Mastering Family Finances: Unveiling The Best Budgeting Strategies For A Thriving Household

Best Budgeting Strategies for Family

Introduction

Dear Readers,

Welcome to our article on the best budgeting strategies for families. In this fast-paced world, it is essential for families to manage their finances effectively and ensure a stable future. Budgeting is a crucial aspect of financial management, and with the right strategies in place, families can achieve their financial goals while enjoying a comfortable lifestyle. In this article, we will explore various budgeting strategies that can help families make the most of their income and build a strong foundation for their future.

1 Picture Gallery: Mastering Family Finances: Unveiling The Best Budgeting Strategies For A Thriving Household

In this article, we will cover:

The importance of budgeting for families

The best budgeting strategies for families

The advantages and disadvantages of these strategies

Frequently asked questions about family budgeting

Conclusion and action steps

Final remarks

What are Budgeting Strategies?

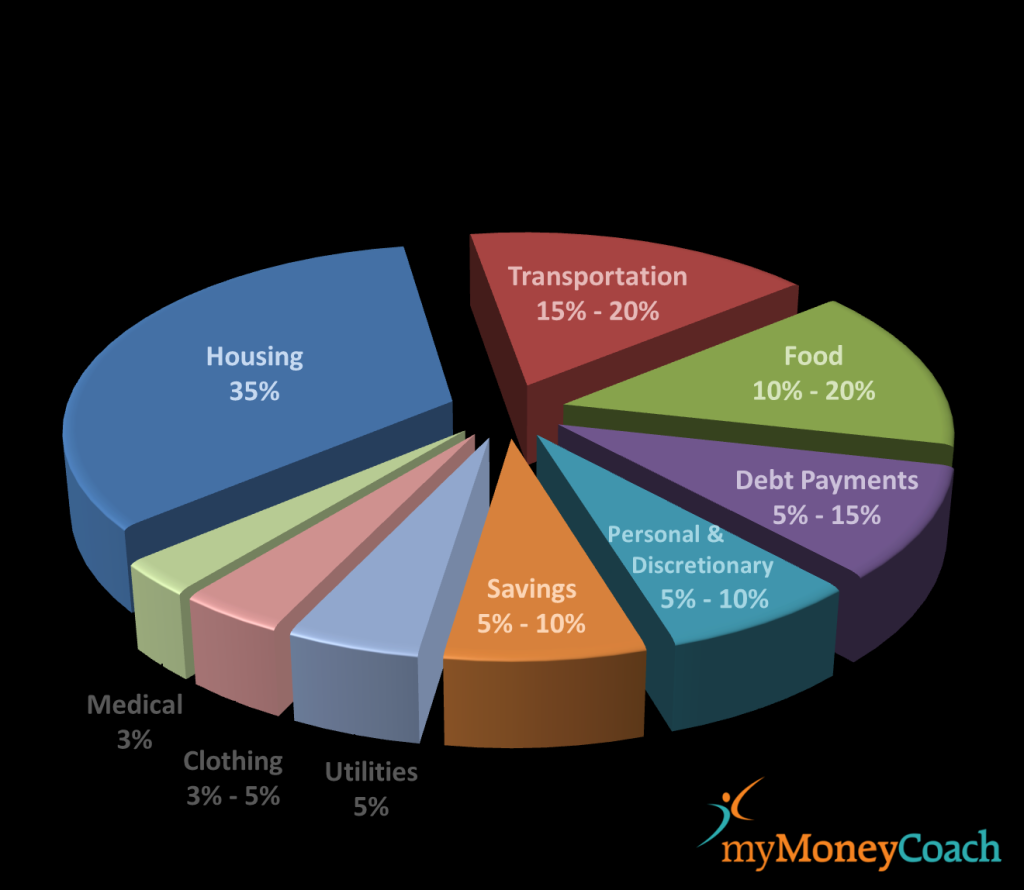

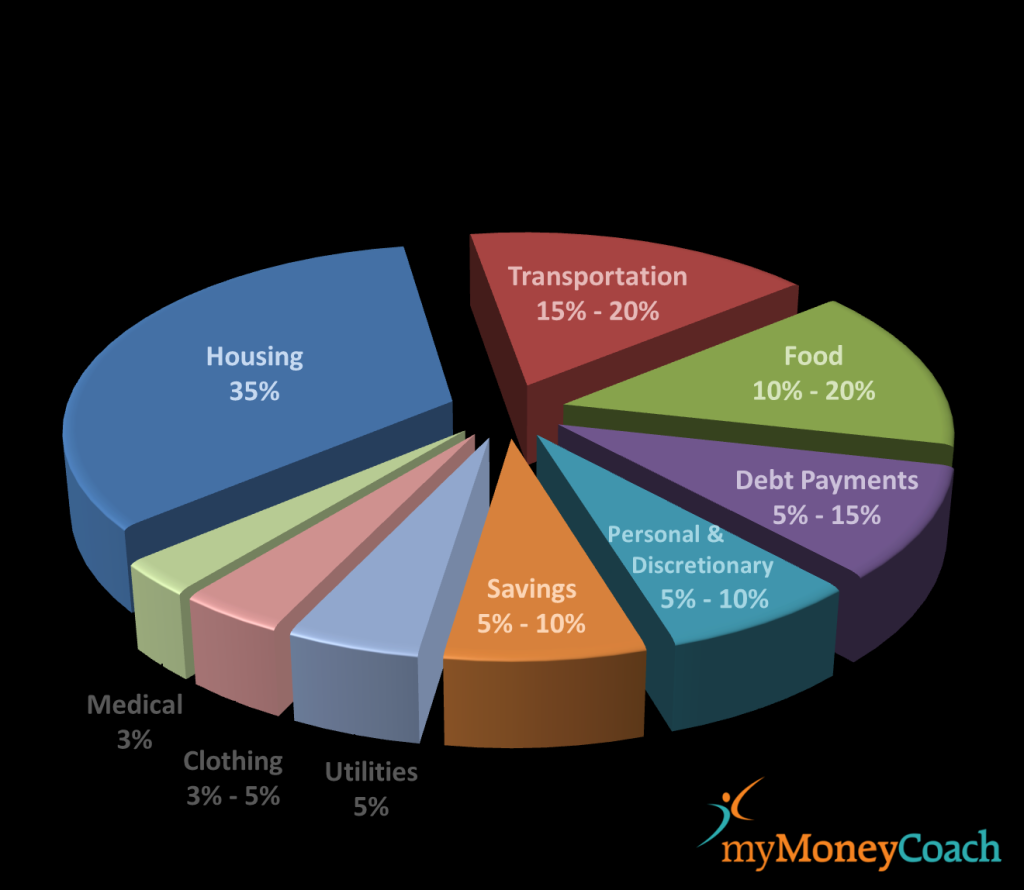

Image Source: mymoneycoach.ca

Before diving into the best budgeting strategies for families, let’s first understand what budgeting strategies are. Budgeting strategies are a set of techniques and practices that families can implement to manage their income, expenses, and savings effectively. These strategies aim to optimize the allocation of funds to various needs and goals, ensuring that families can meet their financial obligations and build wealth for the future.

Why are Budgeting Strategies Important for Families?

Effective budgeting strategies are essential for families due to several reasons:

