Secure Your Future With Retirement Savings 30: Take Action Now!

Retirement Savings 30: Secure Your Future

Introduction

Dear Readers,

Welcome to our informative article on retirement savings. In today’s fast-paced world, it is crucial to plan for your future, especially when it comes to financial security during retirement. We understand that retirement can be an overwhelming topic, but with proper planning, you can ensure a comfortable and stress-free retirement at the age of 30. In this article, we will guide you through the various aspects of retirement savings, providing you with valuable information to make informed decisions about your future.

1 Picture Gallery: Secure Your Future With Retirement Savings 30: Take Action Now!

Now, let’s dive into the details and explore the world of retirement savings at the age of 30.

The What of Retirement Savings 30

Retirement savings at the age of 30 refers to the process of setting aside a portion of your income to accumulate funds for your retirement. It involves making strategic investments and taking advantage of retirement savings plans and accounts to ensure financial stability in your later years. By starting early, you can benefit from the power of compounding and ensure a sizeable nest egg by the time you reach retirement age.

Importance of Starting Early

🚀 Starting your retirement savings journey at the age of 30 gives you a significant advantage. The earlier you start, the longer your money has time to grow and compound. By starting early, you can potentially accumulate a larger retirement fund compared to those who delay their savings.

Types of Retirement Savings Accounts

Image Source: ctfassets.net

📚 There are various retirement savings accounts available, such as 401(k), Individual Retirement Accounts (IRA), and Roth IRA. Each account offers different tax advantages and withdrawal rules. It is essential to understand the options available to make informed decisions based on your financial goals and circumstances.

Retirement Savings vs. Traditional Savings

💼 Understanding the difference between retirement savings and traditional savings is crucial. While traditional savings accounts provide liquidity and flexibility, retirement savings accounts offer specific tax advantages and incentives to encourage long-term savings for retirement.

Setting Realistic Goals

📈 It is essential to set realistic goals to create an effective retirement savings plan. Assess your current financial situation, estimate your future expenses, and determine the amount you need to save consistently to achieve your retirement goals. Setting achievable milestones will keep you motivated and focused on your long-term financial objectives.

Seeking Professional Advice

🤝 If you feel overwhelmed or unsure about retirement savings, consider consulting a financial advisor. They can provide personalized guidance based on your unique circumstances and help you develop a robust retirement savings strategy.

The Who of Retirement Savings 30

Retirement savings at the age of 30 is not limited to a specific group of individuals. It is a concept that can benefit anyone who wishes to secure their financial future. Whether you are a young professional just starting your career or someone who wants to catch up on their retirement savings, it is never too late to start planning.

Young Professionals

🎓 Young professionals in their 30s have a unique advantage when it comes to retirement savings. With a longer time horizon and potentially higher earning potential, they can set aside a significant portion of their income towards retirement savings. Starting early allows them to harness the power of compounding and build a substantial retirement fund over time.

Late Bloomers

🌼 Even if you are in your 30s or beyond and have not started saving for retirement, it is never too late to begin. While you may need to contribute more aggressively to catch up, it is still possible to accumulate a substantial retirement fund. By making smart investment decisions and seeking professional advice, late bloomers can secure their financial future.

Self-Employed Individuals

👩💼👨💼 Self-employed individuals often have different retirement savings options compared to traditional employees. They can contribute to retirement plans like Simplified Employee Pension Individual Retirement Accounts (SEP IRAs) or solo 401(k)s. Understanding the available retirement savings options and maximizing contributions can help self-employed individuals build a robust retirement fund.

Couples and Families

👪 Retirement savings is not limited to individuals; couples and families can also benefit from strategic retirement planning. By combining their resources and setting joint retirement goals, couples and families can ensure financial security for their later years.

Entrepreneurs

💼 Entrepreneurs often face unique challenges when it comes to retirement savings. Without the presence of an employer-sponsored retirement plan, they need to take proactive steps to set up retirement accounts and make consistent contributions. Exploring retirement savings options specifically designed for entrepreneurs can help them secure their financial future.

The When of Retirement Savings 30

When it comes to retirement savings, the earlier you start, the better. However, it is never too late to begin saving for retirement. Even if you have not started in your 30s, it is crucial to take action and make retirement savings a priority. Developing a habit of consistent saving and investing will significantly impact your financial future.

Starting in Your 30s

📅 Starting your retirement savings journey in your 30s is ideal. With several decades ahead of you until retirement, you have ample time to save, invest, and grow your retirement fund. Take advantage of employer-sponsored retirement plans, such as a 401(k), and maximize your contributions to benefit from potential employer matches.

