Master Your Finances With The Ultimate Budgeting System Strategy: Take Control Of Your Money Today!

Budgeting System Strategy: Unlocking Financial Success

Greetings, Readers! Today, we will delve into the world of budgeting system strategy, a powerful tool that can help you take control of your finances and achieve your financial goals. In this article, we will explore the what, who, when, where, why, and how of budgeting system strategy, as well as its advantages and disadvantages. So, let’s dive in and discover how this strategy can pave the way to financial success!

Introduction

Budgeting system strategy is a methodical approach to managing personal or business finances. It involves creating a detailed plan that outlines your income, expenses, and financial goals. This strategic approach enables you to make informed decisions about spending, saving, and investing, ultimately leading to a healthier financial future.

2 Picture Gallery: Master Your Finances With The Ultimate Budgeting System Strategy: Take Control Of Your Money Today!

At its core, budgeting system strategy helps you understand where your money goes, identify areas for improvement, and allocate your resources effectively. It empowers you to prioritize your financial goals, whether it’s paying off debt, saving for a dream vacation, or investing for retirement.

Now, let’s explore the essential aspects of budgeting system strategy:

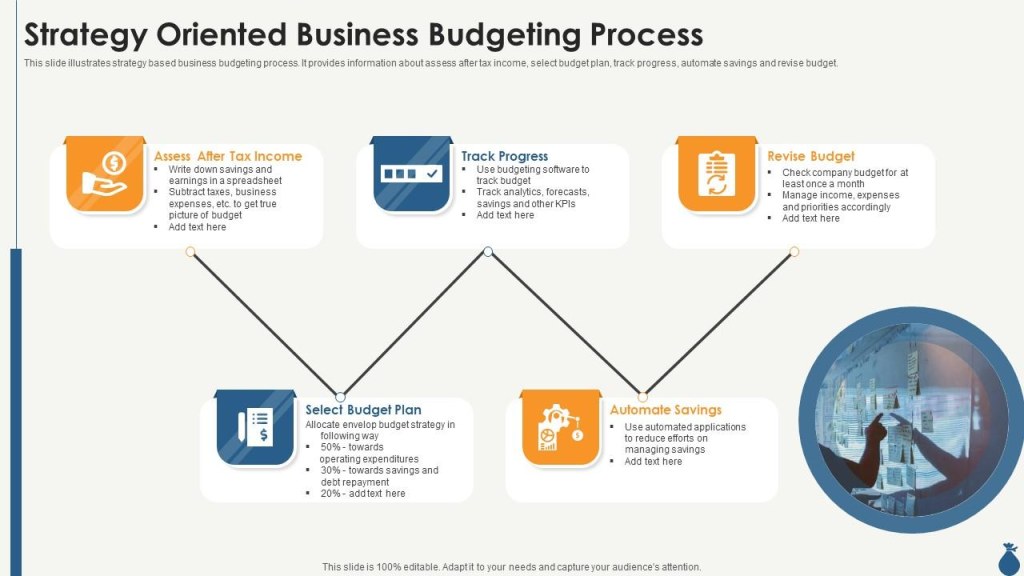

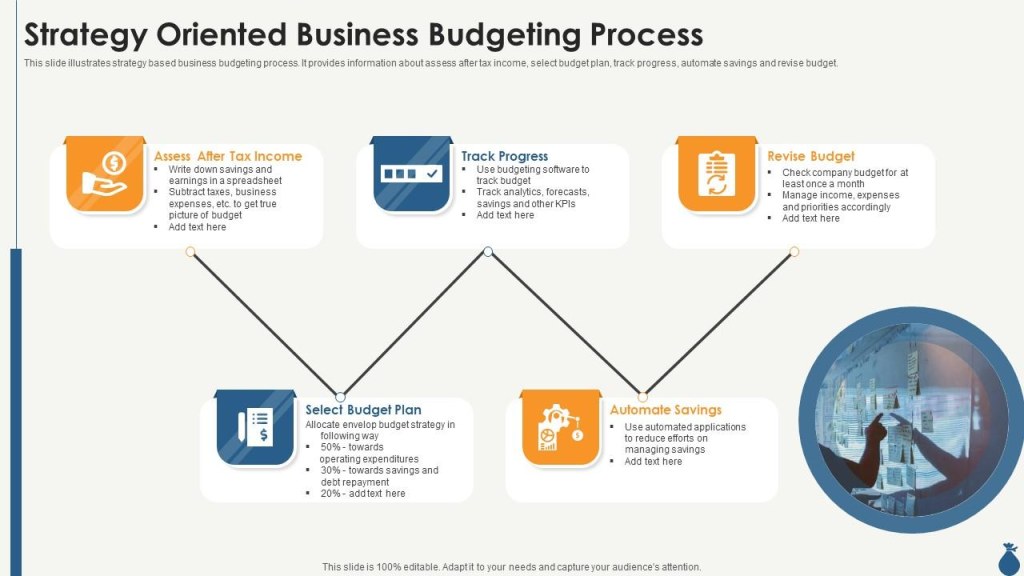

What is Budgeting System Strategy?

🔑 Budgeting system strategy is a comprehensive financial plan that provides a roadmap for managing your money. It involves tracking your income, expenses, and savings meticulously to ensure financial stability and success.

Image Source: slideteam.net

🔑 The goal of budgeting system strategy is to create a balance between your income and expenses, allowing you to optimize your financial resources and achieve your short-term and long-term financial goals.

🔑 This strategy involves analyzing your spending habits, establishing savings targets, and monitoring your progress regularly. By implementing a budgeting system strategy, you gain control over your finances and make informed financial decisions.

Why is Budgeting System Strategy Important?

🔑 Implementing a budgeting system strategy is crucial for various reasons:

🟢 It helps you gain control over your finances and avoid unnecessary debt.

Image Source: gcom.cloud

🟢 It allows you to track your spending habits and identify areas for improvement.

🟢 It helps you prioritize your financial goals and allocate resources accordingly.

