Mastering Your Finances: Unveiling The 4.3 Budgeting Strategies For Success

4.3 Budgeting Strategies

Welcome, readers! In this article, we will explore 4.3 budgeting strategies that can help you effectively manage your finances and achieve your financial goals. Budgeting is a crucial aspect of personal and business finance, and implementing the right strategies can make a significant difference in your financial success. Let’s dive into the details and discover how these strategies can benefit you.

Table of Contents

1. Introduction

3 Picture Gallery: Mastering Your Finances: Unveiling The 4.3 Budgeting Strategies For Success

2. What is Budgeting? 🤔

Image Source: slideteam.net

3. Who Can Benefit from Budgeting? 🤷♂️

4. When Should You Start Budgeting? 📅

5. Where Can You Implement Budgeting Strategies? 🌍

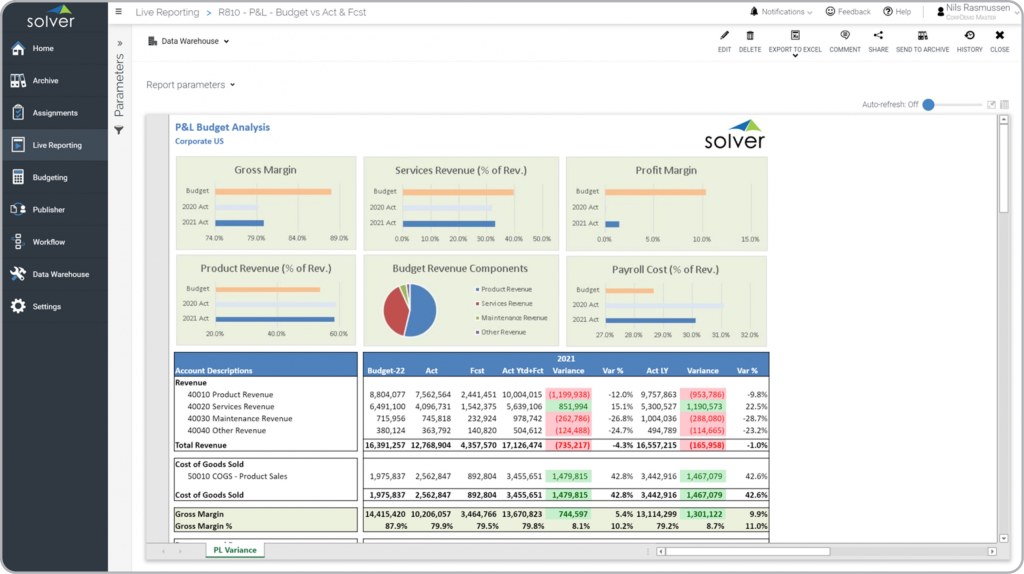

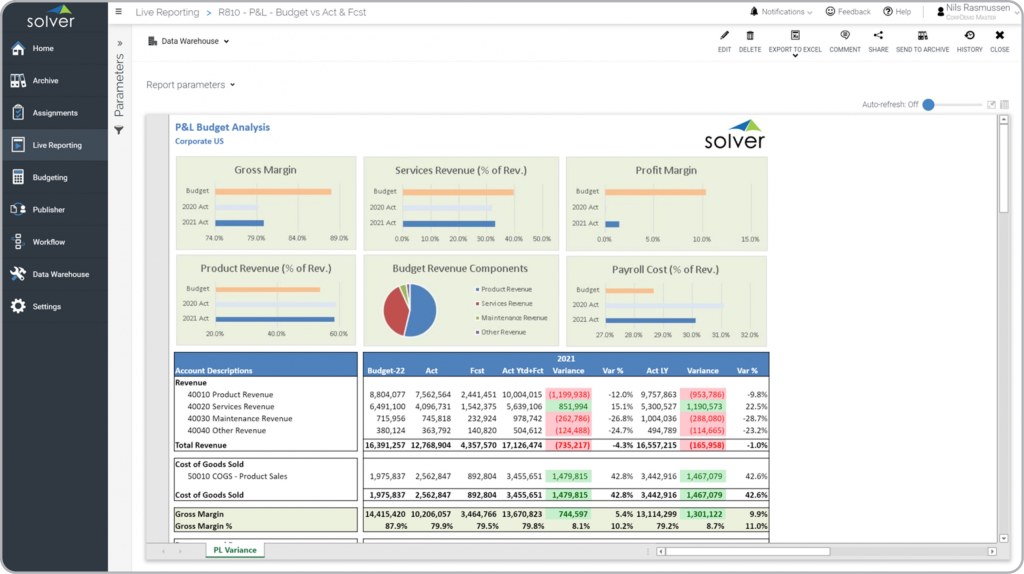

Image Source: solverglobal.com

6. Why Are Budgeting Strategies Important? ❓

7. How to Implement 4.3 Budgeting Strategies? 📝

Image Source: completecontroller.com

8. Advantages of 4.3 Budgeting Strategies ✅

9. Disadvantages of 4.3 Budgeting Strategies ❌

10. Frequently Asked Questions (FAQs) ❓

11. Conclusion

12. Final Remarks

1. Introduction

Budgeting is the process of creating a plan for your income and expenses, allowing you to allocate your resources effectively. It involves tracking your income, expenses, savings, and investments to ensure financial stability and achieve your financial goals. By implementing 4.3 budgeting strategies, you can take control of your finances and make informed decisions about your money.

