Unlocking The Power Of Budgeting Strategies For Saving: Your Key To Financial Freedom

Budgeting Strategies for Saving

Introduction

Hello Readers,

2 Picture Gallery: Unlocking The Power Of Budgeting Strategies For Saving: Your Key To Financial Freedom

Welcome to our article on budgeting strategies for saving! In today’s fast-paced world, managing finances and saving money has become more important than ever. Whether you’re just starting your financial journey or looking to improve your existing budget, this article will provide you with valuable insights and strategies to help you achieve your saving goals. So, let’s dive in!

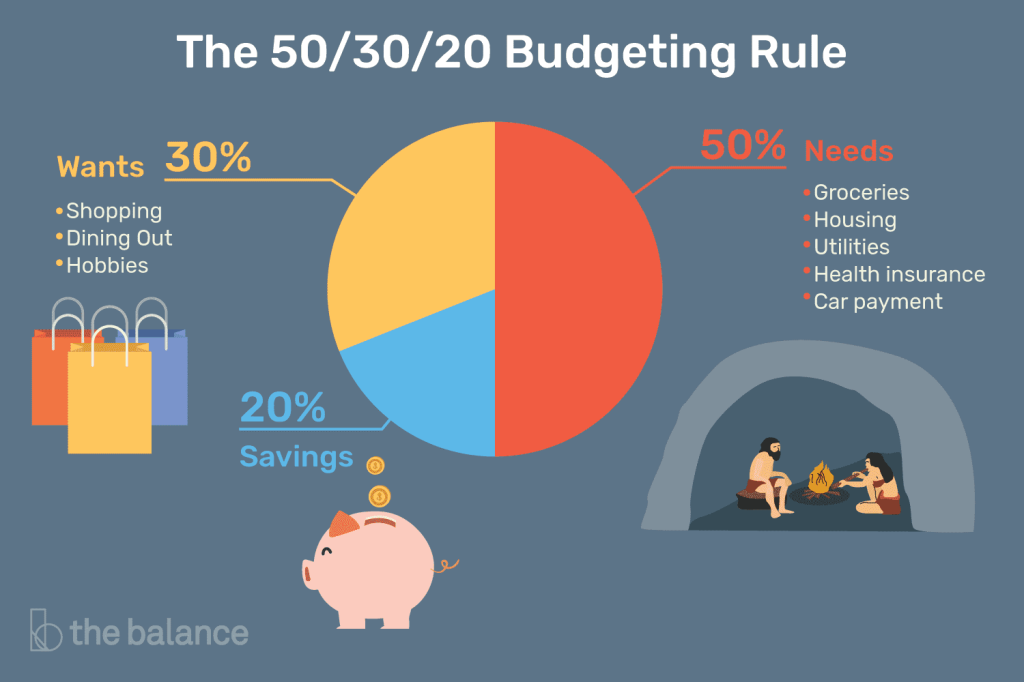

1. What are budgeting strategies for saving?

Image Source: mint.com

Budgeting strategies for saving refer to the various techniques and approaches individuals use to effectively manage their finances and allocate funds towards savings. These strategies involve creating a budget, setting financial goals, tracking expenses, and making intentional choices about spending and saving.

2. Who can benefit from budgeting strategies for saving?

Anyone who wants to improve their financial well-being and build a strong foundation for the future can benefit from budgeting strategies for saving. Whether you’re a student, young professional, or nearing retirement, implementing these strategies can help you achieve your financial goals and secure your financial future.

