Maximize Your Finances With Budget Strategy Group: Empowering Your Financial Future

Budget Strategy Group: Unlocking Financial Success

Introduction

Dear Readers,

3 Picture Gallery: Maximize Your Finances With Budget Strategy Group: Empowering Your Financial Future

Welcome to this informative article on the budget strategy group. In today’s fast-paced world, managing finances effectively has become crucial for individuals and businesses alike. The budget strategy group is an essential tool that can help you achieve financial stability and success. In this article, we will delve into the details of this strategy, exploring its benefits, implementation, and more. So, let’s get started!

Overview of Budget Strategy Group

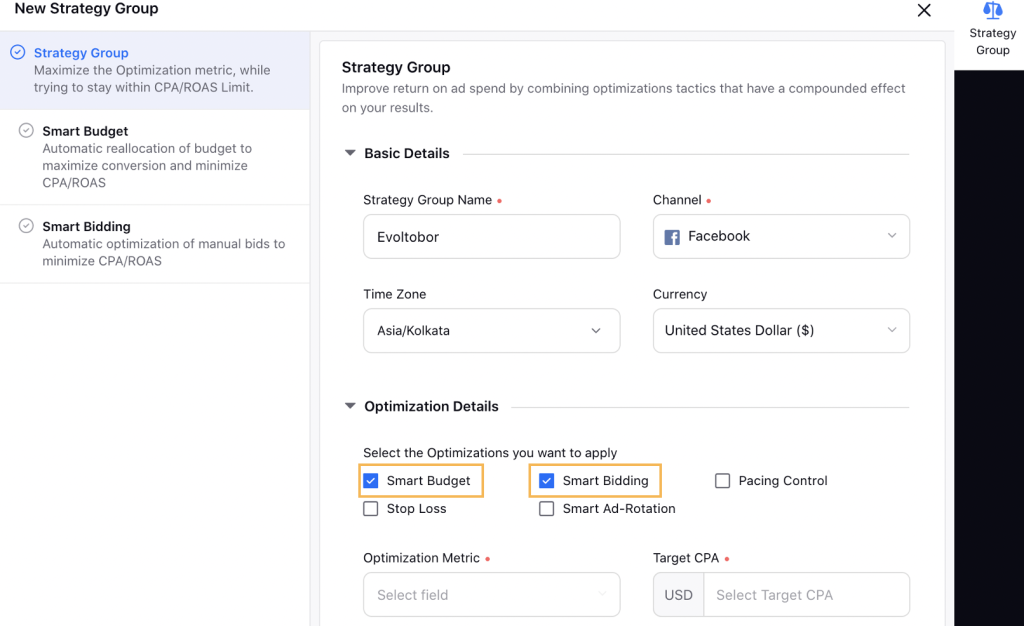

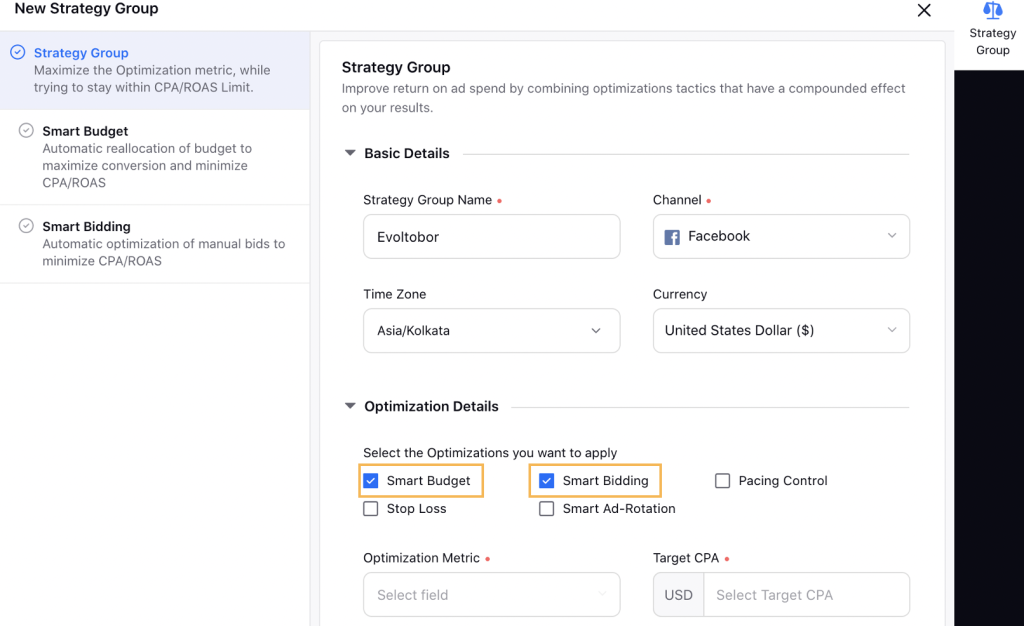

Image Source: sprinklr.com

Before we dive into the intricacies, let’s understand what the budget strategy group entails. This group is a dedicated team or department responsible for developing and executing effective budgeting plans. They analyze financial data, forecast future expenses, and work towards achieving financial goals. With their expertise, they ensure optimal resource allocation, cost control, and decision-making based on financial insights.

