Nurse’s Budget Mastery: Unveiling Strategies For Nurses To Optimize Finances

Budget Strategies for Nurses

Greetings, Readers!

Nurses play a crucial role in the healthcare system, providing essential care and support to patients. However, managing personal finances can be challenging, especially with the rising cost of living. In this article, we will explore budget strategies specifically tailored for nurses, helping them achieve financial stability and peace of mind. By implementing these strategies, nurses can better manage their income, save for the future, and make informed financial decisions. Let’s dive in!

2 Picture Gallery: Nurse’s Budget Mastery: Unveiling Strategies For Nurses To Optimize Finances

Introduction

1. The Importance of Budgeting for Nurses

Image Source: pinimg.com

2. The Benefits of Budgeting

3. The Challenges Nurses Face in Managing Finances

4. The Purpose of This Article

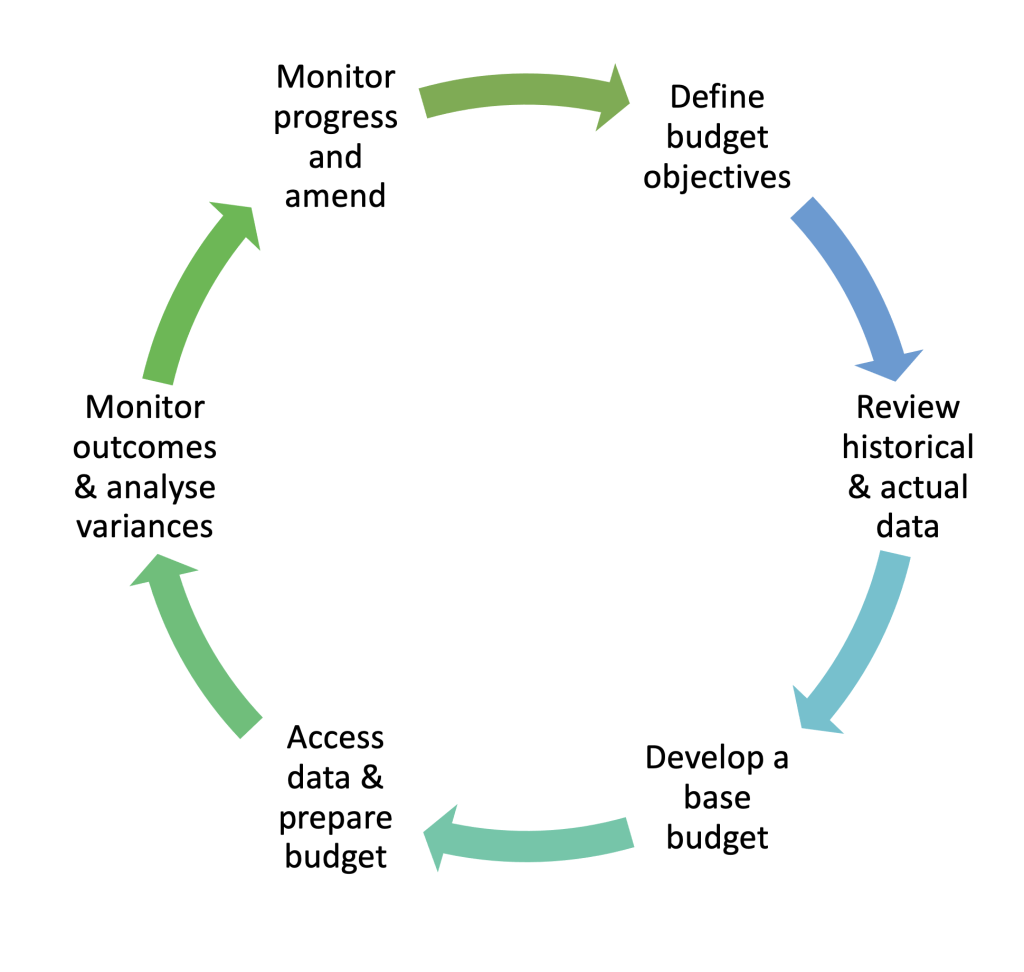

Image Source: pressbooks.pub

5. How This Article Will Help Nurses

