Revolutionize Your Finances With An Effective Budgeting Implementation Strategy: Take Control Now!

Budgeting Implementation Strategy: A Comprehensive Guide

Introduction

Hello, Readers!

2 Picture Gallery: Revolutionize Your Finances With An Effective Budgeting Implementation Strategy: Take Control Now!

Welcome to this comprehensive guide on budgeting implementation strategy. In today’s fast-paced and competitive business environment, effective budgeting is crucial for the success and sustainability of any organization. By implementing a well-thought-out budgeting strategy, companies can optimize their financial resources, make informed decisions, and achieve their goals.

Image Source: ytimg.com

In this article, we will explore the different aspects of budgeting implementation strategy, including its definition, key components, advantages, disadvantages, and practical tips for successful implementation. Whether you are a business owner, manager, or finance professional, this guide will provide you with valuable insights to enhance your budgeting practices.

So, let’s dive in and discover the world of budgeting implementation strategy!

What is Budgeting Implementation Strategy? 📊

Budgeting implementation strategy refers to the process of developing, executing, and monitoring a budget plan to achieve financial goals and objectives. It involves setting targets, allocating resources, and tracking performance to ensure optimal utilization of funds. A well-designed implementation strategy allows organizations to align their financial plans with their overall business strategy and make informed decisions.

