Secure Your Future: Unlock Retirement Savings For Millennials Now!

Retirement Savings for Millennials

Introduction

Dear Readers,

2 Picture Gallery: Secure Your Future: Unlock Retirement Savings For Millennials Now!

Welcome to our article on retirement savings for millennials. In this day and age, it is crucial for young individuals like yourself to start thinking about your future and how you can secure a comfortable retirement. Despite the challenges faced by millennials, there are still various options available that can help you build a solid financial foundation for your retirement years. In this article, we will explore the what, who, when, where, why, and how of retirement savings for millennials, along with the advantages and disadvantages of different approaches. So, let’s dive in and start planning for a prosperous future!

What is Retirement Savings for Millennials?

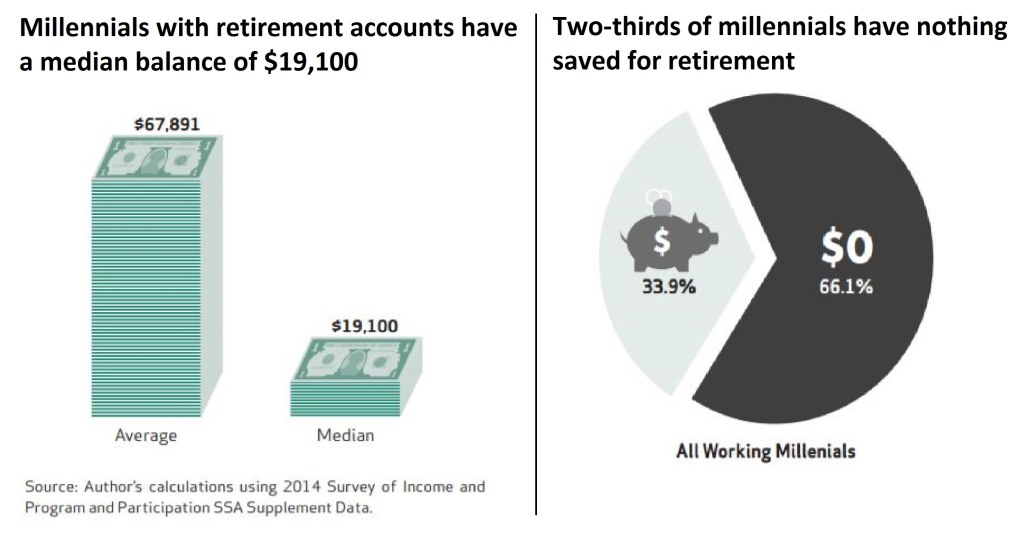

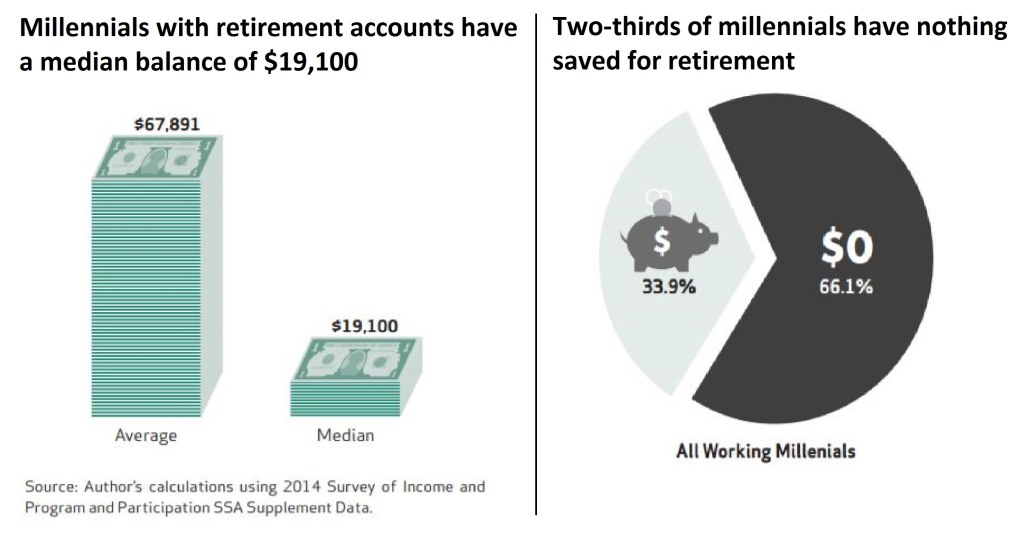

Image Source: cnbc.com

Retirement savings for millennials refers to the process of setting aside funds and investments specifically aimed at securing a financially stable retirement. This involves making strategic decisions about saving, investing, and planning for the long term to ensure a comfortable lifestyle during the golden years. Millennials face unique challenges compared to previous generations, such as high student loan debt, stagnant wages, and uncertain economic conditions. However, with careful planning and the right knowledge, millennials can still build a strong financial foundation for retirement.