6. How to Get Started with Budgeting

7. The Components of a Budget

What: Budget Strategies for Nurses

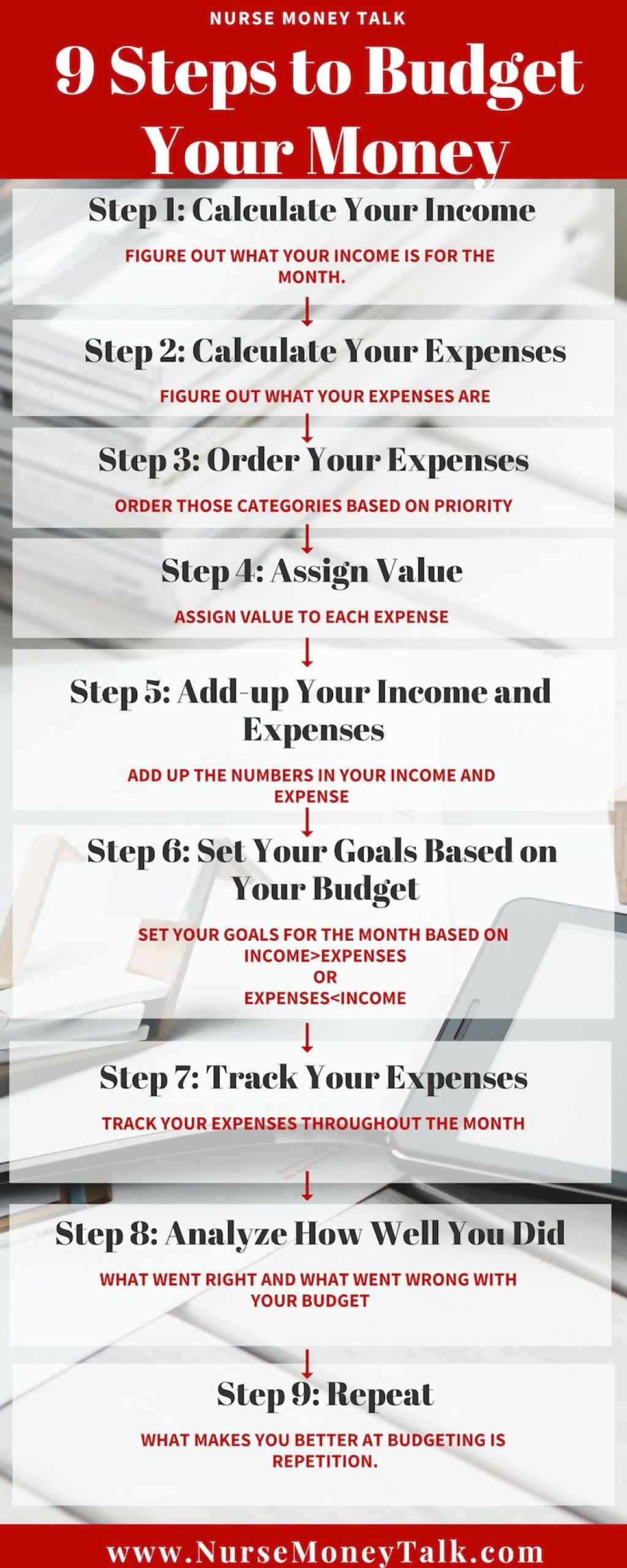

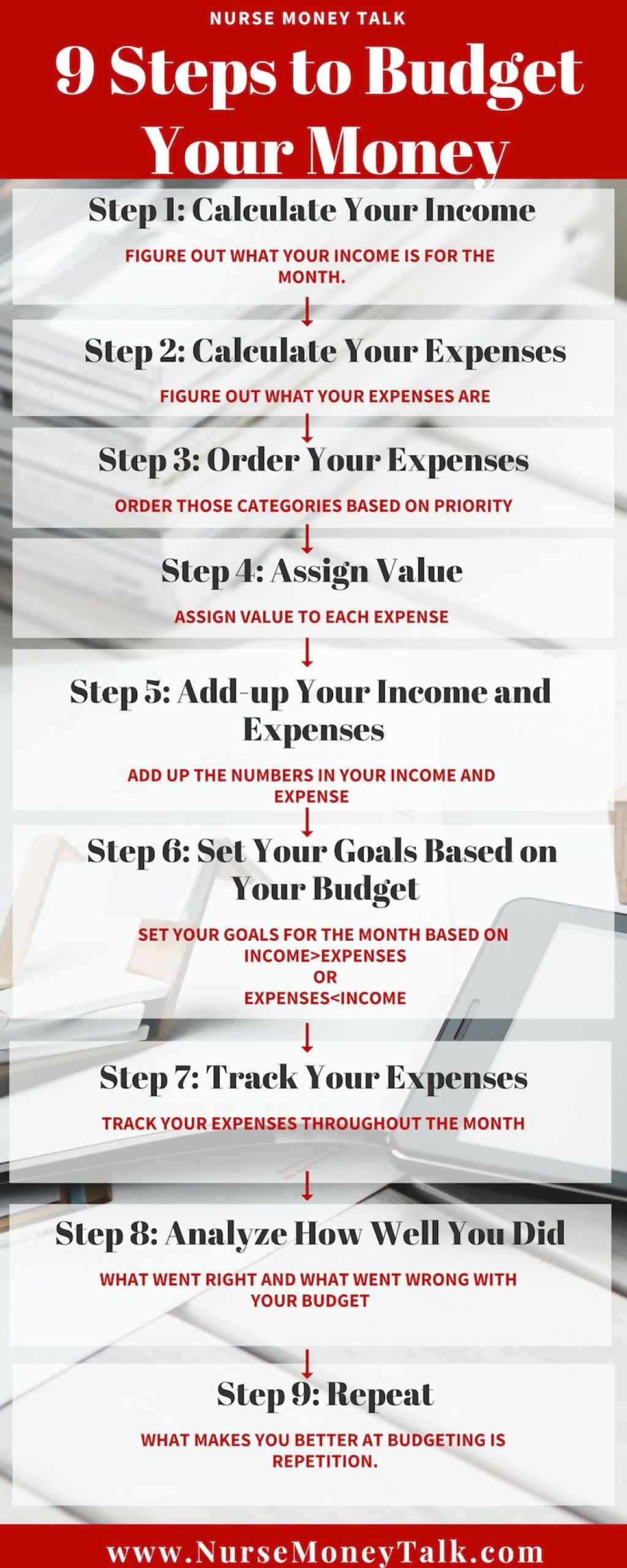

Creating a budget allows nurses to track their income and expenses effectively. By understanding their financial situation, nurses can make informed decisions about their spending habits, savings, and investments. Implementing the following budget strategies can help nurses achieve financial stability:

1. Track Your Income and Expenses

2. Set Financial Goals

3. Prioritize Your Spending

4. Create an Emergency Fund

5. Minimize Debt

6. Save for Retirement

7. Invest Smartly

Who: Nurses and Their Budgets

Nurses from all specialties can benefit from implementing budget strategies. Whether you are a registered nurse, nurse practitioner, or a travel nurse, managing your finances is essential. Regardless of your income level or experience, budgeting can help you achieve financial security and plan for the future.

