Unveiling The Eye-Opening Retirement Savings Average By Age: Discover Your Financial Future Now!

Retirement Savings Average by Age

Introduction

Dear Readers,

2 Picture Gallery: Unveiling The Eye-Opening Retirement Savings Average By Age: Discover Your Financial Future Now!

Welcome to our article on retirement savings average by age. In today’s fast-paced world, it is crucial to plan for our future, especially when it comes to our finances. Retirement savings play a vital role in ensuring a comfortable and secure life after retirement. By understanding the average savings required for retirement based on age, we can make informed decisions and take appropriate actions to secure our financial future. In this article, we will delve into the details of retirement savings average by age, providing you with valuable insights and guidance.

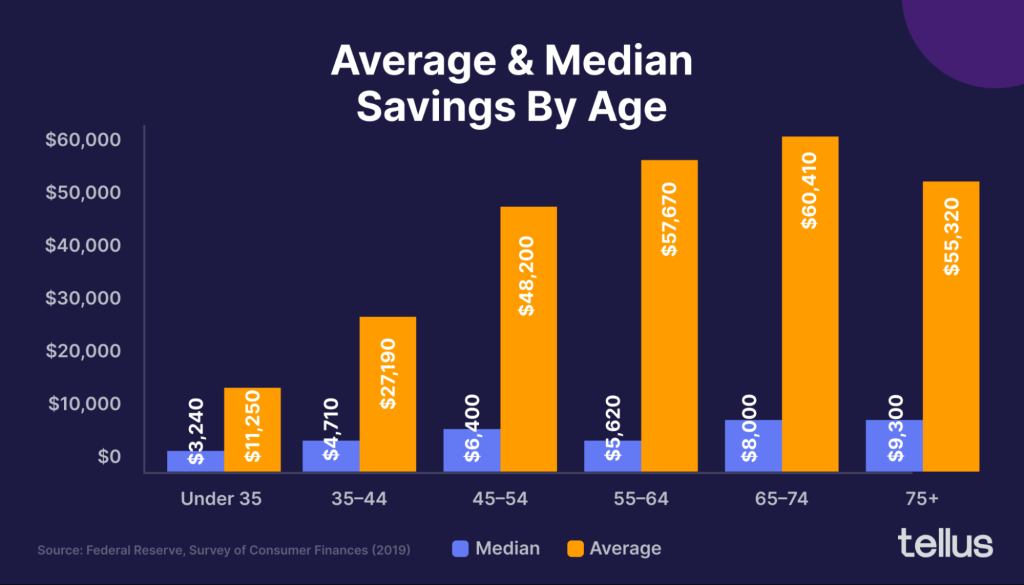

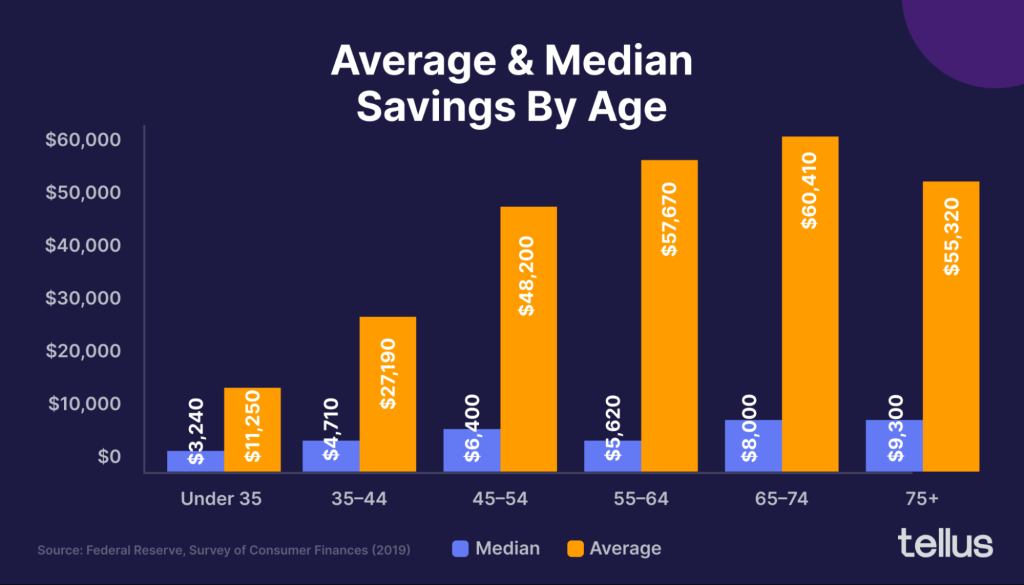

Table: Retirement Savings Average by Age

Age Group

Average Retirement Savings

Image Source: tellusapp.com

20-29

$10,000

30-39

$45,000

40-49

$63,000

50-59

$117,000

60 and above

$172,000

What is Retirement Savings Average by Age?

