Maximizing Success: The Ultimate Budget Strategy Business Plan For Smashing Results!

Budget Strategy Business Plan: A Comprehensive Guide for Success

Welcome, readers! Today, we will delve into the world of budget strategy business plans, a crucial aspect of any successful organization. In this article, we will explore the ins and outs of creating an effective budget strategy, and how it can significantly impact the growth and success of your business. So, without further ado, let’s dive in and unlock the secrets to budget strategy business plans!

Introduction

When it comes to running a successful business, having a well-defined budget strategy is paramount. A budget strategy serves as a roadmap, guiding your financial decisions and ensuring that your organization stays on track to achieve its goals. It is not just a mere document filled with numbers; it is a powerful tool that helps you allocate resources effectively, mitigate risks, and make informed business decisions.

2 Picture Gallery: Maximizing Success: The Ultimate Budget Strategy Business Plan For Smashing Results!

A budget strategy encompasses various elements, such as revenue projections, expense forecasts, cash flow management, and financial goal setting. It is a comprehensive plan that outlines how your business will generate income, manage costs, and make strategic investments. By developing a solid budget strategy, you can gain a competitive edge, improve financial stability, and steer your business towards long-term success.

Now, let’s take a closer look at the key components of a budget strategy business plan.

What is a Budget Strategy Business Plan? 📊

A budget strategy business plan is a detailed document that outlines your organization’s financial goals and the strategies you will employ to achieve them. It provides a comprehensive overview of your company’s revenue streams, cost structures, and financial projections. A well-crafted budget strategy business plan helps you align your financial resources with your business objectives and enables you to make informed decisions for the future.

Revenue Projections 💰

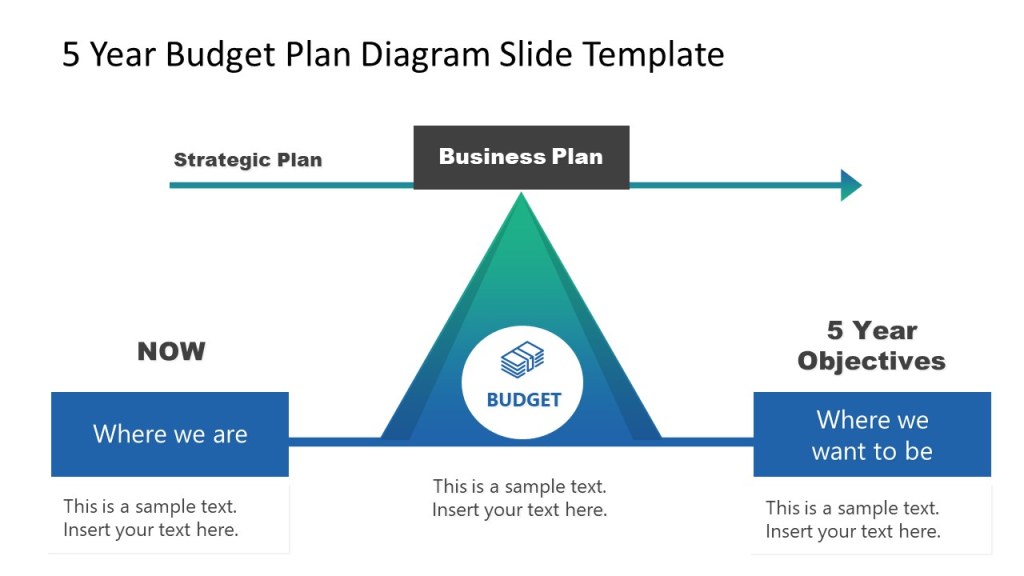

Image Source: slidemodel.com

One of the primary components of a budget strategy business plan is revenue projections. This involves estimating the income your business will generate over a specific period. It is essential to conduct thorough market research, analyze industry trends, and consider internal factors such as product pricing and sales forecasts. Accurate revenue projections provide valuable insights into your business’s financial health and help you set realistic goals.

