Maximize Your Retirement Savings In NZ: Unlock A Secure Future With Us!

Retirement Savings in New Zealand: A Comprehensive Guide

Greetings, Readers! Today, we will delve into the vital topic of retirement savings in New Zealand. As we all know, planning for our golden years is essential to ensure financial security and peace of mind. In this article, we will provide you with valuable insights, tips, and information on retirement savings in NZ. So, let’s begin this informative journey together.

Introduction

Retirement savings play a crucial role in securing a comfortable future. In New Zealand, individuals are encouraged to save and invest wisely to ensure a financially stable retirement. With an aging population and an uncertain economic landscape, it has become increasingly important to understand the ins and outs of retirement savings in NZ. In this comprehensive guide, we will explore the various aspects of retirement savings, including what it entails, who it benefits, when to start planning, where to invest, why it is necessary, and how to go about it.

2 Picture Gallery: Maximize Your Retirement Savings In NZ: Unlock A Secure Future With Us!

What is Retirement Savings? 📚

Retirement savings refer to the funds set aside by individuals during their working years to sustain their lifestyle after retirement. It involves making regular contributions to retirement plans or investment vehicles that generate income over time. These savings serve as a safety net and supplement government-funded retirement benefits, ensuring a comfortable and financially independent future.

Who Can Benefit from Retirement Savings? 🤔

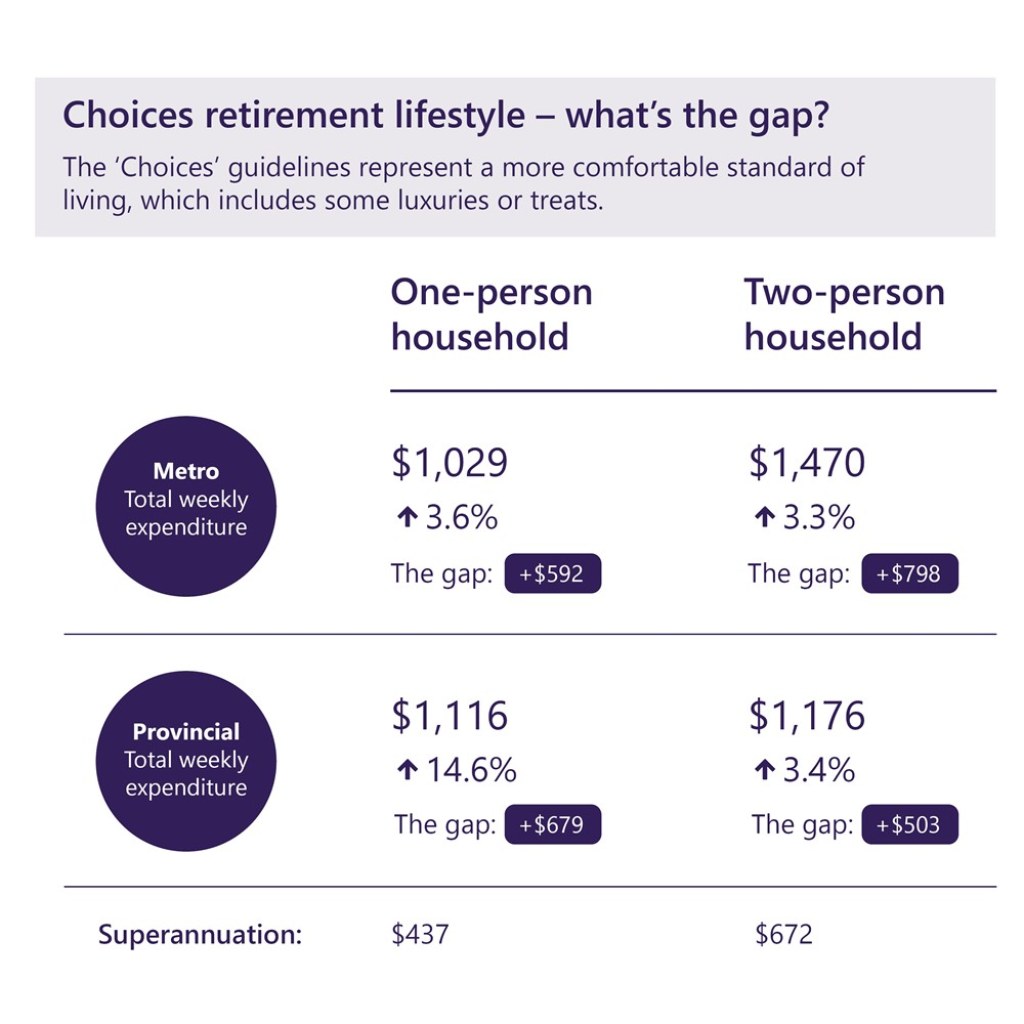

Image Source: consilium.co.nz

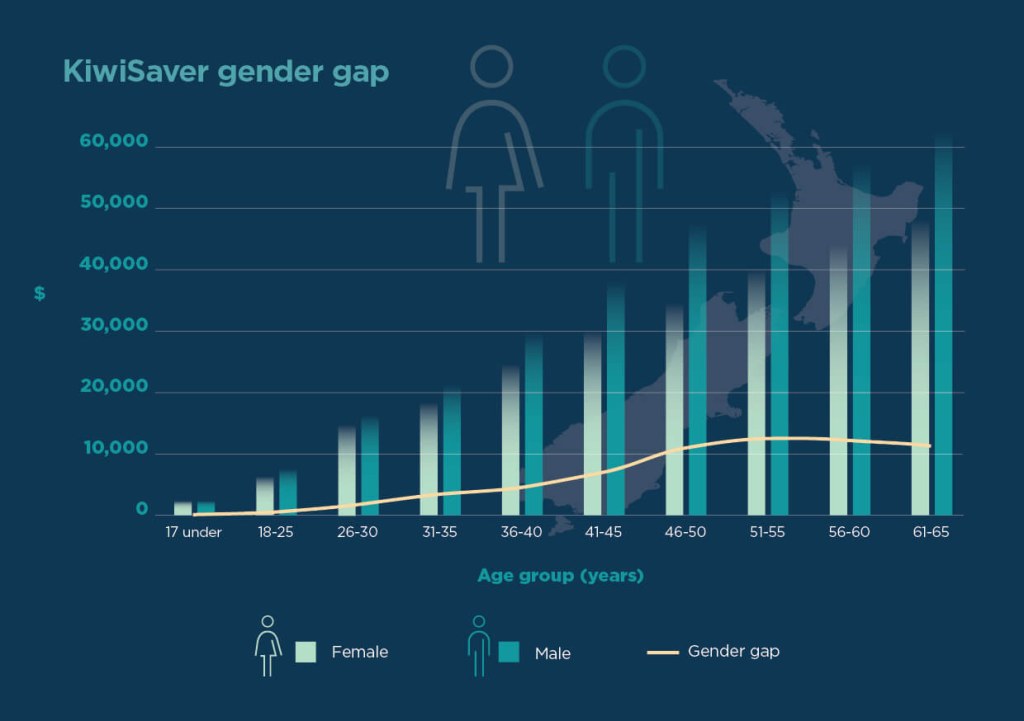

Retirement savings are beneficial for individuals from all walks of life. Whether you are a young professional embarking on your career or someone approaching retirement age, saving for retirement is essential. It offers financial security and the freedom to enjoy your retirement years without financial constraints. Additionally, self-employed individuals and those without access to employer-sponsored retirement plans must take charge of their savings.

When Should You Start Planning for Retirement? ⏰

It is never too early to start planning for retirement. The earlier you begin, the more time your savings have to grow through the power of compounding. Ideally, it is recommended to start saving for retirement in your twenties or as soon as you enter the workforce. However, even if you are in your thirties, forties, or beyond, it is crucial to take action and create a solid retirement savings plan.

