Secure Your Future: Maximize Retirement Savings 15% Of Gross Or Net Income Now!

Retirement Savings 15% of Gross or Net: A Guide to Securing Your Future

Introduction

Dear Readers,

1 Picture Gallery: Secure Your Future: Maximize Retirement Savings 15% Of Gross Or Net Income Now!

Welcome to our comprehensive guide on retirement savings! In today’s fast-paced world, it is essential to plan for your future and ensure financial security during your golden years. In this article, we will delve into the concept of retirement savings, specifically focusing on whether it should be 15% of your gross or net income. By the end of this guide, you will have a clear understanding of how much you should save and why it is crucial for your financial well-being.

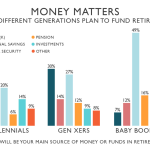

Image Source: substackcdn.com

So, let’s dive in and explore the intricacies of retirement savings together!

What is Retirement Savings 15% of Gross or Net?

🔍 To understand retirement savings and its significance, it is essential to define what it entails. Retirement savings refers to the funds you set aside during your working years to support yourself after you retire. The specific percentage you should save is often a topic of debate and confusion. One commonly discussed figure is 15% of your gross or net income.

🔍 Gross income refers to the total amount you earn before any deductions or taxes. On the other hand, net income is your take-home pay after taxes and other deductions have been subtracted. Deciding whether to base your savings on gross or net income depends on various factors, and we will explore them in detail in the following sections.

Who Should Consider Saving 15% of Gross or Net Income?

🔍 Saving 15% of your income is a prudent choice for individuals who prioritize financial security and wish to maintain their current lifestyle during retirement. It is particularly relevant for employed individuals who receive a regular salary or income. By allocating a significant portion of your earnings towards retirement savings, you can build a substantial nest egg that will provide a comfortable future.

🔍 However, it is important to note that financial situations vary from person to person. Factors such as existing debt, current expenses, and personal goals should be considered when determining the appropriate percentage to save. We will discuss these factors further in the following sections.

When Should You Start Saving?

🔍 The ideal time to start saving for retirement is as early as possible. The power of compound interest allows your savings to grow exponentially over time, providing a greater financial cushion in the long run. By starting early, you can take advantage of this compounding effect and potentially reduce the amount you need to save each year.

🔍 However, even if you haven’t started saving early, it’s never too late to begin. It is crucial to create a realistic savings plan that aligns with your current financial situation and retirement goals. Remember, every little bit counts, and the sooner you start, the better off you’ll be.

Where Should You Invest Your Retirement Savings?

🔍 Once you have determined the percentage of your income to allocate towards retirement savings, the next step is to decide where to invest those funds. Common investment options include individual retirement accounts (IRAs), 401(k) plans, or other employer-sponsored retirement plans. Each option has its own advantages and considerations, and it is crucial to research and consult with a financial advisor to make informed decisions.

🔍 Additionally, diversifying your investments is a prudent strategy. By spreading your savings across different assets, such as stocks, bonds, and real estate, you can mitigate risks and potentially earn higher returns.

Why is Retirement Savings Important?

🔍 Retirement savings play a vital role in ensuring your financial security during your golden years. With increasing life expectancy and rising healthcare costs, it is crucial to have sufficient funds to support yourself after you retire. By diligently saving a percentage of your income, you are taking proactive steps towards a comfortable and worry-free retirement.

🔍 Moreover, relying solely on government-provided retirement benefits may not be sufficient to maintain your desired standard of living. By taking control of your retirement savings, you are empowering yourself to create the future you envision.

How Can You Determine the Ideal Percentage to Save?

🔍 Deciding whether to save 15% of your gross or net income requires careful consideration of various factors. Firstly, evaluate your current expenses and determine how much you can comfortably allocate towards savings. It is crucial to strike a balance between saving for the future and meeting your present needs.

🔍 Secondly, consider any outstanding debt or financial obligations. Paying off high-interest debt, such as credit card balances or student loans, should also be prioritized alongside retirement savings. By reducing your debt burden, you can free up more funds for future savings.

