Empowering Budgeting Strategies For Single Moms: Unlock Financial Independence Now!

Budgeting Strategies for Single Moms

Introduction

Dear Readers,

3 Picture Gallery: Empowering Budgeting Strategies For Single Moms: Unlock Financial Independence Now!

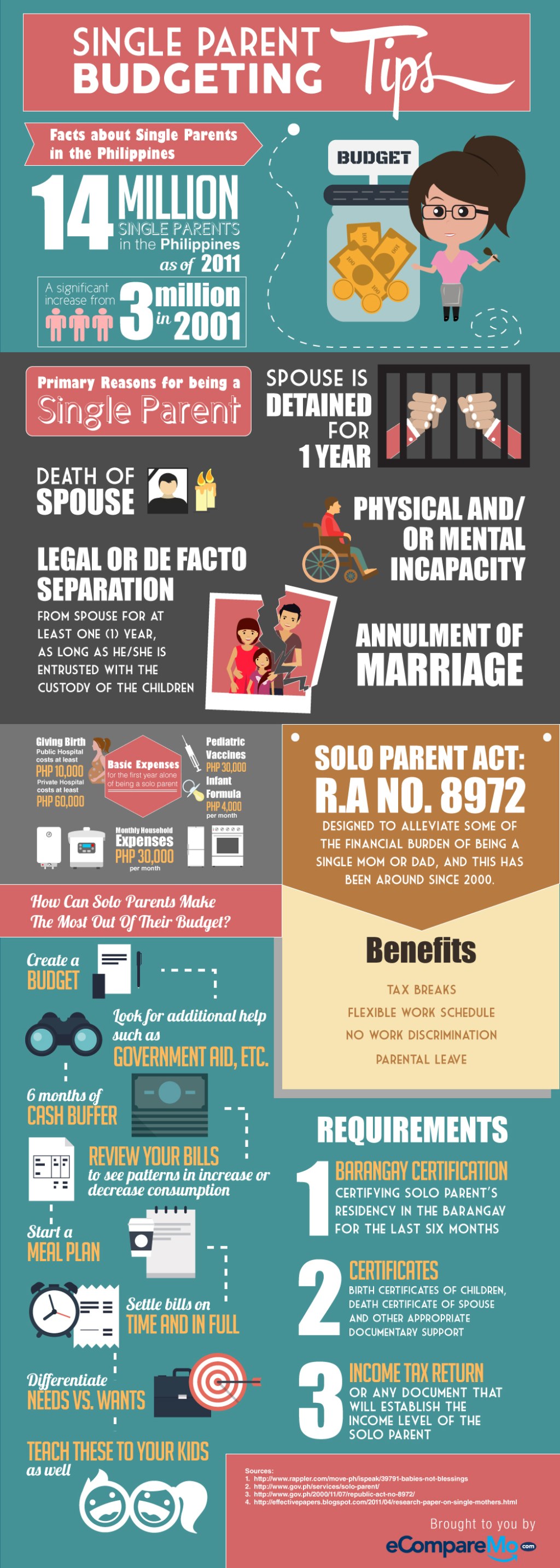

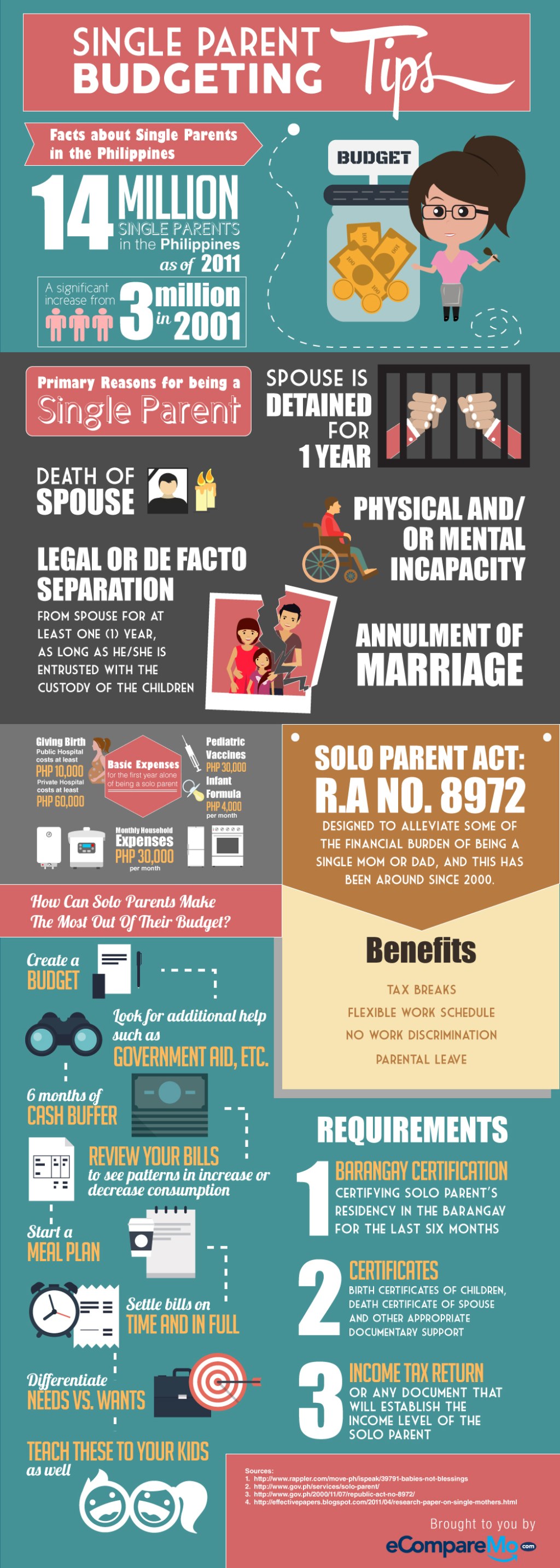

Today, we will be discussing budgeting strategies specifically tailored for single moms. Being a single mom is a challenging role, and managing finances can often be overwhelming. However, with effective budgeting strategies, you can take control of your finances and secure a stable future for yourself and your children. In this article, we will explore various budgeting techniques and provide you with valuable insights and tips to help you navigate through this journey successfully.

Image Source: 3financialgroup.com

Without further ado, let’s delve into the world of budgeting strategies for single moms.

Budgeting Strategies for Single Moms

1. What is budgeting?

Before diving into the strategies, let’s understand what budgeting means. Budgeting is the process of creating a plan to manage your income and expenses effectively. It allows you to allocate funds for essential needs, save for the future, and prioritize your financial goals.

✨ Key Point: Budgeting is essential for single moms as it provides them with a clear understanding of their financial situation and helps them make informed decisions.

2. Who should implement budgeting strategies?

Image Source: poconorecord.com

Whether you are a single mom or not, everyone can benefit from implementing budgeting strategies. However, single moms face unique challenges as they are solely responsible for managing their household finances. Therefore, it is crucial for single moms to adopt effective budgeting strategies to ensure financial stability for themselves and their children.

✨ Key Point: Budgeting strategies are specifically designed to address the financial needs and challenges faced by single moms.

3. When should you start budgeting?

Image Source: windows.net

It is never too late to start budgeting. As a single mom, it is important to begin budgeting as soon as possible to gain control over your finances. Whether you are just starting your journey as a single mom or have been one for a while, now is the perfect time to take charge of your financial future.

✨ Key Point: The earlier you start budgeting, the better prepared you are to handle financial emergencies and achieve your long-term financial goals.

4. Where can you find budgeting tools and resources?

There are numerous budgeting tools and resources available both online and offline. You can find budgeting apps, spreadsheets, and websites that offer comprehensive guides and tools to help you create and manage your budget effectively. Additionally, there are community organizations and support groups that provide financial education and assistance for single moms.

✨ Key Point: Utilizing technology and seeking assistance from financial experts can greatly assist you in implementing successful budgeting strategies.

