The Ultimate Budget Option Strategy: Unleash Your Financial Potential Now!

Budget Option Strategy: Maximizing Value on a Limited Budget

Greetings, Readers! Today, we will delve into the world of budget option strategy. In this article, we will explore the ins and outs of this approach and how it can help you make the most out of your limited resources. So, sit back, relax, and let’s dive in!

Introduction

3 Picture Gallery: The Ultimate Budget Option Strategy: Unleash Your Financial Potential Now!

When it comes to managing a tight budget, finding cost-effective solutions becomes essential. This is where the budget option strategy comes into play. This strategy involves carefully selecting options that offer the best value for your money, allowing you to achieve your goals without breaking the bank.

By using the budget option strategy, you can optimize your spending, whether it’s for personal finance, business operations, or any other aspect of your life. In the following sections, we will explore the what, who, when, where, why, and how of this strategy, along with its advantages and disadvantages. So, let’s get started!

What is Budget Option Strategy? 🤔

Image Source: pankajchaudhary.in

The budget option strategy is a methodology that focuses on finding cost-effective alternatives to achieve desired outcomes. It involves carefully evaluating available options and selecting those that provide the best value for the resources invested. This strategy emphasizes maximizing value within a limited budget, enabling individuals and businesses to make the most out of their financial resources.

By employing the budget option strategy, you can identify opportunities to save money without compromising on quality or efficiency. It encourages resourcefulness and creative thinking to find innovative solutions that align with your budget constraints.

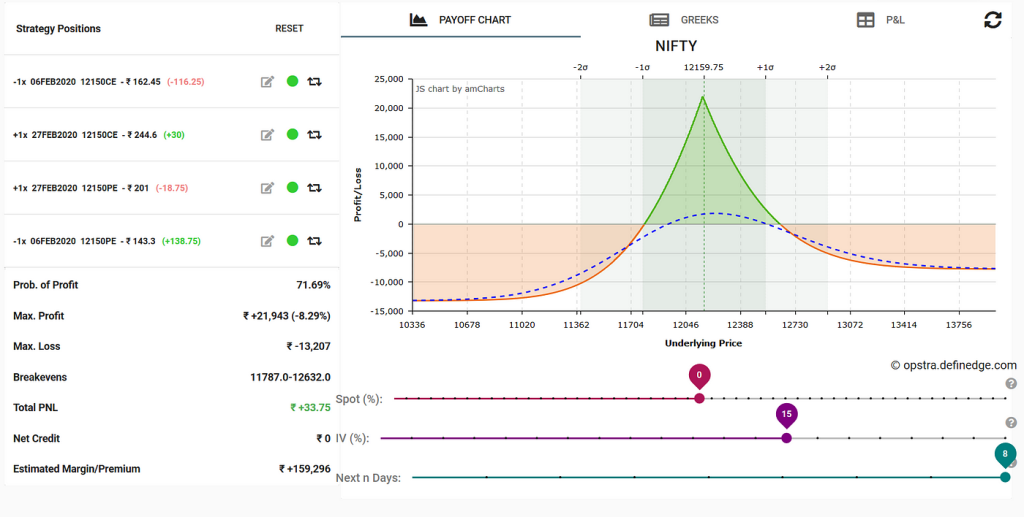

Who Can Benefit from Budget Option Strategy? 🤷♂️

Image Source: pankajchaudhary.in

The budget option strategy is beneficial for a wide range of individuals and organizations. Whether you are a student, a small business owner, or even a large corporation, this strategy can help you optimize your spending and achieve your goals without overspending.

Students, for example, can use this strategy to manage their expenses while still obtaining the necessary resources for their education. Small businesses can leverage the budget option strategy to cut costs without compromising on product quality or customer satisfaction. Even large corporations can benefit by implementing this strategy in specific departments or projects to reduce unnecessary expenses.

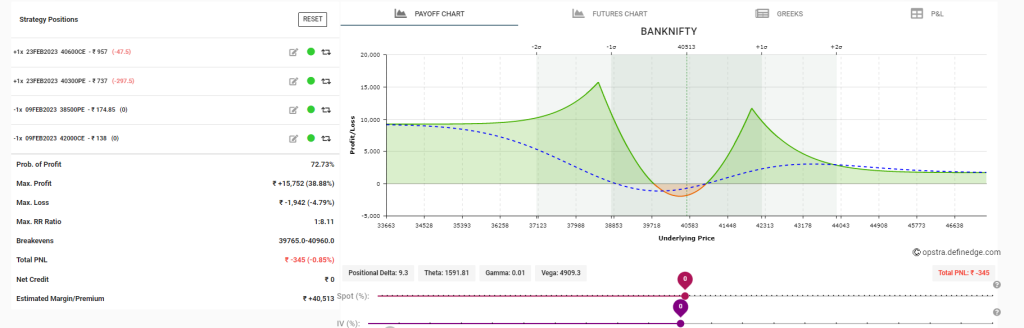

When and Where to Apply the Budget Option Strategy? 📅📍

The budget option strategy can be applied in various scenarios and locations. Whether you are planning a vacation, conducting market research, or purchasing equipment for your business, this strategy can help you make informed decisions while staying within your budget.

