Unlocking Success: The Power Of Budget Strategy Is Within Your Reach!

Budget Strategy Is: Maximizing Your Finances for Success

Introduction

Greetings, Readers! Welcome to this informative article on budget strategy is. As we navigate through life, it becomes crucial to manage our finances effectively. Budget strategy is a powerful tool that can help individuals, families, and businesses optimize their financial resources and ultimately achieve success. In this article, we will explore the various aspects of budget strategy is, including its definition, importance, and implementation. So, let’s dive in and discover how budget strategy is can transform your financial journey!

1 Picture Gallery: Unlocking Success: The Power Of Budget Strategy Is Within Your Reach!

What is Budget Strategy Is?

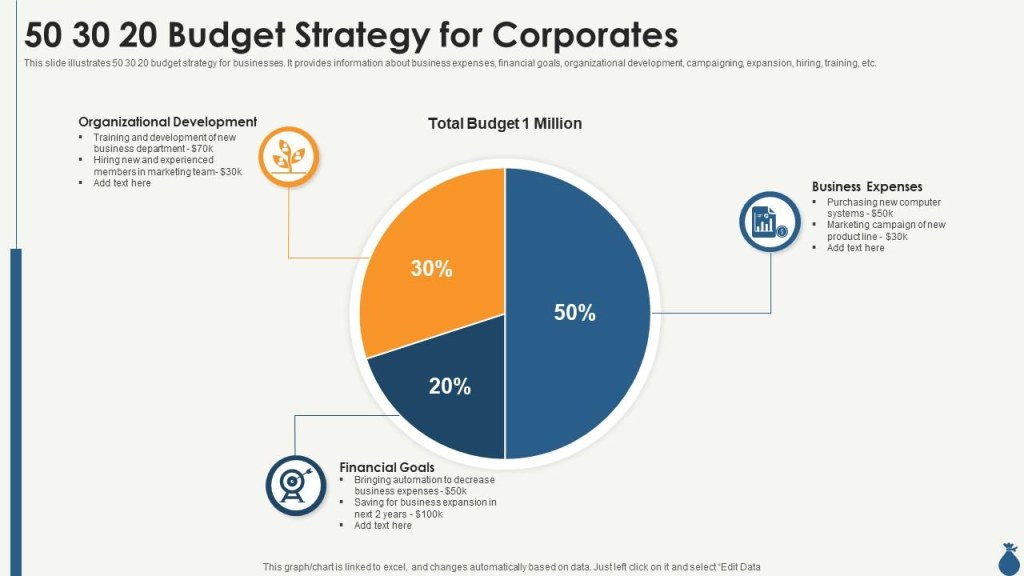

🔍 Budget strategy is refers to the systematic planning and allocation of funds to achieve specific financial goals. It involves analyzing income, expenses, and savings to create a blueprint for managing and optimizing finances. By implementing a budget strategy is, individuals can make informed decisions regarding their spending habits, investments, and savings. This strategic approach allows for better control over finances and ultimately leads to financial stability and growth.

Definition of Budget Strategy Is

Image Source: licdn.com

📋 Budget strategy is can be defined as a comprehensive financial plan that outlines income, expenses, savings, and investments. It involves setting clear financial goals, monitoring spending patterns, and making necessary adjustments to achieve those goals. Budget strategy is also about prioritizing financial needs and aligning them with long-term objectives. It provides a roadmap for managing finances efficiently and helps individuals make informed financial decisions.

Importance of Budget Strategy Is

💼 Budget strategy is plays a vital role in personal and business finance. It offers several advantages, such as:

📈 Effective financial management: By implementing a budget strategy is, individuals and businesses can gain control over their finances, reduce debt, and allocate funds wisely.

💰 Goal-oriented approach: With a budget strategy is, financial goals can be set and worked towards systematically, ensuring progress and financial success.

🔄 Adaptability and flexibility: Budget strategy is allows for adjustments and reallocation of funds based on changing circumstances or financial priorities.

🔒 Risk management: A well-planned budget strategy is helps identify potential financial risks and provides a cushion to mitigate them.

🌱 Building wealth: By consistently following a budget strategy is, individuals can save and invest wisely, thus building wealth over time.

However, it is essential to consider the potential disadvantages or challenges of budget strategy is as well. Let’s explore these further.