5. Why is budgeting important for single moms?

Budgeting is crucial for single moms due to the unique financial responsibilities they face. It helps them prioritize expenses, save for emergencies and future goals, and avoid unnecessary debt. Additionally, budgeting provides single moms with a sense of control over their finances, reducing stress and promoting financial independence.

✨ Key Point: Budgeting empowers single moms to make informed decisions and ensures financial stability for themselves and their children.

6. How can you start budgeting as a single mom?

Starting your budgeting journey as a single mom can be overwhelming, but with the right approach, it becomes manageable. Begin by assessing your income and expenses, identifying areas where you can cut back, and setting realistic financial goals. Create a monthly budget plan, track your spending, and make adjustments as needed. Remember to prioritize savings and emergency funds to secure your financial future.

✨ Key Point: Starting small and staying consistent with your budgeting efforts will yield significant long-term benefits.

Advantages and Disadvantages of Budgeting Strategies for Single Moms

Advantages:

1. Financial Stability: Budgeting provides single moms with a sense of financial stability, allowing them to meet their needs and prepare for the future.

2. Debt Management: By following a budget, single moms can avoid unnecessary debt and manage existing debts effectively.

3. Goal Achievement: Budgeting helps single moms set and achieve financial goals, such as saving for education, buying a home, or starting a business.

4. Stress Reduction: Having control over finances reduces stress and promotes overall well-being.

5. Positive Role Modeling: Implementing budgeting strategies sets a positive example for children, teaching them the importance of financial responsibility.

Disadvantages:

1. Rigidity: Strict adherence to a budget may limit flexibility and spontaneous spending.

2. Initial Learning Curve: It may take time and effort to understand and implement budgeting strategies effectively.

3. Unexpected Expenses: Budgeting may not always account for unforeseen expenses, requiring adjustments along the way.

4. Temptation to Overspend: Without discipline, budgeting can be challenging, and the temptation to overspend may arise.

5. Potential for Frustration: Managing finances can be overwhelming at times, leading to frustration and discouragement.

Frequently Asked Questions (FAQs)

1. Can budgeting really make a difference in my financial situation as a single mom?

Yes, budgeting can significantly impact your financial situation as a single mom. It provides clarity, control, and a roadmap to achieving your financial goals.

2. How can I stick to my budget when unexpected expenses arise?

When unexpected expenses arise, review your budget, and make necessary adjustments. Consider cutting back on non-essential expenses temporarily and explore alternative solutions.

3. Is it possible to save money as a single mom on a tight budget?

Yes, saving money as a single mom on a tight budget is possible. Start by identifying areas where you can reduce expenses and prioritize saving even small amounts regularly. Every penny counts!

4. What if my income fluctuates as a single mom?

If your income fluctuates, it is crucial to create a budget based on your average income. Consider setting aside a portion of your earnings during high-income months to cover expenses during low-income months.

5. How often should I review and update my budget?

You should review and update your budget regularly, ideally on a monthly basis. This allows you to assess your progress, make necessary adjustments, and ensure you stay on track towards your financial goals.

Conclusion

In conclusion, implementing effective budgeting strategies is essential for single moms to ensure financial stability and provide a secure future for themselves and their children. By creating a budget, tracking expenses, and setting realistic financial goals, single moms can take control of their finances and overcome any challenges they may encounter.

Remember, budgeting is a journey, and it requires dedication and consistency. Stay focused, seek support when needed, and celebrate your progress along the way. You have the power to create a brighter financial future for yourself and your family.

Final Remarks

Friends, as we conclude this article, it is crucial to remember that budgeting is a personal journey, and what works for one person may not work for another. The strategies mentioned in this article are meant to serve as a starting point for your budgeting journey. It is essential to customize these strategies to fit your unique circumstances and financial goals.

Always consult with financial professionals before making any significant financial decisions. Budgeting takes time and patience, but with determination, you can achieve financial success as a single mom.

Wishing you all the best on your budgeting journey!

This post topic: Budgeting Strategies