Expense Forecasts 💸

In conjunction with revenue projections, expense forecasts are crucial for developing an effective budget strategy business plan. This involves estimating the costs associated with running your business, such as salaries, overhead expenses, marketing campaigns, and production costs. By accurately forecasting your expenses, you can ensure that your business operates within its means and identify areas where cost-cutting measures can be implemented.

Cash Flow Management 💼

Effective cash flow management is another critical aspect of a budget strategy business plan. Cash flow refers to the movement of money in and out of your business. It is crucial to maintain a positive cash flow to meet your financial obligations and sustain day-to-day operations. A budget strategy helps you monitor your cash inflows and outflows, identify potential cash flow gaps, and implement strategies to maintain a healthy financial position.

Financial Goal Setting 🎯

Setting financial goals is an integral part of any budget strategy business plan. By clearly defining your objectives, you can focus your efforts and resources towards achieving them. Financial goals can include increasing revenue, reducing costs, improving profitability, or expanding into new markets. With measurable and achievable goals in place, you can track your progress and make adjustments to your budget strategy as needed.

Risk Mitigation 🛡️

A budget strategy business plan also plays a vital role in mitigating financial risks. By conducting thorough risk assessments and incorporating contingency plans into your budget strategy, you can safeguard your business against potential disruptions. This includes identifying potential cash flow shortages, anticipating market fluctuations, and preparing for unforeseen circumstances that could impact your organization’s financial stability.

Investment Opportunities 📈

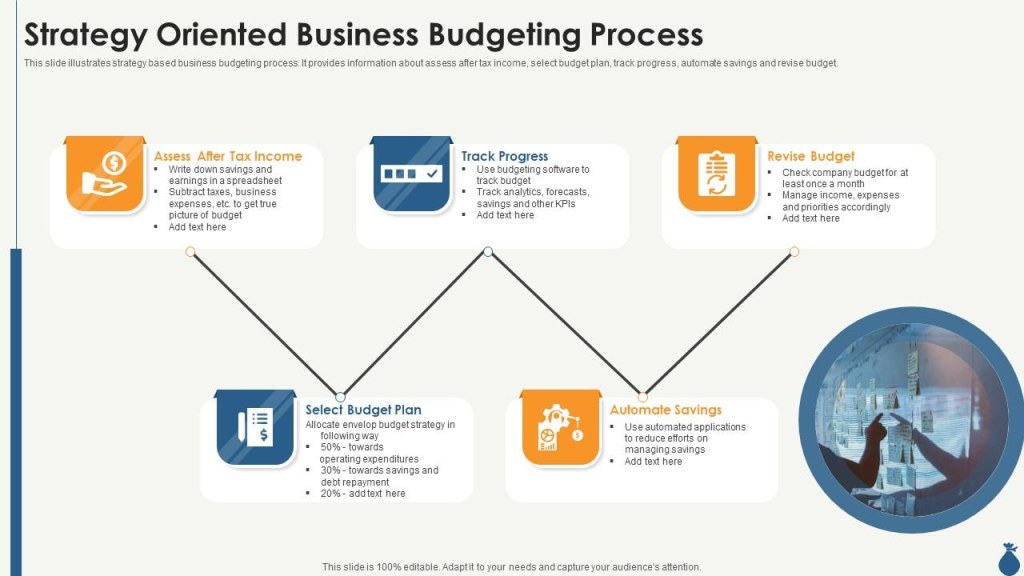

Image Source: licdn.com

Lastly, a budget strategy business plan enables you to identify investment opportunities that align with your business objectives. By analyzing your financial resources and assessing market trends, you can make strategic investments that drive growth and maximize returns. This could include expanding your product line, entering new markets, or investing in research and development. A well-defined budget strategy helps you allocate funds to these opportunities and optimize your return on investment.