🟢 It enables you to save for emergencies, future expenses, and retirement.

Image Source: licdn.com

🟢 It provides a clear financial picture, allowing you to make informed decisions about investments and major purchases.

🟢 It reduces financial stress and promotes peace of mind.

🟢 It empowers you to achieve financial stability and long-term success.

Who Can Benefit from Budgeting System Strategy?

🔑 Budgeting system strategy is beneficial for individuals, families, entrepreneurs, and businesses of all sizes. Regardless of your financial situation, implementing a budgeting system strategy can help you gain control over your finances and achieve your financial goals.

🔑 If you’re drowning in debt, struggling to make ends meet, or simply want to optimize your financial resources, budgeting system strategy is a powerful tool that can transform your financial outlook.

When Should You Implement Budgeting System Strategy?

🔑 The best time to implement a budgeting system strategy is now! Whether you’re just starting your financial journey or looking to improve your existing financial situation, it’s never too early or too late to create a budgeting system strategy.

🔑 If you’re experiencing financial challenges, such as overwhelming debt or living paycheck to paycheck, implementing a budgeting system strategy can provide the structure and guidance you need to overcome these obstacles.

Where Can You Implement Budgeting System Strategy?

🔑 Budgeting system strategy can be implemented in various areas of your life:

🌟 Personal Finances: Implementing a budgeting system strategy in your personal life allows you to manage your income, expenses, and savings effectively. It helps you achieve financial goals such as saving for a down payment on a house or paying off student loans.

🌟 Business Finances: For entrepreneurs and business owners, budgeting system strategy is essential for managing cash flow, reducing costs, and maximizing profits. It enables you to make strategic financial decisions and propel your business towards success.

🌟 Project Finances: Whether you’re planning a vacation, a home renovation, or any other significant project, implementing a budgeting system strategy ensures that you allocate resources appropriately and avoid overspending.

How to Implement Budgeting System Strategy?

🔑 To implement a budgeting system strategy effectively, follow these steps:

1️⃣ Identify Your Financial Goals: Determine your short-term and long-term financial goals, such as paying off debt, saving for retirement, or purchasing a home.