Key Components of Budgeting Implementation Strategy

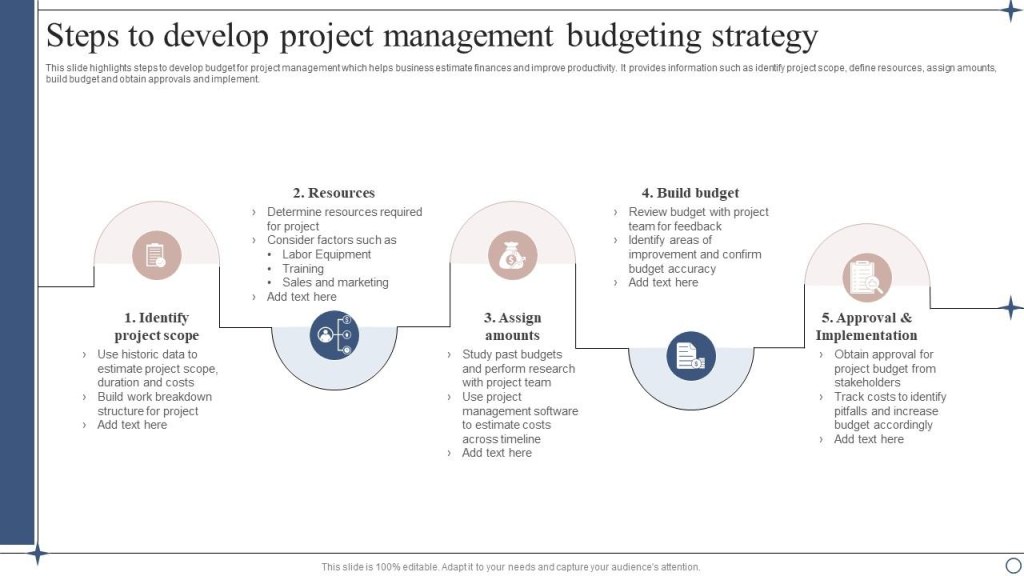

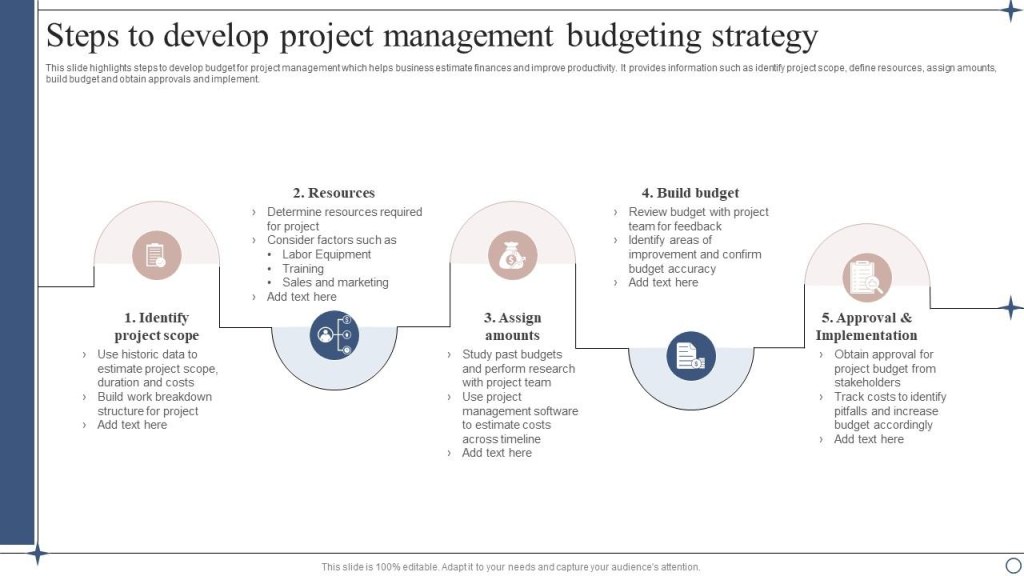

Image Source: slideteam.net

A successful budgeting implementation strategy consists of several key components:

Goal Setting: Clearly define the financial objectives and targets that the budget aims to achieve.

Resource Allocation: Determine how and where the available resources will be allocated to different departments or projects.

Performance Monitoring: Establish a system to track and evaluate the actual performance against the budgeted targets.

Variance Analysis: Analyze the differences between the budgeted figures and the actual results to identify areas of improvement.

Flexibility: Allow for adjustments and revisions in the budget plan to adapt to changing business conditions.

Communication: Ensure effective communication and collaboration between stakeholders involved in the budgeting process.

Continuous Improvement: Regularly review and refine the budgeting implementation strategy to enhance its effectiveness.

Who Should Implement Budgeting Implementation Strategy? 🤔

Budgeting implementation strategy is essential for organizations of all sizes and industries. It should be implemented by:

Business Owners: To ensure the financial stability and growth of their companies.

Managers: To make informed decisions and effectively allocate resources within their departments.

Finance Professionals: To develop accurate budgets and provide financial insights to support decision-making.

Nonprofit Organizations: To manage their funds and meet their mission objectives.

Regardless of your role or industry, understanding and implementing a budgeting strategy can significantly contribute to the success of your organization.

When is the Right Time to Implement Budgeting Implementation Strategy? ⌛

The right time to implement a budgeting strategy is at the beginning of a fiscal year or when setting annual financial goals. However, it’s never too late to start implementing or improving your budgeting practices. Organizations facing financial challenges or planning new projects can also benefit from implementing a budgeting strategy at any time.

Remember, the earlier you start, the more time you have to evaluate and adjust your financial plans for better outcomes.

Where to Implement Budgeting Implementation Strategy? 📍

Budgeting implementation strategy should be implemented across all levels and departments within an organization. It should be integrated into the overall management and decision-making processes. Whether you are a small business, a multinational corporation, or a nonprofit organization, budgeting strategy should be a fundamental part of your financial management practices.

Regardless of the industry or location, effective budgeting implementation strategy can be applied anywhere as long as it aligns with the organization’s goals and objectives.

Why is Budgeting Implementation Strategy Important? 🌟

Budgeting implementation strategy plays a crucial role in the success and sustainability of an organization. Here are the key reasons why it is important:

Financial Control: It provides organizations with control over their financial resources by setting limits and guidelines for spending.

Goal Alignment: It ensures that the financial goals and objectives are aligned with the overall business strategy and vision.

Resource Optimization: It helps in optimizing the use of available resources by allocating them based on priority and strategic importance.

Risk Management: It allows organizations to identify and mitigate financial risks by anticipating potential challenges and developing contingency plans.

Decision Support: It provides decision-makers with accurate and timely financial data to make informed decisions.

Performance Evaluation: It enables organizations to evaluate their performance against the budgeted targets and take corrective actions if necessary.