Catching Up in Your 30s

🏃 If you have not started saving for retirement in your 30s, it is essential to catch up as soon as possible. Increase your savings rate, cut unnecessary expenses, and consider working with a financial advisor to accelerate your retirement savings. While catching up may require more significant sacrifices, it is crucial to prioritize your financial future.

Adjusting Your Strategy

🔄 As you progress through your 30s, it is essential to periodically review and adjust your retirement savings strategy. Life circumstances, such as career changes, marriage, or the birth of a child, may require modifications to your savings plan. Regularly reassessing your financial goals and retirement timeline will ensure that you stay on track towards a secure retirement.

The Where of Retirement Savings 30

Retirement savings at the age of 30 is not limited to a specific geographical location. It is a concept that can be applied globally. However, the availability of retirement savings plans and accounts may vary depending on the country and region you reside in.

United States

🇺🇸 In the United States, retirement savings options include employer-sponsored plans like 401(k)s, individual retirement accounts (IRAs), and Roth IRAs. Each plan offers its own set of benefits and tax advantages. It is crucial to explore these options and choose the one that aligns with your financial goals.

United Kingdom

🇬🇧 The United Kingdom offers pension schemes, including workplace pensions and personal pensions. These schemes provide individuals with an opportunity to save for retirement with the added benefit of employer contributions and tax relief. Exploring the available pension schemes and taking advantage of employer contributions is crucial for building a substantial retirement fund.

Australia

🇦🇺 In Australia, retirement savings are primarily facilitated through superannuation funds. Employers are required to contribute a percentage of employees’ salaries to superannuation funds, which individuals can access upon retirement. Maximizing superannuation contributions and considering additional voluntary contributions can significantly boost retirement savings.

Canada

🇨🇦 Canada offers registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs) as popular retirement savings options. RRSPs provide tax advantages for contributions, while TFSAs allow tax-free growth on investments. Understanding the contribution limits and withdrawal rules of these accounts is essential for effective retirement planning.

The Why of Retirement Savings 30

Retirement savings at the age of 30 is crucial for several reasons. By starting early and making consistent contributions towards your retirement fund, you can:

Ensure Financial Security

💰 Retirement savings provide a safety net and ensure financial security during your later years. By accumulating a substantial retirement fund, you can cover expenses, maintain your desired lifestyle, and enjoy the fruits of your labor without financial stress.

Take Advantage of Compounding

📈 The power of compounding can significantly impact the growth of your retirement savings. By starting early, your money has more time to grow, and the interest earned on your investments can reinvest and generate even more returns. Compounding allows your retirement fund to multiply over time.

Counteract Inflation

💹 Inflation erodes the purchasing power of money over time. By saving and investing for retirement, you can counteract the impact of inflation and ensure that your money retains its value. By investing in assets that outpace inflation, you can maintain your standard of living during retirement.

Reduce Reliance on Social Security

🌐 Depending solely on social security benefits may not be sufficient to cover all your expenses during retirement. By saving and investing for retirement, you can reduce your reliance on social security and have more control over your financial future.

Enjoy Retirement to the Fullest

🏖️ Retirement should be a time to relax, pursue hobbies, and spend time with loved ones. By diligently saving for retirement, you can ensure that you have the financial means to enjoy your retirement years without worrying about money.

The How of Retirement Savings 30

Retirement savings at the age of 30 requires careful planning and disciplined execution. Here are some essential steps to get started:

Set Clear Goals

🎯 Determine your retirement goals and establish a clear vision for your future. Consider factors such as the desired retirement age, estimated expenses, and the lifestyle you wish to maintain. Setting specific goals will help you stay motivated and focused on your retirement savings journey.

Create a Budget

💰 Develop a budget to understand your income, expenses, and areas where you can cut back to save more for retirement. Analyze your spending habits and identify areas where you can make adjustments. Implementing a budget will free up funds that can be directed towards retirement savings.

Maximize Employer Contributions

📊 If your employer offers a retirement savings plan, such as a 401(k) or pension scheme, make sure to maximize your contributions. Take advantage of any employer matches, as they provide an immediate return on your investment. Employer contributions can significantly boost your retirement fund.

Explore Individual Retirement Accounts

🏦 Consider opening an individual retirement account (IRA) or a Roth IRA to supplement your employer-sponsored retirement plan. IRAs offer tax advantages and flexibility, allowing you to grow your retirement savings through a wider range of investment options.

Diversify Your Investments

📊📈 Diversification is key to mitigating risk and maximizing returns. Allocate your retirement savings across different asset classes, such as stocks, bonds, and real estate. Diversifying your investments can help protect your retirement fund from market volatility and ensure long-term growth.