It’s essential to have a clear understanding of your financial situation and goals before creating a budget. Whether you want to save for a down payment on a house, pay off debt, or start a business, budgeting can help you achieve these objectives faster.

In this article, we will explore a variety of budgeting strategies that can be applied to different financial situations. These strategies will empower you to make smart financial choices and prioritize your spending based on your goals and values.

Now, let’s dive into the details and learn more about the 4.3 budgeting strategies that can transform your financial life.

2. What is Budgeting? 🤔

Budgeting is the process of creating a plan for your income and expenses, allowing you to allocate your resources effectively. It involves tracking your income, expenses, savings, and investments to ensure financial stability and achieve your financial goals. By implementing budgeting strategies, you can take control of your finances and make informed decisions about your money.

Why is Budgeting Important?

Budgeting is essential because it helps you:

1. Prioritize your spending: With a budget, you can allocate your money towards your most important goals and values.

2. Track your expenses: By monitoring your spending, you can identify areas where you can cut back and save money.

3. Save for the future: Budgeting allows you to set aside money for emergencies, retirement, and other long-term financial goals.

4. Reduce stress: Knowing where your money is going and having a plan in place can alleviate financial stress and uncertainty.

5. Achieve financial goals: By budgeting effectively, you can work towards paying off debt, saving for a down payment, or starting a business.

Overall, budgeting provides a clear roadmap for your finances, enabling you to make informed decisions and take control of your financial future.

3. Who Can Benefit from Budgeting? 🤷♂️

Everyone can benefit from budgeting, regardless of their income level or financial situation. Whether you’re a student, a young professional, a business owner, or nearing retirement, budgeting can help you achieve your financial goals and live a more financially secure life.

If you find yourself living paycheck to paycheck, struggling with debt, or unsure of where your money goes each month, then budgeting is especially crucial for you. By tracking your income and expenses, you can identify areas where you’re overspending and make necessary adjustments to improve your financial situation.

Even if you’re already financially stable, budgeting can provide additional benefits, such as helping you save more, invest wisely, and plan for the future. It allows you to align your spending with your values and live a more intentional life.

No matter your age or financial status, implementing budgeting strategies can bring significant positive changes to your financial well-being.

4. When Should You Start Budgeting? 📅

The best time to start budgeting is now. It doesn’t matter if you’re beginning your first job, starting a family, or nearing retirement—having a budget in place is always beneficial.

Starting early allows you to develop good financial habits and make smart money decisions from the beginning. However, it’s never too late to start budgeting. Even if you’ve never budgeted before, you can begin today and start taking control of your finances.

Remember, budgeting is an ongoing process. Your financial situation and goals may change over time, so it’s essential to review and update your budget regularly.

5. Where Can You Implement Budgeting Strategies? 🌍

Budgeting strategies can be implemented in various areas of your life, including:

1. Personal finance: Create a budget to manage your personal income, expenses, and savings.

2. Business finance: Develop a budget for your business to track revenue, expenses, and profit.

3. Household budgeting: Create a budget to manage household expenses, such as rent, utilities, and groceries.

4. Travel budgeting: Plan your travel expenses and allocate funds for transportation, accommodation, and activities.

5. Event budgeting: Create a budget for special events, such as weddings, birthdays, or parties.

6. Project budgeting: Develop a budget for specific projects, such as home renovations or launching a new product.

These are just a few examples of where you can implement budgeting strategies. The key is to identify areas of your life where you want to improve your financial management and create a budget accordingly.

6. Why Are Budgeting Strategies Important? ❓

Budgeting strategies are essential because they provide structure and guidance for managing your finances effectively. Here are some key reasons why budgeting strategies are crucial:

1. Financial control:

By implementing budgeting strategies, you gain control over your finances. You know where your money is going and can make informed decisions to align your spending with your goals and priorities.

2. Goal achievement:

Having a budget allows you to set and achieve financial goals. Whether it’s saving for a down payment, paying off debt, or starting a business, budgeting strategies help you allocate resources towards these objectives.

3. Debt reduction:

By tracking your expenses and prioritizing your spending, you can reduce and eliminate debt more effectively. Budgeting strategies help you identify areas where you can cut back and allocate those savings towards debt repayment.

