Mastering Capital Budget Strategies In Austin: Unleash The Power Of Your Investments Today!

Capital Budget Strategies in Austin: Planning for Success

Introduction

Dear Readers,

1 Picture Gallery: Mastering Capital Budget Strategies In Austin: Unleash The Power Of Your Investments Today!

Welcome to this informative article on capital budget strategies in Austin. In today’s rapidly evolving business landscape, organizations need effective strategies to allocate their financial resources wisely. This article aims to provide you with valuable insights into capital budgeting and help you make informed decisions for your business.

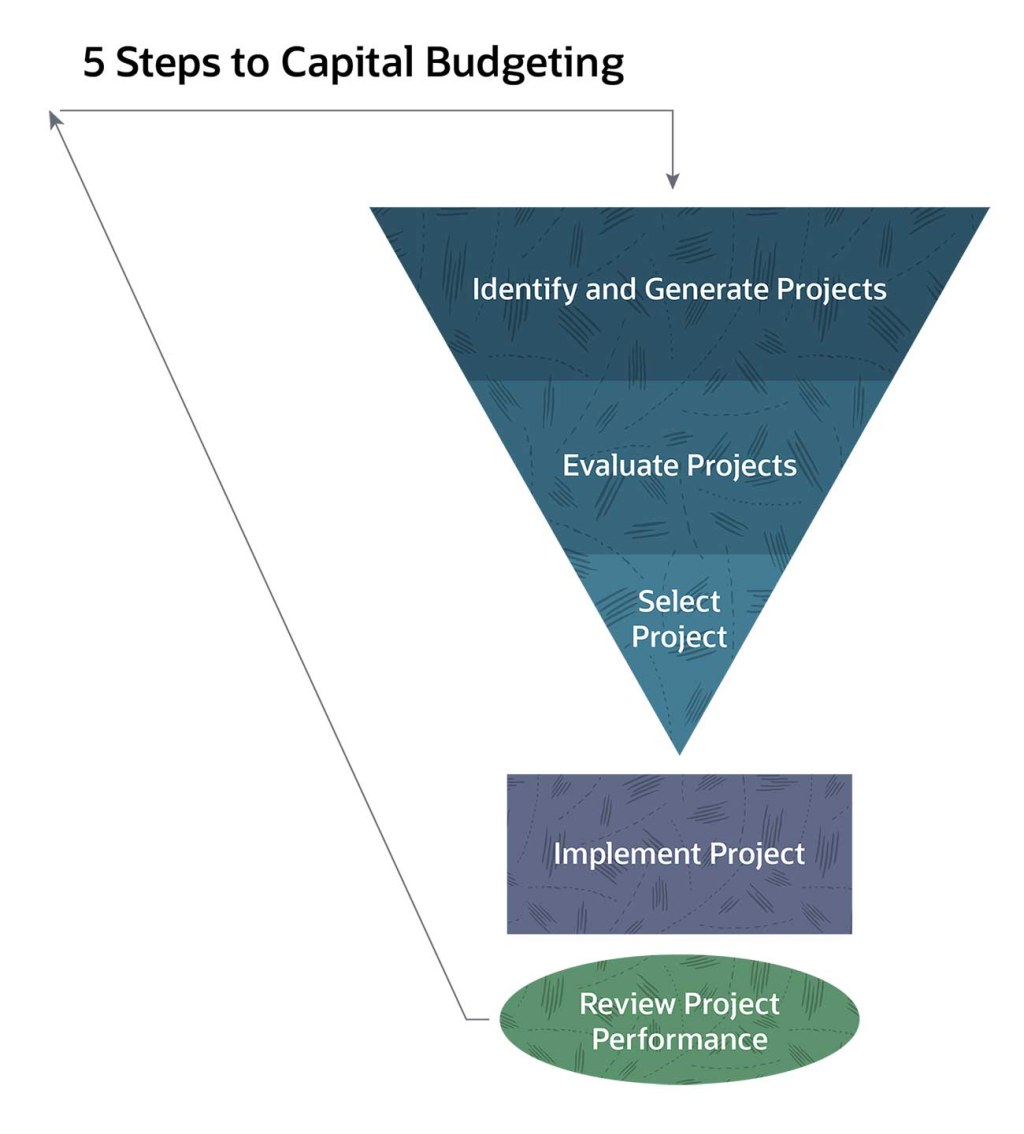

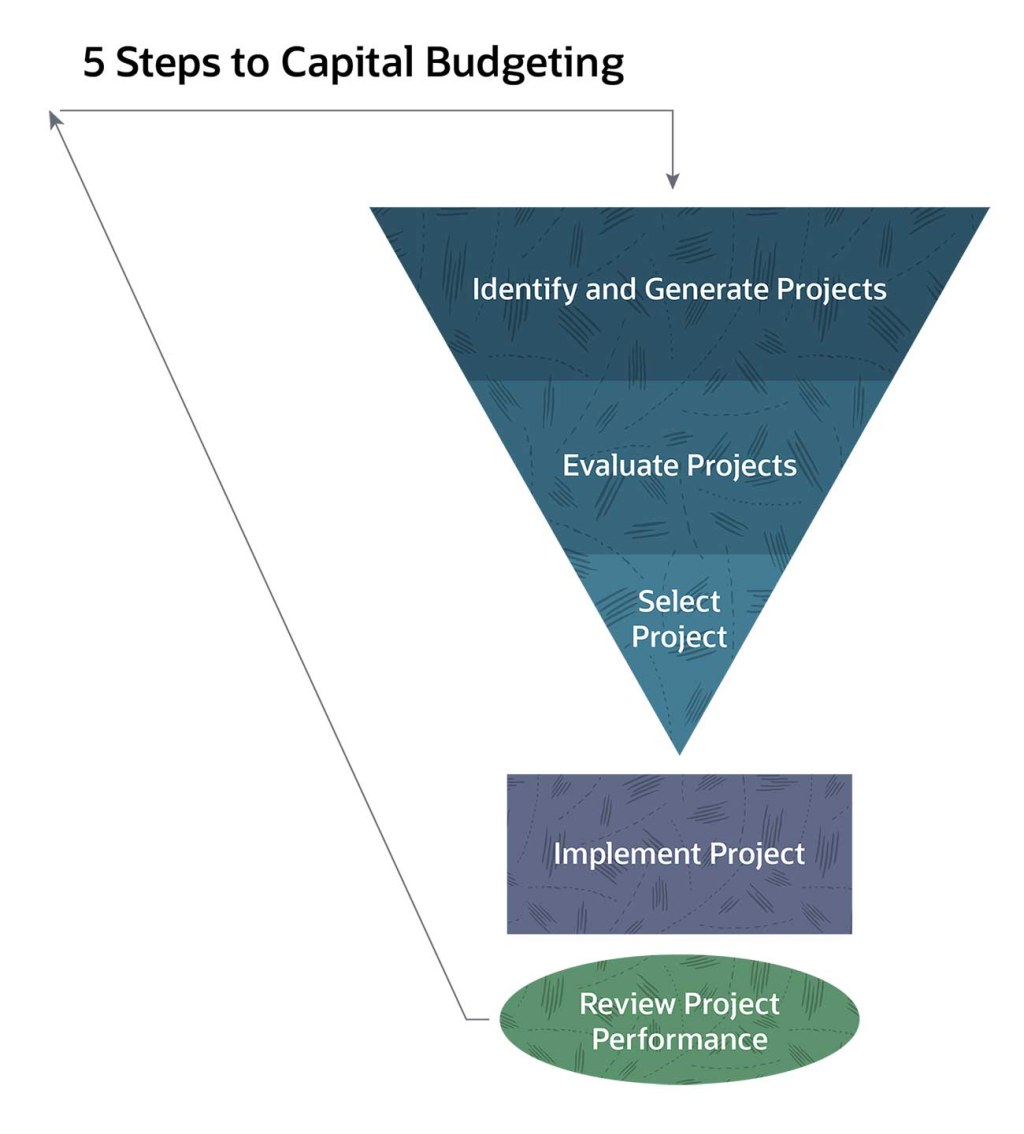

What is Capital Budgeting?

Image Source: netsuite.com

Capital budgeting refers to the process of planning and managing a company’s long-term investments in assets and projects. It involves evaluating potential investments, estimating their financial returns, and determining which projects are most likely to generate positive cash flows.

Who Benefits from Capital Budget Strategies?

Capital budget strategies benefit various entities, such as corporations, government agencies, and non-profit organizations. By allocating funds wisely and investing in projects with high potential returns, these entities can optimize their financial resources and achieve their long-term goals.

When to Implement Capital Budget Strategies?

Implementing capital budget strategies is crucial during the planning phase of a project or investment. It is essential to consider factors such as market conditions, available resources, and anticipated cash flows to determine the right time for capital expenditure.

