Unlock Financial Freedom: Retirement Savings – How Much Is Enough? Discover Your Ideal Amount Now!

Retirement Savings: How Much is Enough?

Dear Readers,

Welcome to our comprehensive guide on retirement savings! In this article, we will dive into the essential aspects of determining how much is enough to save for a comfortable retirement. As retirement planning is a crucial financial decision that can significantly impact your future, it is vital to have a clear understanding of the factors involved.

3 Picture Gallery: Unlock Financial Freedom: Retirement Savings – How Much Is Enough? Discover Your Ideal Amount Now!

Introduction

Retirement savings play a paramount role in ensuring a financially stable and stress-free retirement. It involves setting aside a portion of your income throughout your working years to support your lifestyle after retirement. However, determining the ideal amount to save can be a perplexing task, considering various factors such as inflation, life expectancy, healthcare costs, and desired retirement lifestyle.

Understanding the key components and calculations involved in retirement savings is essential for every individual to make informed financial decisions. In this article, we will explore the what, who, when, where, why, and how of retirement savings to help you make educated choices about your retirement goals.

What is Retirement Savings?

Retirement savings refer to the funds accumulated over a person’s working years to support their financial needs during retirement. It serves as a safety net and ensures a comfortable lifestyle after leaving the workforce. These savings can come from various sources, such as employer-sponsored retirement plans, individual retirement accounts (IRAs), and personal investments.

The Importance of Retirement Savings

Image Source: insider.com

Retirement savings are crucial for maintaining financial independence and security in your golden years. By saving diligently, you can avoid relying solely on social security benefits or burdening your loved ones during retirement. Moreover, having ample savings allows you to pursue your desired lifestyle, travel, engage in hobbies, and enjoy a stress-free retirement.

The Risks of Insufficient Retirement Savings

Insufficient retirement savings can lead to financial hardships and compromise your quality of life after retirement. Without adequate funds, you may be forced to rely on government assistance or face significant limitations in meeting your basic needs and fulfilling personal aspirations. It is essential to save diligently to avoid potential financial struggles.

Who Needs to Save for Retirement?

Retirement savings are not limited to a specific group of individuals. Everyone, regardless of their income level or age, should prioritize saving for retirement. Whether you are a fresh graduate, mid-career professional, or nearing retirement, it is crucial to start saving early and consistently.