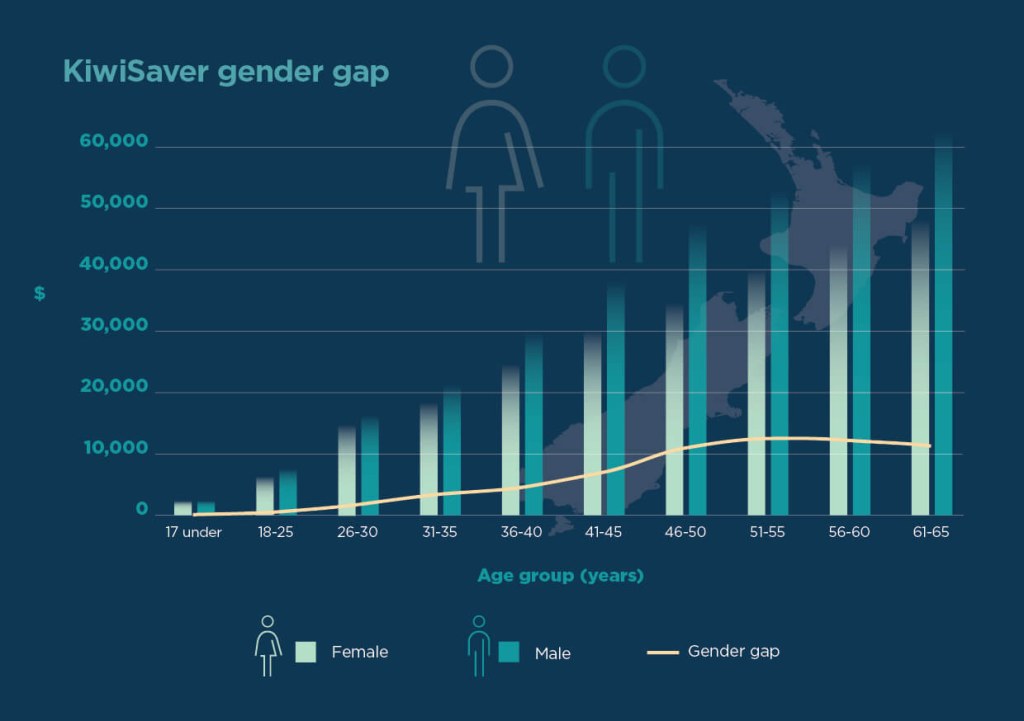

Where to Invest Your Retirement Savings? 🌍

Choosing the right investment options for your retirement savings is crucial to maximize returns and mitigate risks. In New Zealand, individuals have several choices, including KiwiSaver, managed funds, term deposits, shares, and property. Each option has its advantages and considerations, and it is advisable to seek professional advice to determine the best investment strategy based on your risk tolerance and retirement goals.