What is a Budget Strategy Group?

A budget strategy group is a team formed within an organization to streamline financial planning and budgeting processes. It comprises financial experts, analysts, and managers who collaborate to develop and implement effective budgeting strategies. This group ensures that financial resources are allocated efficiently, expenses are monitored, and financial goals are met.

Who Should Form a Budget Strategy Group?

Any organization, regardless of its size or industry, can benefit from establishing a budget strategy group. Whether you are a startup, a non-profit organization, or a multinational corporation, having a dedicated team to handle financial planning and budgeting can prove invaluable. This group can comprise individuals from finance, accounting, and management departments, working in tandem to achieve financial success.

When Should a Budget Strategy Group Be Implemented?

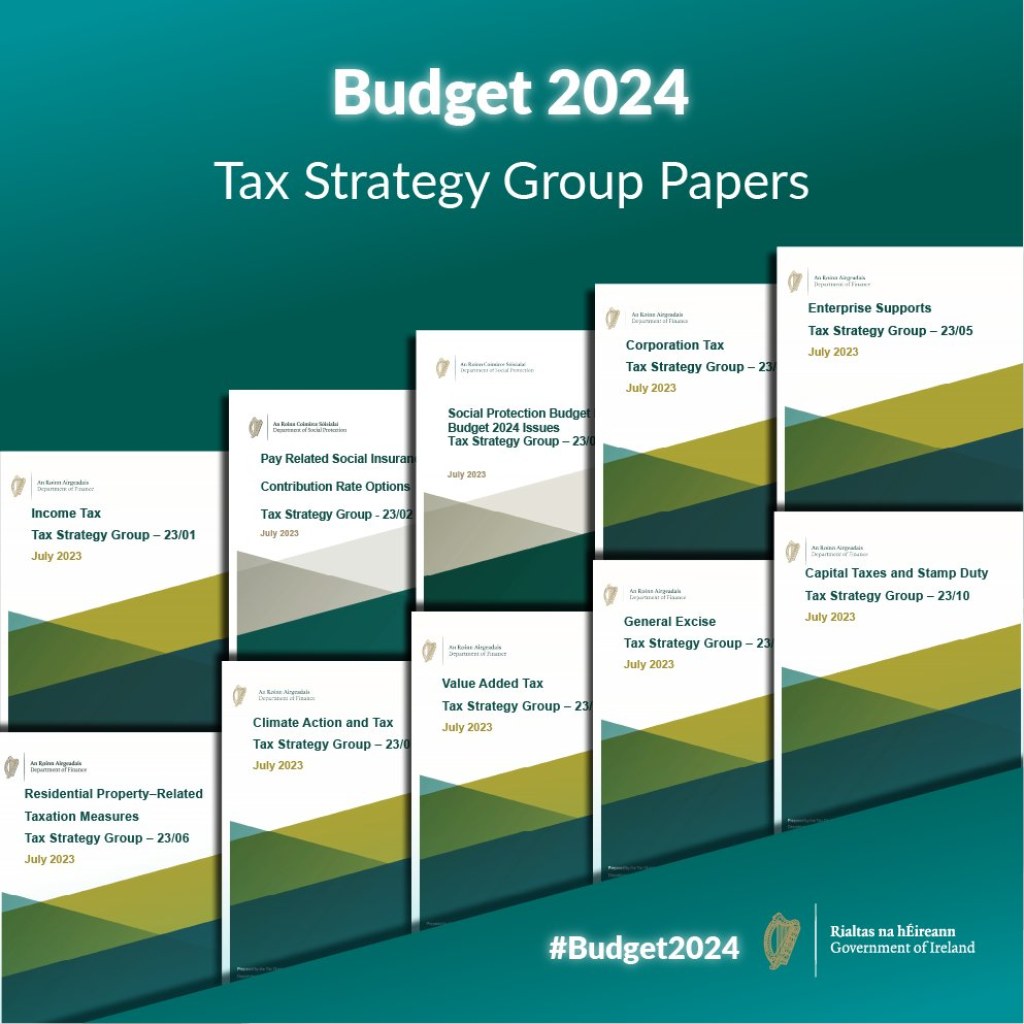

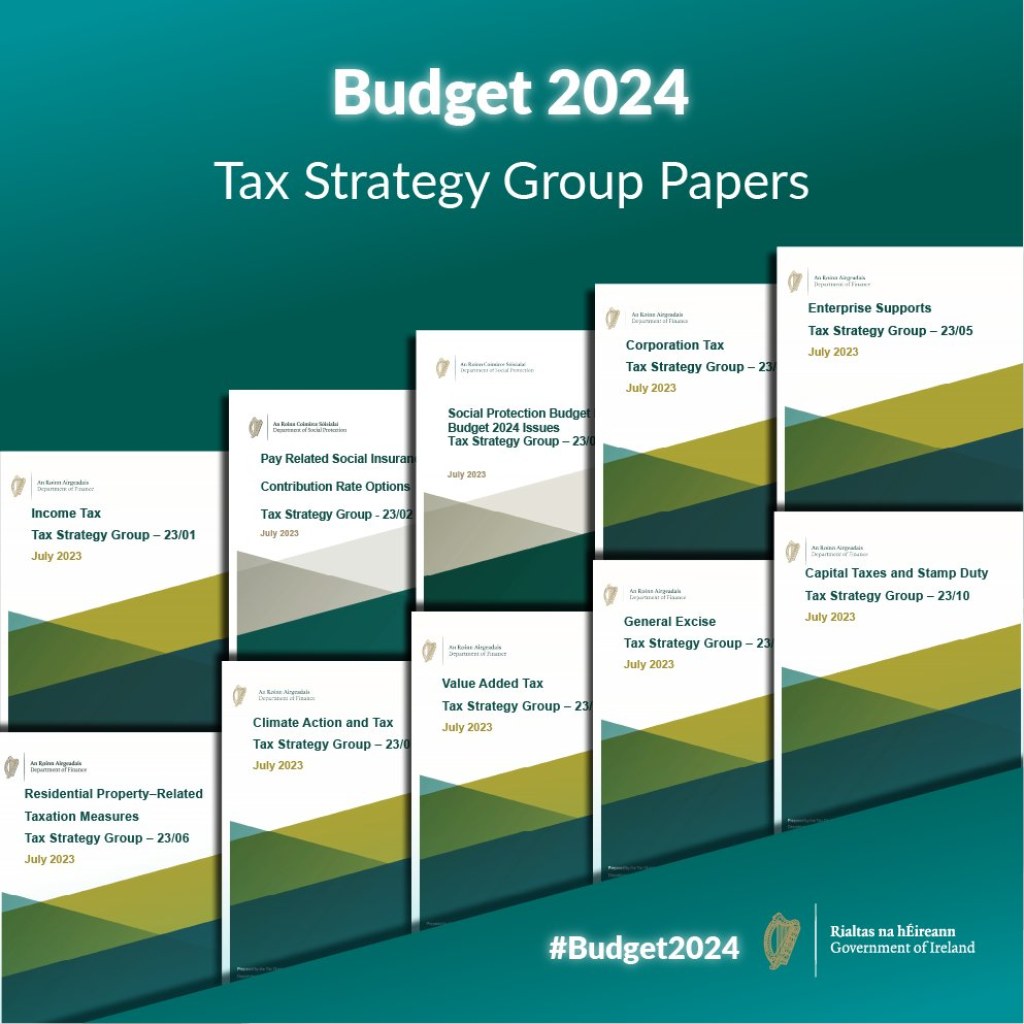

Image Source: sprinklr.com

The ideal time to implement a budget strategy group is during the initial stages of an organization’s financial planning process. By incorporating this group from the beginning, you can establish a solid foundation for financial management. However, even if your organization is already established, it’s never too late to form a budget strategy group. Adapting to changing financial circumstances and improving financial decision-making can benefit any organization.

Where Can You Find a Budget Strategy Group?

The budget strategy group can be found within an organization, functioning as an internal department or team. The group may have a designated space within the organization’s structure, such as the finance or accounting department. In some cases, organizations may also outsource budget strategy groups to external financial consulting firms, leveraging their expertise to enhance financial planning and budgeting processes.

Why is a Budget Strategy Group Important?

Image Source: twimg.com

A budget strategy group plays a pivotal role in an organization’s financial success. Here are some key reasons why this group is important:

Effective Resource Allocation: The group ensures that financial resources are allocated optimally, minimizing wastage and maximizing productivity.

