Secure Your Future: Achieve Retirement Savings Of 1 Million With Ease!

Retirement Savings 1 Million: A Pathway to Financial Freedom

Introduction

Dear Readers,

1 Picture Gallery: Secure Your Future: Achieve Retirement Savings Of 1 Million With Ease!

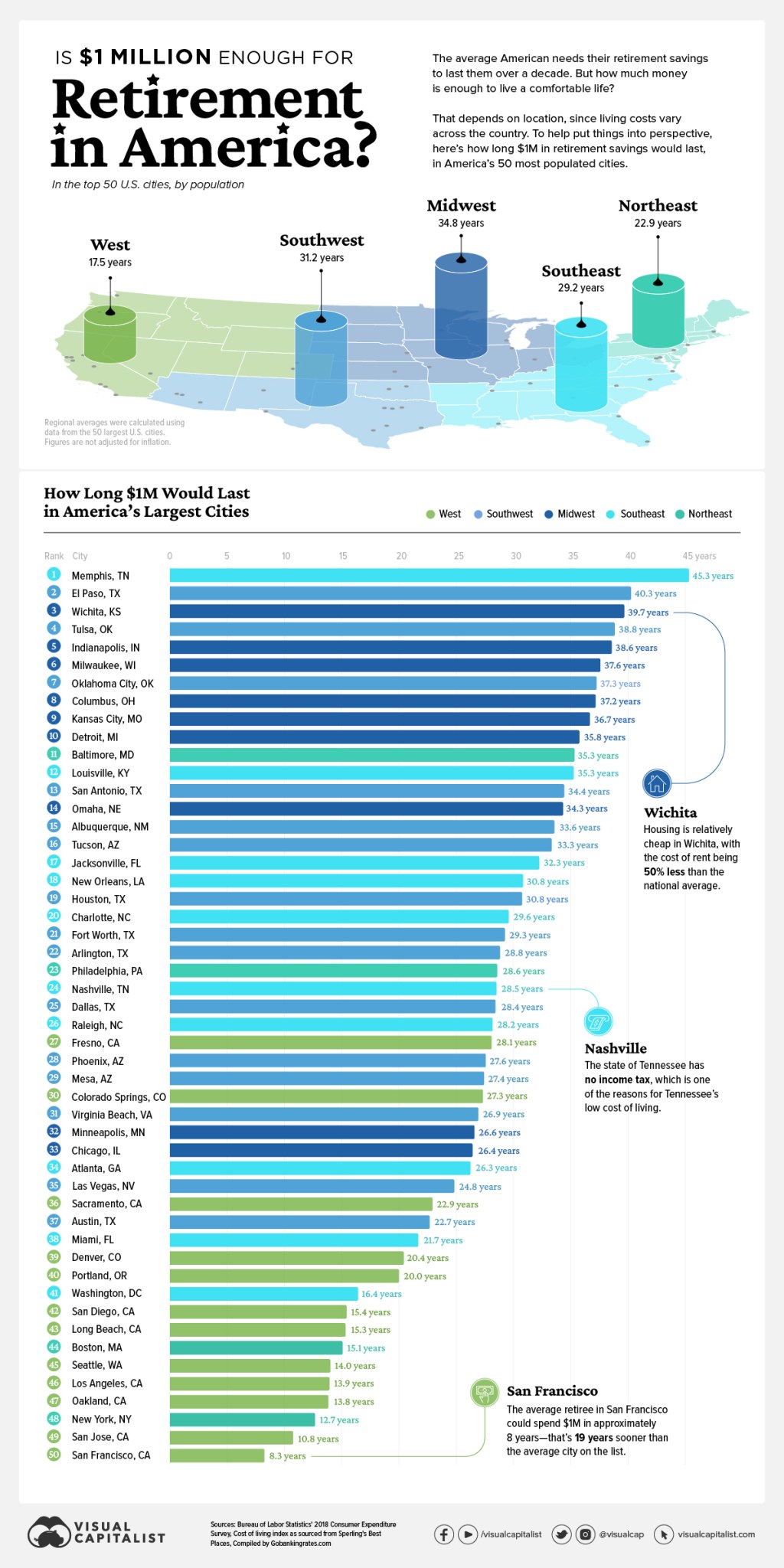

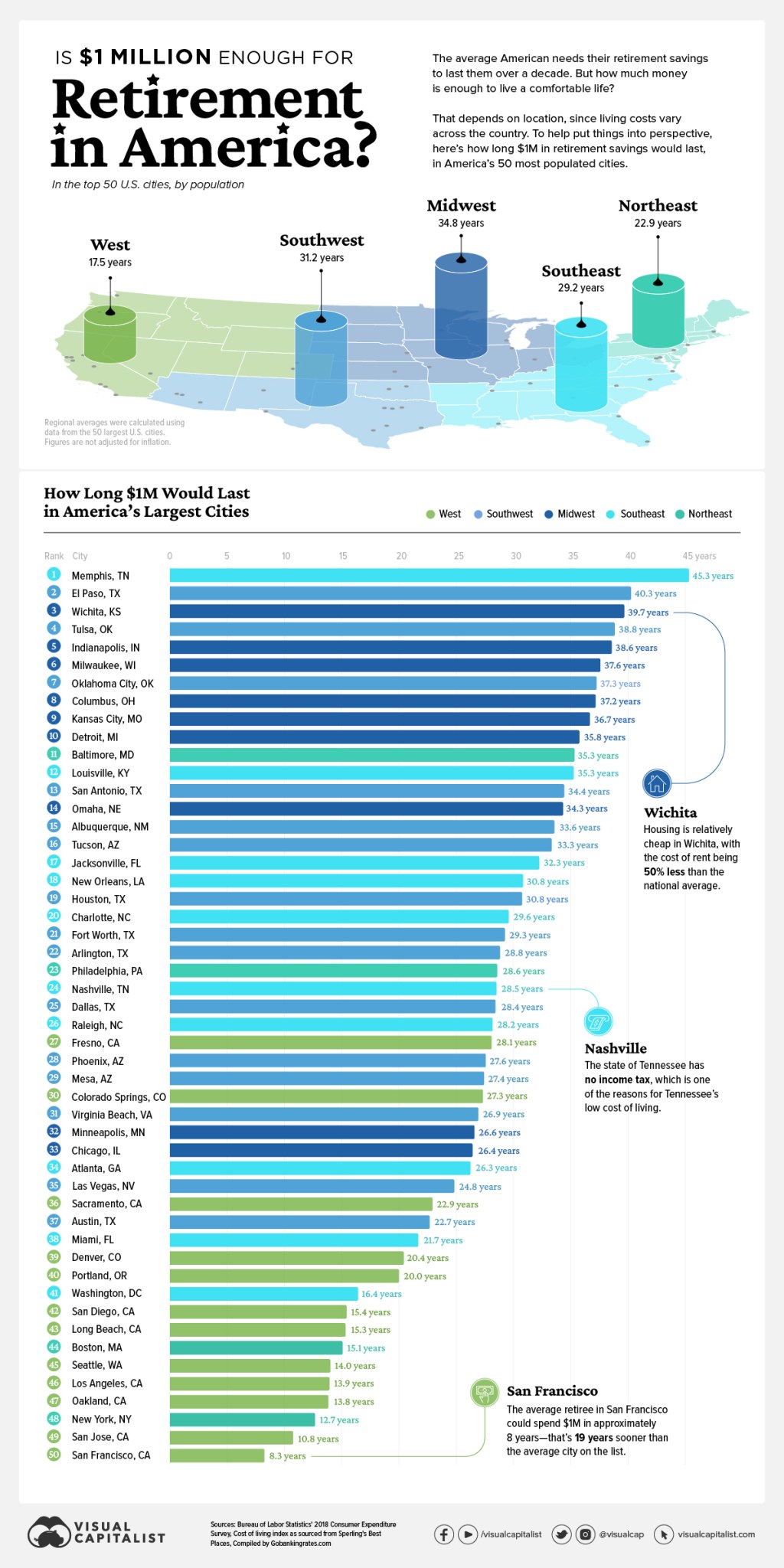

Welcome to another insightful article on retirement savings! In this piece, we will delve into the topic of retirement savings with a focus on achieving a target of 1 million dollars. As we all know, retirement planning is a critical aspect of financial stability and peace of mind. By saving diligently and investing wisely, it is possible to build a substantial nest egg that can sustain us throughout our golden years. Let’s explore the ins and outs of retirement savings and how you can reach the coveted 1 million mark.

Table: Retirement Savings 1 Million Overview

Information

Details

Image Source: visualcapitalist.com

Target Amount

1 million dollars

Timeframe

Years leading up to retirement

Investment Options

Stocks, bonds, mutual funds, real estate, etc.

Risk Tolerance

Varies based on individual preferences

Retirement Age

Usually 60-65 years, but can vary

What is Retirement Savings 1 Million?

🔍 Retirement savings 1 million refers to the goal of accumulating a one million dollar nest egg to support oneself financially during retirement. It involves a disciplined approach to saving and investing over a period of time, often spanning several decades.

