Secure Your Future: Maximize Retirement Savings 2022 And Plan For A Worry-Free Retirement!

Retirement Savings 2022: Securing Your Future

Introduction

Dear Readers,

2 Picture Gallery: Secure Your Future: Maximize Retirement Savings 2022 And Plan For A Worry-Free Retirement!

Welcome to our informative article on retirement savings for the year 2022. In today’s fast-paced world, it is essential to plan for your retirement to ensure a secure and comfortable future. With the constantly evolving economic landscape, it is crucial to stay updated on the latest trends and strategies for saving and investing. In this article, we will provide you with valuable insights and tips to help you make informed decisions regarding your retirement savings. Let’s dive in!

What is Retirement Savings?

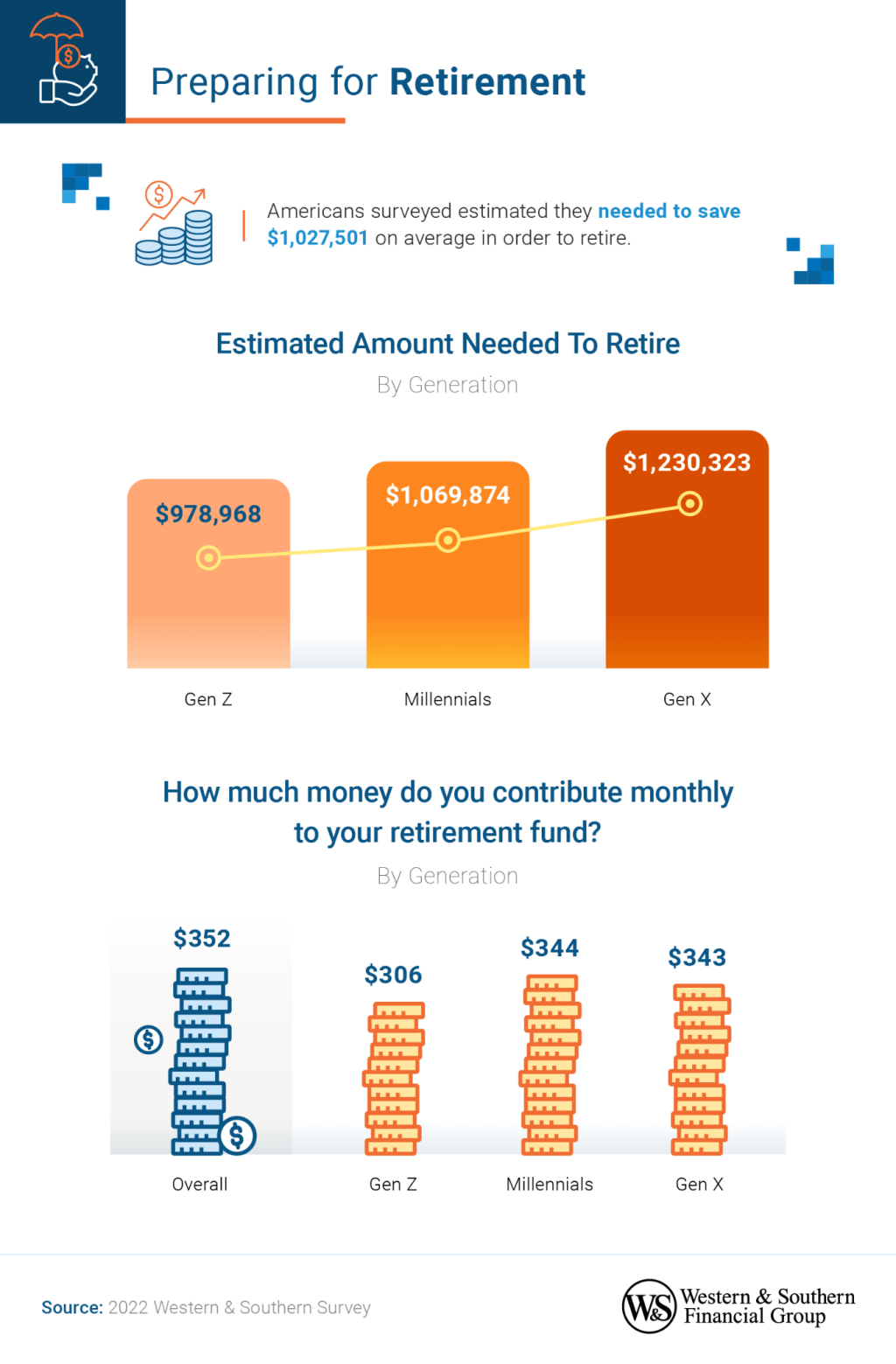

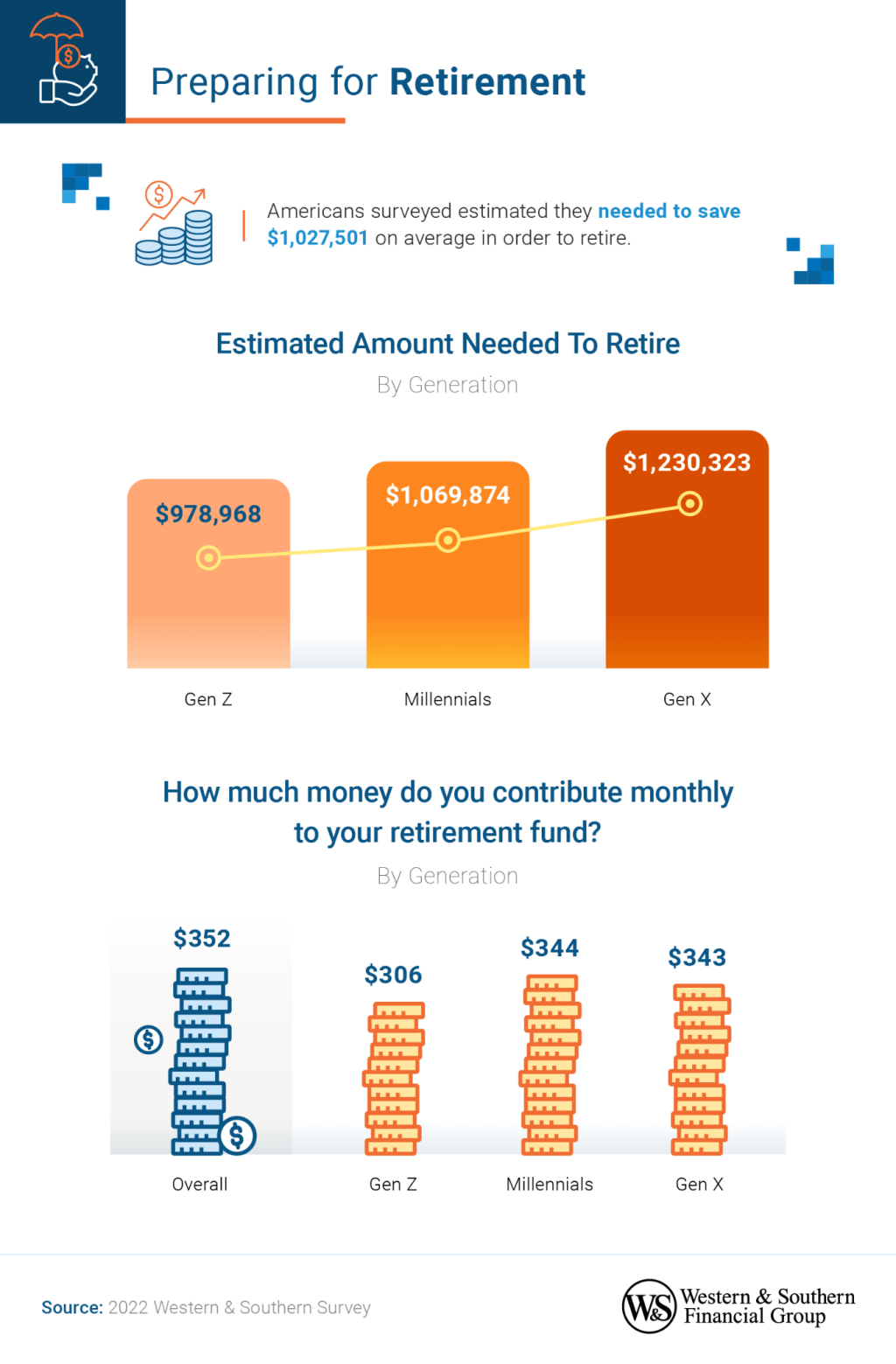

Image Source: westernsouthern.com

🔍 Retirement savings refers to the funds that individuals set aside during their working years to support themselves financially after they retire. It involves saving a portion of one’s income regularly and investing it wisely to grow the funds over time. By accumulating retirement savings, individuals aim to replace their pre-retirement income and maintain their desired lifestyle during their golden years.