🔍 Lastly, align your retirement savings goals with your desired lifestyle after retirement. Consider factors such as desired travel, hobbies, or any anticipated healthcare expenses. Understanding your retirement goals will help you determine the percentage you need to save to achieve them.

Advantages and Disadvantages of Retirement Savings 15% of Gross or Net

Advantages:

1. 💰 Increased Financial Security: Saving 15% of your income provides a solid financial foundation for retirement, reducing the risk of facing financial hardships later in life.

2. 💪 Compound Interest Growth: Starting early and consistently saving allows your funds to grow through the power of compounding, potentially resulting in significant wealth accumulation.

3. 💼 Maintaining Lifestyle: By saving a substantial percentage of your income, you can ensure that your desired lifestyle is maintained even after retirement.

4. 📈 Investment Opportunities: Retirement savings can be invested in various assets, offering the potential for increased returns and wealth growth.

5. 🏦 Tax Advantages: Certain retirement savings vehicles, such as traditional IRAs or 401(k) plans, offer tax advantages that can help maximize your savings.

Disadvantages:

1. 💸 Reduced Disposable Income: Allocating 15% of your income towards retirement savings may require making sacrifices in your current lifestyle and discretionary spending.

2. 📉 Opportunity Costs: The funds used for retirement savings could have been used for other purposes, such as purchasing a home or investing in higher education.

3. 💼 Unforeseen Circumstances: Life is unpredictable, and unexpected events may require dipping into your retirement savings, potentially affecting your overall financial security.

4. 📉 Market Volatility: Investing your retirement savings exposes you to market risks, and economic downturns or stock market fluctuations can impact the value of your investments.

5. 💼 Limited Access to Funds: Most retirement savings vehicles have penalties or restrictions on withdrawals before a certain age, limiting your access to funds in case of emergencies.

Frequently Asked Questions (FAQs)

1. Can I save more than 15% of my income for retirement?

Yes, saving more than 15% of your income is always an excellent choice if your financial situation allows it. The more you save, the greater your financial security during retirement.

2. What if I can’t afford to save 15% of my income?

It’s essential to save what you can comfortably afford. While 15% is a guideline, any amount saved towards retirement is better than nothing. Start small and gradually increase your savings as your financial situation improves.

3. Can I rely solely on Social Security for my retirement?

While Social Security provides a safety net, it is often not sufficient to maintain your desired lifestyle during retirement. It is crucial to have additional savings to supplement your retirement income.

4. Should I consult a financial advisor for retirement savings?

Yes, consulting a financial advisor can provide valuable insights and help you create a personalized retirement savings plan based on your unique circumstances and goals.

5. What if I have a pension plan or employer-matched contributions?

Having a pension plan or employer-matched contributions can complement your personal retirement savings. It’s important to take advantage of these benefits as they can significantly boost your retirement fund.

Conclusion

In conclusion, saving 15% of your gross or net income for retirement is a wise financial decision. By allocating a significant portion of your earnings towards retirement savings, you are taking proactive steps to secure your future and maintain your desired lifestyle during your golden years.

Remember, the ideal percentage to save may vary based on individual circumstances. It is crucial to evaluate your current financial situation, set realistic goals, and seek professional advice when necessary.

Start planning and saving early, consider various investment options, and continually reassess your retirement savings strategy to ensure it aligns with your evolving needs and goals. Your future self will thank you for the financial security and peace of mind that comes with a well-funded retirement.

Final Remarks

Dear Readers,

Retirement savings is a critical aspect of securing your financial future. However, it is important to note that the information provided in this article is for informational purposes only and should not be considered as financial advice. Every individual’s financial situation is unique, and it is recommended to consult a qualified financial advisor for personalized guidance.

Remember, diligent savings, wise investments, and regular reassessment of your retirement plan are key to achieving your long-term financial goals. Start today and take control of your financial future!

This post topic: Budgeting Strategies