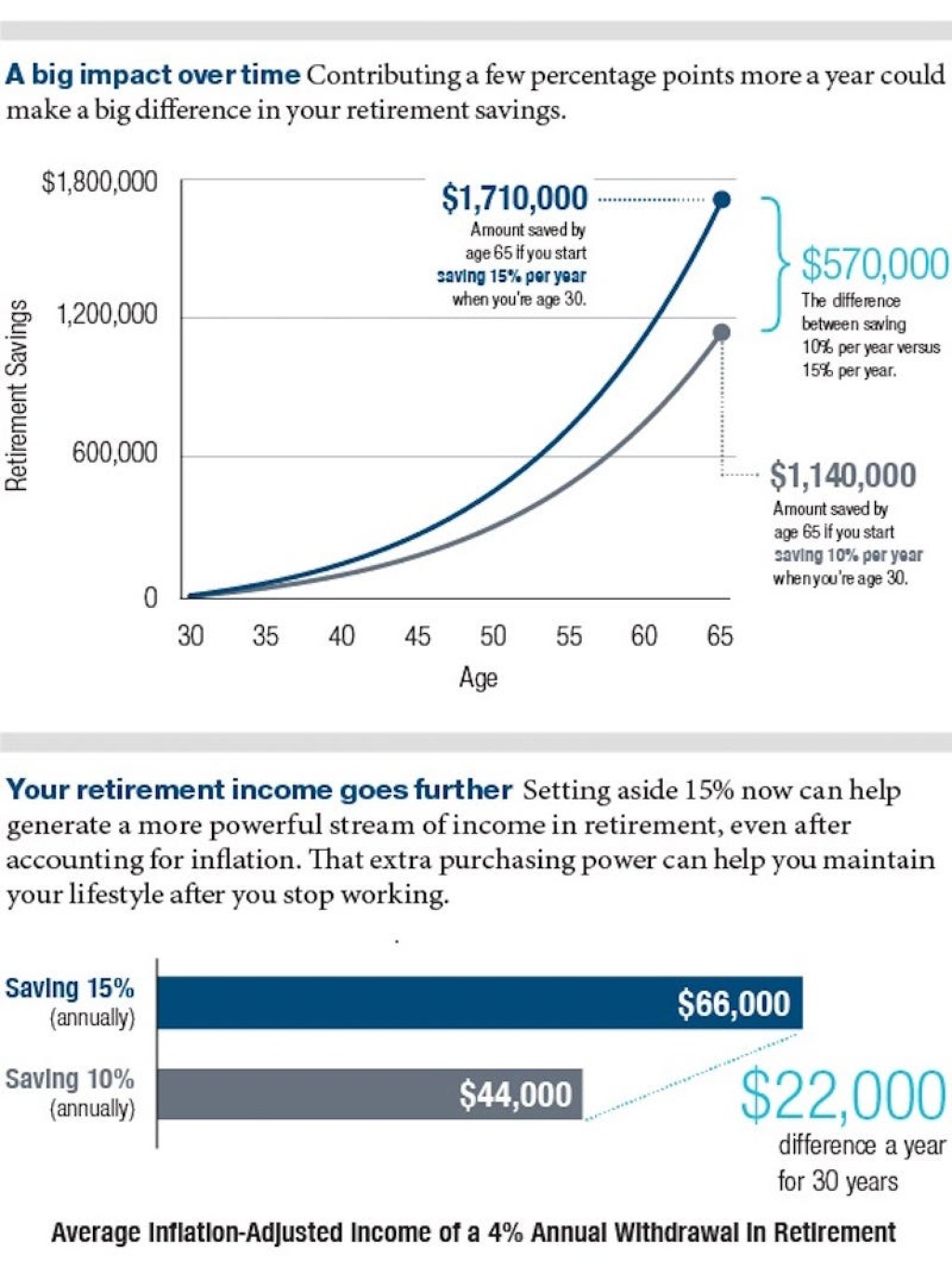

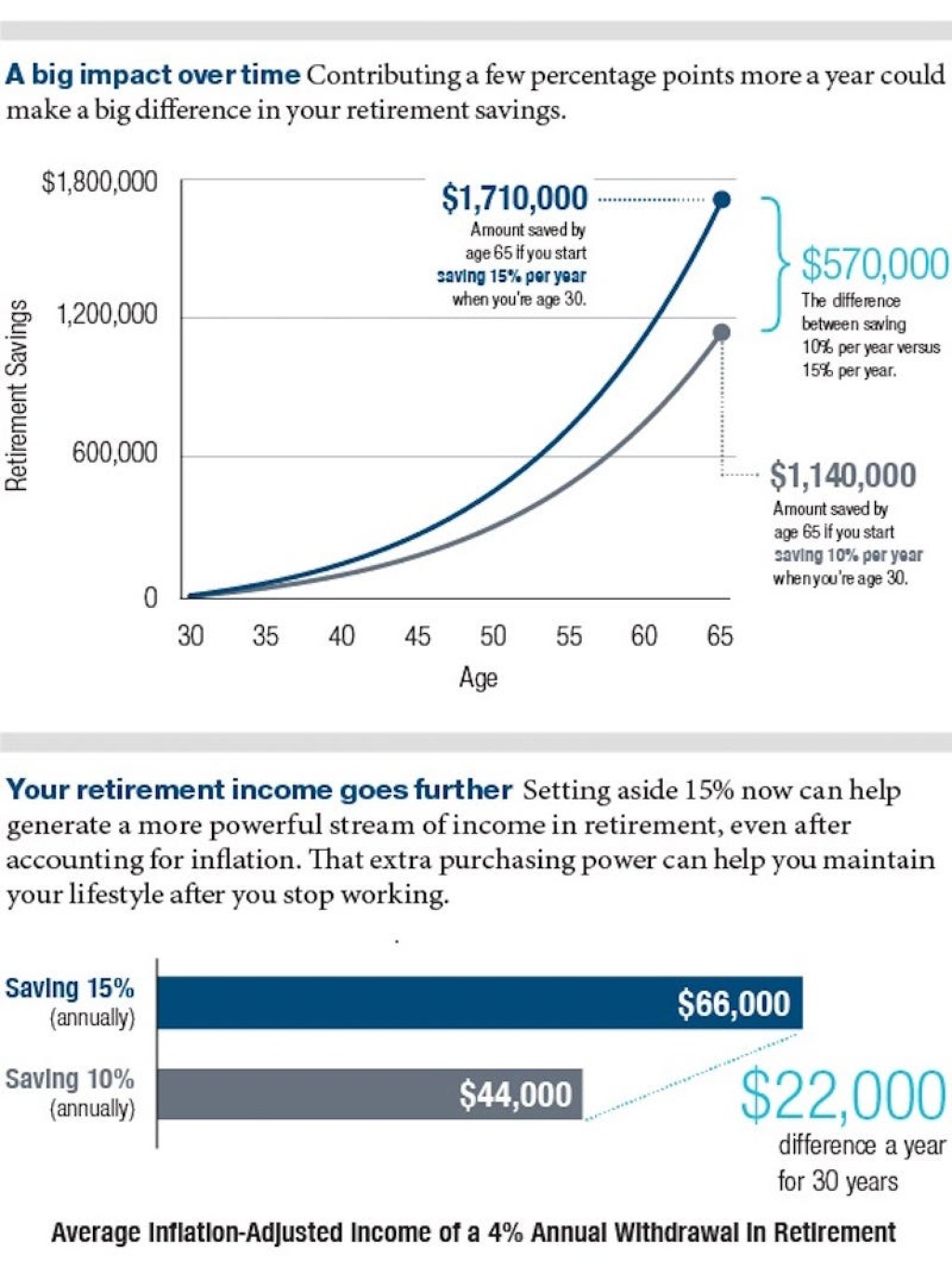

The Benefits of Early Retirement Savings

Starting your retirement savings early offers several advantages. Firstly, it allows you to take advantage of compound interest, which can significantly grow your savings over time. Secondly, early savings provide a longer time horizon for investment growth, reducing the need for larger monthly contributions. Lastly, it allows you to develop disciplined saving habits, ensuring a financially secure future.

The Challenges of Late Retirement Savings

While it is never too late to start saving for retirement, late starters face certain challenges. Late savers may need to contribute larger sums of money each month to catch up on their savings goals. Additionally, they may have a shorter timeframe for investments to grow and may need to adjust their retirement expectations to align with their financial capabilities.

When Should You Start Saving for Retirement?