Financial Stability: Budgeting strategies provide families with a sense of financial stability by ensuring that income is allocated to cover essential expenses, savings, and debt payments.

Goal Achievement: With the right budgeting strategies, families can work towards their goals, such as saving for education, buying a house, or planning for retirement.

Debt Management: Budgeting strategies help families manage their debts efficiently, ensuring timely repayments and avoiding unnecessary interest charges.

Reduced Financial Stress: By having a well-planned budget, families can reduce financial stress and have peace of mind knowing that their finances are under control.

Who Can Benefit from Budgeting Strategies?

Any family, regardless of their income level, can benefit from implementing budgeting strategies. Whether you are a single-income household or a dual-income household, budgeting can help you make the most of your financial resources and achieve your financial goals.

When Should Families Start Implementing Budgeting Strategies?

It is never too early or too late to start implementing budgeting strategies. Families should ideally start as soon as possible to develop good financial habits and secure their financial future. However, even if you haven’t started budgeting yet, it’s never too late to begin. The important thing is to take the first step and commit to managing your finances effectively.

Where Can Families Implement Budgeting Strategies?

Budgeting strategies can be implemented in all aspects of a family’s financial life. From daily expenses to long-term financial goals, families can use these strategies to make informed decisions and ensure that their financial resources are used wisely.

Why are Budgeting Strategies Effective?