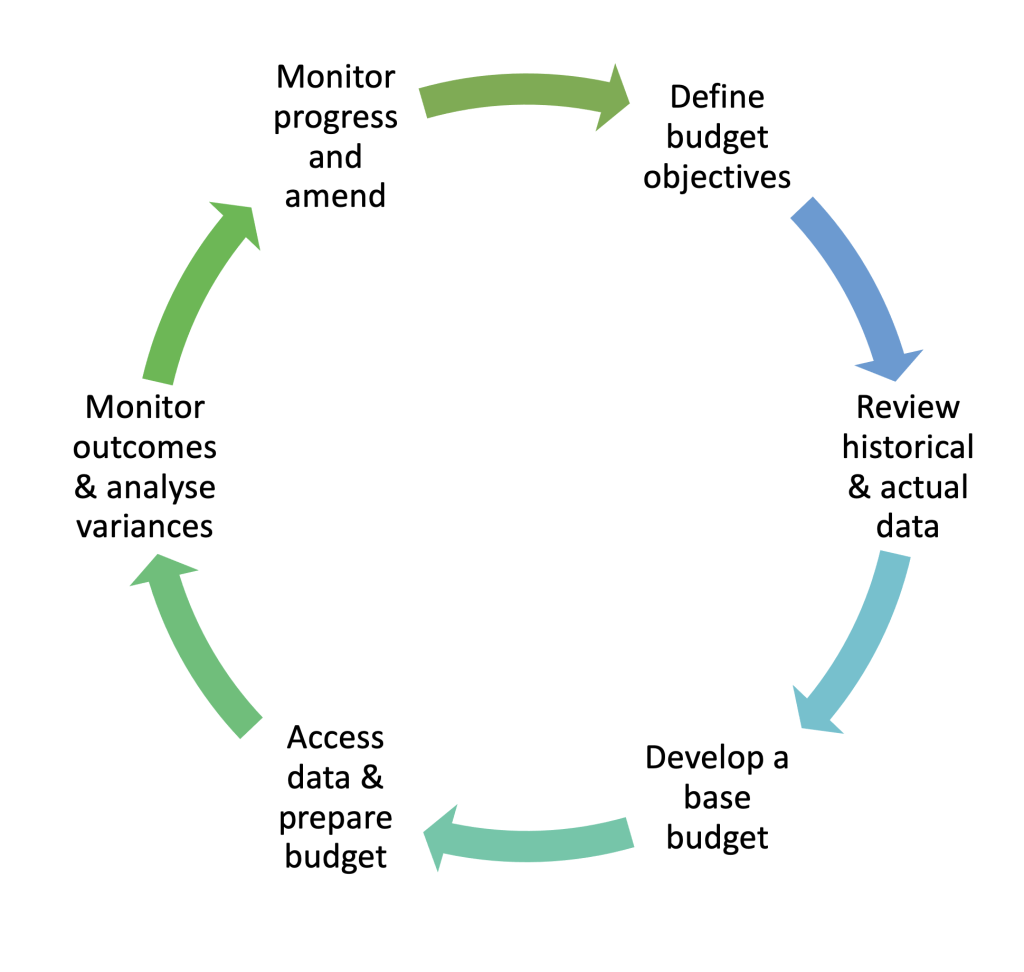

When: The Timing of Budget Strategies

It is never too early or too late to start budgeting. As soon as you begin your nursing career, it is crucial to develop good financial habits. By implementing budget strategies early on, you can avoid unnecessary debt, build savings, and secure a stable financial future.

Where: Implementing Budget Strategies

Budgeting can be done anywhere, as long as you have access to your financial information. You can create a budget using pen and paper, a spreadsheet, or various budgeting apps available for smartphones and computers. Choose a method that suits your preferences and enables you to track your income and expenses effectively.

Why: The Benefits of Budget Strategies

Budget strategies provide numerous benefits for nurses:

1. Financial Stability: Budgeting helps nurses achieve financial stability by tracking income and expenses, avoiding unnecessary debt, and saving for emergencies.

2. Peace of Mind: By having a clear understanding of their financial situation, nurses can reduce stress and anxiety related to money matters.

3. Goal Achievement: Budgeting allows nurses to set and achieve their financial goals, whether it’s buying a house, paying off student loans, or saving for retirement.

4. Improved Financial Decision-Making: With a budget in place, nurses can make informed decisions about their spending habits, investments, and savings.

5. Future Planning: By saving and investing wisely, nurses can secure their financial future and enjoy a comfortable retirement.

How: Implementing Budget Strategies

Implementing budget strategies requires careful planning and discipline. Follow these steps to get started:

1. Assess Your Current Financial Situation

2. Set Realistic Financial Goals

3. Create a Monthly Budget

4. Track Your Income and Expenses

5. Prioritize Your Spending

6. Build an Emergency Fund

7. Minimize Debt

Advantages and Disadvantages of Budget Strategies for Nurses

1. Advantages of Budget Strategies:

– Increased financial stability and security

– Reduction of unnecessary debt

– Ability to achieve financial goals

– Improved decision-making regarding finances

– Enhanced future planning for retirement