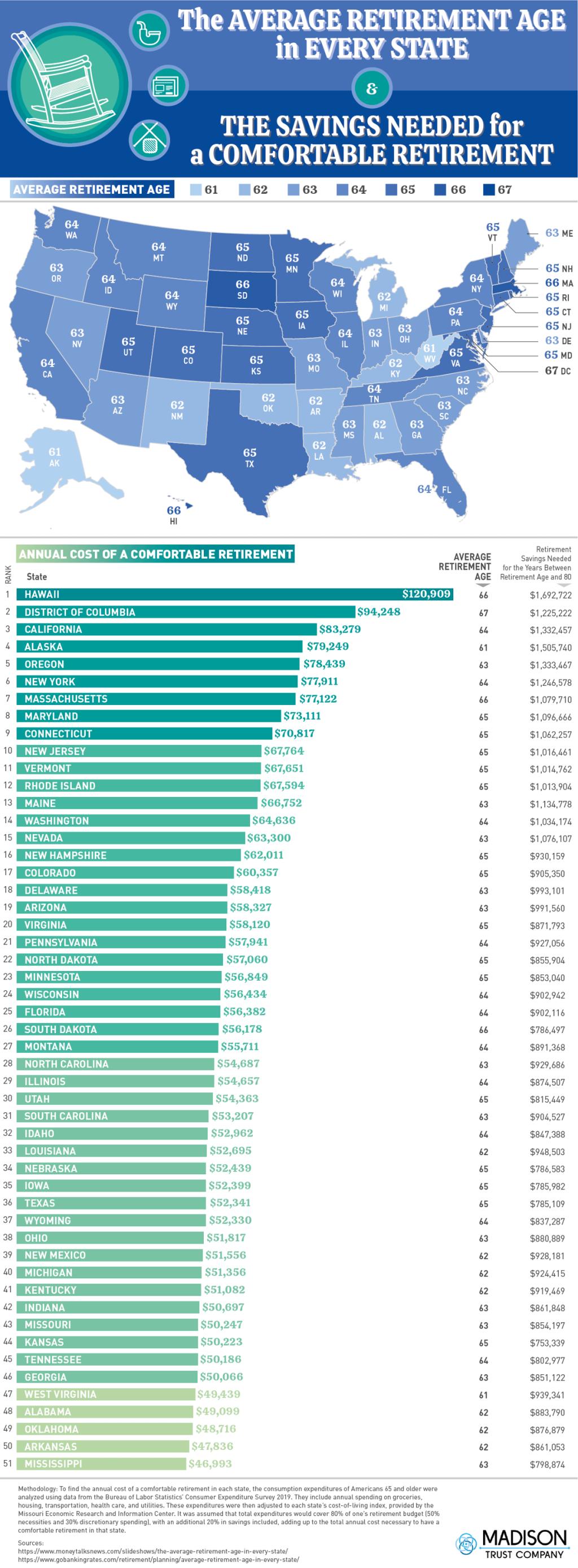

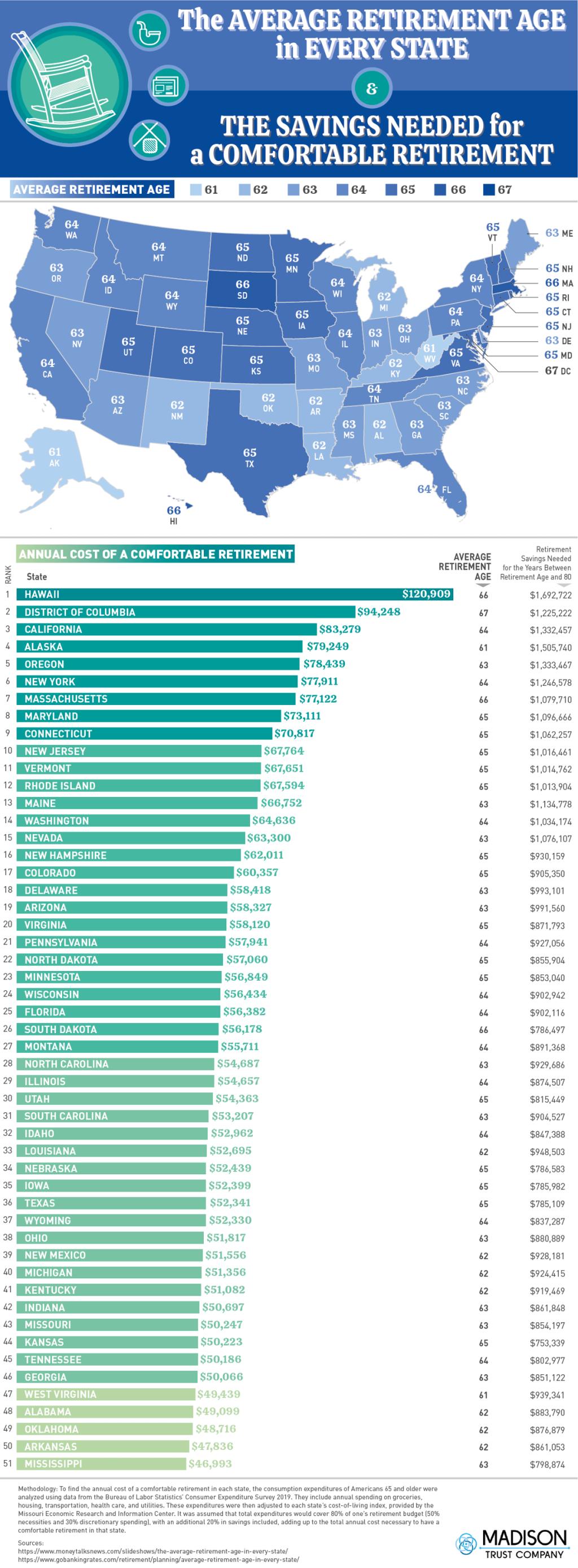

Image Source: madisontrust.com

🔍 Retirement savings average by age refers to the recommended amount of money individuals should have saved for retirement based on their age group. It provides a benchmark for individuals to assess their savings progress and make adjustments if necessary.

Who Should Be Concerned About Retirement Savings Average by Age?

🔍 Everyone should be concerned about retirement savings average by age. Regardless of your current age, planning for retirement and saving adequately is essential to ensure financial security in your golden years.

When Should You Start Saving for Retirement?

🔍 The earlier you start saving for retirement, the better. Ideally, individuals should start saving for retirement as soon as they start earning income. The power of compound interest allows your savings to grow significantly over time, giving you a head start on building your retirement nest egg.

Where Can You Invest for Retirement Savings?

🔍 There are various investment options available for retirement savings, such as employer-sponsored retirement plans like 401(k)s, individual retirement accounts (IRAs), and annuities. It is essential to consider your risk tolerance, time horizon, and financial goals when choosing the right investment vehicle for your retirement savings.

Why is Retirement Savings Average by Age Important?

🔍 Retirement savings average by age is important because it provides individuals with a target goal to strive for. Knowing the average savings required for retirement based on age allows individuals to assess their progress, make adjustments if necessary, and take appropriate actions to ensure a financially secure retirement.

How Can You Increase Your Retirement Savings?

🔍 There are several ways to increase your retirement savings:

Start saving early and consistently.

Take advantage of employer matching contributions in retirement plans.

Maximize your retirement plan contributions.

Invest wisely and diversify your portfolio.

Consider delaying your retirement age.

Seek professional financial advice.

Advantages and Disadvantages of Retirement Savings Average by Age

Advantages:

Provides a benchmark for individuals to assess their savings progress.

Motivates individuals to save more for retirement.

Enables individuals to plan and make adjustments based on their age group.

Disadvantages:

May not consider individual circumstances and financial goals.