Advantages and Disadvantages of Budget Strategy Is

Advantages of Budget Strategy Is

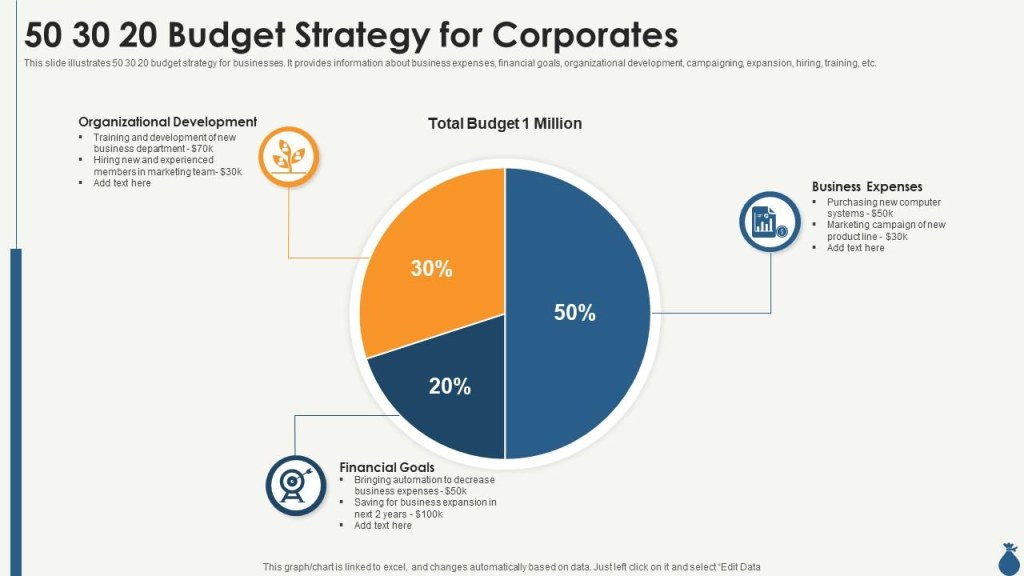

Image Source: slideteam.net

👍 Effective budget strategy is offers several benefits:

1. Improved financial discipline: A budget strategy is instills discipline and accountability, encouraging individuals to make responsible financial choices.

2. Enhanced savings: By tracking expenses and allocating funds wisely, a budget strategy is facilitates increased savings, which can be used for emergencies or future investments.

3. Debt reduction: With a budget strategy is, individuals can identify areas of excessive spending and redirect funds towards debt repayment, resulting in a reduction in overall debt.

4. Better decision-making: By having a clear overview of income and expenses, individuals can make informed decisions regarding investments, purchases, and financial commitments.

5. Financial security: A budget strategy is provides a sense of financial security, knowing that funds are allocated to cover essential expenses and future goals.

Disadvantages of Budget Strategy Is

👎 While a budget strategy is has numerous benefits, it may present some challenges:

1. Rigidity: A strict budget strategy is may limit spontaneous spending or restrict the ability to adapt to unexpected financial situations.

2. Time-consuming: Creating and maintaining a budget strategy is requires time and effort, including tracking expenses, analyzing data, and making adjustments.

3. Unrealistic expectations: Setting overly ambitious financial goals can lead to frustration and demotivation if they are not achieved within designated timelines.

4. Unexpected expenses: Despite the best budgeting efforts, unforeseen expenses or emergencies may occur, which can disrupt the balance of a budget strategy is.

5. Lack of flexibility: Some individuals may find it challenging to stick to a budget strategy is due to the limitations it imposes on their spending habits or lifestyle choices.

Frequently Asked Questions (FAQ)

1. Is budget strategy is only for individuals, or can businesses also benefit from it?

📌 Budget strategy is applicable to both individuals and businesses. It provides a structured approach to managing finances and achieving financial goals.

2. How often should I review and update my budget strategy is?

📌 It is recommended to review and update your budget strategy is regularly, preferably on a monthly basis. This allows for adjustments based on changing income, expenses, or financial priorities.

3. Can a budget strategy is help me save for long-term goals, such as retirement?

📌 Absolutely! A budget strategy is is an excellent tool for long-term financial planning. By allocating funds towards retirement savings and investments, you can work towards a secure future.

4. What should I do if I consistently overspend despite having a budget strategy is?

📌 If overspending is a recurring issue, consider reviewing your budget strategy is and identifying areas where adjustments can be made. It may also be helpful to seek professional financial advice.

5. Can a budget strategy is help me become debt-free?

📌 Yes, a budget strategy is can be instrumental in reducing and eventually eliminating debt. By allocating funds towards debt repayment and minimizing unnecessary expenses, you can work towards becoming debt-free.

Conclusion

In conclusion, budget strategy is is a powerful tool that can transform your financial journey. It provides a structured approach to managing and optimizing finances, allowing individuals and businesses to achieve their financial goals. By implementing a budget strategy is, you can gain control over your finances, reduce debt, save for the future, and make informed financial decisions. Remember, financial success requires discipline, commitment, and regular review of your budget strategy is. So, take the first step towards a brighter financial future and start maximizing your finances today!

Final Remarks

🔖 The information provided in this article is intended for general informational purposes only and should not be considered as financial advice. It is always recommended to consult with a professional financial advisor or planner before making any significant financial decisions. The authors and publishers of this article do not assume any liability for the actions or decisions taken by readers based on the information provided.

This post topic: Budgeting Strategies