Budgeting strategies are effective because they provide families with a clear roadmap for managing their finances. By tracking income and expenses, families can identify areas where they can cut back, save more, and optimize their spending. Additionally, budgeting strategies help families prioritize their financial goals, ensuring that their limited resources are allocated to the most important areas.

How Can Families Implement Budgeting Strategies?

Implementing budgeting strategies requires families to take several key steps:

Evaluate Income and Expenses: Start by understanding your monthly income and expenses. This will help you identify areas where you can make adjustments and save more.

Create a Budget: Based on your evaluation, create a budget that allocates funds for essential expenses, savings, and debt repayments. Make sure to set realistic goals and stick to your budget.

Track Spending: Keep a record of all your expenses to ensure that you stay within your budget. Use budgeting apps or spreadsheets to make tracking easier.

Review and Adjust: Regularly review your budget to see if any adjustments are needed. As circumstances change, you may need to modify your budget to accommodate new expenses or goals.

Seek Professional Advice: If you’re struggling with budgeting or have complex financial situations, consider seeking advice from a financial planner or advisor.

Advantages and Disadvantages of Budgeting Strategies

As with any financial strategy, there are advantages and disadvantages to implementing budgeting strategies:

Advantages of Budgeting Strategies

Financial Control: Budgeting strategies give families control over their finances, allowing them to make informed decisions and prioritize their goals.

Debt Reduction: By allocating funds towards debt repayments, budgeting strategies can help families reduce their debt burden and achieve financial freedom.

Savings Growth: Budgeting strategies encourage families to save consistently, leading to the growth of emergency funds, retirement savings, and other financial reserves.

Goal Achievement: With a budget in place, families can work towards their financial goals, whether it’s buying a house, funding education, or planning for a dream vacation.

Reduced Financial Stress: Knowing that their finances are well-managed and under control, families can experience reduced financial stress and enjoy peace of mind.

Disadvantages of Budgeting Strategies

Restrictive: Some families may find budgeting strategies restrictive, as they require discipline and may limit spending in certain areas.

Time-Consuming: Implementing and maintaining a budget can be time-consuming, especially when tracking expenses and reviewing financial goals.

Unexpected Expenses: Budgeting strategies may not account for unexpected expenses, leaving families unprepared for financial emergencies.

Changing Priorities: As family circumstances change, priorities may shift. Budgeting strategies may require adjustments to accommodate new goals or expenses.

Frequently Asked Questions about Family Budgeting

1. What if my income is irregular?

If your income is irregular, it can be challenging to create a monthly budget. In such cases, consider averaging your income over a longer period and creating a budget based on the average. Additionally, building an emergency fund can help you manage any income fluctuations effectively.

2. How can I involve my children in budgeting?

Teaching children about budgeting is an important life skill. You can involve your children by explaining the concept of money, involving them in age-appropriate financial discussions, and encouraging them to set saving goals.

3. Should I prioritize debt repayment or savings?

The priority between debt repayment and savings depends on your specific circumstances. Generally, it’s advisable to focus on high-interest debt repayment first, as it can save you money in the long run. However, it’s essential to have some savings for emergencies while paying off debt.

4. Are there budgeting strategies for single parents?

Absolutely! Single parents can benefit from budgeting strategies by following similar principles and adapting them to their unique circumstances. In some cases, single parents may need to allocate more funds towards childcare or other specific expenses.

5. How often should I review my budget?

It’s recommended to review your budget regularly, preferably on a monthly basis. This allows you to track your progress, make adjustments if needed, and ensure that your budget aligns with your current financial goals.

Conclusion

In conclusion, implementing effective budgeting strategies is vital for families to achieve financial stability and build a prosperous future. By understanding the importance of budgeting, who can benefit from it, when and where to implement it, why it is effective, and how to get started, families can take control of their finances and make informed decisions. Remember, budgeting requires discipline and commitment, but the long-term benefits far outweigh the efforts. Take the first step towards financial freedom by implementing the best budgeting strategies for your family today!

Final Remarks

Dear Readers, we hope this article has provided you with valuable insights into the best budgeting strategies for families. It is important to note that financial situations vary, and what works for one family may not work for another. Therefore, we encourage you to adapt these strategies to suit your unique needs and goals. If you have any specific questions or need personalized advice, we recommend consulting with a financial professional. Remember, budgeting is a journey, and with dedication and perseverance, you can achieve your financial dreams. Best of luck!

This post topic: Budgeting Strategies