Who Should Be Concerned About Retirement Savings?

Retirement savings is a concern for individuals of all ages, but it becomes even more critical for millennials. As a generation, millennials face the daunting task of saving for retirement in an era of economic uncertainty and increasing life expectancy. With traditional pension plans becoming less common and Social Security facing challenges, millennials need to take control of their financial future to ensure a comfortable retirement. It is never too early to start saving, and the earlier millennials begin planning for retirement, the greater their chances of achieving their desired lifestyle in the future.

When Should Millennials Start Saving for Retirement?

The ideal time for millennials to start saving for retirement is now. The power of compounding interest makes starting early crucial to achieving long-term financial goals. By starting to save in their early twenties, millennials can take advantage of the years of potential growth ahead of them. However, it is never too late to start saving, and even those who are in their thirties or forties can make significant progress by implementing sound saving and investing strategies.

Where to Save for Retirement as a Millennial?

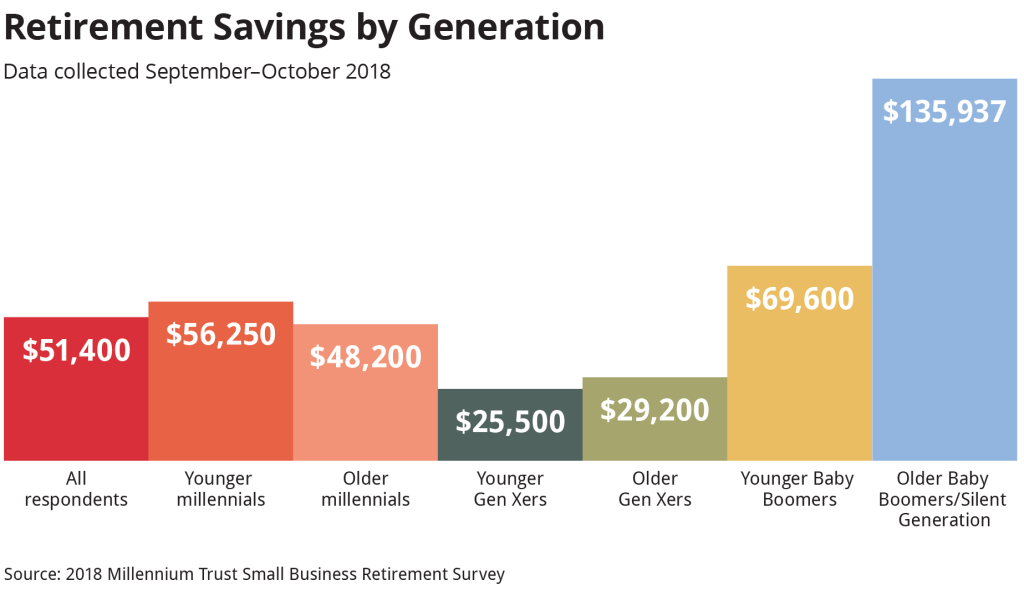

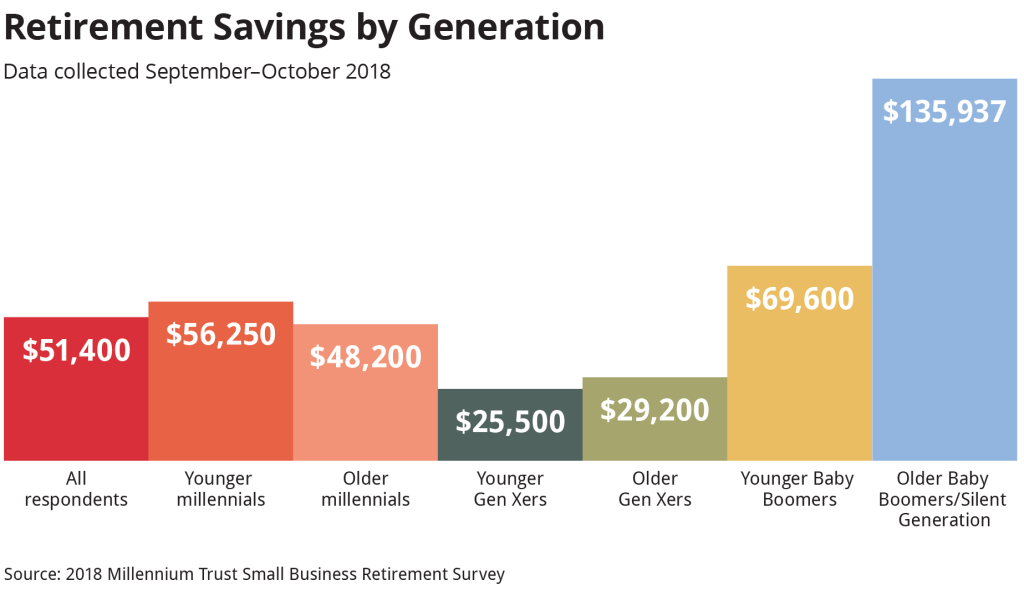

Image Source: amazonaws.com

There are several options available for millennials to save for retirement. One popular choice is employer-sponsored retirement plans, such as 401(k)s or 403(b)s. These plans offer tax advantages and may include employer matching contributions, making them an attractive option. Additionally, individual retirement accounts (IRAs) provide another avenue for retirement savings. Traditional IRAs offer tax-deferred growth, while Roth IRAs allow for tax-free withdrawals in retirement. Millennials can also consider investing in low-cost index funds or exchange-traded funds (ETFs) to diversify their retirement portfolio.

Why Is Retirement Savings Important for Millennials?

Retirement savings is crucial for millennials due to the changing landscape of retirement benefits. Unlike previous generations, millennials cannot rely solely on pensions or Social Security to fund their retirement. By taking control of their own savings, millennials can ensure a comfortable and financially secure future. Saving for retirement also provides a sense of financial independence and peace of mind, knowing that they have taken the necessary steps to secure their financial future.

How Can Millennials Save for Retirement?

Millennials can save for retirement by adopting various strategies. Firstly, they should establish a budget and identify areas where they can reduce expenses and redirect those savings towards retirement accounts. Automating contributions to retirement accounts is another effective method, as it removes the temptation to spend the money elsewhere. Millennials should also aim to increase their savings rate over time as their income grows. Lastly, seeking professional financial advice and educating themselves about different investment options can help millennials make informed decisions about their retirement savings.

Advantages and Disadvantages of Retirement Savings for Millennials

Advantages:

1. Financial Independence: Retiring with sufficient savings allows millennials to maintain their desired lifestyle without relying on others for financial support.

2. Flexibility and Control: Saving for retirement gives millennials the flexibility to pursue their passions and interests during their golden years.