2️⃣ Track Your Income and Expenses: Record your income and track your expenses meticulously. Use a budgeting tool or spreadsheet to categorize your expenses and identify areas where you can cut back.

3️⃣ Create a Budget: Based on your financial goals and income, create a budget that allocates resources to necessary expenses, savings, and debt repayment. Ensure that your budget is realistic and flexible.

4️⃣ Monitor and Adjust: Regularly monitor your spending, savings, and progress towards your financial goals. Make adjustments as needed to stay on track and adapt to changing circumstances.

5️⃣ Seek Professional Help: If you’re struggling with complex financial situations or need expert guidance, consider consulting a financial advisor or accountant who can provide personalized advice.

Advantages and Disadvantages of Budgeting System Strategy

Now, let’s explore the advantages and disadvantages of implementing a budgeting system strategy:

Advantages of Budgeting System Strategy

1. 🟢 Increased Financial Awareness: Implementing a budgeting system strategy increases your awareness of your financial situation and helps you make informed decisions.

2. 🟢 Debt Reduction: By prioritizing debt repayment in your budget, you can reduce or eliminate your debt faster.

3. 🟢 Savings Growth: Budgeting system strategy allows you to save consistently and grow your savings over time, providing you with a financial safety net.

4. 🟢 Goal Achievement: With a budgeting system strategy, you can set and achieve your financial goals, whether it’s buying a home, starting a business, or retiring comfortably.

5. 🟢 Reduced Financial Stress: By having a clear financial plan, budgeting system strategy helps reduce financial stress and promotes peace of mind.

Disadvantages of Budgeting System Strategy

1. 🔴 Initial Adjustment: Implementing a budgeting system strategy requires discipline and adjustment, which may be challenging at first.

2. 🔴 Unexpected Expenses: Despite careful planning, unexpected expenses can arise, potentially disrupting your budgeting system strategy.

3. 🔴 Time-Consuming: Maintaining a budgeting system requires time and effort, especially in the initial stages. Regular monitoring and adjustments are necessary.

4. 🔴 Flexibility Limitations: Strict adherence to a budgeting system strategy may limit spontaneity or flexibility in your spending habits.

5. 🔴 Unrealistic Expectations: Setting overly ambitious financial goals or underestimating expenses can lead to frustration and discouragement.

Frequently Asked Questions (FAQ)

Q1: Can I still enjoy life while implementing a budgeting system strategy?

A1: Absolutely! Implementing a budgeting system strategy doesn’t mean sacrificing enjoyment. It’s about making conscious spending choices to align your expenses with your priorities and goals.

Q2: How long does it take to see the results of a budgeting system strategy?

A2: The timeline for seeing results varies depending on your financial situation and goals. However, with consistent implementation and monitoring, you should start noticing positive changes within a few months.

Q3: What if my income fluctuates? Can I still implement a budgeting system strategy?

A3: Yes, you can. When your income fluctuates, it’s crucial to create a budget that considers both the high and low months. Prioritize building an emergency fund to buffer any income fluctuations.

Q4: Can I modify my budgeting system strategy as my financial situation changes?

A4: Absolutely! Your budgeting system strategy should be flexible and adaptable to changes in your financial situation. Regularly review and adjust your budget as needed.

Q5: What if I have multiple financial goals? How do I prioritize them?

A5: Prioritizing financial goals depends on your personal circumstances and values. Consider factors such as urgency, feasibility, and long-term impact when determining the order of priority for your goals.

Conclusion: Take Control of Your Financial Future

In conclusion, implementing a budgeting system strategy is a powerful step towards achieving financial success. By creating a detailed plan, tracking your income and expenses, and prioritizing your financial goals, you can gain control over your finances and pave the way to a brighter future.

So, don’t wait any longer. Start implementing a budgeting system strategy today and take charge of your financial destiny. Your future self will thank you!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. Before implementing any financial strategies, consult with a certified financial advisor or accountant to assess your individual needs and circumstances.

This post topic: Budgeting Strategies