Monitor and Adjust Regularly

🔍 Regularly review your retirement savings strategy and adjust it as needed. Keep track of your investments’ performance, reassess your risk tolerance, and make any necessary changes to stay on track towards your retirement goals. Seeking professional advice can provide valuable insights and guidance.

Advantages and Disadvantages of Retirement Savings 30

Advantages

1. 🚀 Starting early allows you to take advantage of compounding and potentially accumulate a larger retirement fund.

2. 💼 Retirement savings provide financial security during your later years and ensure a comfortable retirement lifestyle.

3. 📈 By saving for retirement, you can counteract the impact of inflation and safeguard your purchasing power.

4. 🌟 Retirement savings allow you to have more control over your financial future and reduce reliance on social security benefits.

5. 🏖️ Accumulating a substantial retirement fund enables you to enjoy your retirement to the fullest, pursuing hobbies and spending time with loved ones.

Disadvantages

1. 📉 Retirement savings require consistent contributions, which may require sacrifices and adjustments to your lifestyle.

2. 💰 Market volatility can impact the value of your retirement investments, potentially affecting your retirement fund.

3. 🕰️ Starting late or not saving enough for retirement can result in a smaller retirement fund and limited options during retirement.

4. 💼 Retirement savings require careful planning and understanding of investment options, which may be overwhelming for some individuals.

5. 🌐 Retirement savings may limit your current disposable income, as a portion of your earnings is directed towards saving for retirement.

Frequently Asked Questions (FAQs)