Advantages and Disadvantages of Budget Strategy Business Plans

Like any business strategy, budget strategy business plans have their fair share of advantages and disadvantages. Let’s take a closer look at both sides of the coin:

Advantages of Budget Strategy Business Plans ✅

1. Financial Control: A well-designed budget strategy gives you greater control over your organization’s finances, allowing you to allocate resources efficiently and make informed decisions.

2. Goal Alignment: Budget strategies help align your financial goals with your overall business objectives, ensuring that your resources are channeled towards achieving them.

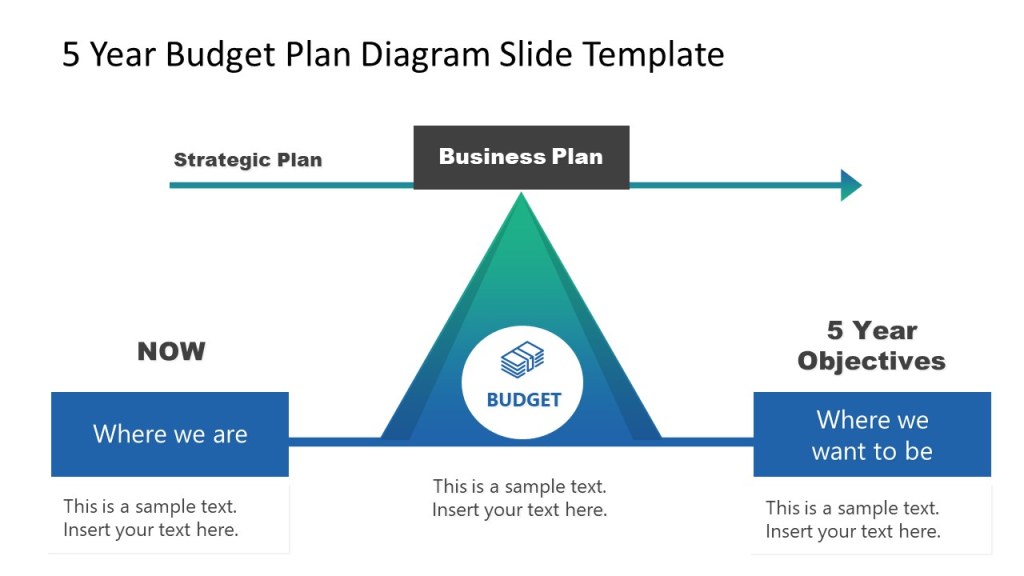

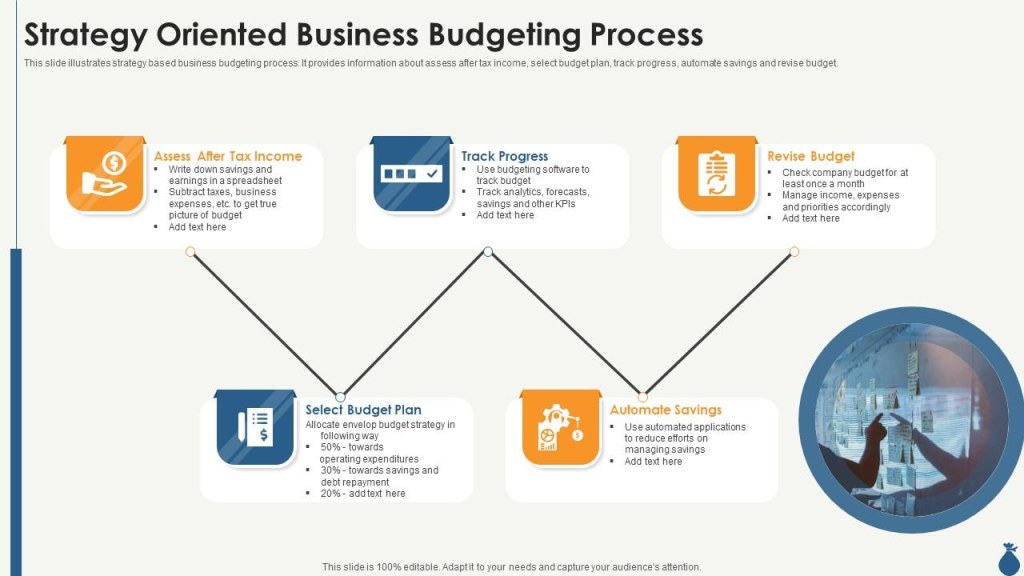

Image Source: slideteam.net

3. Resource Optimization: By identifying areas of excess spending or inefficient resource allocation, budget strategies enable you to optimize your resources and improve operational efficiency.

4. Performance Evaluation: Budget strategies serve as a benchmark for evaluating your business’s financial performance, enabling you to track progress and identify areas for improvement.

5. Risk Management: A budget strategy helps you anticipate and mitigate financial risks, ensuring that your business is prepared for unexpected challenges.

Disadvantages of Budget Strategy Business Plans ❌

1. Rigidity: Budget strategies can sometimes be inflexible, making it challenging to adapt to rapidly changing business environments or unforeseen circumstances.

2. Time-Consuming: Developing and maintaining a budget strategy requires significant time and effort, diverting resources away from other critical business activities.

3. Limited Accuracy: Despite careful planning, budget strategies may not always accurately predict future financial outcomes, leading to unforeseen budget shortfalls or surpluses.

4. Over-Reliance on Assumptions: Budget strategies are based on assumptions and forecasts, which may not always align with actual market conditions or consumer behavior.

5. Lack of Flexibility: Strict adherence to a budget strategy may hinder innovation or the ability to capitalize on emerging opportunities that fall outside of the initial plan.

Frequently Asked Questions (FAQs) about Budget Strategy Business Plans

Q1: How often should I review and update my budget strategy?

A1: It is recommended to review and update your budget strategy on a regular basis, at least annually. However, major shifts in your business environment or significant internal changes may require more frequent updates.