2. Disadvantages of Budget Strategies:

– Requires discipline and self-control

– May require lifestyle adjustments

– Initial time investment to set up and maintain the budget

– Unexpected expenses may disrupt the budget

– Requires ongoing monitoring and adjustments

Frequently Asked Questions (FAQs)

1. How long does it take to see the benefits of budgeting?

– The benefits of budgeting can be seen within a few months of implementing the strategies. However, long-term financial stability and goal achievement may take several years.

2. Is it necessary to consult a financial advisor when budgeting?

– While not necessary, consulting a financial advisor can provide valuable insights and personalized advice to help nurses make informed financial decisions.

3. Can budgeting help nurses pay off their student loans?

– Yes, budgeting allows nurses to allocate funds towards paying off their student loans systematically. By prioritizing debt repayment in the budget, nurses can accelerate the loan repayment process.

4. Should nurses budget for leisure and entertainment expenses?

– Yes, budgeting should include allocations for leisure and entertainment expenses. It is essential to strike a balance between responsible spending and enjoying life’s pleasures.

5. How often should nurses review and adjust their budget?

– It is recommended to review and adjust the budget monthly or whenever there are significant changes in income or expenses. Regular monitoring ensures the budget remains aligned with financial goals and circumstances.

Conclusion

In conclusion, implementing budget strategies is crucial for nurses to achieve financial stability and peace of mind. By tracking income and expenses, setting financial goals, and making informed decisions, nurses can secure their financial future. It is never too late to start budgeting, so take the first step today and reap the many benefits it offers.

Thank you for reading, and best of luck on your financial journey!

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional financial advice. Each nurse’s financial situation is unique, and it is recommended to consult a financial advisor or professional for personalized guidance.

This post topic: Budgeting Strategies