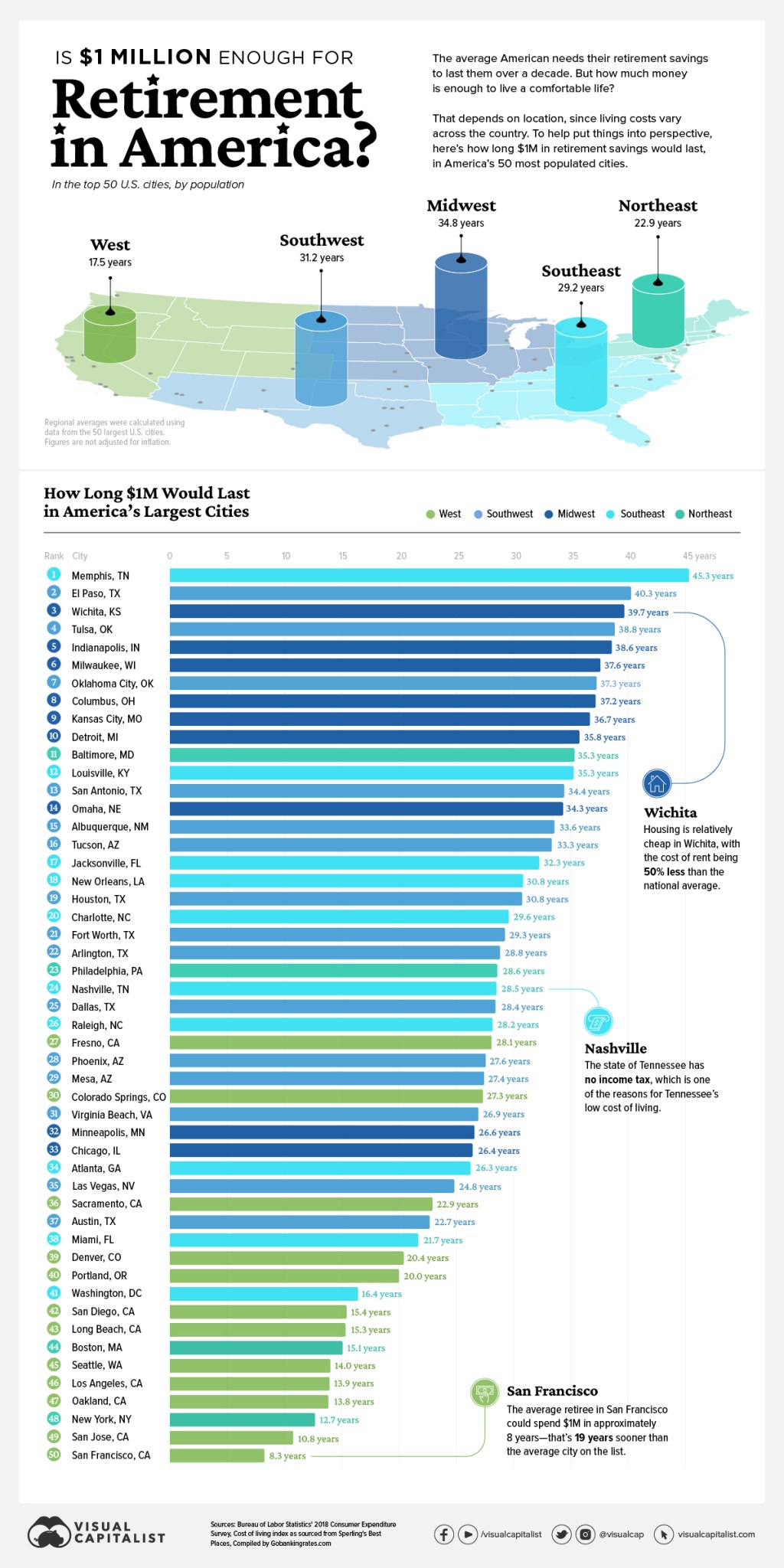

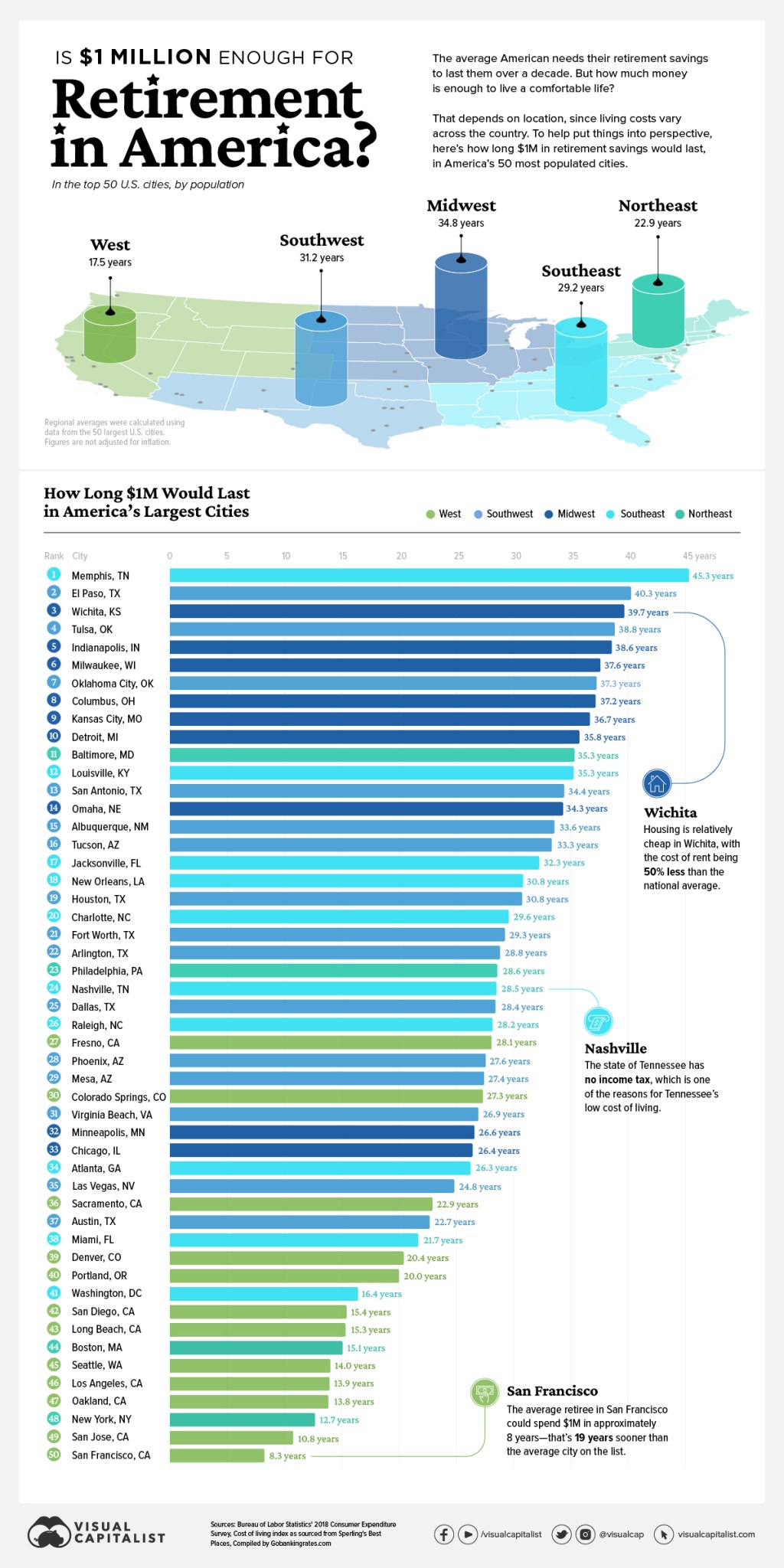

Image Source: visualcapitalist.com

The ideal time to start saving for retirement is as early as possible. The power of compounding allows your investments to grow exponentially over time, increasing the value of your savings. The earlier you begin, the more time your investments have to grow, reducing the pressure of high savings rates in the future.

The Advantages of Starting Young

Starting your retirement savings in your twenties or thirties offers significant advantages. It allows you to set aside smaller portions of your income each month while still achieving your savings goals. Moreover, starting young provides a cushion for potential financial setbacks, ensuring you stay on track to meet your retirement objectives.

The Importance of Mid-Career Savings

If you haven’t started saving for retirement in your early years, the mid-career stage is the next best time to begin. By this stage, you may have a higher income, making it easier to allocate a larger portion towards your retirement savings. Although you may need to save at a higher rate, it is still feasible to achieve your desired retirement goals.

The Urgency of Late-Career Savings

For individuals in their fifties or approaching retirement age, the urgency to save significantly increases. Late-career savers need to maximize their contributions and consider catch-up provisions offered by retirement plans to boost their savings. While it may require more significant financial adjustments, diligent savings can still lead to a comfortable retirement.

Where Should You Save for Retirement?