Q2: What are some common budgeting pitfalls to avoid?

A2: Common budgeting pitfalls include underestimating expenses, overestimating revenue, failing to account for unforeseen circumstances, and not actively monitoring and adjusting your budget as needed.

Q3: Should I involve my team in the budgeting process?

A3: Yes, involving your team in the budgeting process can lead to greater buy-in and ownership of the budget strategy. It also allows for valuable input and insights from those who are directly involved in the day-to-day operations of your business.

Q4: How can I ensure that my budget strategy remains flexible?

A4: To ensure flexibility, it is important to build contingency plans into your budget strategy, regularly monitor your financial performance, and be open to adjusting your budget as needed based on changing circumstances.

Q5: What are some key performance indicators (KPIs) to track in relation to my budget strategy?

A5: Key performance indicators to track can include revenue growth rate, profit margin, return on investment, cash flow ratio, and budget variance.

Conclusion: Taking Action for Financial Success

Friends, crafting a budget strategy business plan is a vital step towards achieving financial success and stability. By carefully considering revenue projections, expense forecasts, cash flow management, financial goal setting, risk mitigation, and investment opportunities, you can pave the way for your organization’s growth and prosperity. Remember to review and update your budget strategy regularly, involve your team, and remain flexible to adapt to changing circumstances. Take action today and unlock the power of a well-crafted budget strategy business plan!

Final Remarks: Your Path to Financial Excellence

In conclusion, developing and implementing an effective budget strategy business plan is critical for the success of any organization. It provides a roadmap for financial decision-making, goal alignment, resource optimization, risk management, and investment opportunities. However, it is essential to be aware of the advantages and disadvantages of budget strategies, continuously review and update your plan, and remain flexible in response to changing circumstances. By following these guidelines, you can set your business on a path to financial excellence. Best of luck on your budget strategy business plan journey!

This post topic: Budgeting Strategies