Where to Apply Capital Budget Strategies?

Capital budget strategies can be applied across multiple industries and sectors. In Austin, these strategies are particularly relevant for businesses in sectors such as technology, real estate, infrastructure development, and manufacturing. By utilizing effective capital budget strategies, businesses in Austin can thrive and contribute to the city’s economic growth.

Why are Capital Budget Strategies Important?

Capital budget strategies play a crucial role in a company’s financial planning and decision-making processes. They help organizations identify viable investment opportunities, minimize financial risks, and ensure optimal utilization of available resources. Effective capital budget strategies can lead to increased profitability, improved competitiveness, and sustainable growth.

How to Implement Capital Budget Strategies?

Implementing capital budget strategies requires a systematic approach. It involves conducting thorough financial analysis, estimating project costs and returns, considering alternative investment options, and evaluating risk factors. Additionally, collaboration between finance, operations, and management teams is essential to make informed decisions and achieve desired outcomes.

Advantages and Disadvantages of Capital Budget Strategies

Advantages

1. 🚀 Enhanced Financial Planning: Capital budget strategies enable businesses to align their long-term financial goals with their investment decisions, resulting in improved financial planning and stability.

2. 💰 Increased Profitability: By investing in projects with high potential returns, organizations can generate increased revenue and profitability over time.

3. 🌱 Promotes Growth and Expansion: Capital budget strategies support business expansion by helping companies identify opportunities for growth, such as expanding into new markets or launching new product lines.

4. ⚖️ Risk Assessment and Mitigation: Through thorough financial analysis and risk assessment, capital budget strategies allow organizations to identify and mitigate potential risks associated with investments.

5. 🌐 Competitive Advantage: Implementing effective capital budget strategies can give businesses a competitive edge by enabling them to make strategic investments that differentiate them from competitors.

6. 💡 Innovation and Technology Adoption: Capital budget strategies can facilitate investments in innovative technologies, enabling businesses to stay ahead in rapidly evolving industries.

Disadvantages

1. 📉 Financial Risk: Capital budget strategies involve investments that may not always generate the expected returns, leading to potential financial losses.

2. ⏳ Time Constraints: The capital budgeting process can be time-consuming, requiring extensive financial analysis and evaluation, which may delay the implementation of projects.

3. 💼 Resource Allocation Challenges: Allocating limited financial resources to various projects can be challenging, especially when multiple projects compete for funding.

4. 🔄 Changing Market Conditions: Unforeseen changes in market conditions can impact the success of capital budget strategies, making it necessary to adapt and adjust investment plans accordingly.

5. 📊 Uncertainty in Forecasting: The accuracy of financial forecasts used in capital budgeting is subject to uncertainty, which can affect investment decisions and outcomes.

Frequently Asked Questions (FAQs)

1. How often should capital budget strategies be reviewed and updated?

Capital budget strategies should be reviewed and updated regularly, typically on an annual basis or when significant changes occur in the business environment.

2. Are there any specific tools or software available to assist in capital budgeting?

Yes, there are various capital budgeting tools and software available that can assist businesses in analyzing investment opportunities, calculating financial metrics, and making informed decisions.

3. How can small businesses benefit from capital budget strategies?

Small businesses can benefit from capital budget strategies by prioritizing investments, allocating resources effectively, and maximizing returns on their limited capital.

4. What are some common challenges businesses face when implementing capital budget strategies?

Common challenges include accurately estimating project costs and returns, assessing risks, managing competing project priorities, and adapting to changing market conditions.

5. How can companies evaluate the success of their capital budget strategies?

Companies can evaluate the success of their capital budget strategies by comparing actual project outcomes with initial projections, monitoring financial performance, and conducting post-project reviews to identify areas for improvement.

Conclusion

Dear Readers, it is evident that capital budget strategies play a pivotal role in managing financial resources effectively and achieving long-term goals. By implementing these strategies, businesses in Austin can optimize their investments, minimize risks, and drive sustainable growth. Remember to evaluate the advantages and disadvantages, ask the right questions, and regularly review and update your capital budget strategies to ensure ongoing success.

Final Remarks

Thank you for taking the time to read this article on capital budget strategies in Austin. The information provided here serves as a general guide, and it is recommended to seek professional advice tailored to your specific business needs. Implementing effective capital budget strategies requires careful planning, analysis, and decision-making. We wish you the best in your financial endeavors and the success of your future investments.

This post topic: Budgeting Strategies