Mastering Popular Budgeting Strategies: Unlock Your Financial Freedom Now!

Popular Budgeting Strategies: A Comprehensive Guide

Greetings, Readers!

Welcome to our comprehensive guide on popular budgeting strategies. In this article, we will explore different budgeting techniques that can help you effectively manage your finances and achieve your financial goals. Whether you are trying to save money, pay off debt, or simply gain better control over your spending, these strategies can provide you with the guidance and structure you need. So, let’s dive in and discover the best budgeting approaches for your financial success.

1 Picture Gallery: Mastering Popular Budgeting Strategies: Unlock Your Financial Freedom Now!

Introduction

1. What are popular budgeting strategies?

Popular budgeting strategies are well-established methods used by individuals and households to plan and allocate their financial resources. These strategies provide a framework for organizing income, expenses, savings, and investments. By following a budgeting strategy, individuals can track their spending, identify areas where they can save money, and work towards long-term financial stability.

Image Source: ctfassets.net

2. Who can benefit from popular budgeting strategies?

Anyone who wants to improve their financial situation can benefit from popular budgeting strategies. Whether you are a college student on a tight budget, a young professional looking to save for the future, or a retiree trying to stretch your retirement savings, these strategies can be tailored to suit your specific needs and goals.

3. When should you start using popular budgeting strategies?

It’s never too early or too late to start using popular budgeting strategies. The sooner you begin, the sooner you can take control of your finances and start working towards your financial goals. However, even if you have been managing your finances without a budget, it’s never too late to start. Budgeting can help you identify unnecessary expenses, save money, and make more informed financial decisions.

4. Where can you implement popular budgeting strategies?

Popular budgeting strategies can be implemented in various areas of your life, including personal finances, household expenses, business finances, and even event planning. Whether you are budgeting for your daily expenses, saving for a vacation, or managing the finances of a small business, these strategies can be applied to any financial situation.

5. Why are popular budgeting strategies important?

Popular budgeting strategies are important because they provide a roadmap for financial success. They help you prioritize your spending, save money, and make informed financial decisions. Budgeting allows you to track your progress towards your financial goals and make adjustments as needed. Moreover, budgeting can reduce financial stress and provide you with peace of mind, knowing that you are in control of your finances.

6. How can you implement popular budgeting strategies?

Implementing popular budgeting strategies starts with setting clear financial goals. Whether you want to save for a down payment on a house, pay off your student loans, or retire early, defining your goals will guide your budgeting decisions. Once you have established your goals, you can create a budget by tracking your income and expenses, identifying areas where you can cut back, and allocating your money accordingly. Regularly reviewing your budget and making adjustments will help you stay on track and ensure your budget remains effective.