Image Source: medium.com

When planning a vacation, for example, you can use the budget option strategy to find affordable accommodations, transportation, and activities without sacrificing enjoyment. In business, you can apply this strategy when sourcing suppliers, negotiating contracts, or optimizing operational processes to minimize costs.

Why Choose the Budget Option Strategy? 🤔✅

There are several compelling reasons why you should consider implementing the budget option strategy:

Cost-Effectiveness: By carefully selecting cost-effective options, you can maximize the value of your resources.

Resource Optimization: This strategy allows you to make the most out of limited financial resources.

Flexibility: The budget option strategy provides flexibility in decision-making, enabling you to adapt to changing circumstances.

Long-Term Savings: By adopting this strategy, you can develop a mindset of financial prudence, leading to long-term savings.

Opportunity Identification: Through the budget option strategy, you can uncover hidden opportunities for cost savings and develop innovative solutions.

By considering these reasons, you can see why the budget option strategy is a valuable approach in various aspects of life.

Advantages and Disadvantages of Budget Option Strategy 📈📉

Like any strategy, the budget option strategy has its pros and cons. Let’s take a closer look:

Advantages of Budget Option Strategy ✅

Cost Savings: The primary advantage of this strategy is the potential for significant cost savings.

Increased Value: By focusing on value for money, you can obtain better outcomes and experiences.

Resource Allocation: The budget option strategy helps allocate limited resources optimally.

Flexibility: This strategy allows for flexibility in decision-making, adapting to changing situations.

Opportunity Discovery: Through this strategy, you can uncover hidden opportunities for cost savings and innovation.

Disadvantages of Budget Option Strategy ❌

Limitations: The budget option strategy may have limitations in terms of available options or quality.

Time-Consuming: Finding the best budget options requires research and evaluation, which can be time-consuming.

Trade-Offs: In some cases, opting for budget options may involve trade-offs between cost and quality.

Risk of Overspending: Without careful planning, there is a risk of overspending or compromising on important aspects.

Market Volatility: Economic factors and market fluctuations can impact the availability and pricing of budget options.

Frequently Asked Questions (FAQ) ❓

Q1: Can I still get quality products or services with a budget option strategy?

A1: Absolutely! The budget option strategy focuses on finding options that offer the best value for your money. With careful research and evaluation, you can discover quality products or services within your budget constraints.

Q2: How can I ensure that I am not compromising on quality when using the budget option strategy?

A2: It’s important to conduct thorough research, read reviews, and compare options when implementing the budget option strategy. By doing so, you can make informed decisions and choose options that meet your quality standards.

Q3: Is the budget option strategy applicable only for personal finance?

A3: No, the budget option strategy can be applied to various aspects of life, including personal finance, business operations, travel planning, and more. It is a versatile approach that helps optimize spending in different contexts.

Q4: Are there any risks associated with the budget option strategy?

A4: As with any strategy, there are risks involved. These include limitations in available options, potential trade-offs between cost and quality, and the need for careful planning to avoid overspending. However, with proper research and evaluation, these risks can be mitigated.

Q5: How can I get started with the budget option strategy?

A5: To get started, assess your budget, identify your goals, and research available options. Compare prices, read reviews, and evaluate the value each option offers. By doing so, you can make informed decisions and maximize the value of your resources.

Conclusion: Take Action and Optimize Your Budget! 🚀

Now that you have gained insights into the budget option strategy, it’s time to put it into action. Start by analyzing your current spending habits, identifying areas where you can implement this strategy, and researching cost-effective options. By making mindful choices and finding creative solutions, you can optimize your budget and achieve your desired outcomes without compromising on quality or satisfaction.

Final Remarks: Embrace Financial Prudence for a Brighter Future

Friends, remember that financial prudence is a lifelong skill that can benefit you in various aspects of life. By adopting the budget option strategy, you are taking a step towards financial independence and maximizing the value of your hard-earned money. Explore, experiment, and always prioritize your financial well-being. Here’s to a brighter, more prosperous future!

This post topic: Budgeting Strategies