Retirement savings can be allocated to various investment vehicles, each with its own advantages and considerations. It is essential to choose the right mix based on your risk tolerance, financial goals, and time horizon.

Employer-Sponsored Retirement Plans

Image Source: ctfassets.net

Many employers offer retirement plans, such as 401(k)s or pension plans, which are excellent options for retirement savings. These plans often include employer matching contributions, tax advantages, and investment options. It is advisable to take full advantage of these plans to maximize your retirement savings potential.

Individual Retirement Accounts (IRAs)

IRAs are self-directed retirement accounts that allow individuals to contribute towards their retirement savings. Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals during retirement. Understanding the eligibility criteria, contribution limits, and tax implications is crucial when considering an IRA.

Personal Investments

Aside from retirement accounts, personal investments such as stocks, bonds, and real estate can also contribute to your retirement savings. Diversifying your investments can help mitigate risks and provide potential growth opportunities. However, it is essential to assess your risk tolerance and seek professional advice when venturing into personal investments.

Why is Retirement Savings Important?

Retirement savings are vital for multiple reasons. Primarily, it ensures financial independence and stability during your golden years, allowing you to maintain your desired lifestyle. Additionally, retirement savings provide a safety net for unexpected expenses, medical emergencies, and other financial challenges that may arise in retirement.