Types of Popular Budgeting Strategies

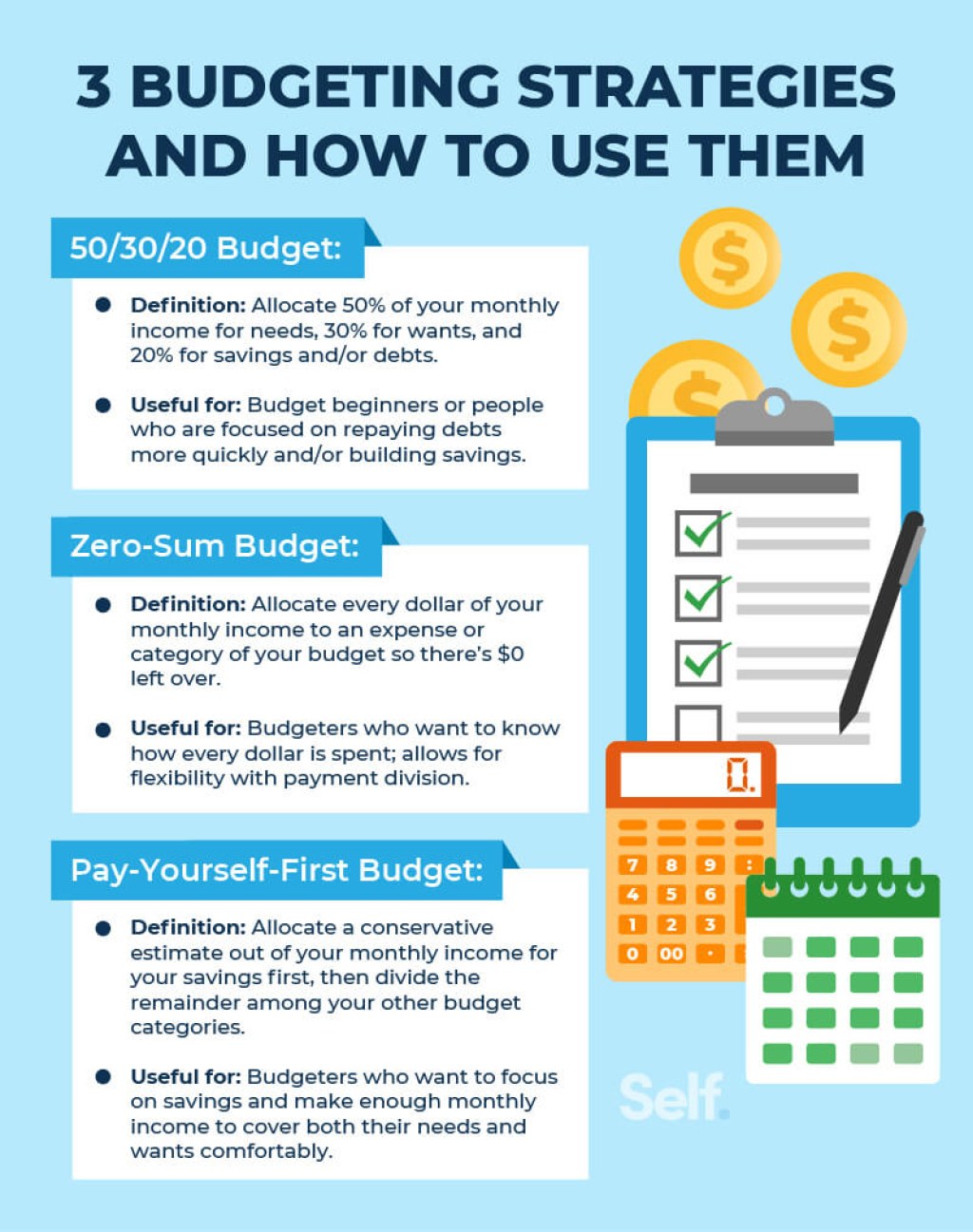

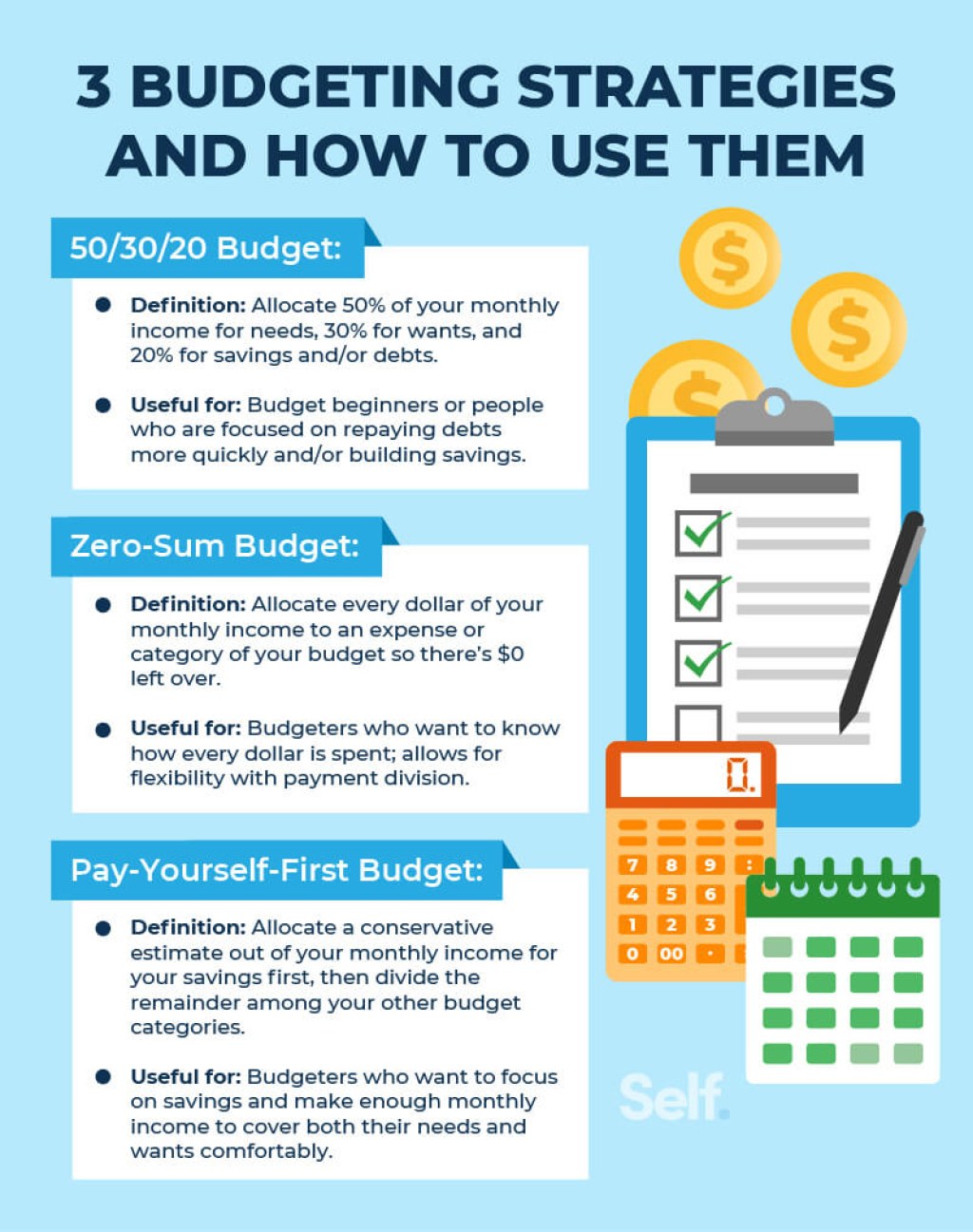

1. The 50/30/20 Budgeting Method

Emoji: 💰

The 50/30/20 budgeting method is a popular strategy that helps individuals allocate their income into three categories: needs, wants, and savings. With this method, 50% of your income is allocated to essential needs, such as housing, utilities, and food. 30% is dedicated to wants, including entertainment, dining out, and non-essential purchases. The remaining 20% is reserved for savings and debt payments.

2. The Envelope System

Emoji: 📩

The envelope system is a cash-based budgeting method that involves dividing your money into different envelopes dedicated to specific spending categories. Each envelope represents a different expense, such as groceries, entertainment, or transportation. This method helps you visually see how much money you have left for each category, preventing overspending and providing better control over your expenses.

3. Zero-Based Budgeting

Emoji: 📊

Zero-based budgeting is a method where every dollar you earn is allocated towards a specific purpose. With this strategy, you start with zero dollars and assign each dollar to a category, such as rent, groceries, or savings. The goal is to ensure that your income minus your expenses equals zero, leaving no money unaccounted for. Zero-based budgeting helps you prioritize your spending and ensures that every dollar has a purpose.

4. The 80/20 Budgeting Rule

Emoji: 🔢

The 80/20 budgeting rule suggests allocating 80% of your income towards essential expenses and financial obligations, such as rent, bills, debt payments, and savings. The remaining 20% can be used for non-essential expenses, such as dining out, entertainment, or personal indulgences. This method ensures that you prioritize your financial responsibilities while still allowing yourself some discretionary spending.

5. The Pay Yourself First Strategy

Emoji: 💵

The pay yourself first strategy involves treating your savings as a non-negotiable expense. Instead of saving whatever is left at the end of the month, you prioritize saving by automatically allocating a portion of your income towards savings or investments. By paying yourself first, you ensure that saving becomes a regular habit, helping you build wealth and achieve your financial goals.

Advantages and Disadvantages of Popular Budgeting Strategies

1. Advantages of Popular Budgeting Strategies

Emoji: 👍

– Increased financial control and awareness

– Better money management skills

– Ability to save for future goals

– Reduced financial stress

– Improved decision-making