Who Can Aim for Retirement Savings 1 Million?

🔍 Retirement savings 1 million is a target that anyone can strive for, regardless of their current financial situation. It is not limited to a specific demographic or income bracket. With careful planning and commitment, individuals of all backgrounds can work towards achieving this goal.

When Should You Start Saving for Retirement?

🔍 The ideal time to start saving for retirement is as early as possible. The power of compound interest allows your savings to grow exponentially over time. By starting early, you can take full advantage of this phenomenon and accumulate a larger retirement fund.

Where to Invest for Retirement Savings 1 Million?

🔍 There are various investment options available for retirement savings, including stocks, bonds, mutual funds, real estate, and more. The key is to diversify your portfolio to mitigate risk and maximize returns. Consulting with a financial advisor can help you make informed investment decisions.

Why Aim for Retirement Savings 1 Million?

🔍 The primary reason to aim for retirement savings of 1 million dollars is to ensure financial security and independence during your golden years. With rising healthcare costs and increasing life expectancy, having a substantial nest egg becomes crucial to maintain your desired lifestyle in retirement.

How to Achieve Retirement Savings 1 Million?

🔍 Building a retirement savings of 1 million dollars requires a combination of disciplined saving, investing in growth-oriented assets, and having a long-term perspective. Consistently contributing to retirement accounts, maximizing employer contributions, and making wise investment choices are some of the key steps to reach this goal.

Advantages and Disadvantages of Retirement Savings 1 Million

🔍 Retirement savings of 1 million dollars offer several advantages, such as financial security, the ability to pursue your dreams, and peace of mind. However, it also comes with certain disadvantages, such as the need for long-term commitment, potential market risks, and the requirement for strict budgeting. Let’s explore these pros and cons in detail:

Advantages of Retirement Savings 1 Million

1. Financial Security: Having a sizable retirement fund provides a safety net, ensuring you can meet your expenses and enjoy a comfortable lifestyle.

2. Pursue Your Dreams: With sufficient savings, you can pursue hobbies, travel, or start a new venture without worrying about financial constraints.

3. Peace of Mind: Knowing that you have adequate funds for retirement allows you to relax and enjoy your golden years without constant financial worries.

Disadvantages of Retirement Savings 1 Million

1. Long-Term Commitment: Building a 1 million dollar retirement fund requires years of consistent saving and investing, which may require sacrifices in the short term.

2. Market Risks: Investments are subject to market fluctuations, and there is always a possibility of losses that can impact the growth of your retirement savings.

3. Strict Budgeting: To reach the 1 million dollar mark, you may need to adhere to a strict budget, which can limit your spending and require financial discipline.

Frequently Asked Questions (FAQ)

1. How much do I need to save each month to reach 1 million dollars in retirement savings?

To determine the monthly savings required, various factors such as your investment returns, time horizon, and current savings must be considered. It is advisable to consult a financial planner who can provide personalized guidance.

2. Can I achieve retirement savings of 1 million dollars if I start saving later in life?

While starting early is advantageous, it is still possible to accumulate 1 million dollars in retirement savings even if you begin later in life. However, you may need to save a higher percentage of your income and make more aggressive investment choices to catch up.

3. Should I solely rely on my employer-sponsored retirement plan for reaching 1 million dollars?

While employer-sponsored retirement plans are an excellent starting point, it is advisable to diversify your investments. Supplementing your savings with an individual retirement account (IRA) or other investment vehicles can help you reach your 1 million dollar goal.

4. Are there any tax advantages to retirement savings?

Yes, certain retirement accounts offer tax advantages. For example, contributions to a traditional IRA may be tax-deductible, and growth within a Roth IRA is tax-free. Consult a tax professional to understand the specific tax implications related to your retirement savings strategy.

5. Is it possible to retire comfortably with less than 1 million dollars?

Yes, it is possible to retire comfortably with less than 1 million dollars, depending on your lifestyle choices and anticipated expenses. However, having a larger retirement fund provides an additional cushion and allows for greater flexibility in retirement.

Conclusion

In conclusion, aiming for retirement savings of 1 million dollars is a worthy goal that can lead to financial freedom and independence in retirement. By starting early, making prudent investment decisions, and remaining committed to saving, you can build a substantial nest egg. Remember, it’s never too late to start saving for retirement. Take control of your financial future today and secure a comfortable tomorrow.

Best wishes,

Your Name

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Every individual’s financial situation is unique, and it is advisable to consult with a qualified professional before making any investment or financial planning decisions. The author and the website are not responsible for any actions taken based on the information provided.

This post topic: Budgeting Strategies