4. Improved savings:

Through budgeting, you can create a systematic approach to saving money. By setting aside a portion of your income each month, you can build an emergency fund, save for retirement, or achieve other long-term financial goals.

5. Better financial decisions:

By understanding your financial situation through budgeting, you can make better decisions when it comes to investments, major purchases, or navigating unexpected financial challenges. Budgeting strategies provide the information and context needed to make informed choices.

Overall, budgeting strategies help you gain control over your finances, achieve your goals, and make better financial decisions.

7. How to Implement 4.3 Budgeting Strategies? 📝

Implementing 4.3 budgeting strategies involves the following steps:

Step 1: Set financial goals:

Identify your financial goals, such as saving for a down payment, paying off debts, or starting a business. Having clear goals will guide your budgeting efforts.

Step 2: Track your income and expenses:

Record all sources of income and track your expenses. Use budgeting tools or apps to simplify the process and gain a comprehensive understanding of your finances.

Step 3: Categorize expenses:

Sort your expenses into categories, such as housing, transportation, groceries, entertainment, and savings. This allows you to identify areas where you can reduce spending and prioritize your financial resources.

Step 4: Allocate funds:

Allocate funds to each category based on your financial goals and priorities. Ensure that essential expenses are covered while leaving room for savings and discretionary spending.

Step 5: Monitor and adjust:

Regularly review your budget and track your progress. Make adjustments as needed to ensure that you’re staying on track towards your financial goals.

By following these steps and implementing the 4.3 budgeting strategies, you’ll be on your way to financial success.

8. Advantages of 4.3 Budgeting Strategies ✅

The 4.3 budgeting strategies offer several advantages:

1. Financial discipline:

By adopting budgeting strategies, you develop discipline in managing your finances. This leads to improved spending habits and long-term financial stability.

2. Goal achievement:

With a budget, you can clearly define and work towards achieving your financial goals. Whether it’s saving for a dream vacation or paying off debt, budgeting strategies help you stay on track.

3. Increased savings:

By prioritizing saving in your budget, you can build an emergency fund, save for retirement, or invest in future opportunities. Budgeting strategies ensure that your savings goals are consistently met.

4. Better decision making:

A budget provides valuable information about your financial situation, allowing you to make informed decisions. You can evaluate the pros and cons of financial choices and choose the best option for your long-term success.

5. Reduced stress:

Knowing where your money is going and having a plan in place reduces financial stress and uncertainty. Budgeting strategies provide peace of mind and enable you to enjoy a more balanced and secure life.

By implementing these 4.3 budgeting strategies, you’ll experience these advantages and more in your financial journey.

9. Disadvantages of 4.3 Budgeting Strategies ❌

While budgeting strategies offer numerous benefits, it’s essential to consider the potential disadvantages:

1. Restrictive:

Some individuals may find budgeting restrictive, as it requires discipline and may limit spontaneous spending. However, budgeting provides a framework for financial stability and goal achievement.

2. Time-consuming:

Creating and managing a budget can be time-consuming, especially when starting. However, once you establish a routine, it becomes more efficient, and the benefits outweigh the initial time investment.

3. Unexpected expenses:

A budget may not fully account for unexpected expenses or emergencies. It’s important to have an emergency fund to cover unforeseen costs and adjust your budget as needed.

4. Inflexibility:

A budget may require adjustments over time due to changing circumstances or financial goals. Being flexible and willing to adapt your budget ensures its continued effectiveness.

5. Potential for overspending:

Without discipline and regular monitoring, there’s a risk of overspending and not adhering to your budget. It’s crucial to stay accountable and review your budget regularly to avoid this pitfall.

While these disadvantages exist, they can be mitigated with proper planning, discipline, and a realistic approach to budgeting.

10. Frequently Asked Questions (FAQs) ❓

Q1: How often should I review my budget?

A1: It’s recommended to review your budget monthly to track your progress and make necessary adjustments. However, you can also review it more frequently if you have significant changes in your income, expenses, or financial goals.

Q2: Can budgeting help me get out of debt?

A2: Absolutely! Budgeting allows you to allocate funds towards debt repayment and identify areas where you can cut back on expenses. By creating a debt repayment plan within your budget, you can accelerate your journey to becoming debt-free.

Q3: Should I use budgeting apps or tools?

A3: Budgeting apps or tools can simplify the process of tracking your income and expenses. They offer features like automatic categorization, expense tracking, and goal setting. However, it’s ultimately a personal choice. Some individuals prefer using spreadsheets or pen and paper to create and manage their budgets.

Q4: Can budgeting help me save for retirement?

A4: Yes! Budgeting allows you to allocate a portion of your income towards retirement savings consistently. By making retirement savings a priority in your budget, you can secure a financially comfortable future.

Q5: Will budgeting guarantee financial

This post topic: Budgeting Strategies