Stakeholder Confidence: It enhances the confidence of stakeholders, such as investors, lenders, and donors, by demonstrating financial discipline and accountability.

How to Implement Budgeting Implementation Strategy? 📝

Implementing a budgeting strategy requires careful planning and execution. Here are some practical steps to guide you:

Define Financial Goals: Clearly define the financial objectives that the budget aims to achieve.

Gather Financial Data: Collect relevant financial data, such as historical performance, market trends, and forecasts.

Develop Budget Templates: Create standardized templates to facilitate the budgeting process across different departments.

Allocate Resources: Allocate resources based on the priorities and strategic objectives of each department or project.

Monitor Performance: Establish a system to track and evaluate the actual performance against the budgeted targets.

Review and Adjust: Regularly review the budget plan and make necessary adjustments to adapt to changing business conditions.

Communicate and Engage: Ensure effective communication and engagement with stakeholders involved in the budgeting process.

Advantages and Disadvantages of Budgeting Implementation Strategy

Like any other business practice, budgeting implementation strategy has its own advantages and disadvantages. Let’s explore them in detail:

Advantages of Budgeting Implementation Strategy ✅

Better Financial Control: It provides organizations with better control over their financial resources and helps prevent overspending.

Goal Clarity: It ensures that everyone in the organization understands and works towards the same financial goals.

Resource Optimization: It helps in optimizing the use of available resources by allocating them strategically.

Efficient Decision-Making: It provides decision-makers with accurate and timely financial data to make informed decisions.

Performance Evaluation: It allows organizations to evaluate their performance and take corrective actions if necessary.

Disadvantages of Budgeting Implementation Strategy ❌

Time-Consuming: Developing and managing a budgeting implementation strategy can be time-consuming, especially for complex organizations.

Rigidness: A rigid budgeting process may limit flexibility and hinder adaptability to changing business conditions.

Resistance to Change: Implementing a budgeting strategy may face resistance from employees who are not accustomed to such practices.

Potential Inaccuracy: Budgets are based on assumptions and forecasts, which may result in inaccuracies if the underlying data is not reliable.

Dependency on Historical Data: Budgeting relies on historical financial data, which may not always reflect future trends accurately.

Frequently Asked Questions (FAQs)

1. What are the essential components of a budgeting implementation strategy?

A budgeting implementation strategy consists of goal setting, resource allocation, performance monitoring, variance analysis, flexibility, communication, and continuous improvement.

2. How often should a budgeting implementation strategy be reviewed?

A budgeting implementation strategy should be reviewed regularly, preferably on a quarterly or annual basis, to ensure its alignment with changing business conditions.

3. Can a budgeting implementation strategy be applied in nonprofit organizations?

Absolutely! Budgeting implementation strategy is equally important and applicable to nonprofit organizations to manage their funds and achieve their mission objectives.

4. Is budgeting implementation strategy only for large corporations?

No, budgeting implementation strategy is relevant for organizations of all sizes. Even small businesses can benefit from implementing a budgeting strategy to optimize their financial resources.

5. How can budgeting implementation strategy enhance stakeholder confidence?

By demonstrating financial discipline, accountability, and effective utilization of resources, budgeting implementation strategy enhances stakeholder confidence, including investors, lenders, and donors.

Conclusion

In conclusion, implementing a budgeting implementation strategy is essential for organizations to achieve their financial goals and make informed decisions. By setting clear objectives, allocating resources effectively, monitoring performance, and continuously improving the process, businesses can optimize their financial resources and enhance their overall performance.

Remember, budgeting implementation strategy is not a one-time activity but an ongoing process. Regular review, flexibility, and adaptability are key to its success. So, take the insights and practical tips provided in this guide and embark on your journey towards effective budgeting implementation strategy!

Final Remarks

Implementing a budgeting implementation strategy requires commitment, collaboration, and continuous improvement. It may face challenges along the way, but by leveraging the power of budgeting, organizations can navigate through uncertain times and achieve sustainable growth.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional financial advice. It is always recommended to consult with a qualified financial advisor or accountant for specific financial planning and budgeting needs.

This post topic: Budgeting Strategies