Protecting Against Inflation

Retirement savings protect against inflation, which erodes the purchasing power of money over time. By saving and investing, you can grow your savings to outpace inflation, ensuring that your retirement funds retain their value and sustain your desired lifestyle.

Reducing Financial Stress

Having sufficient retirement savings reduces financial stress and anxiety associated with retirement. It provides peace of mind, knowing that you have the means to cover your expenses and pursue your passions during your post-working years. By eliminating financial worries, you can fully enjoy the freedom and relaxation that retirement offers.

How Much Retirement Savings is Enough?

The amount needed for retirement savings varies for each individual based on their desired lifestyle, anticipated expenses, and retirement goals. Several factors need to be considered when determining the ideal amount, including:

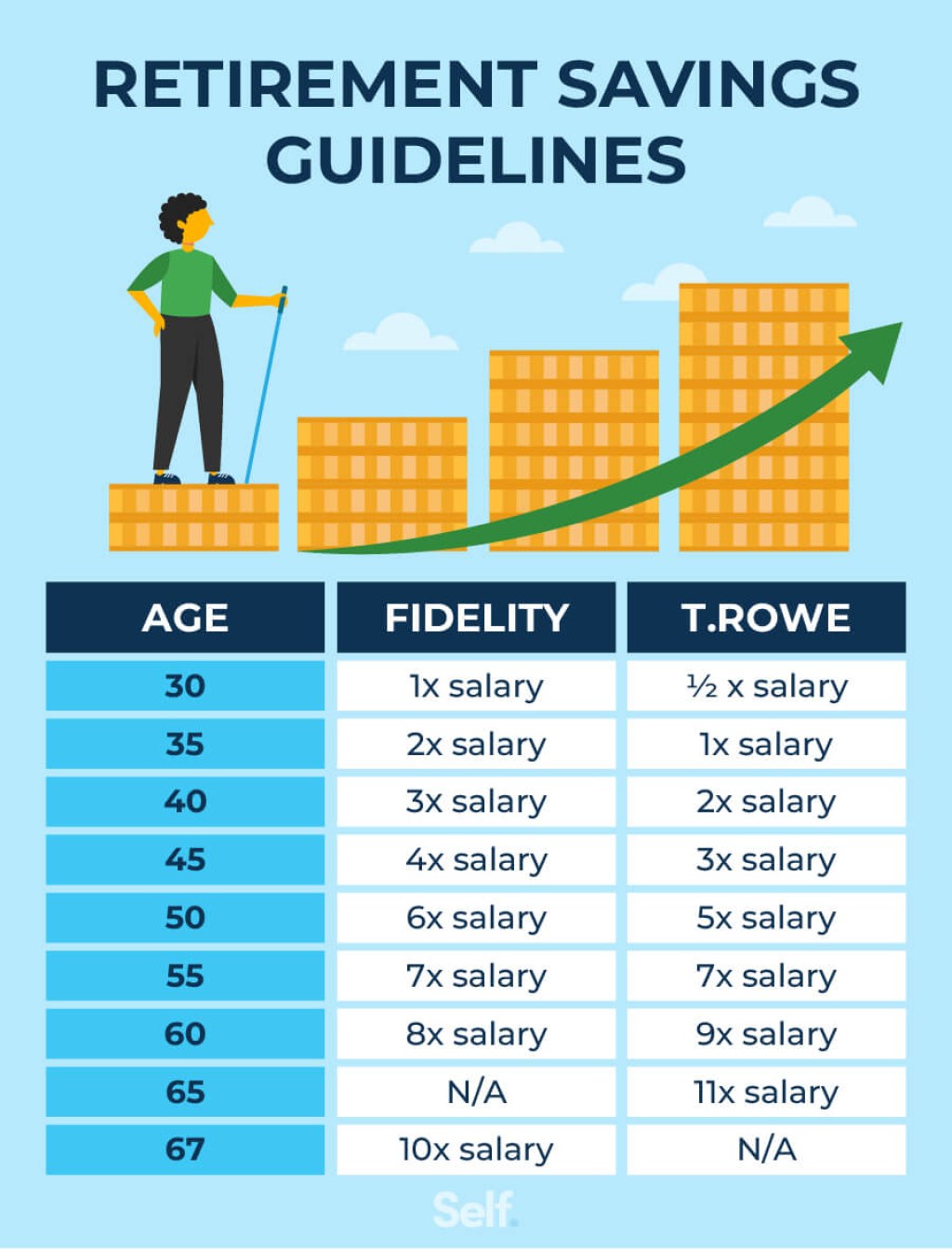

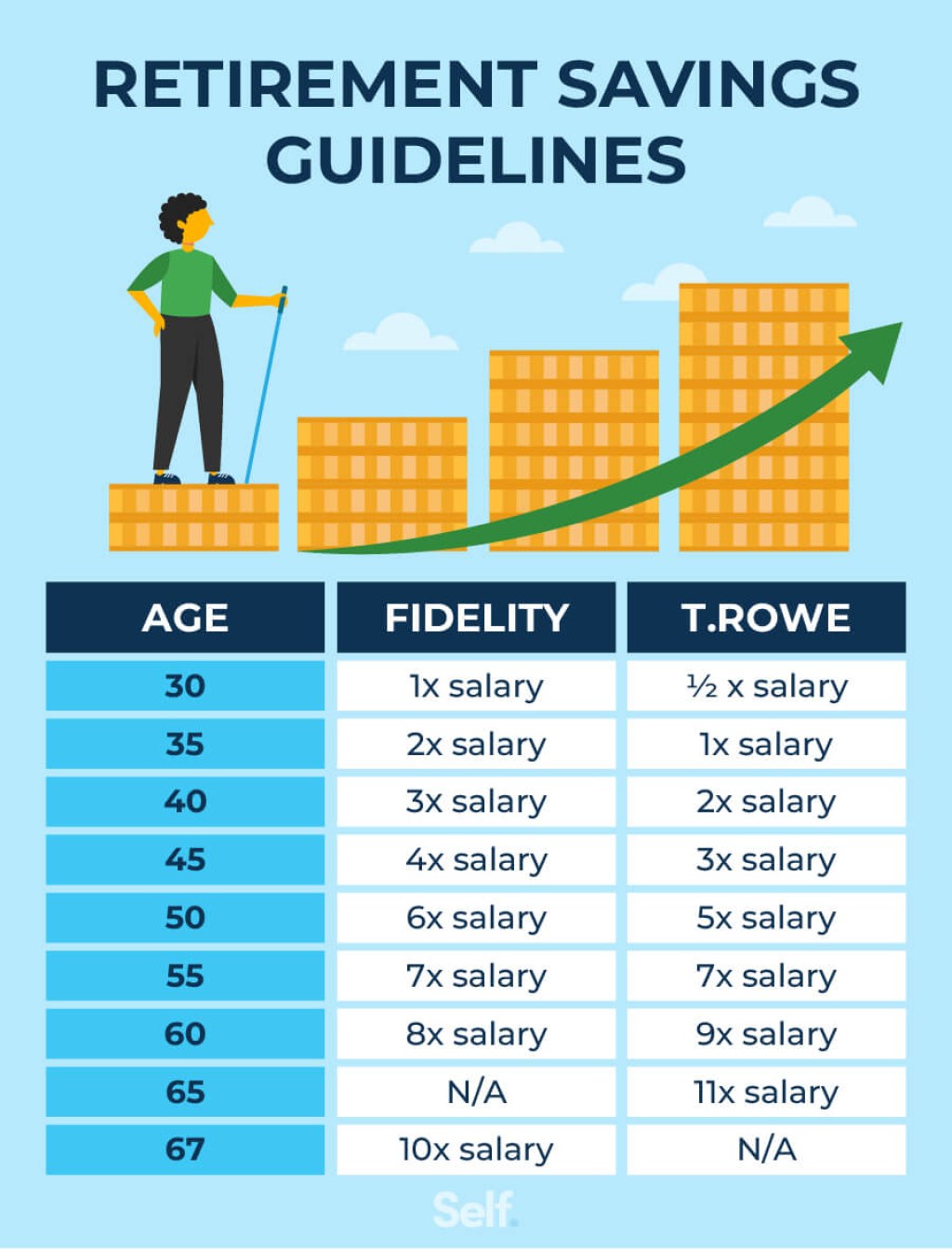

Current Age and Retirement Age

Understanding your current age and the age at which you plan to retire is essential for determining the amount needed. The longer your retirement timeframe, the more savings you will require.

