Secure Your Retirement Savings At 30 Years Old – Act Now For A Bright Future!

Retirement Savings at 30 Years Old: How to Secure Your Financial Future

Greetings, Readers! In today’s fast-paced and ever-changing world, it’s crucial to start planning for your retirement as early as possible. By the time you reach 30 years old, you should already have a solid foundation for your retirement savings. This article aims to provide you with valuable information on how to ensure a secure financial future. So, let’s delve into the world of retirement savings at 30 years old.

The Importance of Retirement Savings

🔑 Saving for retirement is essential to maintain financial stability during your golden years. It enables you to maintain the same standard of living and enjoy the fruits of your labor without worrying about financial constraints.

2 Picture Gallery: Secure Your Retirement Savings At 30 Years Old – Act Now For A Bright Future!

What is Retirement Savings?

Retirement savings refers to the funds set aside during your working years to support your lifestyle after you stop working. This encompasses various investment vehicles, such as pensions, 401(k)s, individual retirement accounts (IRAs), and other investment options.

Who Should Start Saving at 30 Years Old?

✅ Anyone who wishes to achieve a comfortable retirement should start saving as early as possible. While financial circumstances vary, starting at 30 years old allows for a longer time horizon to grow your retirement nest egg through compounding interest.

When Should You Begin Saving?

⏳ The earlier, the better! Starting to save for retirement at 30 years old provides ample time to build a substantial savings pool. However, it’s never too late to start. Even if you haven’t begun yet, take action now to secure your financial future.

Where Should You Invest Your Retirement Savings?

Image Source: ctfassets.net

🌍 There are numerous investment options available to grow your retirement savings. These include employer-sponsored retirement plans like 401(k)s, IRAs, real estate investments, stocks, bonds, mutual funds, and more. Diversifying your investments is key to mitigate risks and maximize potential returns.