1. How much should I save for retirement at the age of 30?

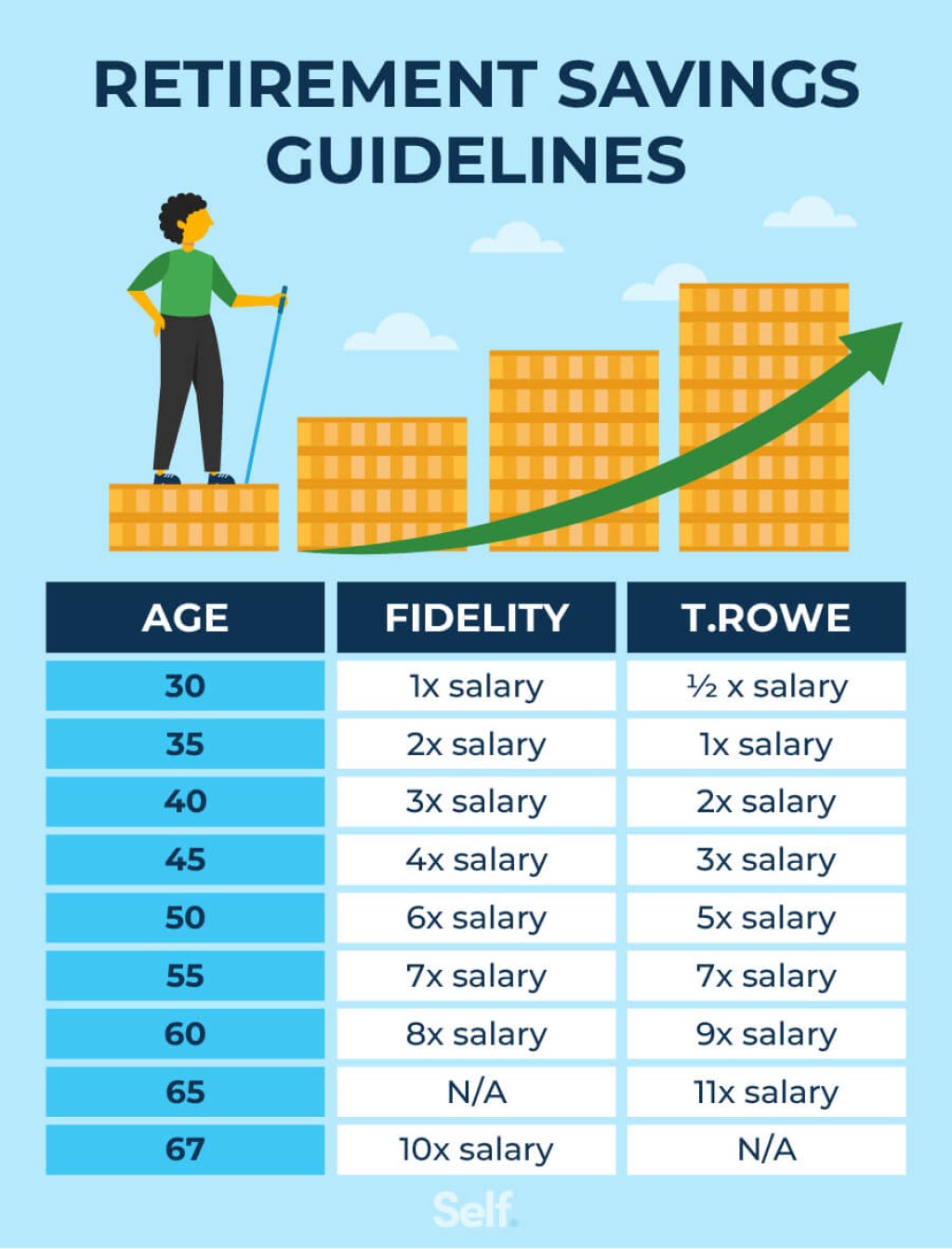

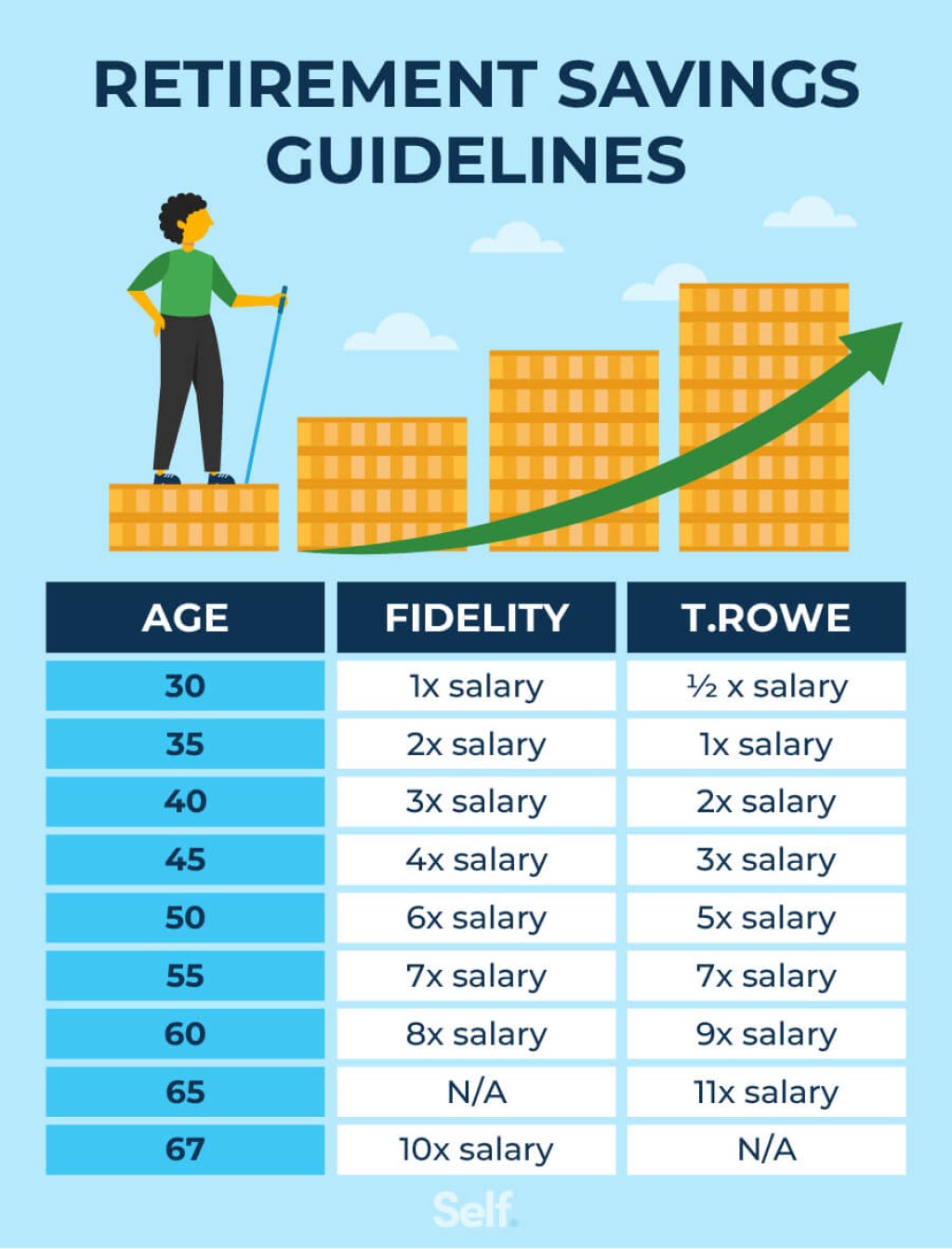

💰 The amount you should save for retirement at the age of 30 depends on various factors, including your desired retirement lifestyle, expected expenses, and retirement age. It is recommended to save at least 15

This post topic: Budgeting Strategies