Desired Retirement Lifestyle

Your desired retirement lifestyle plays a significant role in estimating your savings needs. Consider factors such as travel, hobbies, healthcare, housing, and other expenses to gauge the financial requirements of your retirement goals.

Expected Inflation Rate

Inflation erodes the purchasing power of money over time. Factoring in an estimated inflation rate allows you to calculate the funds required to maintain your desired lifestyle throughout your retirement years.

Healthcare Costs

Healthcare expenses tend to increase as individuals age, and it is crucial to incorporate these costs into your retirement savings calculations. Consider potential medical bills, insurance premiums, and long-term care expenses when determining the ideal savings amount.

Social Security and Pension Benefits

Social security benefits and pension income can contribute to your retirement funds. Understanding the expected amount of these benefits allows you to adjust your savings goals accordingly.

Consulting a Financial Advisor

Determining the exact amount needed for retirement savings can be complex. Seeking professional guidance from a financial advisor can help you assess your specific financial situation, set realistic goals, and develop a personalized retirement savings plan.

Advantages and Disadvantages of Retirement Savings

Advantages of Retirement Savings

1. Financial Independence: Retirement savings provide the financial freedom to enjoy your retirement years without relying on others.

2. Peace of Mind: Sufficient savings reduce financial stress and provide peace of mind for a comfortable retirement.

3. Pursue Personal Aspirations: With ample savings, you can pursue hobbies, travel, and engage in activities that bring joy and fulfillment.

4. Flexibility and Control: Retirement savings provide flexibility and control over your financial decisions during retirement.

5. Legacy for Loved Ones: By saving diligently, you can leave a financial legacy for your loved ones, providing them with security and support.

Disadvantages of Retirement Savings

1. Financial Constraints: Saving for retirement may require sacrifices and lifestyle adjustments during your working years.

2. Market Volatility: Investments made for retirement savings are subject to market fluctuations, which can impact the growth of your savings.

3. Inflation Risk: Inflation can erode the purchasing power of your savings, necessitating careful planning to ensure your funds retain their value.

4. Unexpected Expenses: Unforeseen circumstances or emergencies may require dipping into your retirement savings, affecting your long-term financial security.

5. Dependency on Investments: Retirement savings heavily rely on investment performance, which may vary and impact the overall value of your savings.

Frequently Asked Questions (FAQs)

1. How much should I save for retirement?

Answer: The amount you should save for retirement depends on various factors, such as your desired lifestyle, anticipated expenses, and retirement goals. It is advisable to consult a financial advisor to assess your specific circumstances and develop a savings plan.

2. Can I start saving for retirement in my thirties?

Answer: Yes, starting to save for retirement in your thirties is still feasible. While you may need to contribute at a higher rate, taking advantage of employer-sponsored retirement plans and other investment options can help you catch up on your savings goals.

3. Is social security enough for retirement?

Answer: Social security benefits alone may not be sufficient to cover all your retirement expenses. It is advisable to supplement your retirement income with personal savings and other investment vehicles to ensure a comfortable retirement.

4. Can I withdraw money from my retirement savings before retirement?

Answer: Withdrawing money from your retirement savings before retirement is possible but may come with penalties and tax implications. It is advisable to consult a financial advisor before making any early withdrawals.

5. How often should I review my retirement savings plan?

Answer: It is recommended to review your retirement savings plan annually or whenever significant life events occur, such as marriage, the birth of a child, or a career change. Regular reviews ensure that your savings align with your evolving financial goals.

Conclusion

In conclusion, retirement savings are a crucial aspect of securing a financially stable future. By understanding the what, who, when, where, why, and how of retirement savings, you can make informed decisions and take the necessary steps to achieve your retirement goals. Remember, it is never too early or too late to start saving for retirement. Begin today and enjoy the peace of mind and financial independence that a well-funded retirement brings.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. Retirement savings are subject to individual circumstances and market fluctuations. It is advisable to consult with a qualified financial advisor before making any financial decisions related to retirement savings.

This post topic: Budgeting Strategies