aspects of retirement funds. It is crucial to seek professional advice before making any financial decisions related to retirement planning.

Please note that the information provided in this article is for educational purposes only and should not be considered as financial advice. Every individual’s financial situation is unique, and it is essential to tailor your retirement planning strategies to your specific needs and goals.

Wishing you a financially secure and fulfilling retirement!

This post topic: Budgeting Strategies