2. Disadvantages of Popular Budgeting Strategies

Emoji: 👎

– Requires discipline and consistency

– Can feel restrictive for some individuals

– Initial setup and learning curve

– Requires regular maintenance and adjustments

– May require sacrifice and lifestyle changes

Frequently Asked Questions (FAQs)

1. How do I choose the right budgeting strategy for me?

Choosing the right budgeting strategy depends on your financial goals, personal preferences, and individual circumstances. Consider your priorities, spending habits, and long-term objectives to determine which strategy aligns best with your needs.

2. Can I use multiple budgeting strategies at the same time?

Absolutely! You can combine different budgeting strategies to create a personalized approach that suits your financial situation. Experiment with different methods and adapt them to your specific needs.

3. What if my financial situation changes?

Flexibility is key when it comes to budgeting. If your financial situation changes, such as a decrease in income or an unexpected expense, you may need to adjust your budget accordingly. Regularly reviewing and updating your budget will ensure it remains effective.

4. How long does it take to see results from budgeting?

The time it takes to see results from budgeting varies for each individual. It depends on factors such as your financial goals, income, and spending habits. However, with consistency and commitment, you can start seeing positive changes in your finances within a few months.

5. What if I make a mistake in my budget?

Mistakes are a natural part of the budgeting process. If you make a mistake, don’t be discouraged. Use it as a learning opportunity and adjust your budget accordingly. Remember, budgeting is a flexible tool that can be modified to suit your needs.

Conclusion

In conclusion, implementing a popular budgeting strategy can have a significant impact on your financial well-being. By taking control of your finances, you can reduce stress, save for the future, and work towards achieving your financial goals. Choose a budgeting strategy that aligns with your needs, regularly review and update your budget, and stay committed to your financial journey. Remember, every small step you take towards budgeting brings you closer to financial freedom.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. Different budgeting strategies may work differently for individuals, and it is important to consult with a financial professional before making any significant financial decisions. Always consider your unique financial circumstances and goals before implementing any budgeting strategy.

This post topic: Budgeting Strategies