Who Should Save for Retirement?

🔍 Everyone, regardless of their age or current financial situation, should save for retirement. Retirement is a phase of life that everyone will eventually experience, and starting early allows individuals to take advantage of the power of compounding. Whether you are in your 20s, 30s, or even closer to retirement age, it is never too late to begin saving for your future.

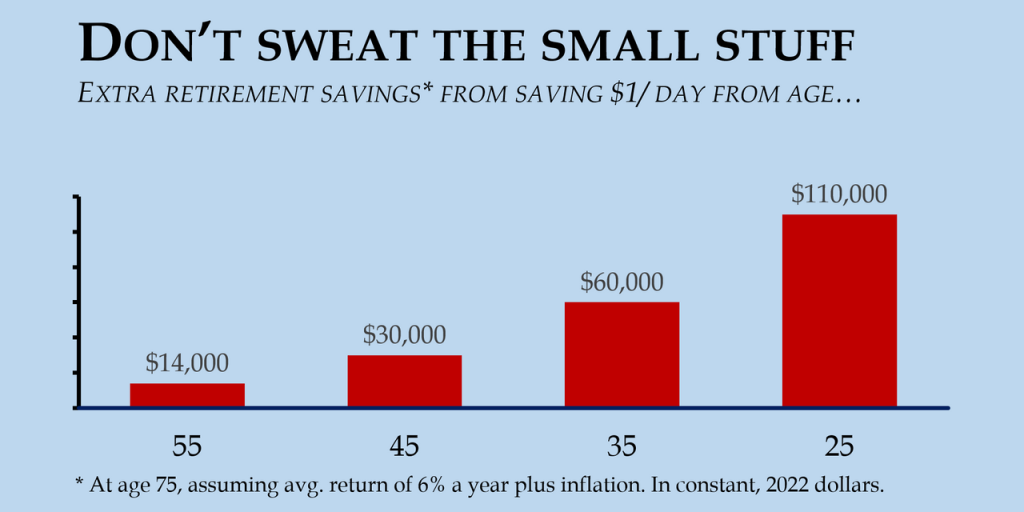

When Should You Start Saving for Retirement?

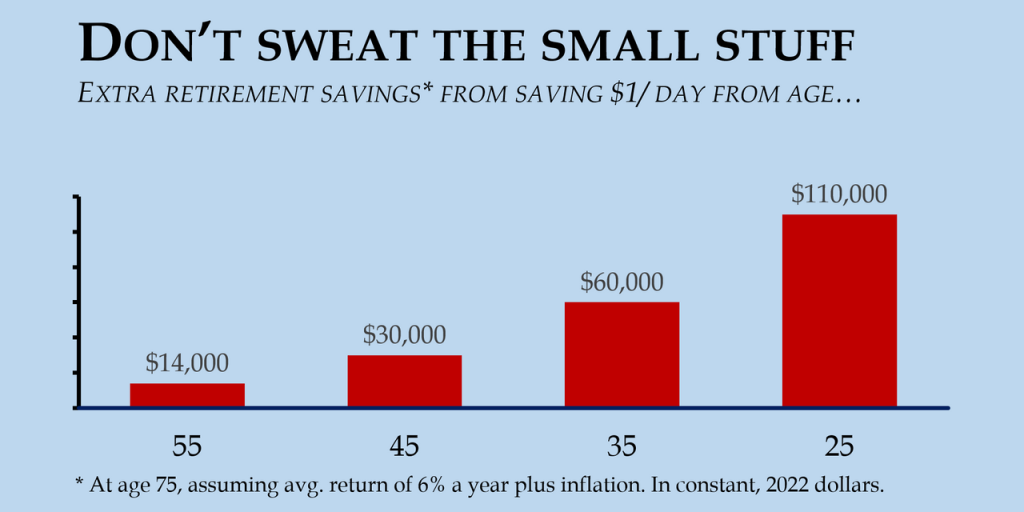

🔍 The answer is simple – the sooner, the better. The earlier you start saving for retirement, the more time your money has to grow. Time is a valuable asset when it comes to investing, as it allows compounding to work its magic. Even small contributions made in your early years can accumulate into a substantial nest egg due to the power of compounding.