Can create stress and anxiety if individuals are unable to meet the average savings targets.

Frequently Asked Questions (FAQs)

Q: Is the retirement savings average by age applicable to everyone?

A: The retirement savings average by age serves as a general guideline, but individual circumstances may vary. It is essential to consider your unique situation and consult a financial advisor for personalized advice.

Q: Can I catch up on retirement savings if I haven’t started early?

A: While starting early is advantageous, it is never too late to start saving for retirement. Make a plan, set realistic goals, and take action to increase your savings.

Q: What happens if I don’t meet the retirement savings average by age?

A: Failing to meet the retirement savings average by age doesn’t mean financial doom. It simply indicates that you may need to make adjustments, save more aggressively, or consider alternative retirement strategies.

Q: Should I rely solely on my retirement savings?

A: Retirement savings should be complemented by other sources of income, such as Social Security benefits, pension plans, and other investments. Diversifying your income sources can provide a more secure financial future.

Q: Can I retire early if I exceed the retirement savings average by age?

A: Exceeding the retirement savings average by age provides a more comfortable cushion for retirement. However, the decision to retire early should consider various factors, such as healthcare expenses, lifestyle choices, and long-term financial sustainability.

Conclusion

In conclusion, planning for retirement and understanding the retirement savings average by age is crucial for financial security in our golden years. By knowing the recommended savings targets based on our age, we can make informed decisions, take appropriate actions, and stay on track to achieve a financially comfortable retirement. Start saving early, invest wisely, and seek professional advice to ensure a prosperous future. Remember, it’s never too early or too late to start saving for retirement. Take control of your financial destiny today!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Individual circumstances may vary, and it is recommended to consult with a qualified financial advisor before making any investment or retirement planning decisions. The authors and publishers of this article are not responsible for any consequences that may arise from the use of the information provided.

This post topic: Budgeting Strategies