Image Source: govt.nz

Why is Retirement Savings Necessary? ❓

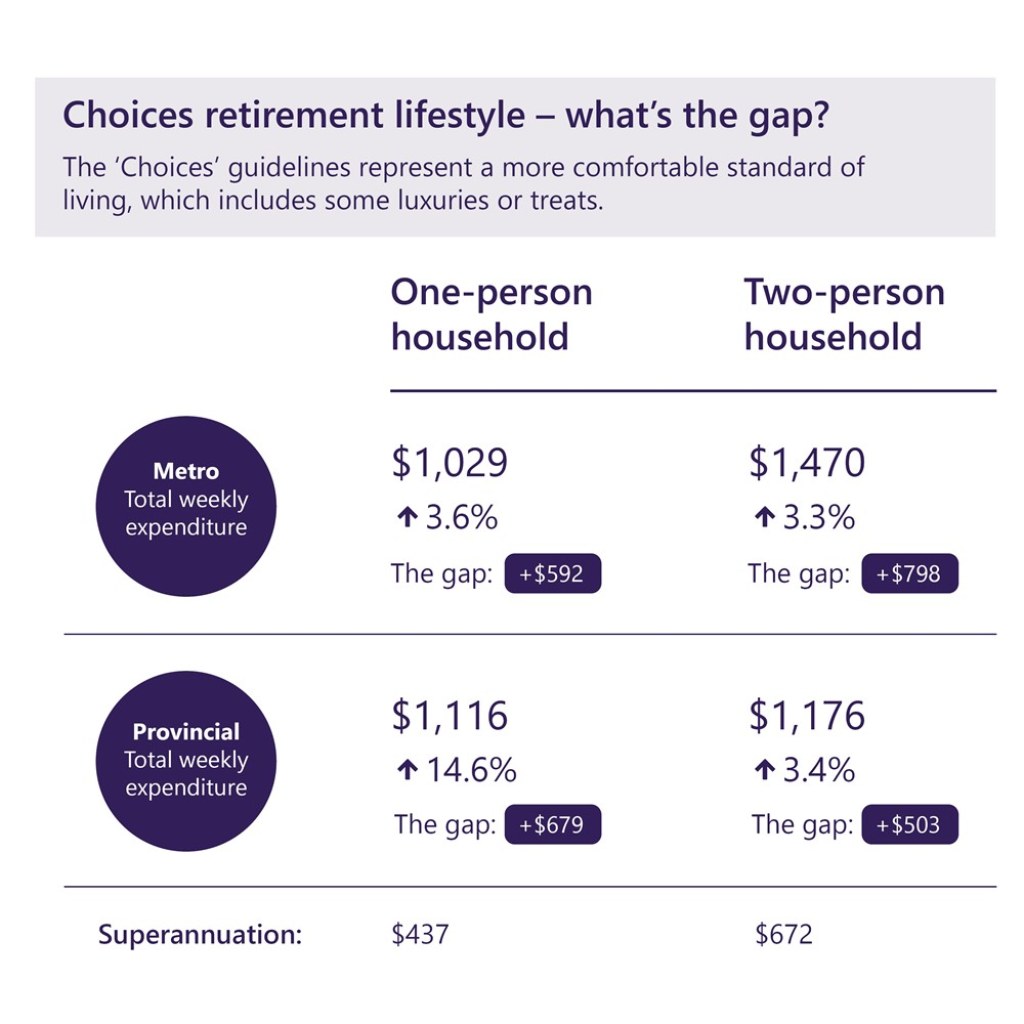

Retirement savings are necessary to bridge the gap between the income received from government-funded retirement benefits and the actual expenses incurred during retirement. As life expectancy increases, the need for a robust retirement savings plan becomes even more evident. Without adequate savings, individuals may face financial hardships and be unable to maintain their desired standard of living.

How to Start Saving for Retirement? 📝

Starting your retirement savings journey requires careful planning and disciplined saving habits. Begin by setting clear retirement goals and estimating your future expenses. Then, explore different retirement savings options available in New Zealand, such as KiwiSaver, and choose the one that aligns with your financial objectives. Make regular contributions and monitor your savings regularly, adjusting your strategy as needed.

The Advantages and Disadvantages of Retirement Savings

Advantages of Retirement Savings ✅

1. Financial Security: Retirement savings provide a safety net and ensure a financially secure future.

2. Independence: Sufficient savings allow individuals to maintain their lifestyle and enjoy retirement without relying solely on government benefits.

3. Flexibility: Retirement savings offer flexibility in choosing when and how to retire, giving individuals the freedom to pursue their passions.

4. Tax Benefits: Certain retirement savings options, such as KiwiSaver, come with tax advantages, allowing you to maximize your savings.

5. Legacy Planning: Building a robust retirement fund enables you to leave a financial legacy for your loved ones.

Disadvantages of Retirement Savings ❌

1. Market Volatility: Investments are subject to market fluctuations, and poor investment decisions can result in losses.

2. Inflation Risk: The impact of inflation can erode the purchasing power of your retirement savings over time.

3. Financial Discipline: Saving for retirement requires consistent contributions and disciplined financial habits.

4. Opportunity Cost: The money allocated for retirement savings might have been used for other purposes or investments.

5. Regulatory Changes: Government policies and regulations regarding retirement savings can change, impacting your savings strategy.

Frequently Asked Questions (FAQs)

1. Can I Withdraw My KiwiSaver Funds Before Retirement Age?

Answer: In certain circumstances, such as significant financial hardship or purchasing your first home, you may be eligible to withdraw your KiwiSaver funds before reaching the retirement age.

2. How Much Should I Contribute to My Retirement Savings Each Month?

Answer: The ideal contribution amount varies based on individual circumstances and goals. It is advisable to contribute at least the minimum required amount for your chosen retirement savings scheme.

3. What Happens to My Retirement Savings if I Pass Away?

Answer: In the event of your passing, your retirement savings can be transferred to your designated beneficiaries or included in your estate for distribution.

4. Are There Penalties for Withdrawing My Retirement Savings Early?

Answer: Withdrawing retirement savings before the designated age may result in penalties or tax implications, depending on the circumstances.

5. How Do I Choose the Right Investment Option for My Retirement Savings?

Answer: Consider factors such as your risk tolerance, investment goals, and time horizon when selecting investment options for your retirement savings. Consulting a financial advisor can provide valuable guidance.

Conclusion

In conclusion, retirement savings in New Zealand are of utmost importance to secure a comfortable and financially independent future. By understanding the key aspects of retirement savings, including what it entails, who can benefit, when to start planning, where to invest, why it is necessary, and how to go about it, individuals can make informed decisions and take control of their retirement journey. Remember, the earlier you start saving, the brighter your retirement years will be. So, take action today and pave the way to a prosperous retirement.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. It is important to consult with a professional financial advisor before making any investment decisions.

This post topic: Budgeting Strategies