Where Should You Invest Your Retirement Savings?

Image Source: mktw.net

🔍 When it comes to investing your retirement savings, it is crucial to consider your risk tolerance, investment knowledge, and financial goals. Options for retirement investments include employer-sponsored retirement plans such as 401(k)s, individual retirement accounts (IRAs), and mutual funds. It is advisable to diversify your investments to mitigate risk and maximize potential returns.

Why Is Saving for Retirement Important?

🔍 Saving for retirement is essential for several reasons. Firstly, it allows you to maintain your current standard of living after retiring. Without sufficient savings, you may find it challenging to cover daily expenses and indulge in leisure activities. Secondly, retirement savings provide a safety net in case of unexpected financial emergencies. Moreover, by saving for retirement, you are ensuring a secure future for yourself and your loved ones.

How Can You Boost Your Retirement Savings?

🔍 There are several strategies you can employ to boost your retirement savings. Start by maximizing your contributions to employer-sponsored retirement plans, taking advantage of any employer matches. Additionally, consider opening an individual retirement account (IRA) and contribute the maximum allowed each year. Cut down on unnecessary expenses, increase your income through side hustles, and educate yourself about investing to make informed decisions.

Advantages and Disadvantages of Retirement Savings

🔍 Retirement savings come with both advantages and disadvantages. Let’s explore them below:

Advantages:

1. Financial Security: Retirement savings provide a safety net and ensure a comfortable lifestyle after retiring.

2. Compound Growth: By starting early and letting your savings grow through compounding, you can achieve significant returns over time.

3. Tax Benefits: Contributions to retirement plans such as 401(k)s and IRAs often come with tax advantages, reducing your current tax liability.

4. Flexibility: Retirement savings give you the freedom to choose how and when you want to retire, providing flexibility and control over your future.

Disadvantages:

1. Market Volatility: Investing in retirement savings exposes you to market fluctuations, which could lead to temporary losses.

2. Early Withdrawal Penalties: Withdrawing retirement savings before reaching the eligible age may result in penalties and taxes.

3. Inflation Risk: Over time, the purchasing power of your retirement savings may decrease due to inflation, requiring careful planning and investment choices.

4. Limited Access: Retirement savings are typically inaccessible until retirement age, limiting your ability to use the funds for other purposes.

Frequently Asked Questions (FAQs)

1. Can I start saving for retirement if I have debt?

Yes, it is possible to save for retirement while managing debt. However, it is essential to strike a balance between debt repayment and retirement savings to avoid financial strain.

2. How much should I save for retirement?

The amount you should save for retirement depends on various factors such as your desired lifestyle, expected retirement age, and current income. It is advisable to aim for saving at least 10-15% of your income towards retirement.

3. What happens if I don’t save enough for retirement?

If you don’t save enough for retirement, you may face financial difficulties during your golden years. You may need to rely on government benefits, downsize your lifestyle, or continue working longer than anticipated.

4. Can I retire early if I have substantial retirement savings?

Yes, having substantial retirement savings can allow you to retire early. However, it is crucial to consider factors such as healthcare costs, inflation, and market fluctuations before making this decision.

5. Should I consult a financial advisor for retirement planning?

Consulting a financial advisor can provide valuable insights and personalized advice tailored to your specific retirement goals. They can help you create a comprehensive retirement plan and guide you through various investment options.

Conclusion

In conclusion, retirement savings are a vital aspect of securing your future and ensuring a comfortable retirement. By starting early, making informed investment choices, and staying disciplined, you can build a substantial nest egg that will support you throughout your golden years. Remember, the key is to create a comprehensive retirement plan that aligns with your goals and regularly reassess and adjust it as needed. So, start saving for retirement today and take control of your financial future.

Final Remarks

Dear Readers,

Investing in retirement savings is a crucial step towards securing your financial future. However, it is essential to conduct thorough research, consult with professionals, and consider your unique circumstances before making any financial decisions. The information provided in this article is for educational purposes only and should not be considered as financial advice. We encourage you to seek guidance from financial advisors or experts to ensure the best outcomes for your retirement savings journey. Remember, it’s never too early or too late to start saving for retirement. Wishing you a prosperous and fulfilling retirement ahead!

This post topic: Budgeting Strategies