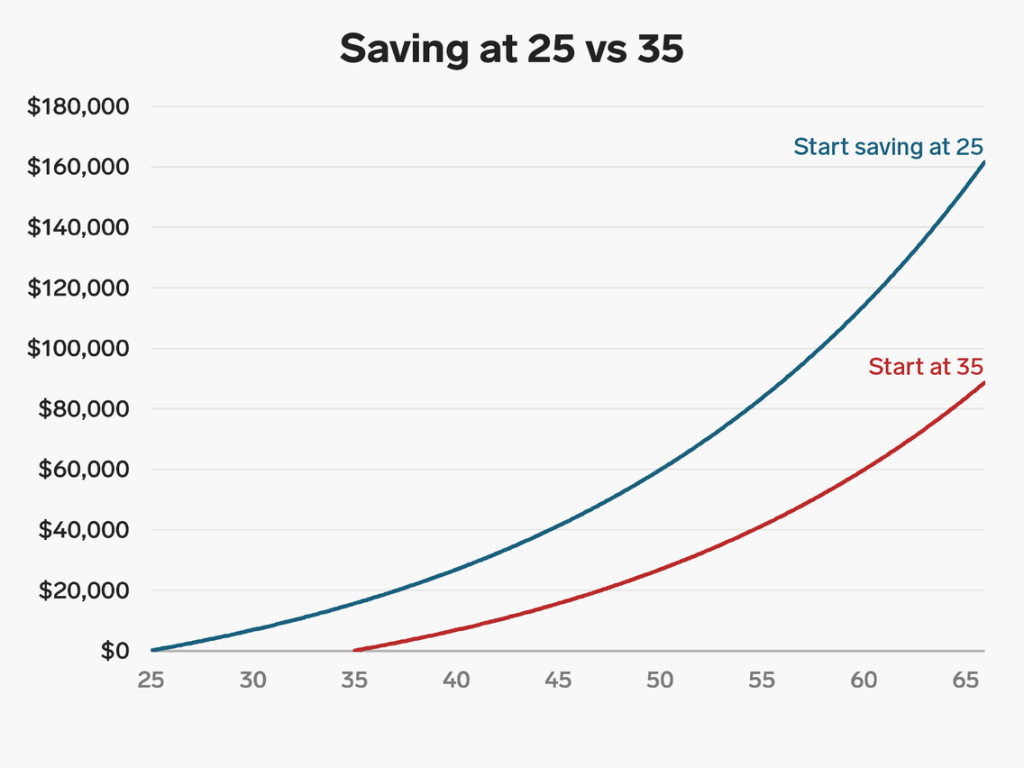

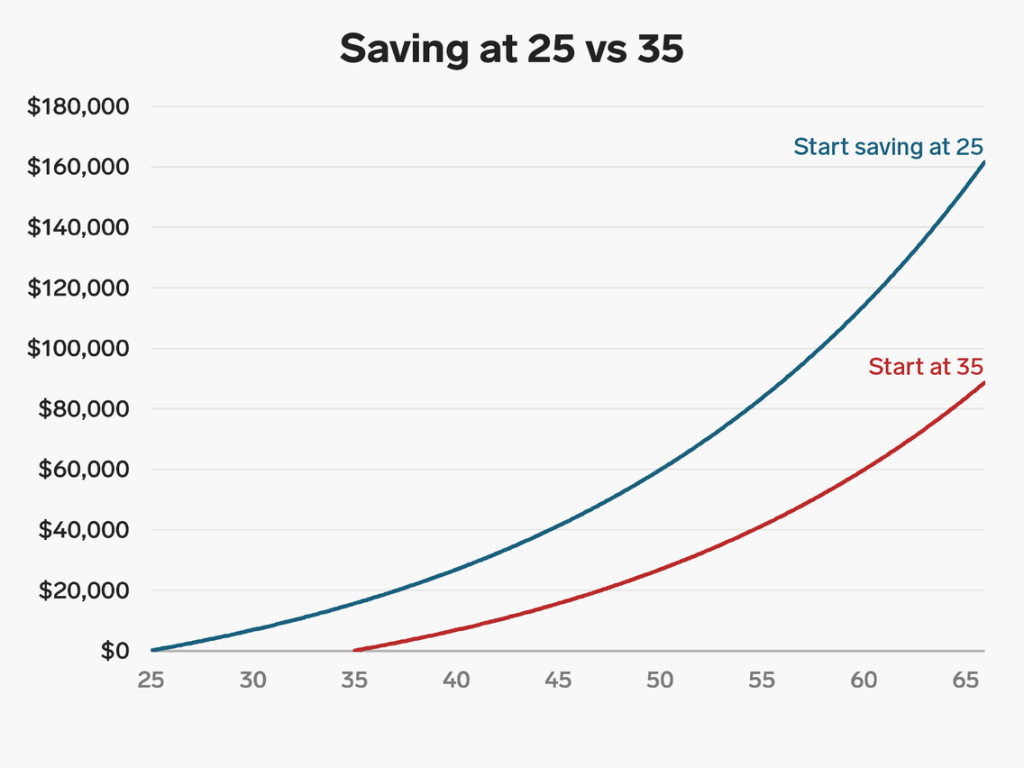

Why is Retirement Savings Crucial at 30 Years Old?

❓ Retirement savings are crucial at 30 years old because you have several decades ahead of you to harness the power of compound interest. By starting early, you allow your investments to grow exponentially over time, giving you a significant advantage in building a robust retirement fund.

How Can You Start Saving for Retirement at 30 Years Old?

🚀 Starting to save for retirement at 30 years old may seem daunting, but it’s achievable with careful planning and discipline. Begin by setting clear financial goals, creating a budget, automating your savings, and seeking professional advice to make informed investment decisions.

The Pros and Cons of Retirement Savings at 30 Years Old

👍 Advantages:

1. Financial Security

✅ Building a substantial retirement savings at 30 years old ensures financial security in your later years, allowing you to enjoy a comfortable lifestyle.

2. Compound Interest

Image Source: insider.com

✅ Starting early allows your savings to benefit from compound interest, where your money grows exponentially over time.

3. Flexibility and Control

✅ Building your retirement savings grants you more control over your financial future and provides greater flexibility in making choices that align with your retirement goals.

👎 Disadvantages:

1. Opportunity Cost

❌ Setting aside money for retirement may mean sacrificing present enjoyment or delaying other financial goals.

2. Economic Uncertainty

❌ Economic downturns or unexpected financial setbacks can affect the growth of your retirement savings, emphasizing the need for emergency funds.

3. Inflation

❌ Inflation erodes the purchasing power of your retirement savings over time, necessitating proper investment strategies to combat its effects.

Frequently Asked Questions (FAQs)

1. How much should I save for retirement at 30 years old?

💡 The general rule of thumb is to save at least 15%-20% of your income for retirement. However, consult with a financial advisor to determine the right savings rate based on your individual circumstances.

2. Can I rely solely on Social Security for retirement?

💡 While Social Security provides a safety net, it’s advisable to have additional retirement savings to maintain a comfortable lifestyle during your retirement years.

3. What if I have existing debt? Should I prioritize paying it off or saving for retirement?

💡 It’s important to strike a balance between paying off debt and saving for retirement. Focus on high-interest debt first, then allocate a portion of your income towards retirement savings.

4. Should I invest in stocks or bonds for my retirement savings?

💡 The ideal asset allocation varies depending on your risk tolerance, investment horizon, and financial goals. A diversified portfolio that includes a mix of stocks and bonds is generally recommended for long-term growth and stability.

5. When can I withdraw my retirement savings?

💡 The age at which you can withdraw your retirement savings without penalties depends on the specific retirement account. For example, with a traditional IRA or 401(k), you can typically start withdrawing funds penalty-free after reaching age 59 ½.

Conclusion: Secure Your Financial Future Now!

In conclusion, it’s never too early or too late to start saving for retirement. By prioritizing your retirement savings at 30 years old, you give yourself a head start towards financial security and freedom. Take advantage of compounding interest, diversify your investments wisely, and seek professional guidance to maximize your retirement savings. Start today, and ensure a comfortable and worry-free retirement tomorrow.

Disclaimer: The information provided in this article is for educational purposes only. It is not intended as financial advice. Please consult with a qualified financial professional before making any investment decisions.

This post topic: Budgeting Strategies