3. Tax Advantages: Retirement accounts such as 401(k)s and IRAs offer tax benefits, allowing millennials to maximize their savings.

4. Compound Growth: Starting early and consistently saving for retirement enables millennials to take advantage of compound growth over time.

5. Peace of Mind: Having a secure retirement savings plan provides peace of mind and reduces financial stress in the future.

Disadvantages:

1. Opportunity Cost: Saving for retirement may require millennials to forgo immediate spending on other goals or experiences.

2. Economic Uncertainty: Market fluctuations and economic downturns can impact the value of retirement savings.

3. Inflation Risk: The rising cost of living can erode the purchasing power of retirement savings over time.

4. Limited Access: Early withdrawals from retirement accounts may result in penalties and taxes, limiting liquidity.

5. Lack of Financial Literacy: Without proper knowledge and guidance, millennials may struggle to make informed investment decisions for their retirement savings.

Frequently Asked Questions (FAQs)

1. Can I withdraw money from my retirement savings before I retire?

Answer: In most cases, early withdrawals from retirement accounts come with penalties and taxes. However, there are certain exceptions, such as using the funds for a first-time home purchase or qualified education expenses.

2. Do I need a financial advisor to help me with retirement savings?

Answer: While it is not mandatory, seeking guidance from a financial advisor can provide valuable insights and help you make informed decisions about your retirement savings. They can assist in creating a personalized plan based on your goals and risk tolerance.

3. Should I prioritize paying off debt or saving for retirement?

Answer: It depends on the interest rates and terms of your debts. Generally, it is wise to strike a balance between debt repayment and retirement savings. Consider prioritizing higher-interest debts while still contributing to your retirement accounts.

4. How much should I save for retirement as a millennial?

Answer: The amount you should save largely depends on your desired lifestyle in retirement, current income, and age. As a rule of thumb, financial experts often recommend saving at least 10-15% of your income for retirement.

5. What happens to my retirement savings if I change jobs?

Answer: When changing jobs, you typically have the option to roll over your retirement savings into a new employer’s plan, an individual retirement account (IRA), or leave the funds in your previous employer’s plan. Each option has its own advantages and considerations, so it is essential to evaluate your choices carefully.

Conclusion

In conclusion, retirement savings for millennials is a topic of utmost importance. By starting early, seeking knowledge, and making informed decisions, millennials can secure a prosperous future and enjoy a comfortable retirement. Remember, it’s never too early or too late to start saving. Take control of your financial future today, and reap the rewards in the years to come. Start planning, start saving, and start building your retirement nest egg!

Best regards,

Your Name

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. Every individual’s financial situation is unique, and it is essential to consult with a professional financial advisor before making any investment decisions or implementing any retirement savings strategies. The author and the website disclaim any liability for any financial loss or damage incurred as a result of following the information provided in this article.

This post topic: Budgeting Strategies