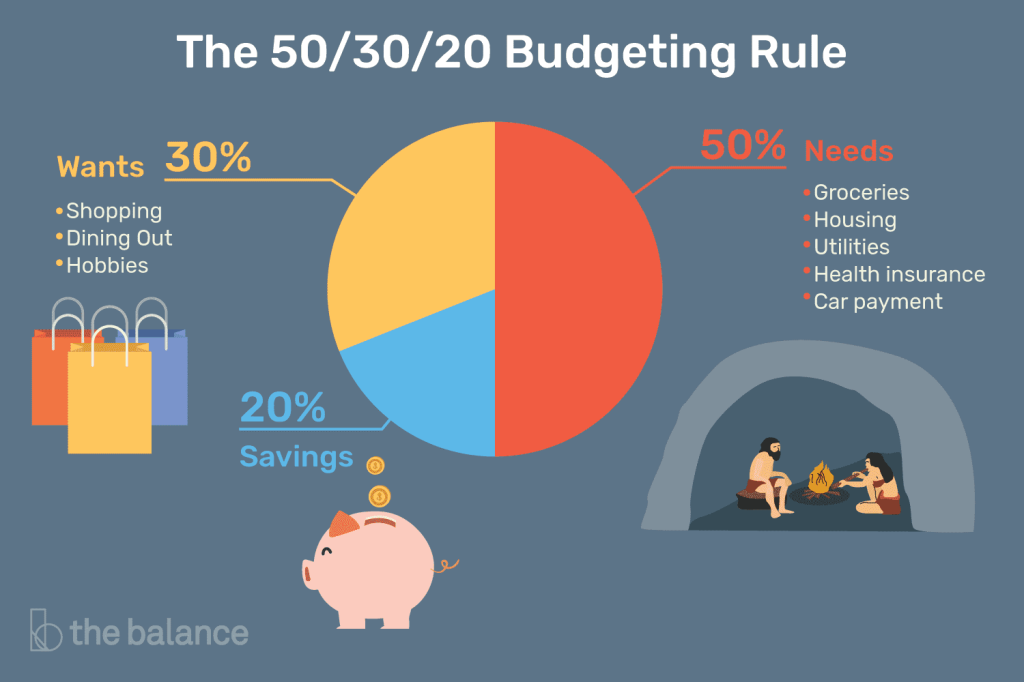

3. When should you start using budgeting strategies for saving?

Image Source: thebalancemoney.com

The sooner you start using budgeting strategies for saving, the better. It’s never too early or too late to take control of your finances and start saving. Whether you’re just starting your first job or have been working for years, implementing these strategies will have a positive impact on your financial well-being.

4. Where can you apply budgeting strategies for saving?

You can apply budgeting strategies for saving in various aspects of your life, such as personal expenses, household expenses, travel, entertainment, and even long-term financial goals like buying a house or planning for retirement. These strategies are flexible and can be tailored to suit your specific needs and financial goals.

5. Why are budgeting strategies for saving important?

Budgeting strategies for saving are important because they provide a roadmap for your financial journey. They help you track your income, expenses, and savings, ensuring that you’re making informed decisions about how you allocate your money. Additionally, these strategies help you build an emergency fund, pay off debts, and achieve long-term financial stability.

6. How can you implement budgeting strategies for saving?

To implement budgeting strategies for saving, start by creating a realistic budget based on your income and expenses. Track your expenses diligently, identify areas where you can cut back, and allocate a specific amount towards savings each month. Use technology tools like budgeting apps or spreadsheets to help you stay organized and accountable.

Advantages and Disadvantages of Budgeting Strategies for Saving

Advantages:

1. Financial Stability: By implementing budgeting strategies for saving, you can achieve financial stability and have a safety net for unexpected expenses.

2. Goal Achievement: These strategies help you set and achieve financial goals, whether it’s buying a car, going on a vacation, or retiring comfortably.

3. Debt Reduction: Budgeting strategies for saving can help you pay off debts faster and avoid falling into a debt trap.

4. Peace of Mind: Knowing that you have control over your finances and a plan in place gives you peace of mind and reduces financial stress.

5. Increased Savings: By carefully tracking your expenses and making intentional choices, you can increase your savings and build wealth over time.

Disadvantages:

1. Discipline Required: Implementing budgeting strategies for saving requires discipline and commitment. It may take time to adjust to a new lifestyle and spending habits.

2. Sacrifices: Depending on your financial goals, you may need to make sacrifices in certain areas of your life to allocate funds towards savings.

3. Unexpected Expenses: Despite careful planning, unexpected expenses can still arise, which may disrupt your budgeting strategies temporarily.

4. Limited Flexibility: Strict adherence to a budget may limit your flexibility in making spontaneous purchases or indulging in non-essential expenses.

5. Initial Effort: Setting up a budget and tracking expenses initially requires time and effort. However, once established, it becomes easier to maintain.

Frequently Asked Questions (FAQs)

1. How much should I allocate towards savings each month?

It is recommended to allocate at least 20% of your income towards savings. However, the exact amount may vary depending on your financial goals and current expenses.

2. Is it necessary to track every single expense?

While tracking every expense is ideal, it may not be practical for everyone. Start by tracking your major expenses and gradually expand to smaller ones for a comprehensive view of your spending habits.

3. Can I save while paying off debts?

Yes, it is possible to save while paying off debts. Allocate a portion of your income towards savings while ensuring that you make consistent payments towards your debts.

4. Are budgeting apps effective?

Yes, budgeting apps can be highly effective in tracking expenses, setting budgets, and providing valuable insights into your spending habits. Research and choose an app that best suits your needs.

5. How often should I review and update my budget?

It is recommended to review and update your budget on a monthly basis. This allows you to make necessary adjustments based on any changes in your income or expenses.

Conclusion

In conclusion, implementing budgeting strategies for saving is crucial for achieving financial stability and securing your future. By creating a budget, setting financial goals, tracking expenses, and making intentional choices, you can take control of your finances and build a strong foundation for the future. Remember, it’s never too late to start saving and every small step counts towards a brighter financial future. So, start implementing these strategies today and witness the positive impact it can have on your life!

Final Remarks

Friends, we hope this article has provided you with valuable insights and strategies on budgeting for saving. Remember that everyone’s financial journey is unique, and it’s important to find the strategies that work best for you. Always consult with a financial advisor for personalized advice and guidance. Happy budgeting and saving!

This post topic: Budgeting Strategies