Cost Control: By closely monitoring expenses, the group helps identify cost-saving opportunities and promotes financial discipline within the organization.

Financial Goal Achievement: With their expertise, the group assists in setting realistic financial goals and works towards achieving them through strategic planning.

Data-driven Decision Making: By analyzing financial data and trends, the group provides valuable insights that support informed decision-making at all levels of the organization.

Improved Financial Planning: With their in-depth knowledge of financial processes, the group helps develop robust financial plans, taking into account various factors and potential risks.

Enhanced Accountability: The budget strategy group promotes accountability by establishing clear financial guidelines, monitoring adherence, and conducting regular audits.

Long-term Financial Stability: By implementing effective budgeting strategies, the group ensures the long-term financial stability and growth of the organization.

How Does a Budget Strategy Group Work?

A budget strategy group follows a structured approach to fulfill its responsibilities. Here’s a step-by-step breakdown of how it typically works:

Defining Financial Goals: The group collaborates with stakeholders to define short-term and long-term financial goals.

Collecting Financial Data: They gather relevant financial data, including income, expenses, investments, and debts.

Analyzing Financial Data: Using advanced tools and techniques, the group analyzes the collected data to identify trends, patterns, and areas of improvement.

Developing Budget Plans: Based on the analysis, the group develops comprehensive budget plans aligned with the organization’s goals.

Implementing Budget Plans: The group works closely with the relevant departments to implement the budget plans effectively.

Monitoring and Control: They continuously monitor expenses, assess budget performance, and make necessary adjustments to ensure adherence to the plans.

Reporting and Analysis: The group prepares regular financial reports and conducts detailed analysis to measure the effectiveness of the budget strategy.

Advantages and Disadvantages of a Budget Strategy Group

Advantages:

Improved Financial Control: The group ensures better control over financial resources and expenses.

Enhanced Decision Making: Financial insights provided by the group enable informed decision-making.

Efficient Resource Allocation: By optimizing resource allocation, the group maximizes productivity.

Financial Goal Achievement: The group helps achieve financial goals through strategic planning and implementation.

Transparency and Accountability: The group promotes transparency and accountability within the organization.

Disadvantages:

Resource Intensive: Establishing and maintaining a budget strategy group can involve additional costs.

Resistance to Change: Employees may resist changes in financial processes or be hesitant to share financial data.

Complexity: Developing and implementing budget plans can be complex, requiring expertise and coordination.

Potential Biases: The group’s decisions may be influenced by personal or departmental biases.

External Factors: External factors such as economic fluctuations may impact the effectiveness of budgeting strategies.

Frequently Asked Questions (FAQs)

Q: How can a budget strategy group benefit individuals?

A: A budget strategy group can benefit individuals by providing them with the knowledge and tools to effectively manage their personal finances. It helps in setting financial goals, tracking expenses, and making informed financial decisions.

Q: Is it necessary for small businesses to have a budget strategy group?

A: While small businesses may not have dedicated budget strategy groups, implementing budgeting principles and involving key stakeholders in the process can greatly benefit their financial stability and growth.

Q: Can a budget strategy group help in cost reduction?

A: Yes, a budget strategy group plays a crucial role in identifying cost-saving opportunities and promoting cost control measures within an organization, leading to overall cost reduction.

Q: What are the key skills required to be a part of a budget strategy group?

A: Members of a budget strategy group should possess strong financial analysis skills, excellent communication and collaboration abilities, data interpretation expertise, and a thorough understanding of financial planning techniques.

Q: How often should budget plans be reviewed and updated?

A: Budget plans should be reviewed and updated on a regular basis, typically quarterly or annually, to ensure they remain aligned with changing financial circumstances and goals.

Conclusion

In conclusion, a budget strategy group offers immense value in achieving financial success. By incorporating this group within an organization, individuals and businesses can effectively manage their finances, make informed decisions, and work towards their financial goals. Whether you are an organization looking to enhance financial control or an individual striving for personal financial stability, implementing a budget strategy group can unlock a world of financial opportunities. Take the first step today and empower yourself or your organization with the power of effective budgeting!

Final Remarks

Dear Readers,

It is important to note that while a budget strategy group can significantly impact financial success, it is not a one-size-fits-all solution. Each organization or individual should tailor their budgeting approach to their unique circumstances and goals. Seek professional advice if needed and remember to regularly reassess and adapt your budget strategy to changing financial landscapes. Financial success is within your reach – embrace the power of budgeting and unlock a prosperous future!

This post topic: Budgeting Strategies