Mastering Your Finances: Unveiling The Power Of 6.2 Budgeting Strategies For A Prosperous Future!

6.2 Budgeting Strategies: Maximizing Financial Efficiency

Introduction

Dear Readers,

Welcome to this informative article on 6.2 budgeting strategies. In today’s fast-paced world, managing finances efficiently is crucial for individuals, businesses, and organizations. By implementing effective budgeting strategies, you can optimize your financial resources, achieve your goals, and secure a stable future.

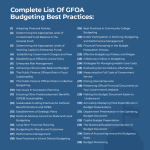

1 Picture Gallery: Mastering Your Finances: Unveiling The Power Of 6.2 Budgeting Strategies For A Prosperous Future!

In this article, we will explore six key budgeting strategies that can help you make informed financial decisions and improve your overall financial well-being. From understanding the basics to exploring advanced techniques, we’ve got you covered. So let’s dive in and unlock the secrets of successful budgeting!

What are 6.2 Budgeting Strategies?

🔍 Budgeting strategies refer to the various techniques and approaches that individuals, businesses, and organizations use to plan, allocate, and manage their financial resources. These strategies help ensure that income is utilized effectively, expenses are controlled, and financial goals are achieved. By following these strategies, you can gain better control over your finances, reduce debt, save for the future, and ultimately achieve financial success.

Now, let’s explore the six fundamental aspects of 6.2 budgeting strategies:

1. What is the Purpose of Budgeting Strategies?

Image Source: medium.com

🔍 The purpose of budgeting strategies is to provide a systematic and structured approach to managing finances. It helps individuals and organizations allocate their income to cover essential expenses, save for future goals, and invest wisely. By setting financial goals and creating a budget, you can track your progress, identify areas for improvement, and make informed financial decisions.

2. Who Can Benefit from Budgeting Strategies?

🔍 Budgeting strategies are beneficial for everyone, regardless of their financial situation. Whether you are an individual looking to manage personal finances or a business aiming to optimize cash flow, implementing effective budgeting strategies can provide numerous advantages. These strategies can be tailored to meet the specific needs of individuals, families, businesses, and even non-profit organizations.

3. When Should You Start Implementing Budgeting Strategies?

🔍 The sooner you start implementing budgeting strategies, the better. It is never too early or too late to take control of your finances. Whether you are just starting your career, planning for retirement, or running a business, budgeting strategies can help you achieve financial stability and success. The key is to start now and make it a regular practice to evaluate and adjust your budget as your financial circumstances change.

4. Where Can You Apply Budgeting Strategies?

🔍 Budgeting strategies can be applied in various areas of life and business. Some common areas include personal finances, household budgeting, business budgeting, project budgeting, and even event budgeting. By implementing these strategies, you can effectively manage income, control expenses, allocate resources, and achieve specific financial goals in any area of your life.

5. Why Are Budgeting Strategies Important?

🔍 Budgeting strategies are important for several reasons. Firstly, they provide financial stability and help you avoid unnecessary debt. Secondly, they enable you to prioritize your spending and focus on what matters most to you. Thirdly, they empower you to save for emergencies, future goals, and retirement. Lastly, budgeting strategies promote financial discipline and awareness, enabling you to make informed financial decisions.

6. How Can You Implement Effective Budgeting Strategies?

Image Source: licdn.com

🔍 Implementing effective budgeting strategies involves several steps. Firstly, you need to assess your current financial situation by reviewing your income, expenses, and debts. Secondly, set specific financial goals and prioritize them based on importance. Thirdly, create a budget by allocating your income to cover essential expenses, savings, investments, and debt repayment. Lastly, regularly monitor and review your budget, making adjustments as needed to ensure your financial goals are on track.

Advantages and Disadvantages of 6.2 Budgeting Strategies

Now that we have explored the key aspects of 6.2 budgeting strategies, let’s take a closer look at the advantages and disadvantages of implementing these strategies:

Advantages:

1. Better Financial Control: Budgeting strategies provide a clear overview of your income and expenses, helping you gain better control over your finances.

2. Debt Reduction: By tracking your expenses and prioritizing debt repayment, budgeting strategies can help you reduce debt and improve your financial health.

3. Goal Achievement: With budgeting strategies, you can allocate funds towards achieving specific financial goals, such as buying a home, starting a business, or saving for education.

4. Improved Financial Decision-Making: By having a budget in place, you can make more informed financial decisions, ensuring your money is used wisely.

5. Increased Savings: Budgeting strategies encourage regular saving, allowing you to build an emergency fund, save for retirement, or plan for future expenses.

Disadvantages:

1. Initial Effort: Setting up and maintaining a budget requires time and effort, especially in the beginning stages.

2. Adjustments and Flexibility: Your financial circumstances may change, requiring adjustments to your budget. Flexibility is essential to ensure your budget remains effective.

3. Unexpected Expenses: Despite careful budgeting, unexpected expenses can arise, potentially affecting your financial plans.

4. Discipline and Self-Control: Budgeting strategies require discipline and self-control to stick to the allocated funds and avoid overspending.

5. Potential Limitations: Depending on your income and financial obligations, budgeting strategies may have limitations in terms of available funds for certain expenses or goals.

FAQs: Answering Your Budgeting Questions

1. Is budgeting only for people with high incomes?

No, budgeting is essential for individuals of all income levels. It helps you manage your finances effectively, regardless of your income. Budgeting allows you to make the most of your financial resources and achieve your goals, no matter how much you earn.

2. Can budgeting strategies help me save for emergencies?

Absolutely! Budgeting strategies emphasize the importance of setting aside funds for emergencies. By allocating a portion of your income towards an emergency fund, you can be prepared for unexpected expenses and have peace of mind knowing you have a financial safety net.

3. How often should I review and adjust my budget?

It is recommended to regularly review and adjust your budget based on your financial circumstances. Major life events, changes in income, or new financial goals may require adjustments to ensure your budget remains effective and aligned with your current situation.

4. Can budgeting strategies help me pay off my debts?

Yes, budgeting strategies are excellent tools for debt repayment. By allocating a specific amount towards debt repayment each month and prioritizing high-interest debts, you can systematically pay off your debts and achieve financial freedom.

5. Are there any mobile apps or tools that can assist with budgeting?

Yes, there are numerous mobile apps and online tools available to assist with budgeting. These apps can help track income and expenses, set financial goals, and provide valuable insights into your spending habits. Some popular budgeting apps include Mint, You Need a Budget (YNAB), and Personal Capital.

Conclusion: Taking Control of Your Financial Future

In conclusion, implementing effective budgeting strategies is crucial for maximizing financial efficiency and achieving your goals. By understanding the purpose, advantages, and disadvantages of budgeting, as well as how to implement these strategies, you can take control of your financial future.

Start by assessing your current financial situation, setting specific goals, and creating a budget that aligns with your needs and aspirations. Regularly review and adjust your budget as necessary, and stay disciplined in managing your finances. Remember, budgeting is a lifelong practice that can lead to financial stability, freedom, and peace of mind.

Take the first step today and embark on your journey towards financial success!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Every individual’s financial situation is unique, and it is recommended to consult with a professional financial advisor before making any significant financial decisions.

This post topic: Budgeting Strategies